Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

About this form

The Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary form allows a trustee to formally terminate a trust when authorized to do so. This document ensures that the beneficiary acknowledges the receipt of trust funds, thus legally closing the trust. It differs from similar forms by specifically addressing the termination of a trust and the distribution of its assets to the beneficiary according to the trustee's discretion.

Situations where this form applies

This form should be used when a trustee is legally permitted to terminate a trust and wishes to formally distribute its assets to the beneficiary. It is commonly necessary when a beneficiary becomes capable of managing their own affairs or when the trust has fulfilled its purpose. Use this form to ensure that both the trustee and beneficiary document the transaction formally, protecting their rights and responsibilities.

Intended users of this form

This form is intended for:

- Trustees who have the authority to terminate a trust.

- Beneficiaries of a trust who are receiving assets after termination.

- Individuals involved in estate planning or trust management.

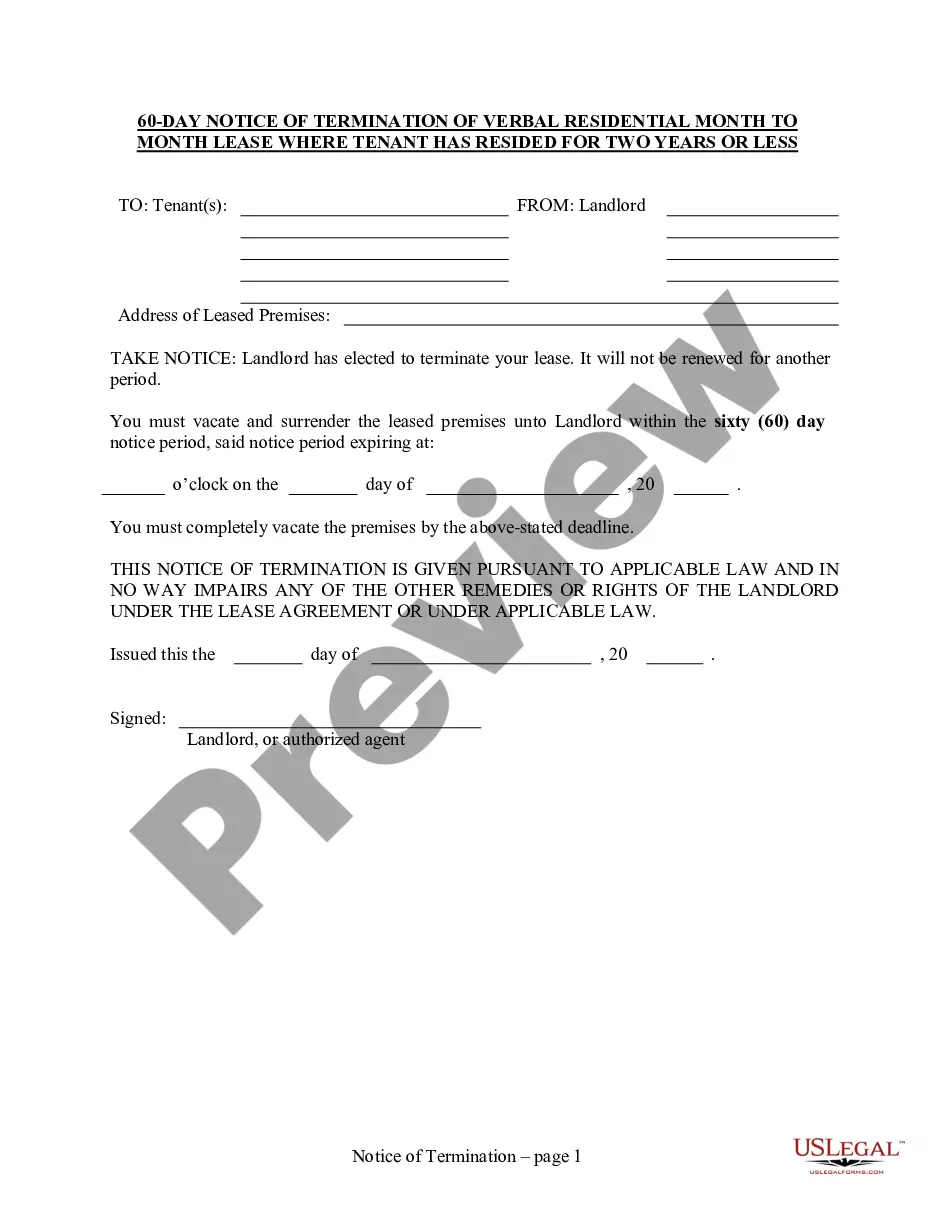

How to complete this form

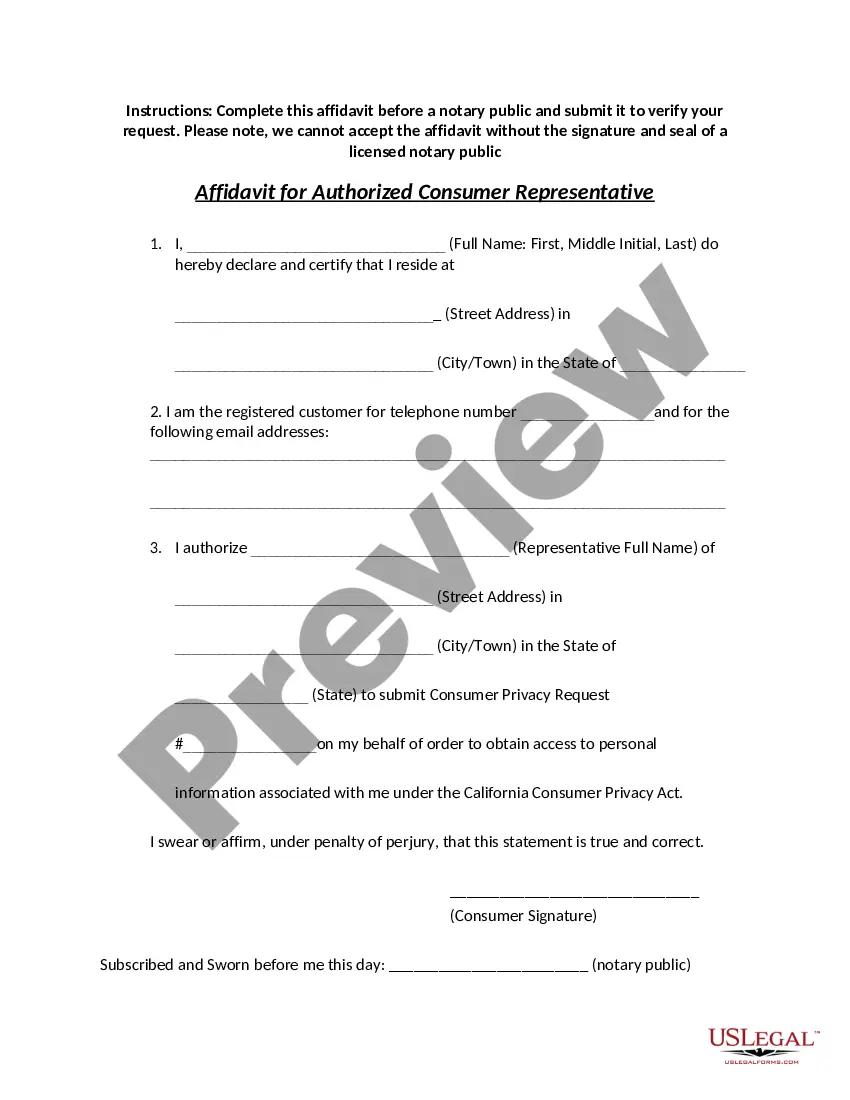

- Identify the parties involved by filling in the names and addresses of the trustee, trustor, and beneficiary.

- Specify the section of the trust agreement that grants the trustee termination power.

- Enter the date on which the trust is being terminated.

- State the reasons for termination in the designated area.

- Both the trustee and beneficiary must sign and date the document in the provided fields.

- Obtain notarization to ensure legal validity, if required by state law.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Typical mistakes to avoid

- Failing to specify the reasons for termination clearly.

- Not obtaining signatures from both the trustee and the beneficiary.

- Ignoring the need for notarization if required by state law.

- Using outdated or incorrect information regarding the trust agreement.

