Florida Mortgage Note

Overview of this form

A mortgage note is a legally binding document used when purchasing real estate. It outlines the obligations of both the seller and the buyer, including the principal amount borrowed, the interest rate, and the payment schedule. This form serves as a promise to repay the borrowed amount under specific terms, distinguishing it from other related documents such as mortgage agreements or deeds of trust. The mortgage note ensures clarity in the borrowing process.

Form components explained

- Identifies the parties involved: buyer(s) and lender.

- Specifies the total principal amount to be repaid.

- Details the interest rate charged on the loan.

- Outlines the payment terms, including due dates and installment amounts.

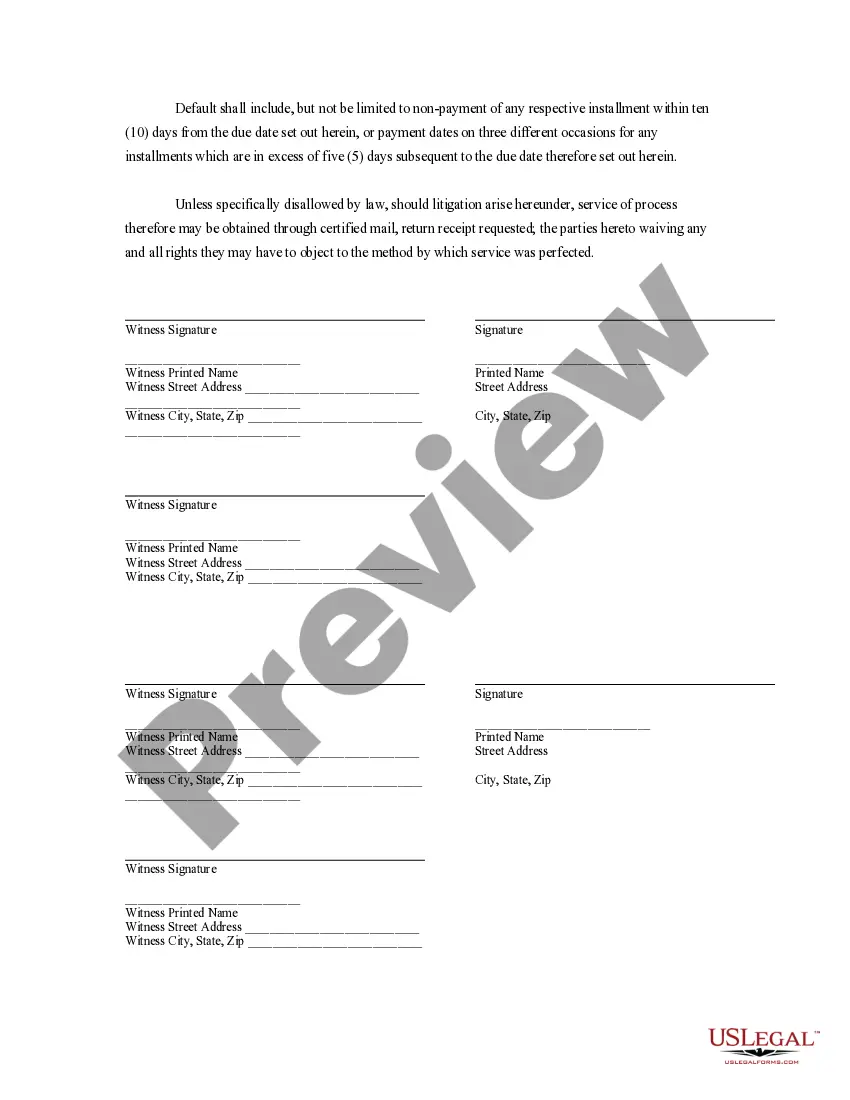

- Includes provisions for default and legal actions.

- Contains clauses for waiving demand or protest by the lender.

When to use this document

This form is necessary when a buyer intends to borrow money to purchase real estate. It is typically used in transactions where the buyer finances the purchase through a loan from a lender, thereby creating a legally enforceable obligation to repay that loan. If you are entering into such an agreement, a mortgage note is essential for documenting the financial terms of the loan.

Who this form is for

The primary users of this mortgage note include:

- Individuals or entities purchasing real estate through financing.

- Lenders providing financing to buyers.

- Real estate professionals managing transactions that involve loans.

- Anyone involved in the sale of property where owner financing is offered.

How to complete this form

- Identify the parties involved by clearly stating the full names of the borrower(s) and lender.

- Specify the total loan amount that is being borrowed.

- Enter the agreed-upon interest rate for the loan.

- Complete the payment schedule, including the monthly installment amount and the start date.

- Review and sign the document in the presence of witnesses, if required.

Is notarization required?

