Release of Lien

What is this form?

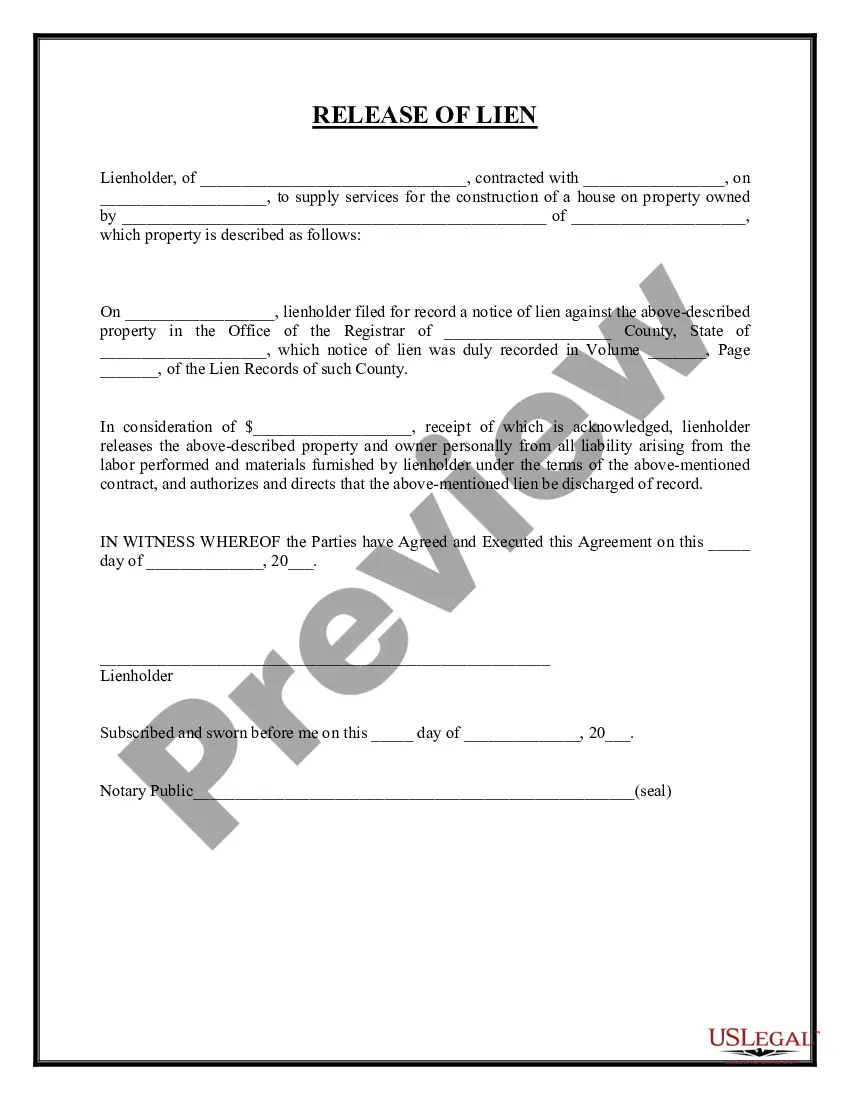

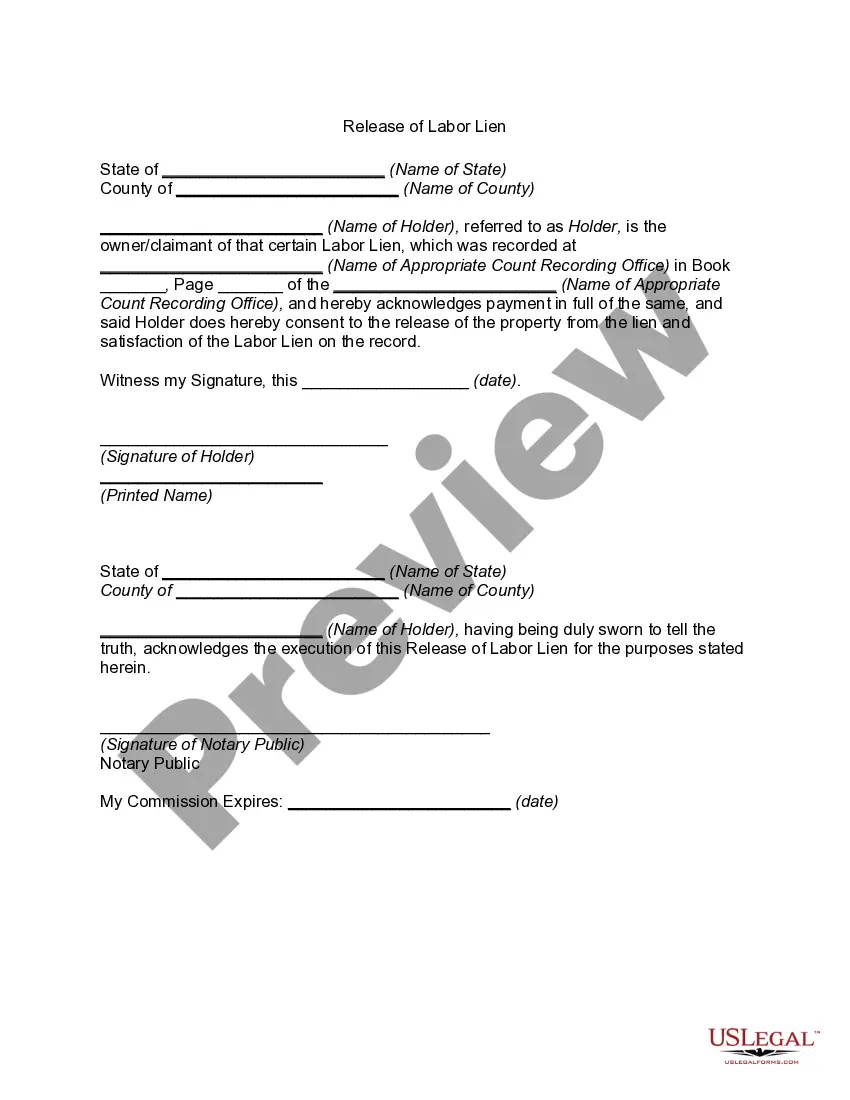

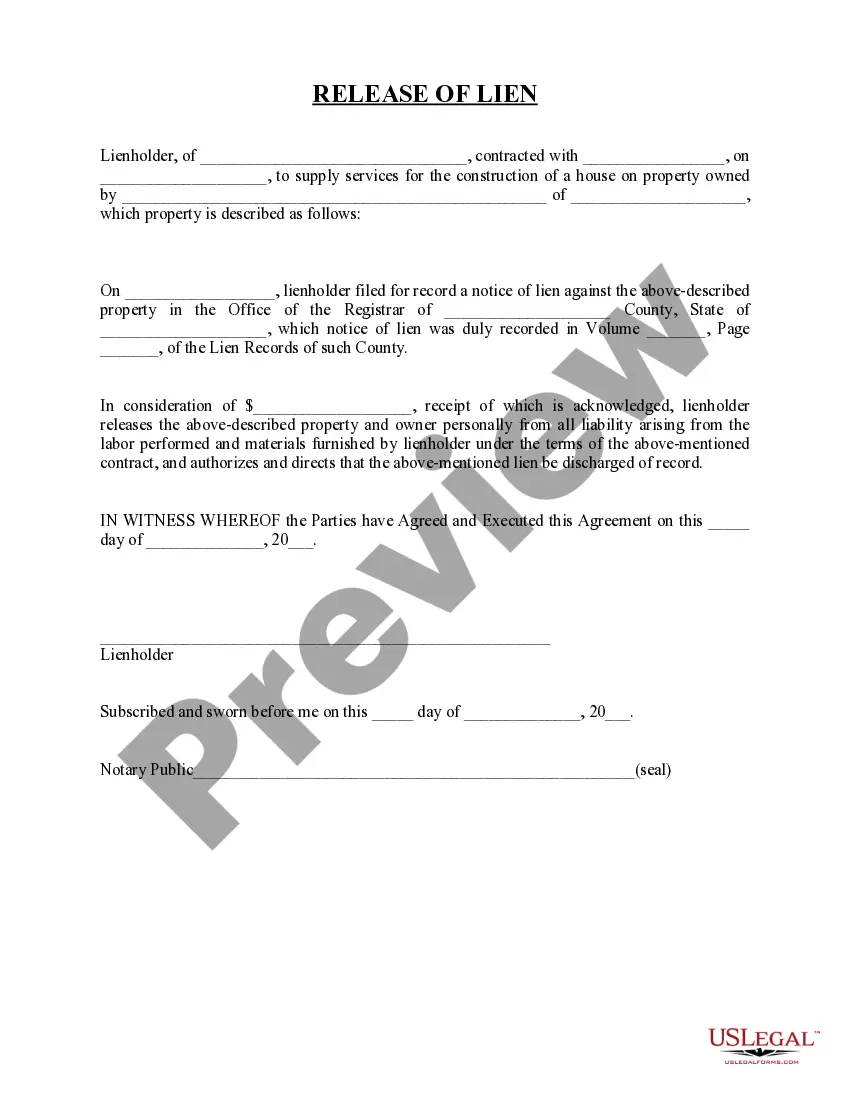

The Release of Lien is a legal document that allows a lienholder to relinquish their claim against a property. This form confirms that the lienholder has completed their work or provided materials under a specific contract, releasing the property owner from all related liabilities. Unlike other forms that may create or manage a lien, this document effectively clears a lien from the public record, signaling that the owner's obligations to the lienholder are fulfilled.

