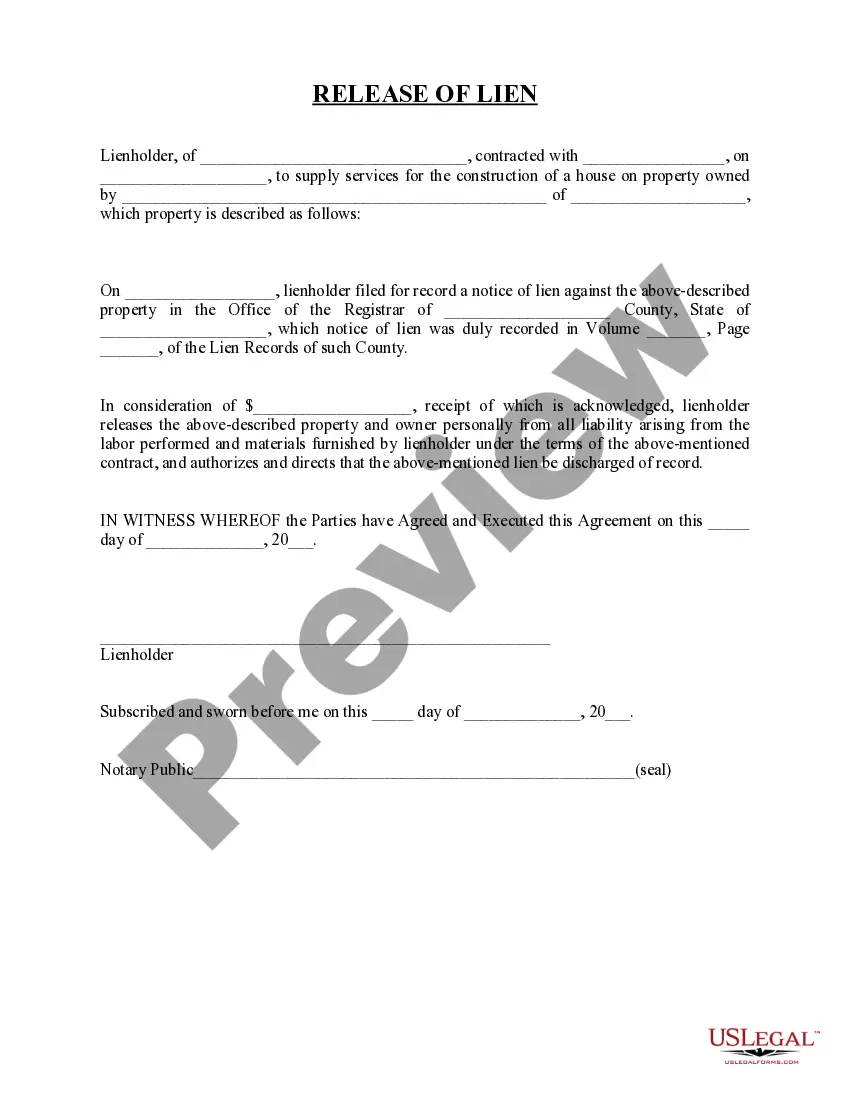

Release of Lien for Property

Description

How to fill out Release Of Lien For Property?

