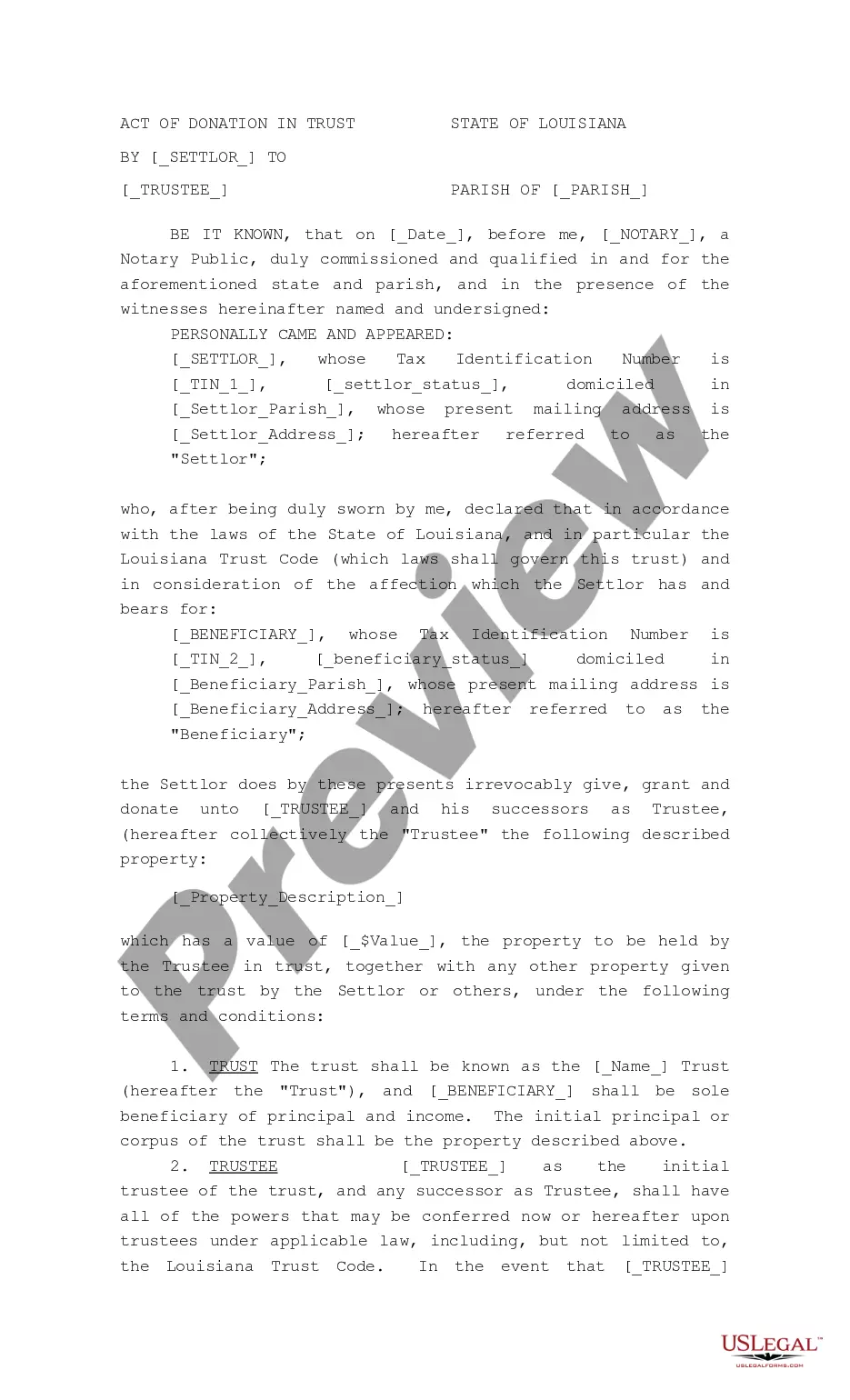

Louisiana Act of Donation in Trust by Settlor to Trustee

Description

How to fill out Louisiana Act Of Donation In Trust By Settlor To Trustee?

