Minnesota Instructions for Release of Land from Lien regarding Dissolution

Description

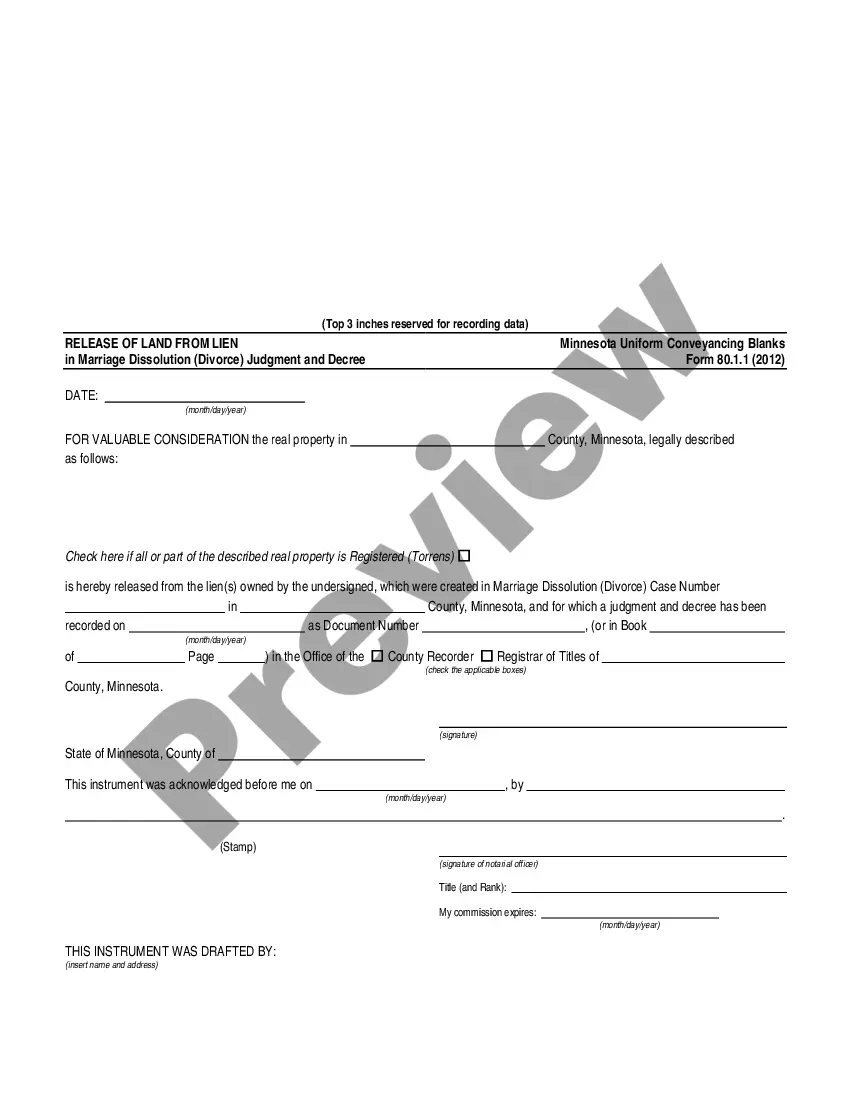

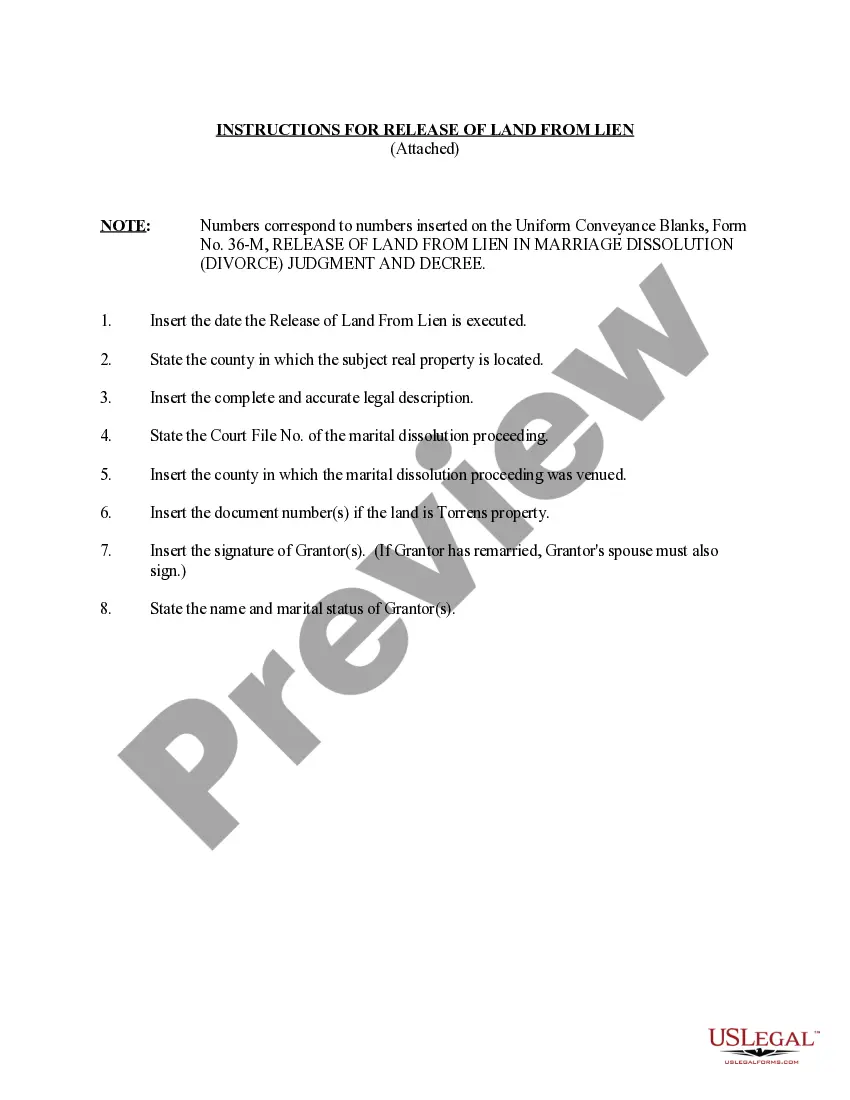

How to fill out Minnesota Instructions For Release Of Land From Lien Regarding Dissolution?

Obtain any template from 85,000 legal documents including Minnesota Instructions for Release of Land from Lien related to Dissolution online with US Legal Forms. Each template is composed and refreshed by state-certified attorneys.

If you possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to gain access to it.

If you haven’t subscribed yet, follow the guidelines below: Check the state-specific criteria for the Minnesota Instructions for Release of Land from Lien related to Dissolution you wish to utilize. Review the description and preview the template. Once you’re assured the template meets your needs, simply click Buy Now. Choose a subscription plan that suits your financial situation. Set up a personal account. Pay using one of two convenient methods: by credit card or through PayPal. Choose a format to download the document in; two choices are available (PDF or Word). Download the file to the My documents section. When your reusable form is prepared, print it out or save it to your device.

- With US Legal Forms, you will consistently have prompt access to the appropriate downloadable template.

- The platform grants you access to forms and categorizes them to simplify your search.

- Utilize US Legal Forms to acquire your Minnesota Instructions for Release of Land from Lien related to Dissolution swiftly and effortlessly.

Form popularity

FAQ

