A Mortgage Assumption Agreement is a legal document that is used when a buyer assumes the existing mortgage of the seller on a property. This agreement is a substitute for a new mortgage agreement, and it gives the buyer the right to take over the payments on the loan from the seller. There are two types of Mortgage Assumption Agreement: an assumable mortgage and a non-assumable mortgage. An assumable mortgage allows a buyer to take over the mortgage from the seller, while a non-assumable mortgage requires the buyer to get a new loan. The Mortgage Assumption Agreement outlines the terms of the assumption, such as the interest rate, the payment amount, and the length of the loan. The agreement also includes any additional fees required by the lender.

Mortgage Assumption Agreement

Description

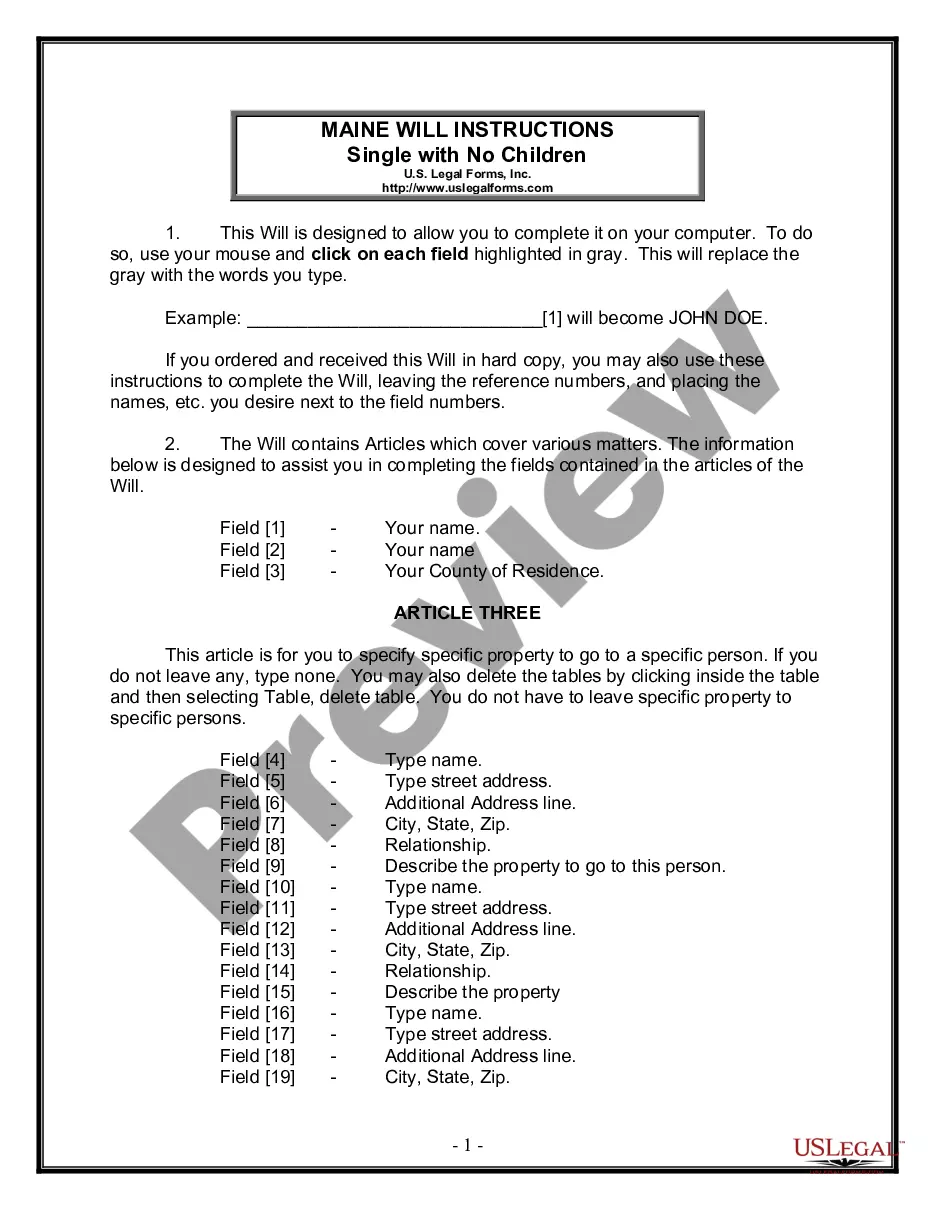

How to fill out Mortgage Assumption Agreement?

US Legal Forms is the most simple and cost-effective way to locate appropriate formal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Mortgage Assumption Agreement.

Getting your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Mortgage Assumption Agreement if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one meeting your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Mortgage Assumption Agreement and save it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reputable assistant in obtaining the required official documentation. Give it a try!

Form popularity

FAQ

In order for you to assume a mortgage, your lender has to first give you the green light. That means meeting the same requirements that you'd need to meet for a typical mortgage, such as having a good enough credit score and a low DTI ratio.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

The assumption fee is the charge paid by the buyer who assumes a mortgage on a property. This fee most commonly occurs when someone buys a property that has not been completely paid off to the bank yet.

The disadvantages of assumable mortgage are as follows: Assuming a mortgage may require the buyer to pay a significant amount as a down payment.One of the significant disadvantages of assumable mortgages is that there are strict income and credit requirements for this loan type.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

Lenders must approve an assumable mortgage. If done without approval, sellers run the risk of having to pay the full remaining balance upfront. Sellers also risk buyers missing payments, which can negatively impact their credit score.

Loan assumption can be a powerful enticement for these buyers as they shop for houses, because it would allow them to pay lower interest rates even as the housing market becomes more expensive.