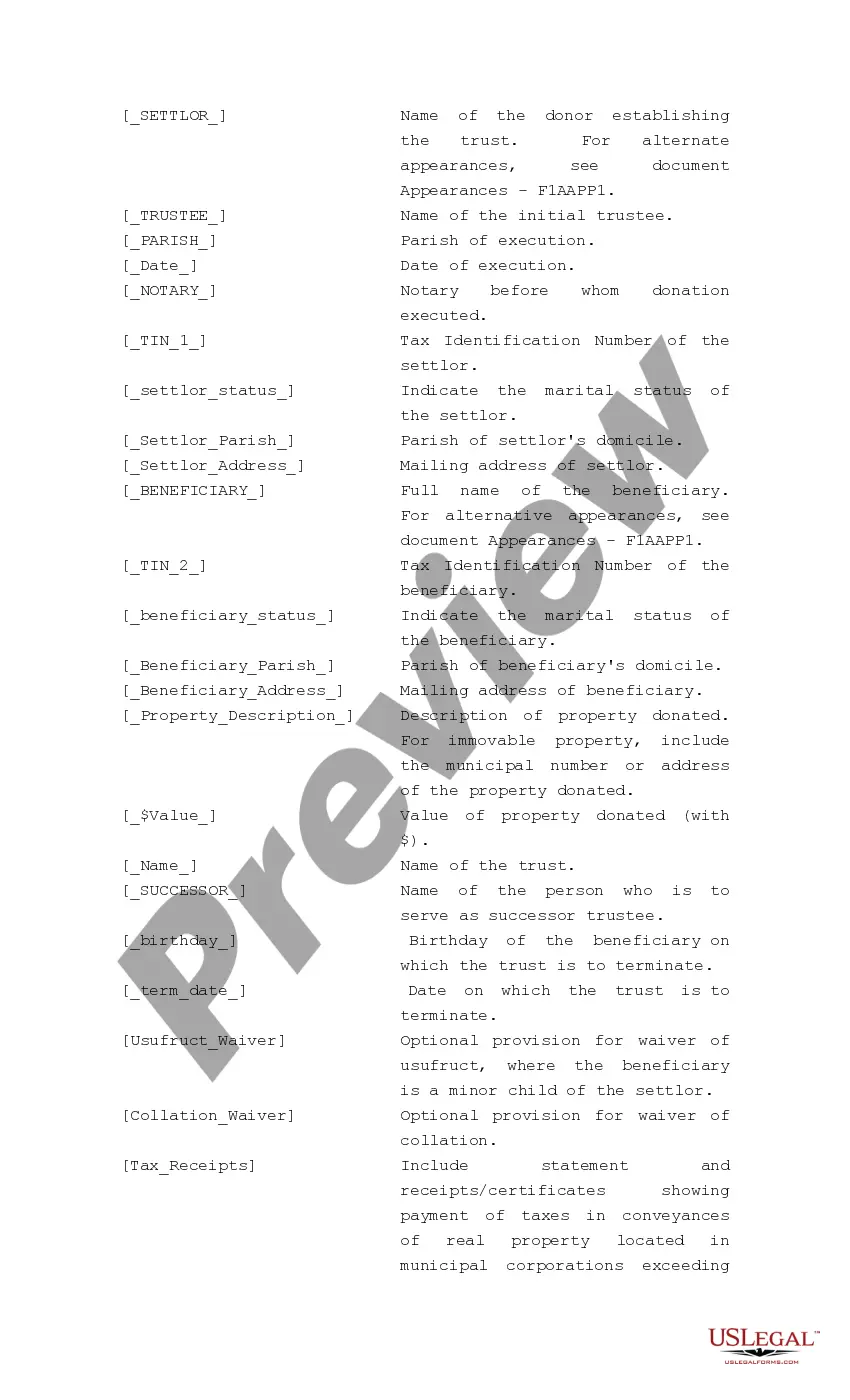

You are invited to the most important legal documents library, US Legal Forms. Here, you can obtain any example, such as Louisiana Act of Donation in Trust by Settlor to Trustee templates and store them (as many as you desire/need). Create official documents in just a few hours instead of days or weeks, without spending a fortune on a lawyer. Access state-specific forms in a few clicks and rest assured knowing they were created by our certified attorneys.

If you’re already a registered user, simply Log In to your account and select Download next to the Louisiana Act of Donation in Trust by Settlor to Trustee you need. Since US Legal Forms is internet-based, you’ll always have access to your downloaded forms, no matter the device you’re using. Find them in the My documents section.

If you don't have an account yet, what are you waiting for? Follow our instructions below to get started.

Once you have finished the Louisiana Act of Donation in Trust by Settlor to Trustee, submit it to your attorney for verification. This extra step is crucial to ensuring you’re completely protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- If this is a state-specific form, verify its validity in your residing state.

- Review the description (if available) to determine if it’s the correct template.

- Explore additional content using the Preview feature.

- If the document suits your needs, click Buy Now.

- To create your account, choose a pricing plan.

- Register using a credit card or PayPal account.

- Download the template in your preferred format (Word or PDF).

- Print the document and complete it with your/your business’s details.