What’s included in this form

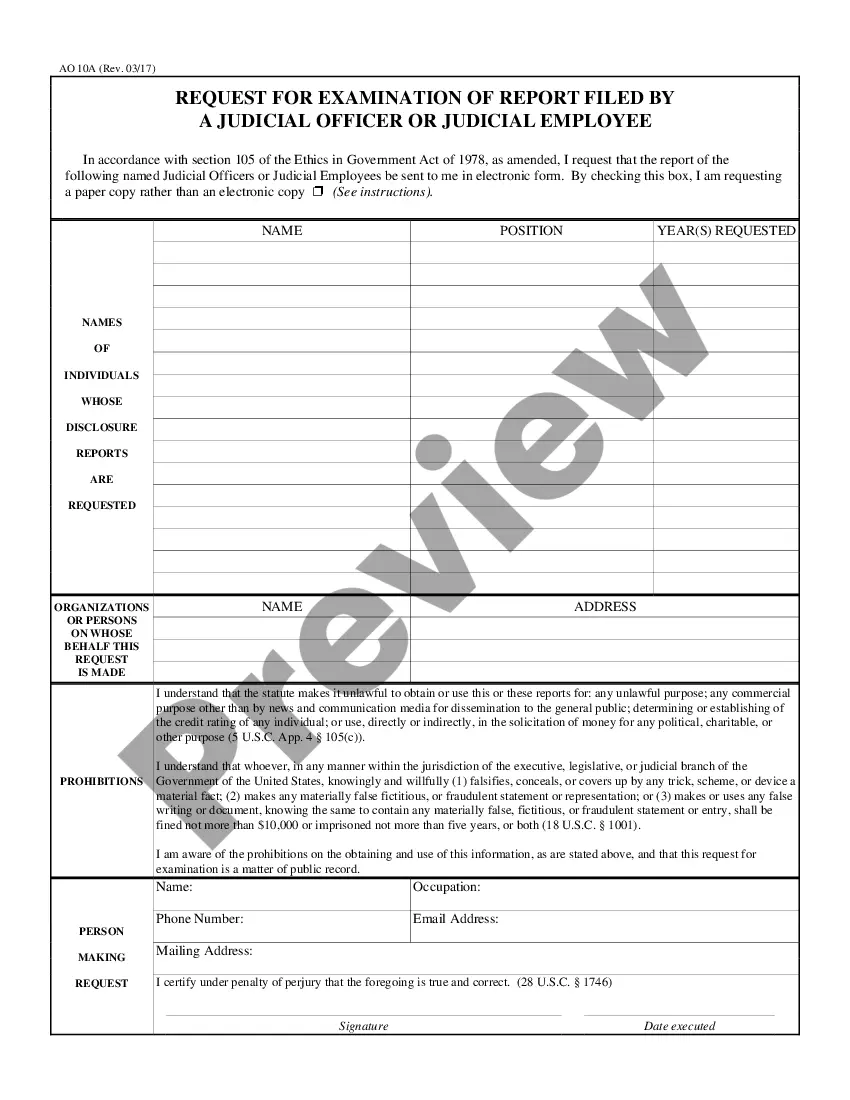

- Identification of the lienholder and property owner

- Date of the original contract for services

- Details of the property affected by the lien

- The consideration received by the lienholder for the release

- Authorization for the lien to be discharged of record

- Signatures of the lienholder and a notary public

When this form is needed

This form is typically used when a contractor or service provider has completed their work on a property and wishes to formally declare that the property owner is no longer liable for any associated payments or claims. It is often utilized in construction or renovation projects where liens are placed to secure payment, and the work has been satisfactorily finished.

