Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

When it comes to drafting a legal document, it is better to delegate it to the experts. Nevertheless, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself can not find a sample to utilize, however. Download Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself right from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you are signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

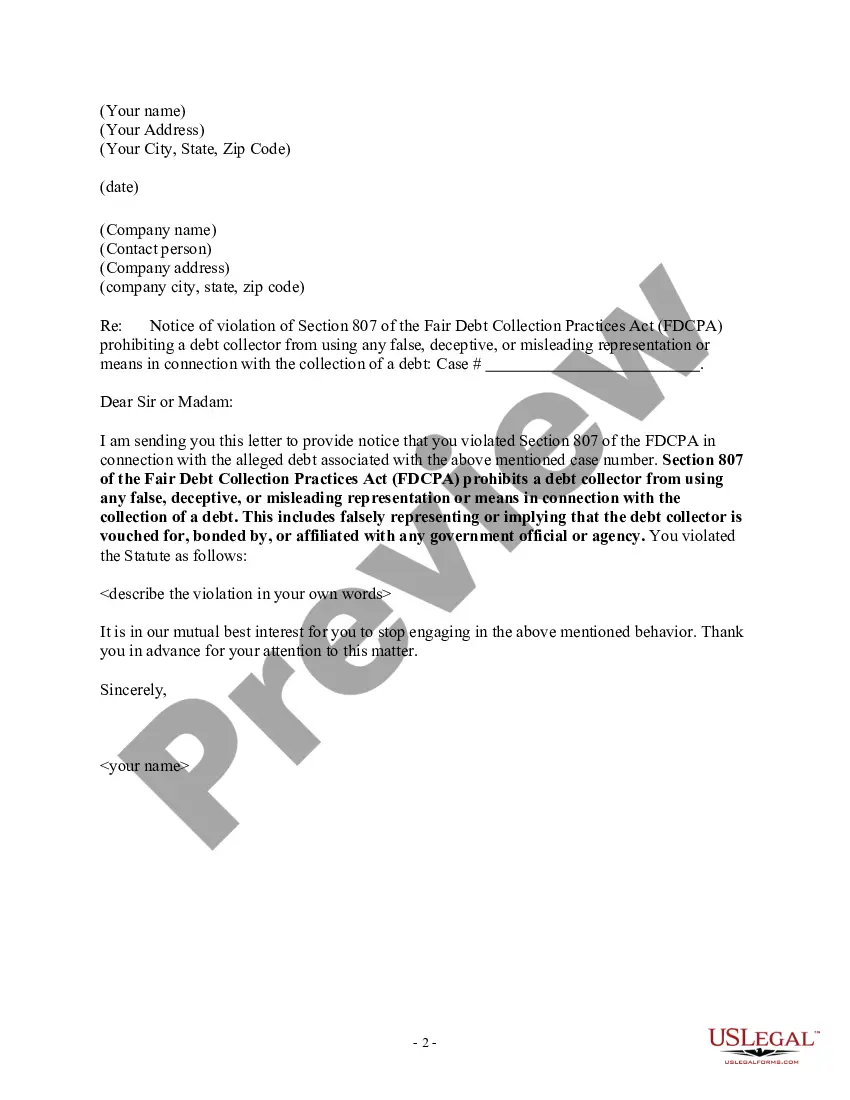

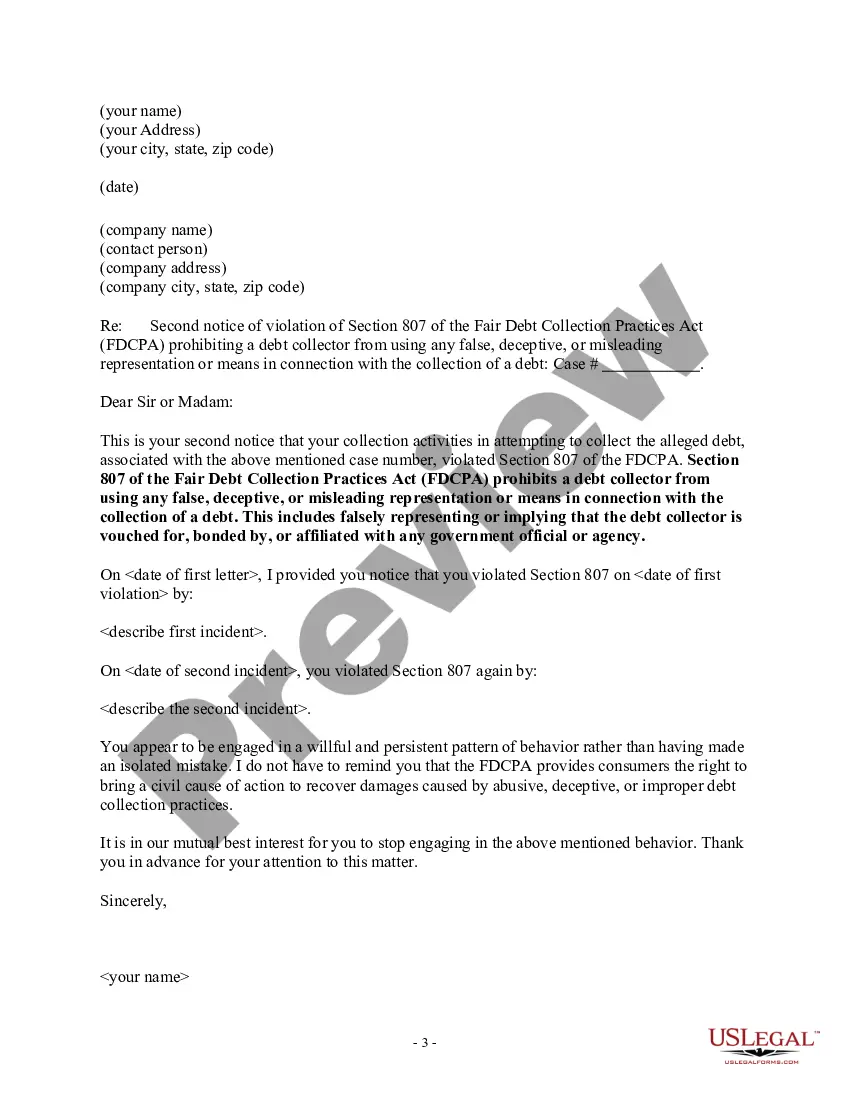

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself quickly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself is downloaded it is possible to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Sue the Debt Collector in State Court. Sue the Creditor in Small Claims Court. Report the Action to a Government Agency. Report the Action to the State Attorney General. Use the Violation as Leverage in Debt Settlement Negotiations.

Under the Fair Debt Collection Practices Act, debt collectors are required to identify themselves in any communication with a debtor. This rule prevents collection agents from tricking consumers into returning calls or other communications without knowing the nature of the communication.

In most cases, a debt collector may not tell anyone other than you, your spouse or your attorney that you owe money.

The Fair Debt Collection Practices Act (FDCPA) protects debtors from harassment by debt collectors. If a collector has violated the FDCPA, you can sue the collector in court. The FDCPA provides a range of damages for successful FDCPA lawsuits, including monetary damages, attorneys' fees, and more.

For example, they can't: misrepresent the amount you owe. lie about being attorneys or government representatives. falsely claim you'll be arrested, or claim legal action will be taken against you if it's not true.

In an individual action, a plaintiff may recover actual damages, but courts have consistently held that additional damages are limited to a maximum of $1,000 per proceeding and not $1,000 per violation. See, e.g., Wright v.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.The court might also order the debt collector to stop engaging in certain collection activities.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.