An Agreement to Buy and Sell Real Estate Assumption of Mortgage is a legally binding document between a buyer and seller of real estate. It outlines the terms and conditions of the sale, including the purchase price, financing terms, and the assumption of a mortgage loan. The agreement also outlines the responsibilities of both the buyer and seller, such as the seller's responsibility to deliver a title free of liens and the buyer's responsibility to assume the mortgage loan. The agreement also includes provisions for any contingencies, such as a home inspection or financing requirements. Different types of Agreement to Buy and Sell Real Estate Assumption of Mortgage include: 1. Purchase Agreement: This outlines the essential terms of the sale, such as the purchase price, financing terms, and the assumption of a mortgage loan. 2. Financing Contingency: This outlines the buyer's responsibility to obtain financing for the purchase within a certain timeframe and any potential remedies if financing is not obtained. 3. Home Inspection Contingency: This outlines the buyer's responsibility to obtain a home inspection and any potential remedies if the inspection reveals any deficiencies. 4. Title Contingency: This outlines the seller's responsibility to deliver a title free of liens and any potential remedies if the title is not free of liens. 5. Closing Contingency: This outlines the buyer's and seller's responsibilities in the closing process, including deadlines for closing and any potential remedies if either party fails to meet their obligations.

Agreement to Buy and Sell Real Estate Assumption of Mortgage

Description

Definition and meaning

The Agreement to Buy and Sell Real Estate Assumption of Mortgage is a legal document that specifies the terms of a real estate transaction where a buyer assumes responsibility for an existing mortgage. This form outlines the obligations of both the buyer and the seller, including how the mortgage payments will be handled and what safety measures are in place to protect both parties during the transaction.

How to complete a form

To properly complete the Agreement to Buy and Sell Real Estate Assumption of Mortgage, follow these steps:

