Minnesota Discovery - Collections Checklist

Understanding this form

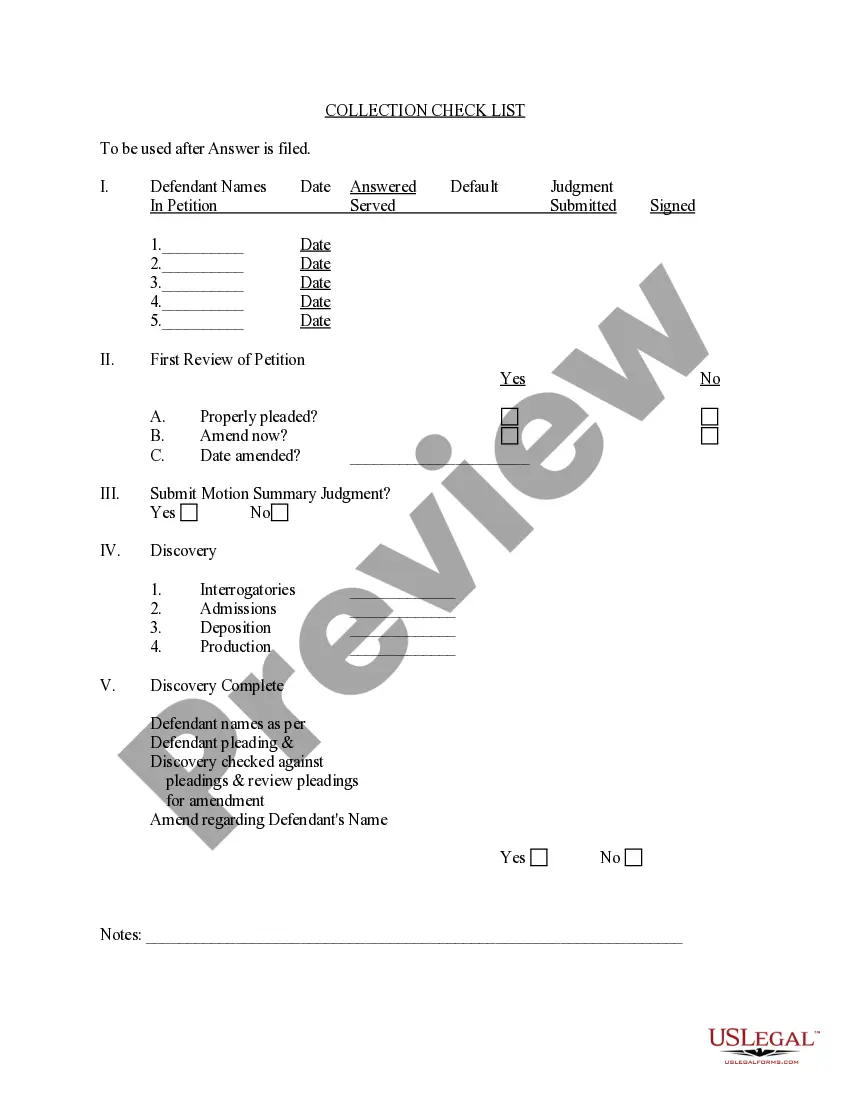

The Discovery - Collections Checklist is a structured tool designed to help individuals and businesses navigate the necessary steps involved in pursuing a collections matter. Unlike other generic legal forms, this checklist is tailored to outline specific discovery actions that can streamline the collections process, ensuring that all required information is obtained efficiently.

Key parts of this document

- Submission of Motion for Summary Judgment

- Interrogatories for information gathering

- Requests for Admissions to confirm facts

- Depositions to record witness testimonies

- Document Production requests for relevant evidence

- Criteria for completeness of discovery

When to use this form

This checklist is ideal for use when initiating a collections case or during the discovery phase of litigation. It assists in ensuring that all necessary discovery actions have been addressed, which can be critical for building a strong case. Utilize this checklist when you need to verify that information from the defendant has been thoroughly collected and reviewed.

Who can use this document

- Creditors pursuing collections

- Businesses dealing with unpaid debts

- Legal professionals managing collections cases

- Individuals representing themselves in court

Steps to complete this form

- Identify the relevant parties involved in the collections matter.

- Enter the necessary details for each discovery action listed, such as interrogatories and admissions.

- Check off each item as you complete the various discovery steps.

- Review the discovery against the pleadings to confirm accuracy.

- Make any amendments regarding party names or other details as necessary.

Notarization guidance

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to complete all sections of the checklist.

- Overlooking deadlines for submitting discovery requests.

- Not reviewing pleadings adequately before submission.

Why use this form online

- Easy access to a professional template created by legal experts.

- Edit and customize the checklist to fit your specific case needs.

- Reliable source of information ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Debt collectors in Minnesota generally have six years to collect a debt. This limit is established by the statute of limitations, starting from the last payment made on the debt. By following the Minnesota Discovery - Collections Checklist, you can better navigate your rights and options regarding debt collection. For tailored resources, consider utilizing USLegalForms, which offers tools to support your needs.

In Minnesota, a debt typically becomes uncollectible after six years. This timeframe starts from the date of your last payment or the last activity on the account. Understanding this period is crucial when using the Minnesota Discovery - Collections Checklist, as it helps you assess the viability of pursuing collections. If you need assistance, platforms like USLegalForms can guide you through the process.