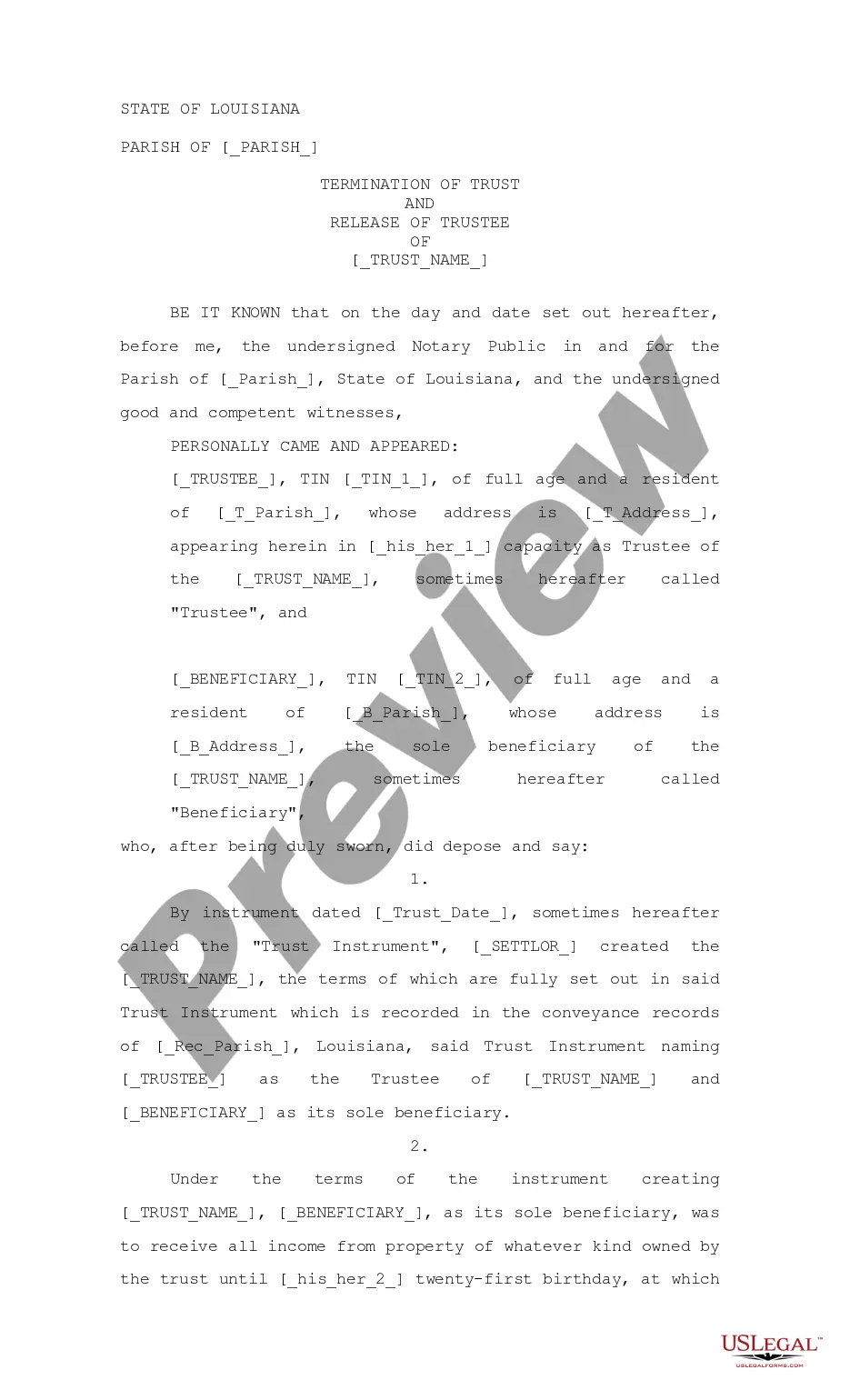

Louisiana Termination of Trust and Release of Trustee

Description

How to fill out Louisiana Termination Of Trust And Release Of Trustee?

Greetings to the largest collection of legal documents, US Legal Forms. Here, you can discover any template, including Louisiana Termination of Trust and Release of Trustee examples and download them (as many as you desire or require). Prepare official documents in a few hours, instead of days or weeks, without having to spend a fortune on a legal expert. Obtain your state-specific example in just a few clicks and feel assured knowing it was created by our skilled legal professionals.

If you’re already a registered user, simply Log In to your account and then click Download next to the Louisiana Termination of Trust and Release of Trustee you wish. Since US Legal Forms is online-based, you will typically have access to your saved templates, regardless of what device you’re utilizing. Find them in the My documents section.