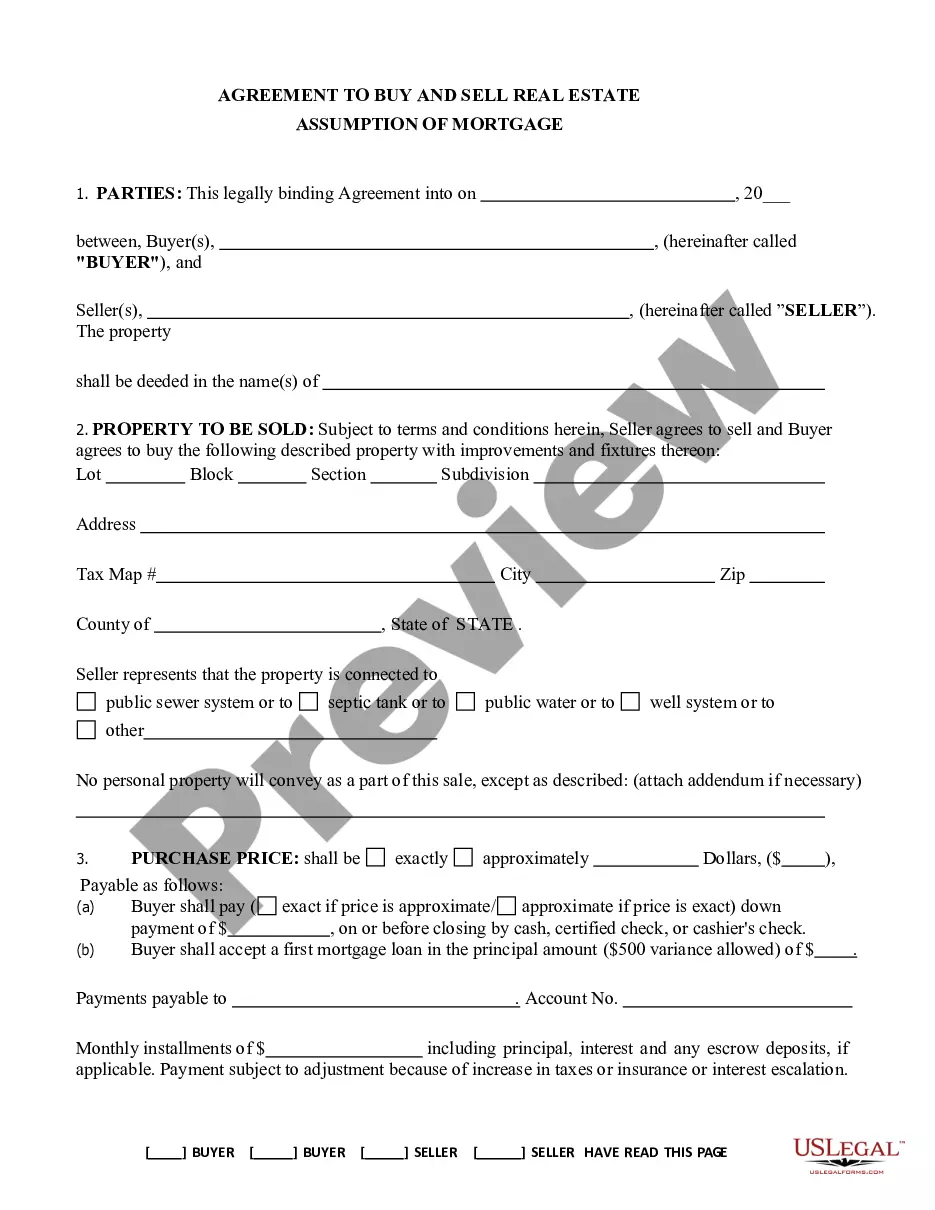

- Identify the parties: Fill in the names of the buyer(s) and seller(s) along with their contact information.

- Describe the property: Include specific details about the property, including its lot number, block number, and address.

- State the purchase price: Clearly specify the amount to be paid for the property along with any required down payment details.

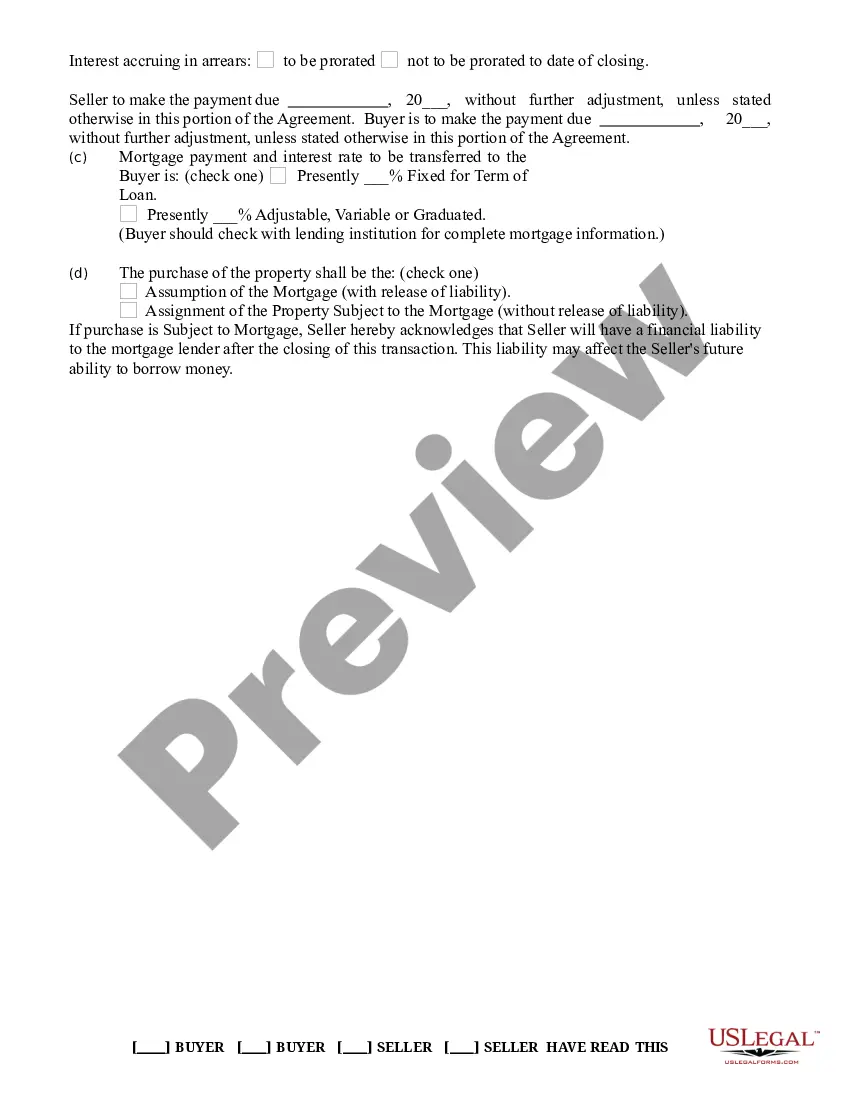

- Mortgage information: Indicate whether the buyer will assume the mortgage or take another financing option. Provide details if applicable.