Why use this form online

- Easy access to a legally sound document drafted by licensed attorneys.

- Convenient downloadable format that allows for quick and secure completion.

- Editable fields to ensure all information is accurate and complete.

State-specific requirements

This form is a general form that can be adapted for use in different states. Since each state has its own laws, make any needed updates before completing it.

Form popularity

FAQ

Resignation is typically done by giving written notice to the beneficiaries and to the successor Trustee. The successor Trustee should receive the resignation so that he or she knows that it's their turn to manage the Trust estate.

Trustees Can Withdraw For Trust UseTrust law varies from state to state, but under no circumstances can a trustee withdraw funds from the trust for the personal use of the trustee.Common trust law dictates that the trustee (or trustees) are the only parties that can disburse funds from a trust account.

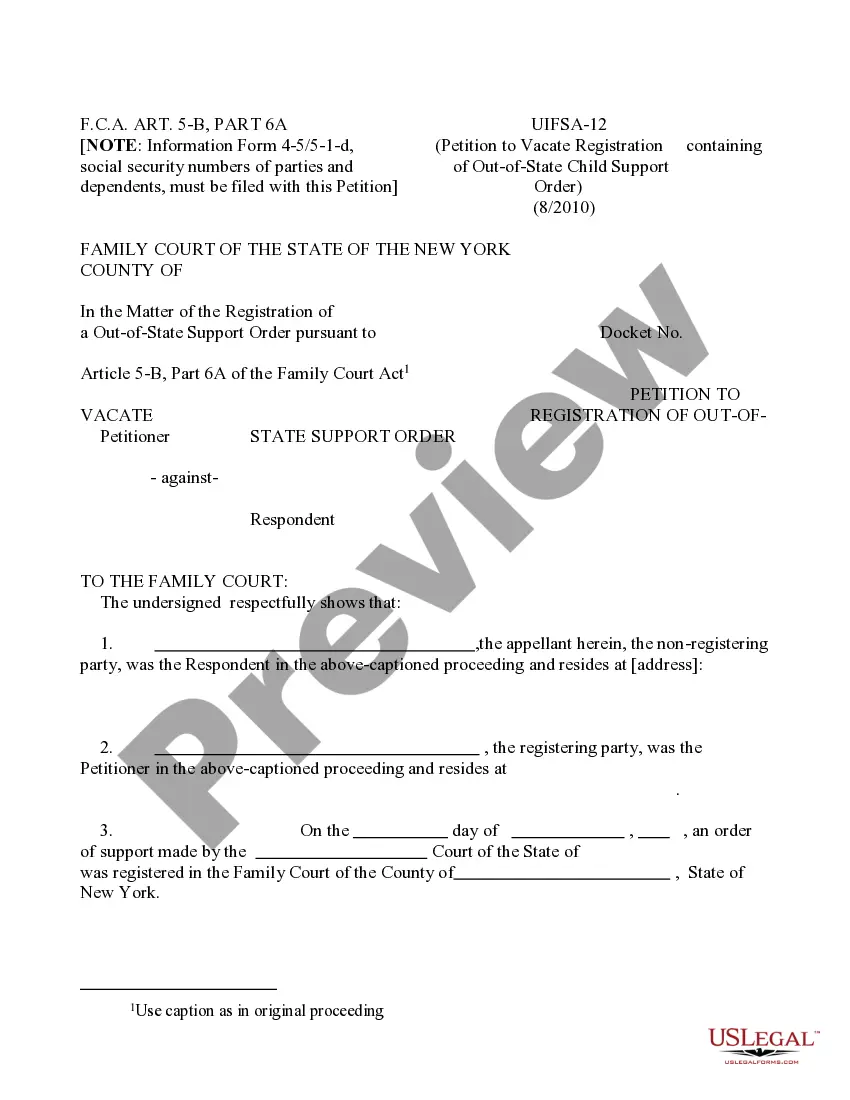

Usually, this means paying any outstanding trust obligations, liquidating assets, filing final income tax returns, preparing a final accounting for the benefit of the beneficiaries, and distributing trust assets to the appropriate beneficiaries.

Although non-indemnified executors may face potential personal liability for their work as estate trustees, the beneficiaries of estates are not obligated to sign such releases and indemnities which are presented to them before receiving any distribution of their inheritance.

