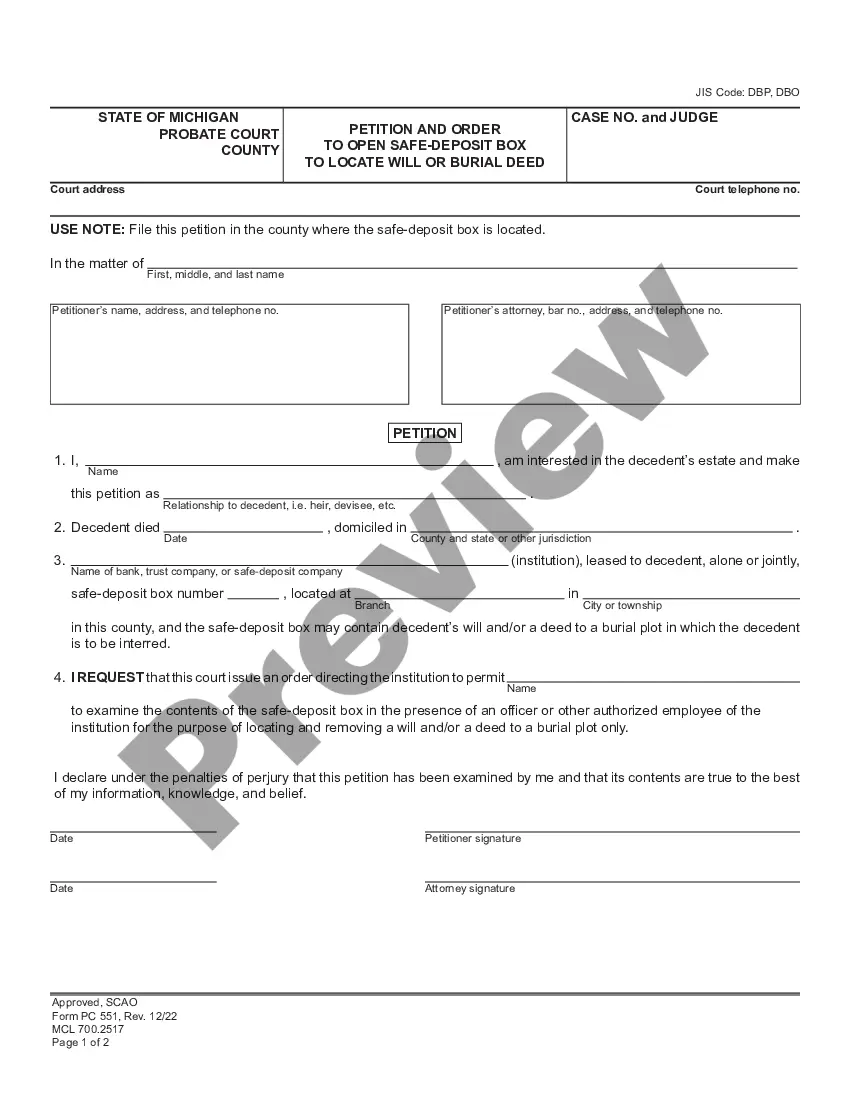

This Safe Deposit Box Certificate and Receipt is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Safe-Deposit Box Certificate and Receipt

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Safe-Deposit Box Certificate And Receipt?

Obtain any version from 85,000 lawful documents including Michigan Safe Deposit Box Certificate and Receipt online with US Legal Forms. Each template is composed and refreshed by state-licensed lawyers.

If you possess a subscription, Log In. Once you’re on the document’s page, click on the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, adhere to the procedures outlined below.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable template. The platform grants you access to documents and categorizes them to ease your search. Utilize US Legal Forms to acquire your Michigan Safe Deposit Box Certificate and Receipt quickly and efficiently.

- Verify the state-specific criteria for the Michigan Safe Deposit Box Certificate and Receipt you require to utilize.

- Browse through the description and preview the template.

- Once you’re certain the template meets your needs, click Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Make payment in one of two acceptable methods: by credit card or through PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

A proof of service document in Michigan serves as evidence that legal documents were properly delivered to the involved parties. This is crucial for maintaining the integrity of the legal process. In instances involving estate matters, such as when dealing with a Michigan Safe-Deposit Box Certificate and Receipt, having a filed proof of service confirms that all parties received notification about the proceedings.

To file a small estate affidavit in Michigan, begin by gathering all necessary documents, including the Michigan Safe-Deposit Box Certificate and Receipt if applicable. Next, complete the affidavit form, ensuring that it's signed by at least two witnesses. You will then submit this affidavit to the appropriate probate court, allowing the court to process the small estate transfer efficiently.

To access your safe deposit box, you must visit your bank where the box is located. You will need to present your Michigan Safe-Deposit Box Certificate and Receipt, along with valid identification. It's important to check the bank's hours for box access, as they may differ from regular banking hours. Once you are verified, a bank representative will assist you in reaching your safe deposit box.

Using a safe deposit box is simple. First, visit your bank to rent a box and receive your Michigan Safe-Deposit Box Certificate and Receipt. When storing items, organize them by importance to make retrieval easy. Regularly review the contents, ensuring that all crucial documents remain current and secure.

Key documents to store include your birth certificates, passports, and original copies of legal agreements. These items often require protection from loss or damage, ensuring they are secure when you need them. The Michigan Safe-Deposit Box Certificate and Receipt should also be stored here, confirming your ownership and access details.

In your safe deposit box, store critical documents such as wills, powers of attorney, and insurance policies. These documents are essential for legal and financial matters, ensuring peace of mind for you and your family. Don't forget to include the Michigan Safe-Deposit Box Certificate and Receipt, which provides proof of ownership.

You should keep important records in your safety deposit box, such as your Michigan Safe-Deposit Box Certificate and Receipt, property deeds, and marriage certificates. Additionally, consider placing items that have sentimental value or significant financial impact, like family heirlooms, in your safe deposit box. This secure storage can safeguard your most important documents.