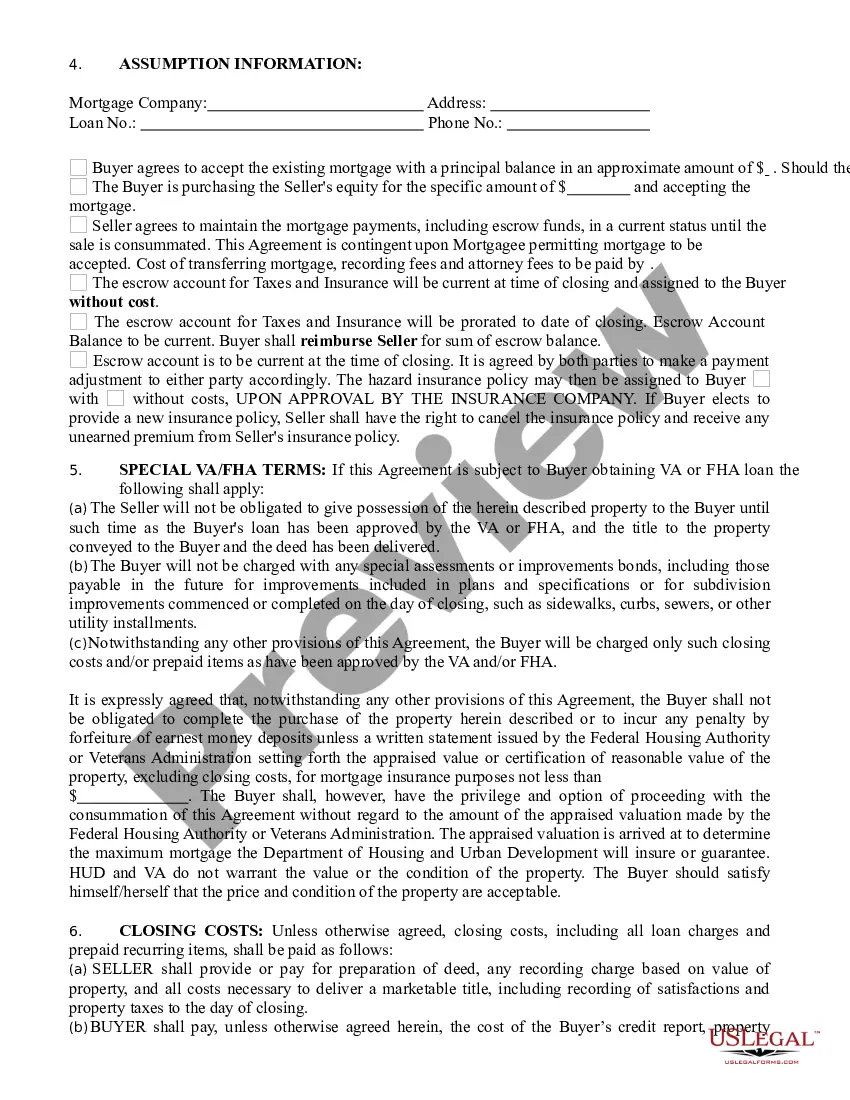

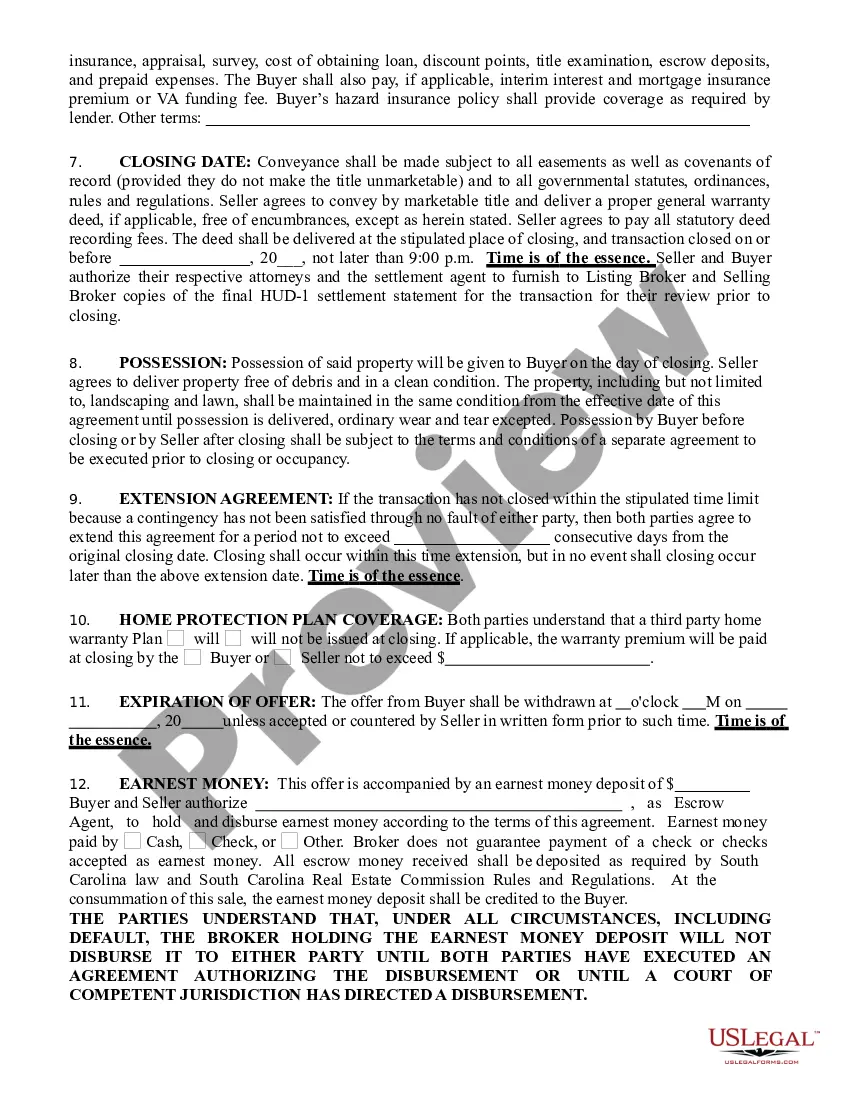

- Include contingencies: Add any contingencies related to financing, inspections, or special terms.

Ensure all parties review the completed form before signing.

Key components of the form

The Agreement to Buy and Sell Real Estate Assumption of Mortgage includes several essential components:

- Parties involved: Clearly specifies the buyer(s) and seller(s).

- Property details: Description of the property being sold.

- Purchase price: Amount being agreed upon for the sale.

- Mortgage terms: Information on the mortgage assumption process.

- Contingencies: Any conditions that must be met for the agreement to be valid.

- Closing costs: Details on who is responsible for various costs.

Who should use this form

This form is suitable for individuals or entities involved in a real estate transaction where the buyer intends to assume an existing mortgage from the seller. It is particularly relevant for:

- Homebuyers who want to take over payments on a seller's mortgage.

- Sellers looking to facilitate the sale of their property while retaining certain mortgage liabilities.

- Real estate professionals assisting clients in understanding options for property transfer.

Common mistakes to avoid when using this form

When completing the Agreement to Buy and Sell Real Estate Assumption of Mortgage, be aware of these common mistakes:

- Incomplete information: Ensure all fields are filled accurately to avoid delays.

- Ignoring contingencies: Failing to state important conditions may lead to issues later.

- Not reviewing terms: Both parties should fully understand their obligations before signing.

How to fill out Agreement To Buy And Sell Real Estate Assumption Of Mortgage?

How much time and resources do you typically spend on drafting formal paperwork? There’s a better option to get such forms than hiring legal specialists or wasting hours searching the web for a proper blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Agreement to Buy and Sell Real Estate Assumption of Mortgage.

To obtain and prepare an appropriate Agreement to Buy and Sell Real Estate Assumption of Mortgage blank, adhere to these simple steps:

- Look through the form content to ensure it meets your state regulations. To do so, check the form description or use the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Agreement to Buy and Sell Real Estate Assumption of Mortgage. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely safe for that.

- Download your Agreement to Buy and Sell Real Estate Assumption of Mortgage on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trusted web solutions. Join us today!

Form popularity

FAQ

A Simple Assumption is where the buyer takes over on the mortgage payments from the seller. This is a private transaction where title to the home passes from the seller to the buyer, and requires less involvement from the lender.

Once the assumption has been approved, you'll also have to pay closing costs, but these are generally lower when you assume a mortgage compared to getting one on your own.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

An assumable mortgage allows a homebuyer to assume the current principal balance, interest rate, repayment period, and any other contractual terms of the seller's mortgage. Rather than going through the rigorous process of obtaining a home loan from the bank, a buyer can take over an existing mortgage.