Form popularity

FAQ

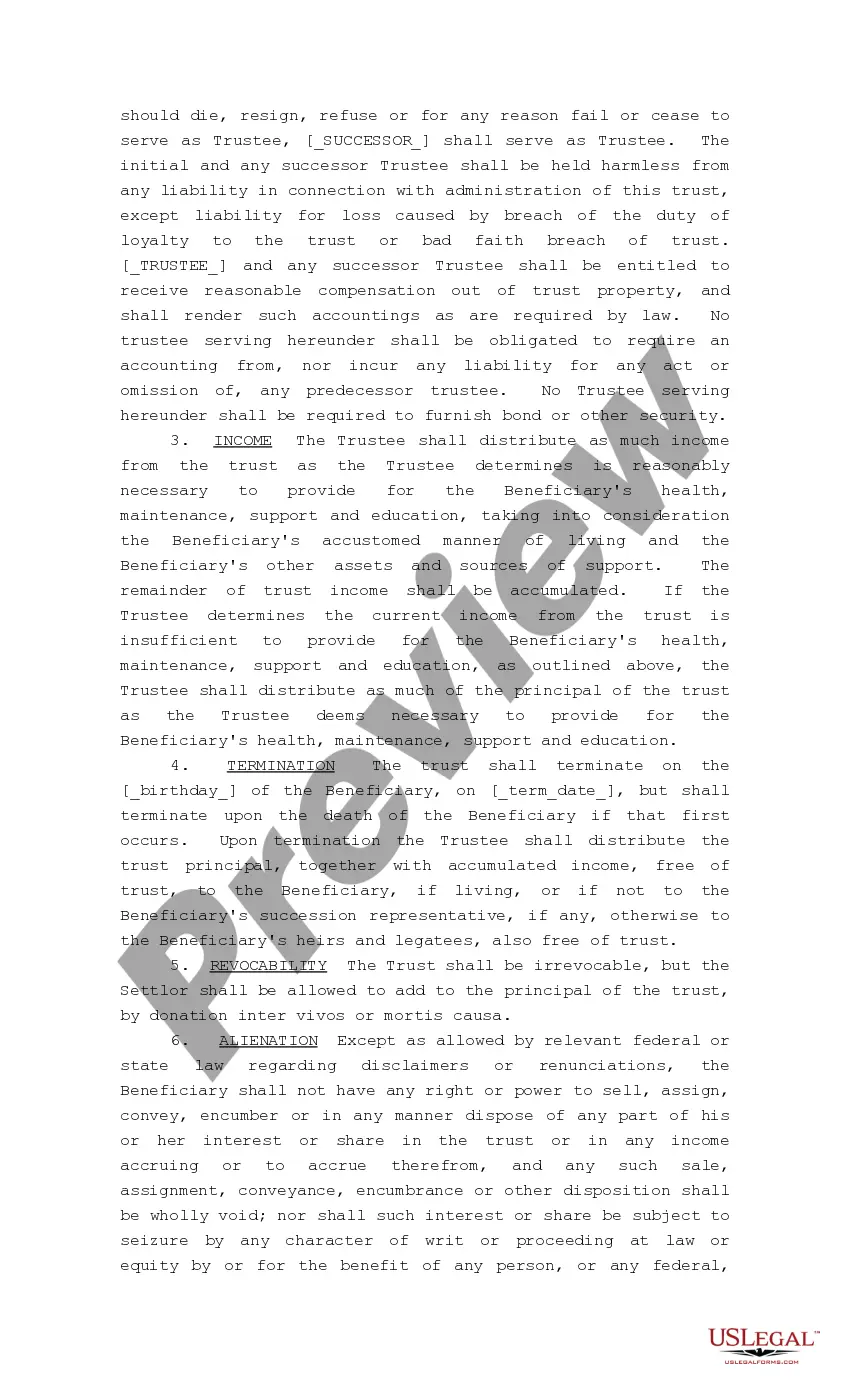

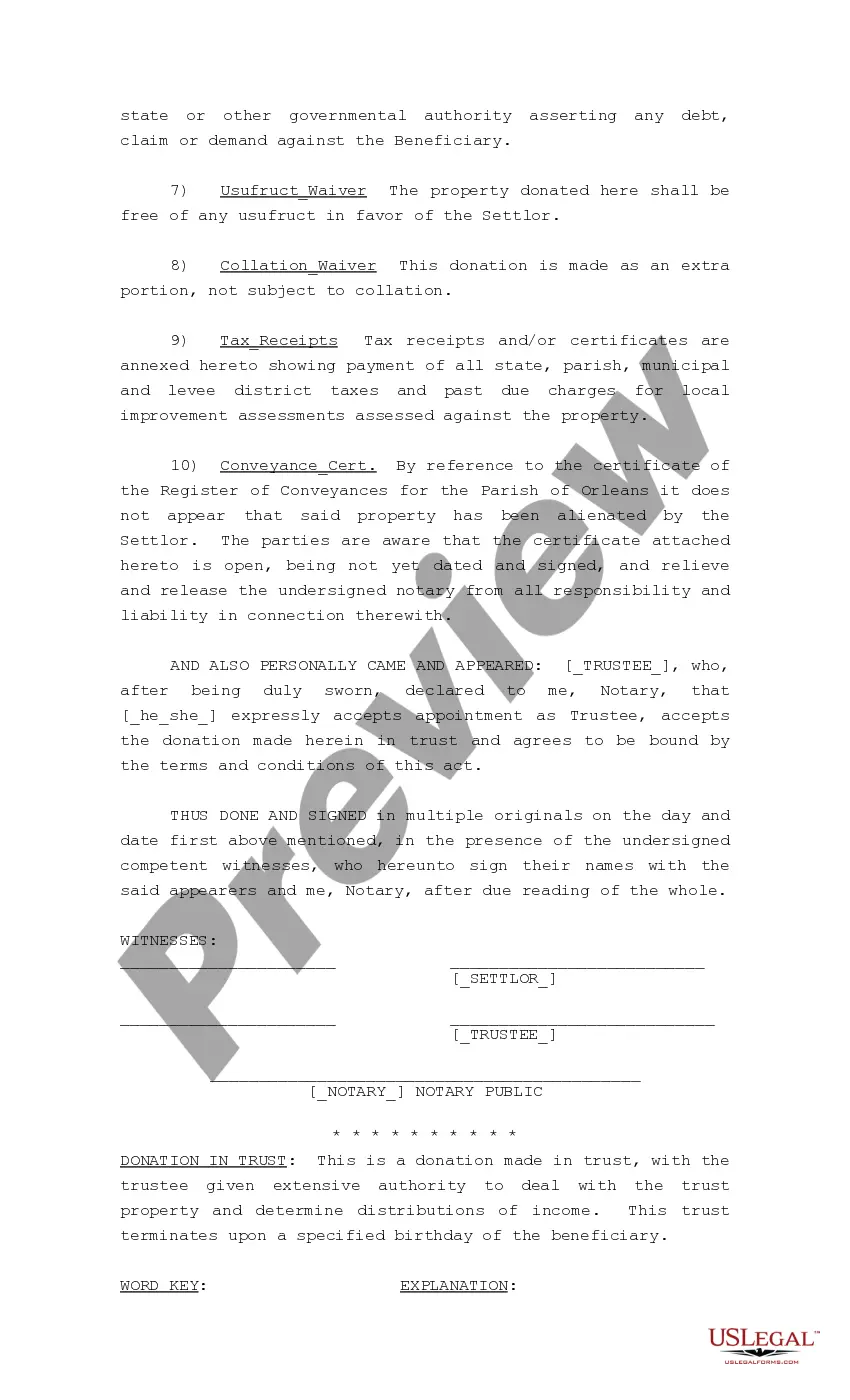

When there are joint Address Address Settlors, both Settlors will automatically be Trustees. The 'Trustees' shall mean the Settlor and the Additional Trustees and any other Trustees for the time being of this Trust.

A settlor is the entity that establishes a trust. The settlor goes by several other names: donor, grantor, trustor, and trustmaker. Regardless of what this entity is called, its role is to legally transfer control of an asset to a trustee, who manages it for one or more beneficiaries.

In law a settlor is a person who settles property on trust law for the benefit of beneficiaries.The settlor may also be the trustee of the trust (where he declares that he holds his own property on trusts) or a third party may be the trustee (where he transfers the property to the trustee on trusts).

A trustee is any type of person or organization that holds the legal title of an asset or group of assets for another person, referred to as the beneficiary. A trustee is granted this type of legal title through a trust, which is an agreement between two consenting parties.

The Donor appoints the Trustees and the Beneficiaries (the Donor can also be a Trustee and a Beneficiary) and the Donor decides how the Trust will work. All this information is contained in a Trust Deed, which is uniquely drafted for each Trust.

Who can be a trustee? A trustee, the person who manages the money and assets in a trust, can be almost anyone. A grantor appoints a trustee when they create the trust. In many cases, the person who creates a revocable living trust, also known as the grantor, settlor, or trustor serves as trustee.

A trustee typically cannot take any funds from the trust for him/her/itself although they may receive a stipend in the form of a trustee fee for the time and efforts associated with managing the trust.

With a revocable trust, the settlor usually retains the right to make changes to any of the trust's terms at any time, including even the ability to terminate the trust and take back all of its property.

A settlor is the entity that establishes a trust. The settlor goes by several other names: donor, grantor, trustor, and trustmaker. Regardless of what this entity is called, its role is to legally transfer control of an asset to a trustee, who manages it for one or more beneficiaries.