A beneficiary can renounce their interest from the trust and, upon the consent of other beneficiaries, be allowed to exit. A trustee cannot remove a beneficiary from an irrevocable trust. A grantor can remove a beneficiary from a revocable trust by going back to the trust deed codes that allow for the same.

But what happens if a trustee steals from the trust, breaching their fiduciary duty? When a trustee acts in this fraudulent manner, they violate beneficiary rights and endanger trust assets. The abused beneficiaries can respond by petitioning for a trust accounting and then the eventual removal of the trustee.

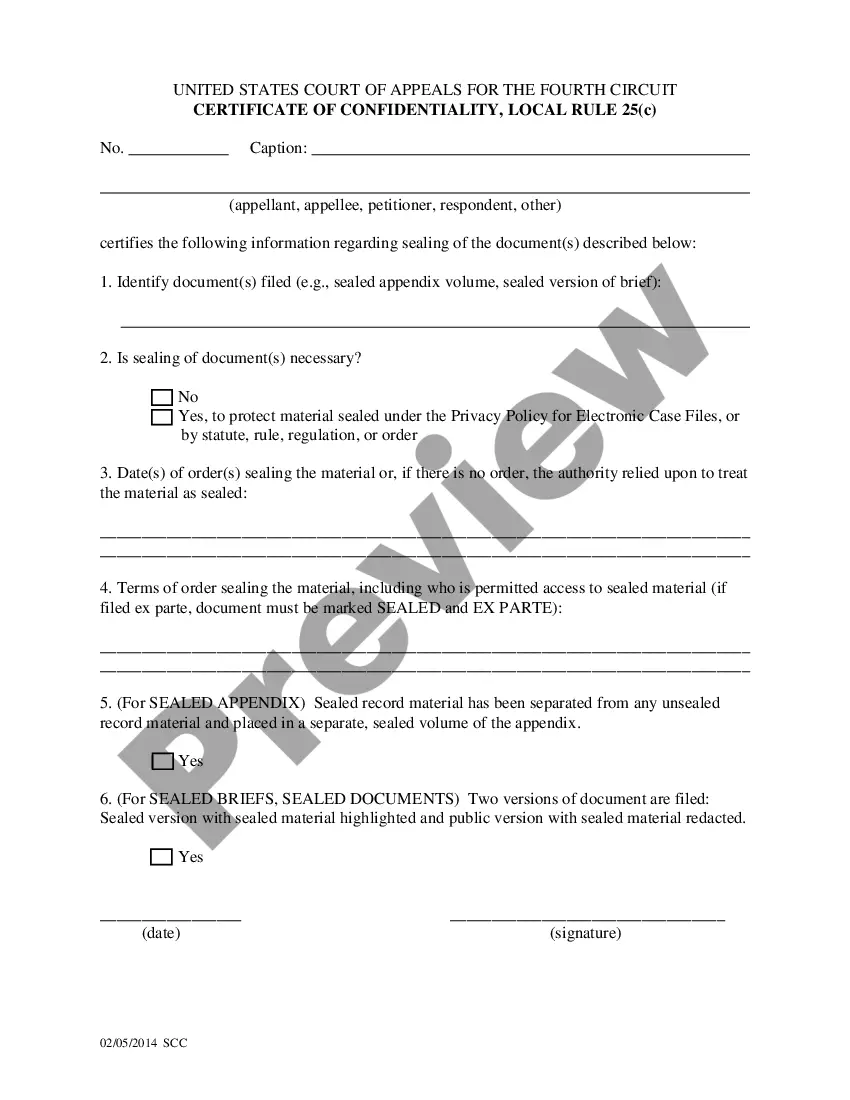

A Receipt and Release Agreement is the means by which a beneficiary of an estate may acknowledge receipt of the property to which he is entitled, and agree to release the executor from any further liability with respect thereto.

A Receipt, Release, Refunding and Indemnification Agreement is a probate tool that allows the executor to distribute estate funds to a beneficiary with the promise from the beneficiary to return the funds if it later turns out they were distributed in error.

A trustee has a duty to conform to the terms of the trust. Legally a trustee cannot spend money in a trust on themselves (unless the are also a beneficiary).