The rules for liens in Minnesota dictate how and when a lien can be placed on a property. Generally, a lien must be properly filed and recorded to be enforceable. Understanding the Minnesota Instructions for Release of Land from Lien regarding Dissolution is crucial, especially when dealing with property division in a divorce. By following these rules, you can ensure your interests are safeguarded during legal proceedings.

A notice of intent to lien form in Minnesota serves as a formal notification to property owners that a lien may be filed against their property. This form typically outlines the reasons for the lien and the amount owed. Familiarizing yourself with the Minnesota Instructions for Release of Land from Lien regarding Dissolution can provide insight into how this notice impacts property during divorce proceedings. Properly managing such notices is essential to protect your legal rights.

The Minnesota guide and file for divorce is a comprehensive resource that helps individuals navigate the divorce process in Minnesota. It offers step-by-step instructions and necessary forms to ensure your case proceeds smoothly. By utilizing the Minnesota Instructions for Release of Land from Lien regarding Dissolution, you can better understand how to manage any related liens on property during your divorce. This guide simplifies complex legal procedures and provides clarity.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

Step 1: Download the Minnesota quitclaim deed. Step 2: Enter the name and address of the preparer on the top left-hand corner of the form. Step 3: Enter the return address information under the preparer's information.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Quit Claim Deeds. This is because the Summary Real Estate Disposition Judgment is an Order signed by the court that requires the Recorder's Office to make the transfer of interest, so all that is required is the judge's signature.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.