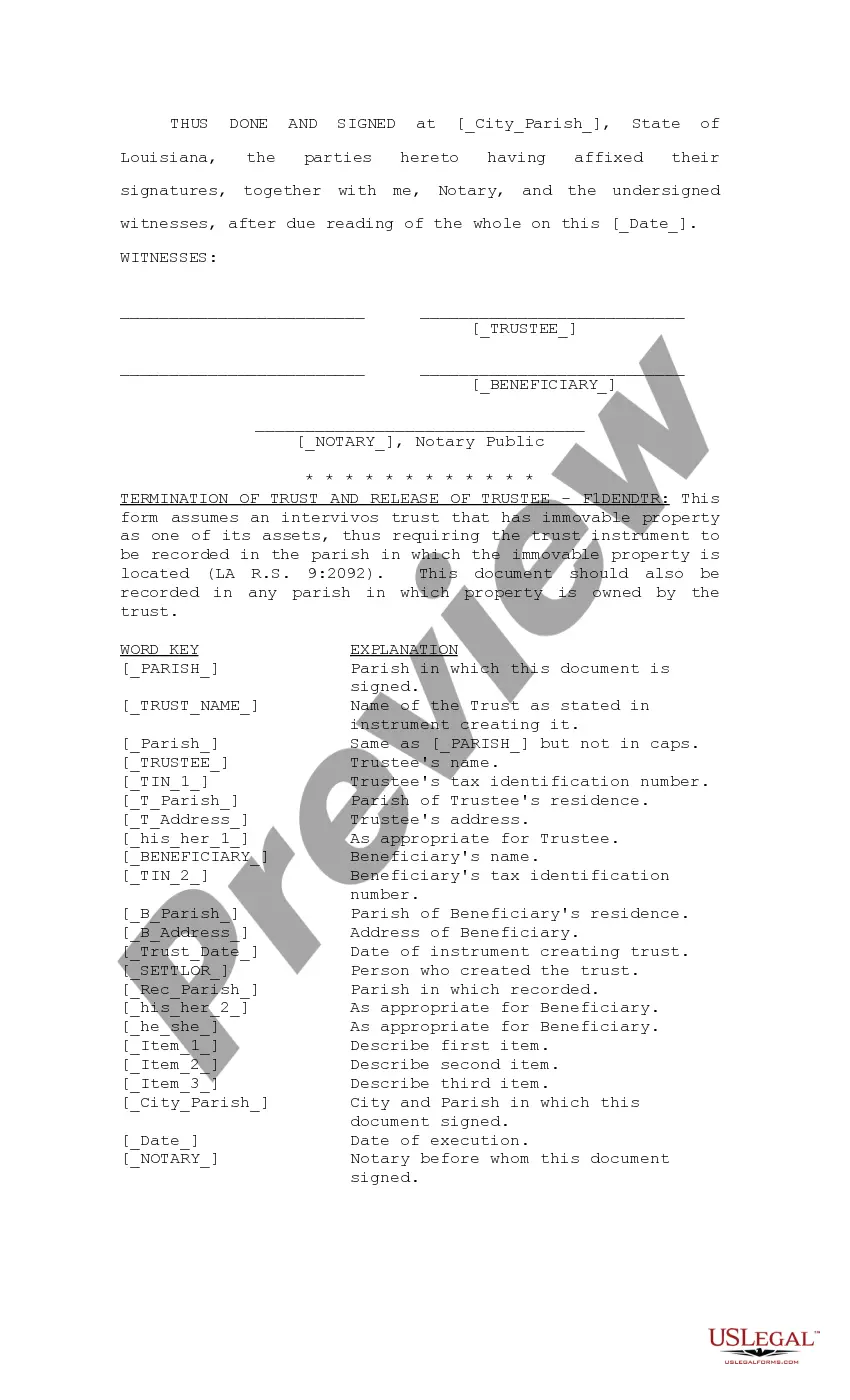

If you do not yet possess an account, what are you waiting for? Follow our instructions below to get started: If this is a state-specific document, verify its legality in your residing state. Review the description (if available) to determine if it’s the suitable template. Explore additional content with the Preview option. If the document meets all of your requirements, simply click Buy Now. To create your account, select a pricing plan. Utilize a credit card or PayPal account to register. Download the document in the format you need (Word or PDF). Print the document and fill it out with your or your business’s details. Once you’ve completed the Louisiana Termination of Trust and Release of Trustee, forward it to your attorney for verification. It’s an additional step but a crucial one to ensure you’re thoroughly protected. Join US Legal Forms today and gain access to thousands of reusable templates.