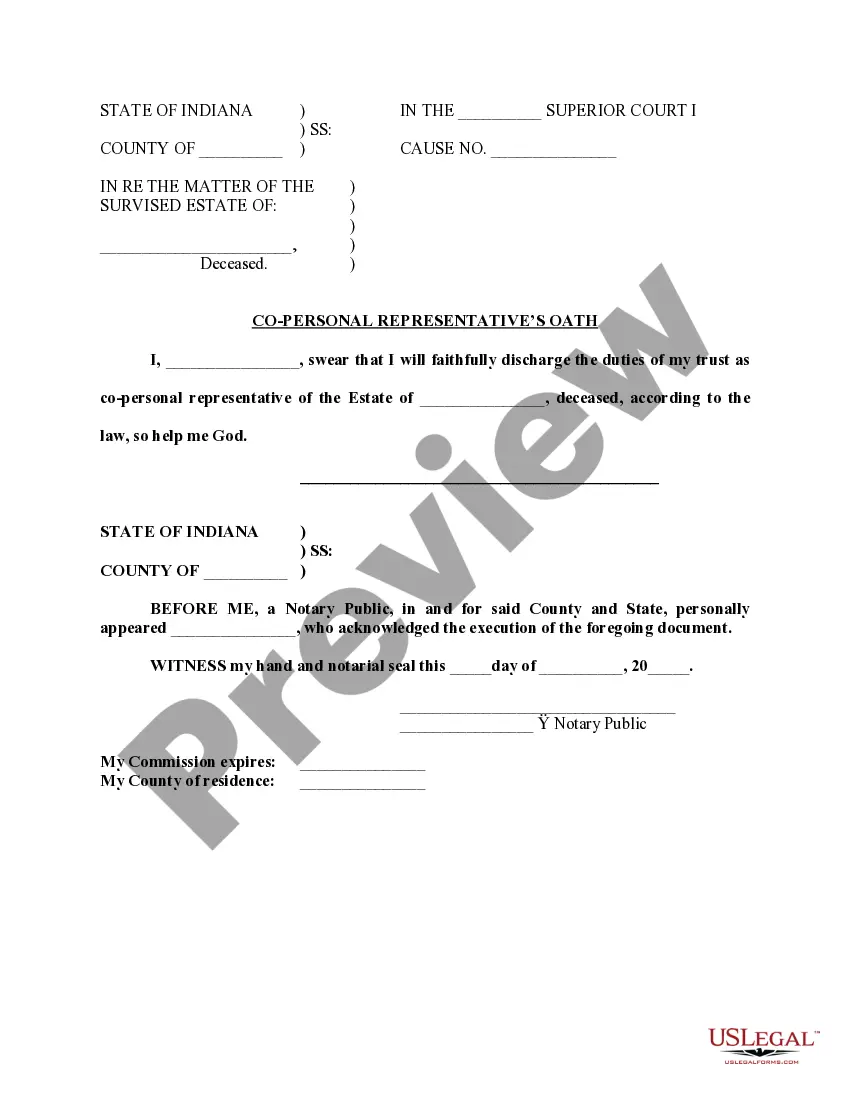

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not specifying the interest rate, leading to potential confusion later.

- Failing to enter the correct loan amount.

- Omitting signatures or witness statements, rendering the document invalid.

- Inaccurately filling in payment terms or schedules.

Benefits of using this form online

- Easy access to standardized templates designed by licensed attorneys.

- Convenience of filling out the form at your own pace.

- Editable formats allow for customization based on specific transaction needs.

- Immediate availability for download and filing.

Looking for another form?

Form popularity

FAQ

Yes, mortgage notes can be considered public records, depending on local regulations in Florida. This means that the details of your Florida mortgage note, such as ownership and transaction history, may be accessible to the public. You can check with your local property appraiser or recorder's office to obtain this information.

Yes, purchasing your own mortgage note is possible and can be beneficial in certain circumstances. This option allows you to take control of your mortgage terms and might provide financial advantages. You should consult with your lender and a financial advisor to better understand the implications of buying your own Florida mortgage note.

In Florida, it is not a requirement for a promissory note to be notarized for it to be legally enforceable. However, notarization can provide an extra layer of authenticity and may help prevent future disputes. If you are dealing with financial transactions, having a notarized Florida Mortgage Note can increase confidence among all parties involved. We recommend consulting uslegalforms for templates and guidance on proper documentation.

Florida laws require that promissory notes contain specific elements for them to be enforceable. The notes must clearly outline the terms of repayment, including interest rates and due dates. Compliance with these legal requirements ensures the validity of your Florida Mortgage Note, helping you avoid complications down the line. If you need assistance in drafting or understanding your notes, consider using platforms like uslegalforms to simplify the process.

In Florida, while recording a promissory note is not a legal requirement, it is a prudent action. By recording your Florida Mortgage Note, you establish a public record that can protect your rights and interests. This step can also clarify the obligations of both the lender and borrower, which can be advantageous in case of any future disputes.

A promissory note can be voided if it is found to have been created under false pretenses, or if one party lacks the capacity to enter into a contract. Other reasons for voidness include fraud, misrepresentation, or if the terms are impossible to fulfill. To maintain the integrity of your Florida Mortgage Note, always ensure that it is clear and binding for both parties involved.

A promissory note may be considered invalid if it lacks essential elements such as the amount owed, signatures from both parties, or a clear understanding of the repayment terms. Additionally, if the note was signed under duress or involves illegal activities, it can be invalidated. It's important to ensure that your Florida Mortgage Note meets all legal criteria to avoid potential issues.

Recording a mortgage note is not mandatory in Florida, but it is highly recommended. Doing so provides public notice of the lien and protects the lender's interests. When you record the Florida Mortgage Note, you help ensure that your mortgage is recognized legally. This step can be crucial in establishing your rights should disputes arise.

In Florida, a promissory note does not necessarily require notarization to be valid. However, having it notarized can provide additional legal protection and serve to verify the identities of the parties involved. If you're looking to create a solid Florida Mortgage Note, considering notarization might add an extra layer of reliability to your agreement.

A promissory note can be considered invalid in Florida if it lacks essential elements like a clear statement of the amount owed, the signature of the borrower, or if it fails to specify repayment terms. Moreover, if the agreement is made under duress or fraud, it can be voided. Ensuring proper compliance with state laws is crucial for maintaining the integrity of your Florida Mortgage Note.