Paralegal Agreement - Self-Employed Independent Contractor

Definition and meaning

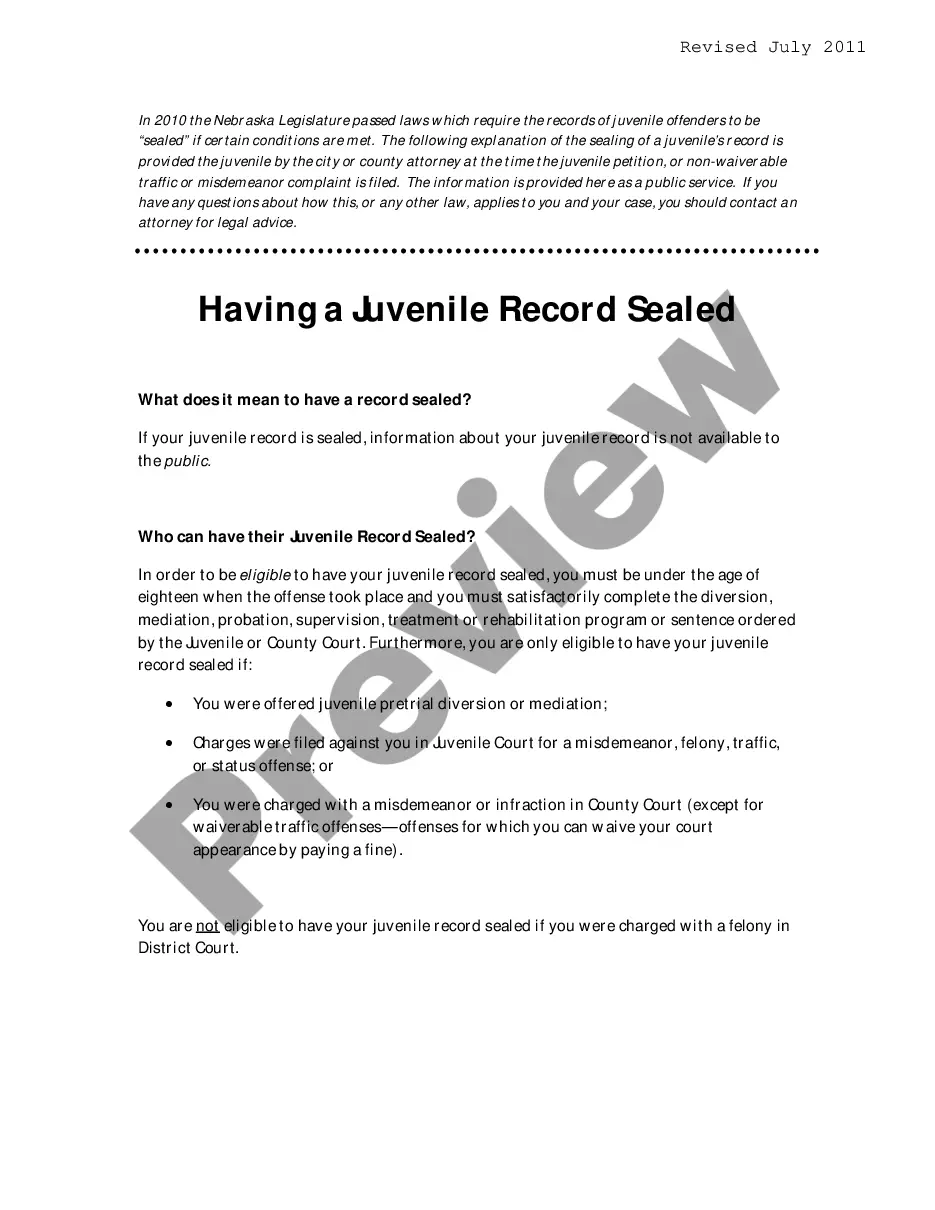

A Paralegal Agreement – Self-Employed Independent Contractor is a legal document that outlines the terms and conditions under which a paralegal agrees to work for an employer as an independent contractor. This agreement clarifies the relationship between the employer and the paralegal, delineating the scope of duties, compensation, confidentiality obligations, and termination conditions.

How to complete a form

To complete a Paralegal Agreement, follow these steps:

- Begin by entering the date the agreement is made.

- Fill in the names of the parties involved, including the Employer and the Paralegal.

- Specify the duration of the contract and any terms of renewal.

- Clearly outline the duties expected of the Paralegal.

- Detail the compensation structure, including payment rates and frequency.

- Include clauses on confidentiality and termination rights.

- Ensure all parties sign and date the agreement to make it legally binding.

Who should use this form

This form is suitable for employers in need of paralegal services who wish to hire a paralegal as an independent contractor. It is also appropriate for individuals with paralegal qualifications looking to offer their services on a contractual basis. Particularly, it is beneficial for new law firms, solo practitioners, or businesses that require temporary legal support.

Key components of the form

A comprehensive Paralegal Agreement will typically include:

- Scope of Duties: A detailed description of the tasks expected from the paralegal.

- Compensation: The payment structure outlining hourly rates or retainer fees.

- Confidentiality Clause: Obligations regarding the handling of sensitive information.

- Termination Conditions: Provisions that detail how and when either party can terminate the agreement.

Common mistakes to avoid when using this form

When completing a Paralegal Agreement, consider avoiding these common pitfalls:

- Failing to clearly define the scope of duties, leading to misunderstandings.

- Neglecting to include payment terms, causing disputes over compensation.

- Overlooking the inclusion of a confidentiality clause, which can expose sensitive information to risks.

- Not specifying termination conditions, which can complicate the conclusion of the working relationship.

Key takeaways

A Paralegal Agreement is essential for establishing a clear and professional relationship between a paralegal and their employer. It serves to protect the interests of both parties while ensuring that all terms are explicitly stated. Remember to thoroughly review the agreement for completeness and clarity before both parties sign to avoid potential misunderstandings in the future.

Form popularity

FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

There's a catch, of course; paralegals cannot practice law, so the most natural type of business to be in is one you can't open.The rise of Alternative Legal Service Providers (ALSPs) is a doorway to business ownership for paralegals. Today, you can start your own firm in a niche such as: Document review.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

There's a catch, of course; paralegals cannot practice law, so the most natural type of business to be in is one you can't open.The rise of Alternative Legal Service Providers (ALSPs) is a doorway to business ownership for paralegals. Today, you can start your own firm in a niche such as: Document review.

However, Business and Professions Code §6450 does set forth educational requirements which California paralegals must satisfy. A contract or freelance paralegal is someone who performs substantive legal work for law firms or corporations, or other entities but is self-employed.

Years of Experience and Salary In 2016, the average annual income for a paralegal was $61,671. Freelance paralegals bill between $22 and $45 per hour depending on experience, specialty, the complexity of the job and geographic location.

NFPA defines a freelance paralegal as "a paralegal who works as an independent contractor with supervision by and/or accountability to a lawyer." Contract paralegals also are qualified through education, work and/or experience to perform legally substantive tasks that, in the absence of the paralegal, would be

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.