Intended users of this form

- Contractors or service providers who have completed a project

- Property owners who need to clear a lien against their property

- Attorneys assisting clients with real estate transactions involving liens

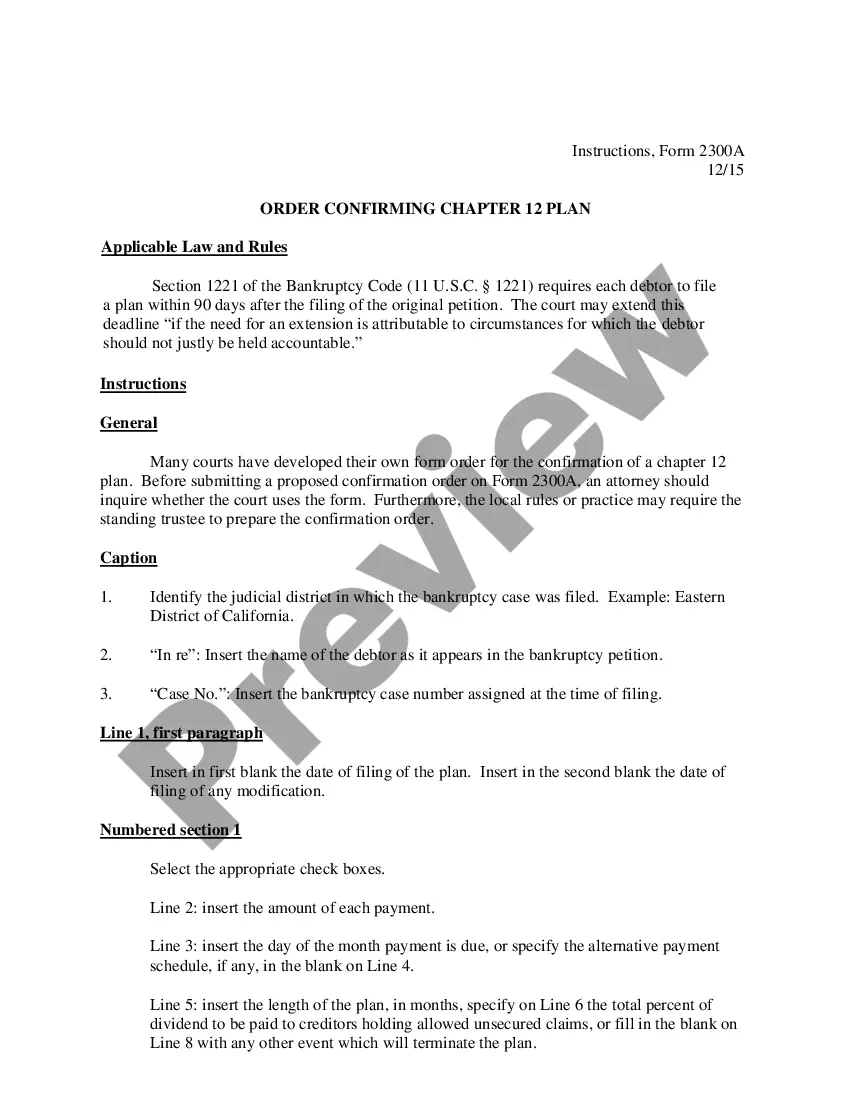

Completing this form step by step

- Identify the lienholder and enter their full name.

- Specify the property owner's name and the date of the original contract.

- Provide a detailed description of the property related to the lien.

- State the amount of consideration received by the lienholder.

- Obtain signatures from the lienholder and ensure notarization.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include the complete legal descriptions of the property.

- Not obtaining a signature from the lienholder.

- Omitting to have the form notarized, if required.

- Forgetting to specify the consideration received.

Why use this form online

- Easy access to legally compliant templates created by licensed attorneys.

- Editable forms allow for customization tailored to your specific needs.

- Convenient download options for immediate use.

- Reliable sources ensure that your form meets legal requirements.

Looking for another form?

Form popularity

FAQ

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

A lien release is used to cancel a lien that has already been filed. Lien releases are also referred to as a release of lien, cancellation of lien, or a lien cancellation. These are typically used to cancel the filed claim from public records.

A claim against, limitation on, or liability against real estate is an encumbrance. Encumbrances include liens, deed restrictions, easements, encroachments, and licenses. An encumbrance can restrict the owner's ability to transfer title to the property or lessen its value.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.When you call the lender, ask for the release of lien department.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

A deed of trust or mortgage is a contract that places a lien on your property. Both provide a way for your lender to take back your home through foreclosure. Deeds of trust and mortgages both serve the same basic purpose.

In a lien theory state, the buyer holds the deed to the property during the mortgage term The buyer promises to make all payments to the lender and the mortgage becomes a lien on the property, but title remains with the buyer.The Deed of Reconveyance removes the lender's interest in the property.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.