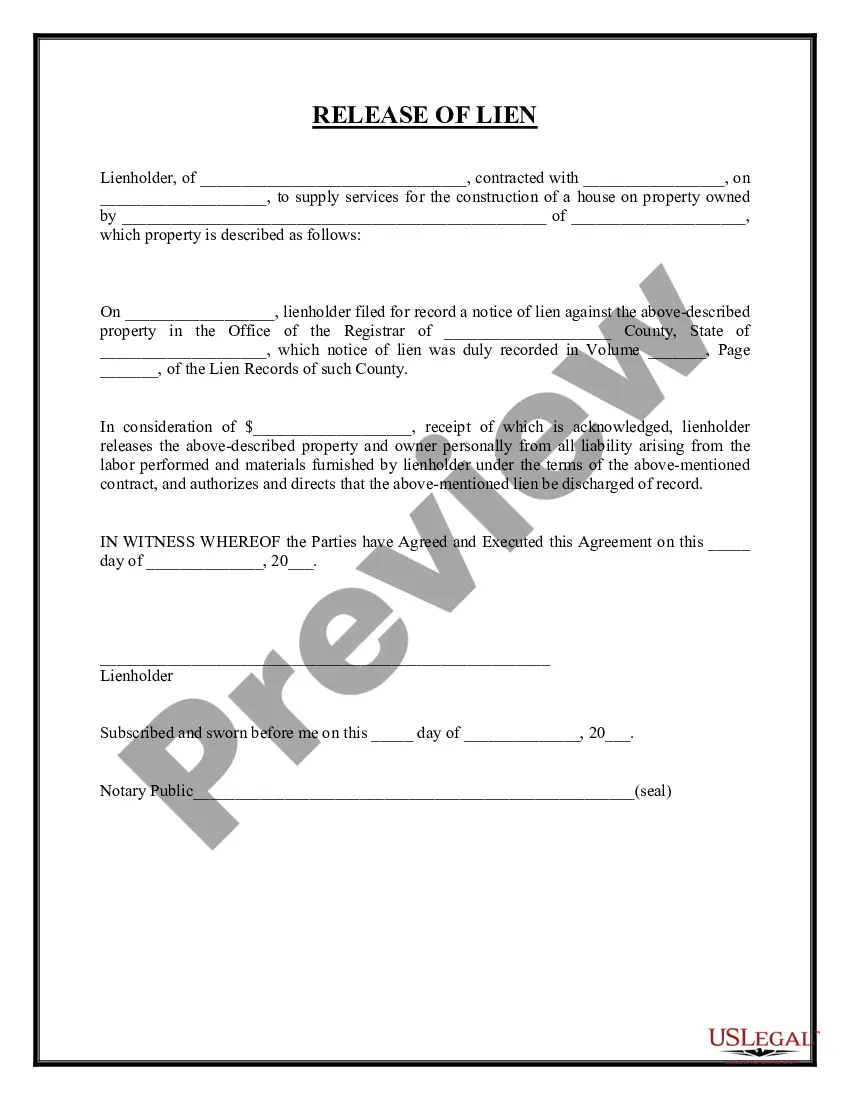

Use US Legal Forms to get a printable Release of Lien for Property. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms library online and offers reasonably priced and accurate samples for customers and legal professionals, and SMBs. The documents are grouped into state-based categories and many of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Release of Lien for Property:

- Check to make sure you get the proper form with regards to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Release of Lien for Property. Over three million users already have utilized our service successfully. Select your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

A deed of trust or mortgage is a contract that places a lien on your property. Both provide a way for your lender to take back your home through foreclosure. Deeds of trust and mortgages both serve the same basic purpose.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

The typical amount of time is 30 to 60 days. Some banks will send the lien release directly to the department of motor vehicles or the county recorder's office on behalf of the borrower, while others send the release to the borrower who then must file it.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

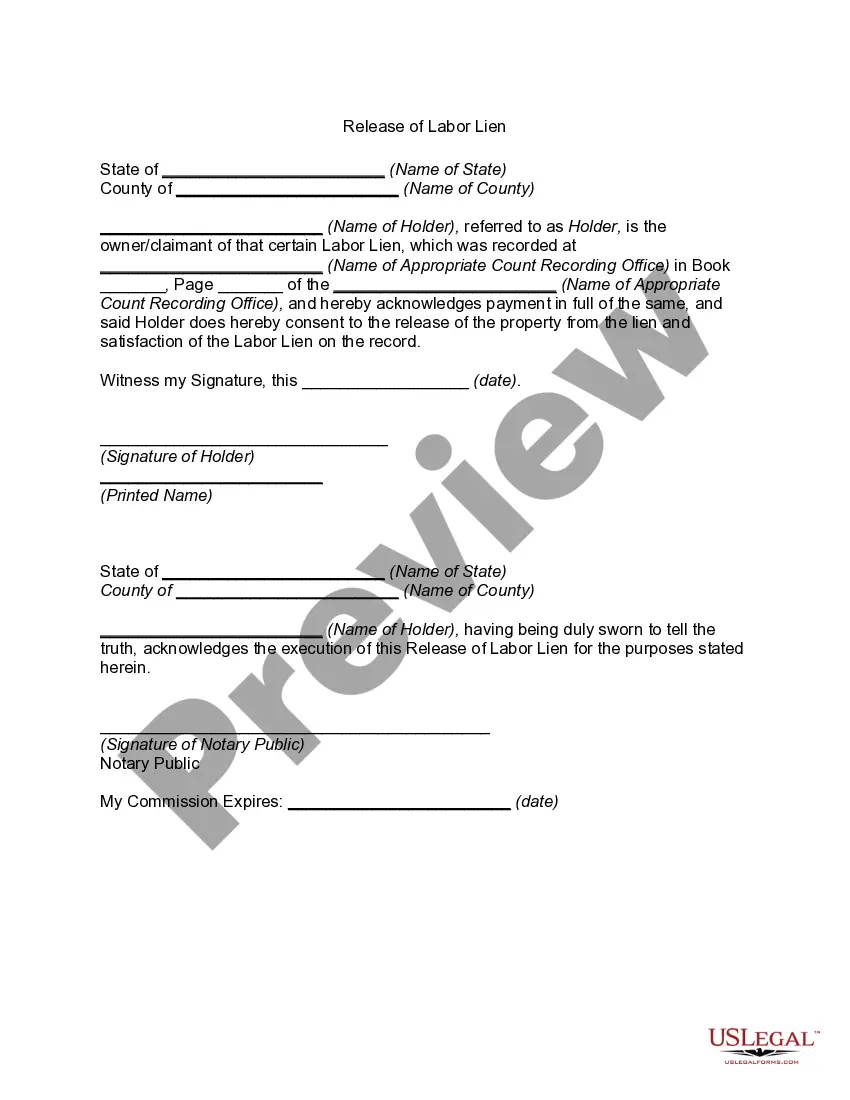

A lien release is used to cancel a lien that has already been filed. Lien releases are also referred to as a release of lien, cancellation of lien, or a lien cancellation. These are typically used to cancel the filed claim from public records.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.When you call the lender, ask for the release of lien department.