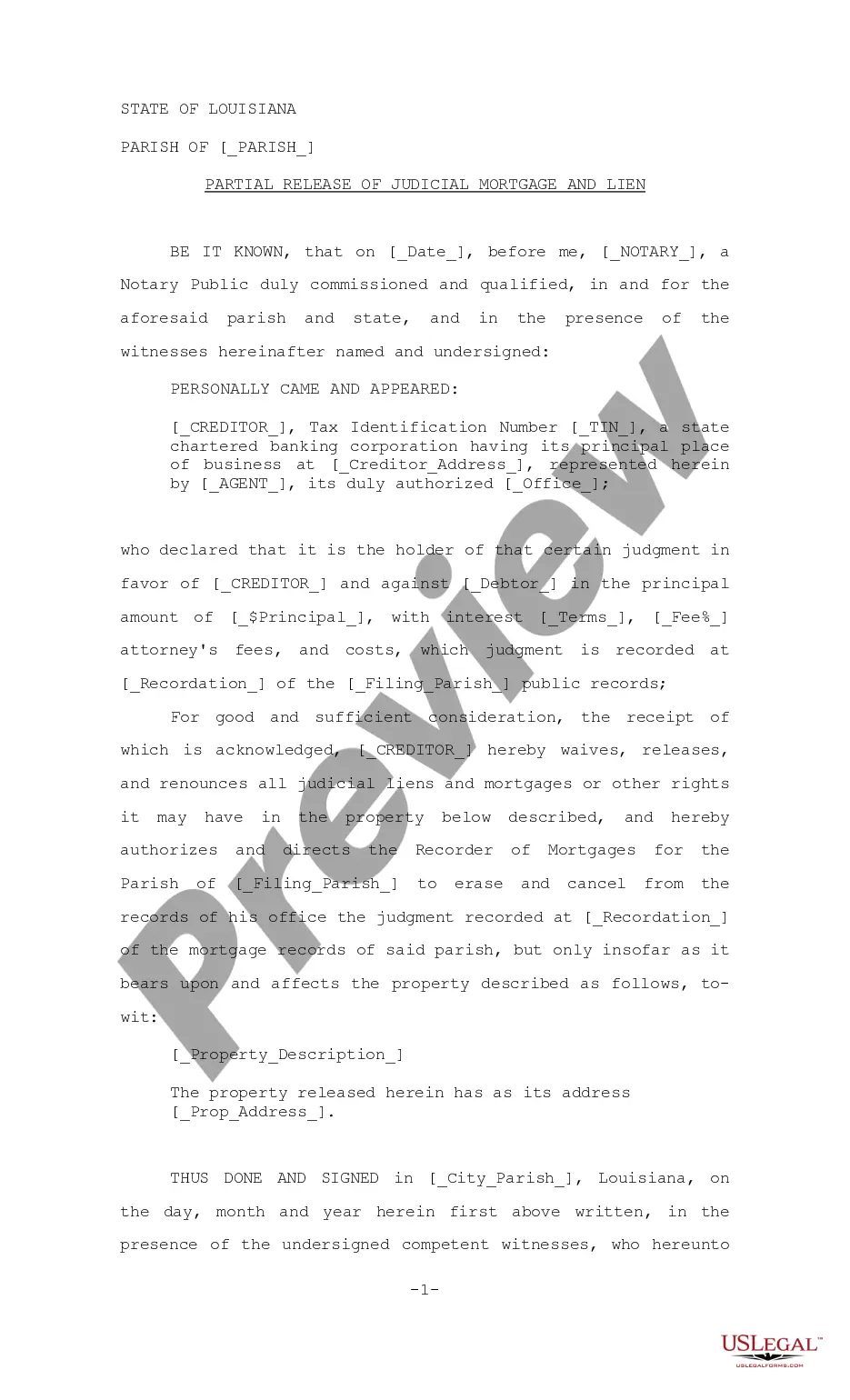

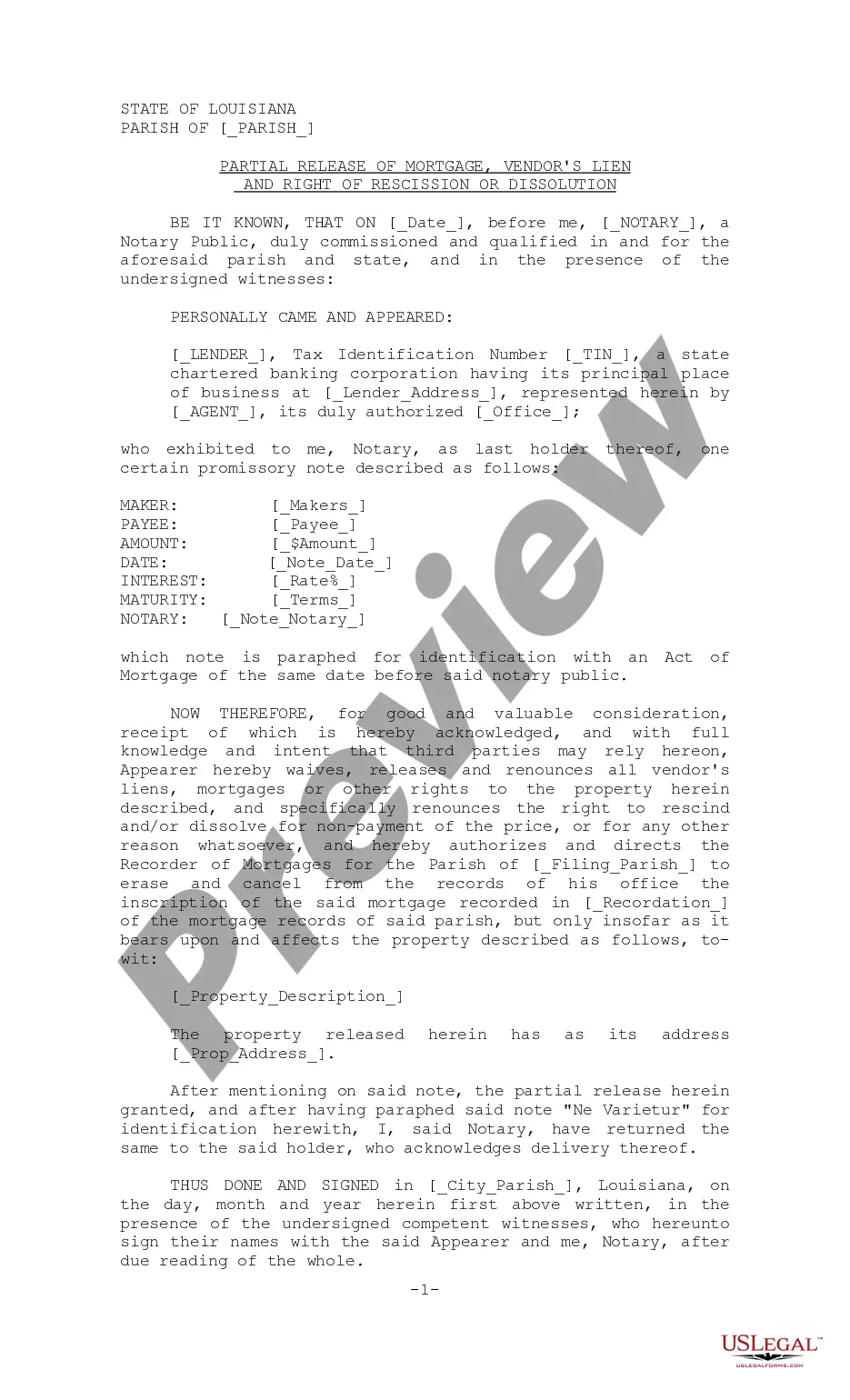

Louisiana Partial Release of Judicial Mortgage and Lien

Description

How to fill out Louisiana Partial Release Of Judicial Mortgage And Lien?

You are invited to the finest legal document collection, US Legal Forms.

Here, you can obtain any template, such as the Louisiana Partial Release of Judicial Mortgage and Lien forms, and download as many as you wish or require.

Produce official documents within a few hours instead of days or weeks, without having to spend a fortune on a lawyer.

If the template meets your needs, simply click Buy Now. To create an account, select a pricing plan, enroll using a credit card or PayPal account, save the document in your preferred format (Word or PDF), print it, and fill it out with your or your business’s information. Once you’ve finished the Louisiana Partial Release of Judicial Mortgage and Lien, submit it to your attorney for validation. It’s an extra step, but an essential one to ensure you’re fully protected. Register for US Legal Forms today and gain access to a multitude of reusable templates.

- Acquire the state-specific form in just a few clicks and feel assured knowing it was created by our licensed attorneys.

- If you’re already a subscribed customer, simply Log In to your account and select Download next to the Louisiana Partial Release of Judicial Mortgage and Lien form you desire.

- Since US Legal Forms is an online platform, you will always have access to your saved templates, regardless of the device you are using.

- Locate them under the My documents tab.

- If you don’t have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this form pertains to a specific state, verify its relevance in your state.

- Review the description (if available) to ascertain if it’s the correct template.

- Examine additional details with the Preview feature.

Form popularity

FAQ

The subcontractor would file a lien waiver before a lien is filed. By doing so, the subcontractor is giving up his or her right to a lien against the property. In comparison, a lien release (also known as release of lien, cancellation of lien, or a lien cancellation) would come into play after the filing of a lien.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

Pay Off Your Entire Debt. Obviously, the fastest way to remove a tax lien is to pay your outstanding state tax debt in full, plus late fees, penalties, and interest. Set Up a Payment Plan. Apply for an Offer in Compromise. Prove the Lien Was in Error.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

Generally, this requires the assistance of a lawyer. The homeowner may petition the courts under Civil Code Section 8480 in California to remove the mechanic's lien when it is not timely issued or recorded. A lawsuit is usually necessary to file it against the owner by the contractor or subcontractor.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

Lien release/cancellations must be recorded, and not just emailed or faxed between parties. Lien waivers, on the other hand, are just exchanged between the parties. For lien waivers, electronic signatures are perfectly acceptable.

Lien release letters should have a conspicuous title such as Release of Lien at the top of the page. The first paragraph should list the date the lien was placed on the property and the names and addresses of both the lienholder and the owner of the property.