Form popularity

FAQ

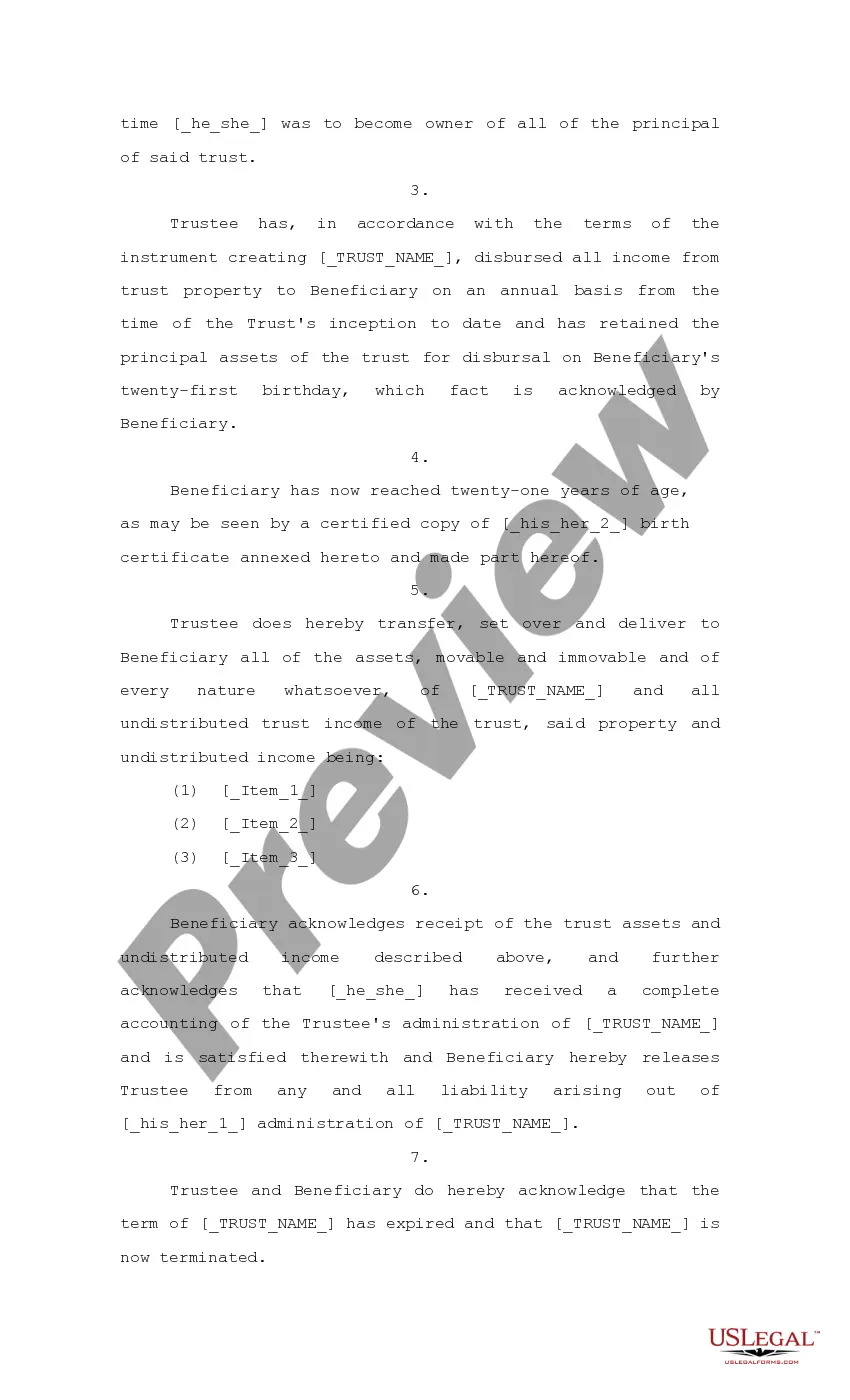

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

If you have a revocable trust, you can get money out by making a request via the trustee. Should you yourself be listed as the trustee, you'll be able to transfer funds and assets out of the trust as you see fit.

Some statutes may allow a trustee to modify or terminate a trust without a court or beneficiary approval, while others may allow modification or termination only with the approval of a beneficiary or a court. Still others may allow termination only if the trust is under a certain value.

The trust deed will ordinarily provide for one of two methods for removing a beneficiary: (a) the exiting beneficiary signs a document renouncing his or her interest as a beneficiary; or (b) the trustee makes a declaration (if he or she has the power to do so under the trust deed) that the beneficiary is no longer a

Usually, this means paying any outstanding trust obligations, liquidating assets, filing final income tax returns, preparing a final accounting for the benefit of the beneficiaries, and distributing trust assets to the appropriate beneficiaries.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Trustees Can Withdraw For Trust UseTrust law varies from state to state, but under no circumstances can a trustee withdraw funds from the trust for the personal use of the trustee.Common trust law dictates that the trustee (or trustees) are the only parties that can disburse funds from a trust account.

A trust usually ends under legal and complete circumstances. After the grantor passes away, the trustee handles the property and assets of the grantor, and the assets are transferred to the beneficiary (or beneficiaries) under the terms dictated in the trust by the grantor.