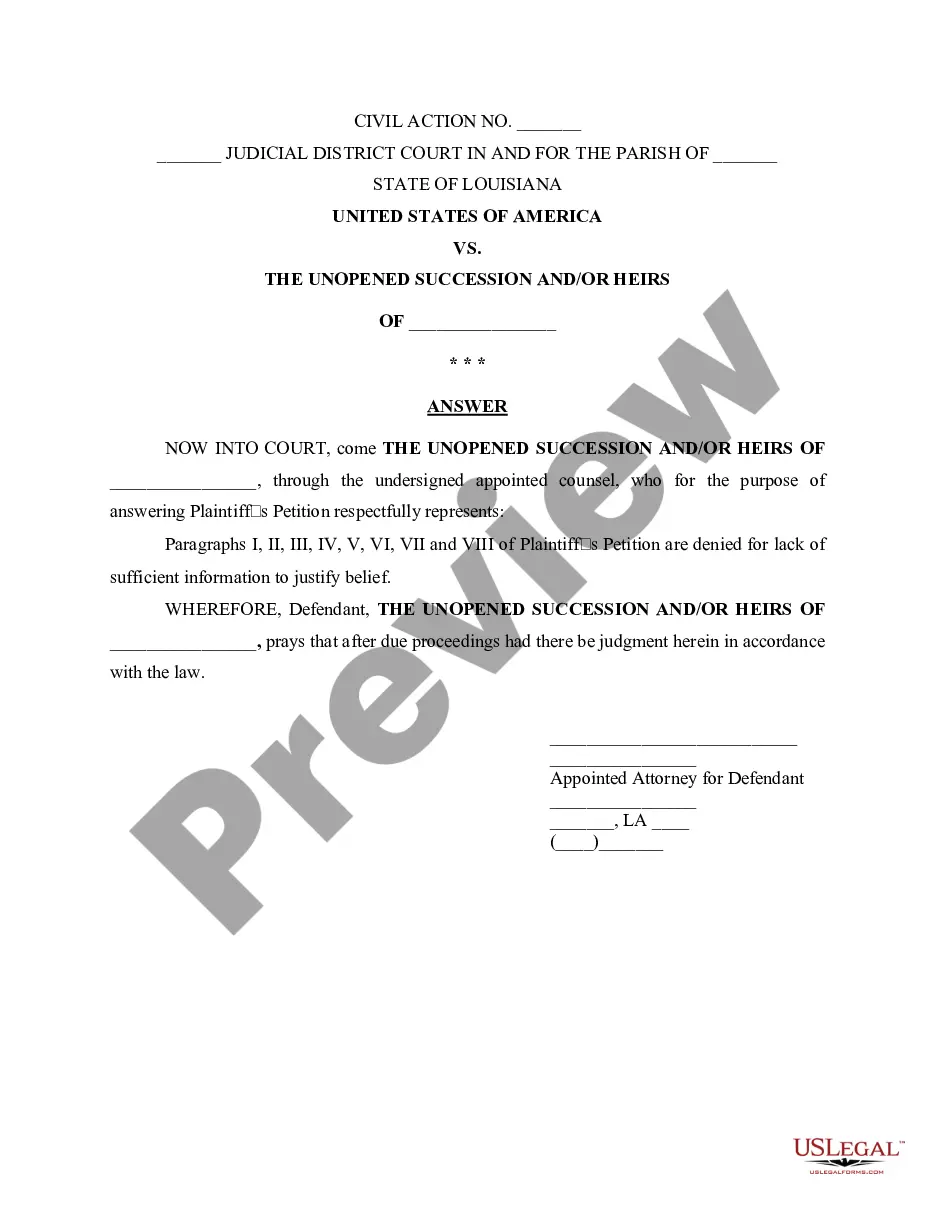

Louisiana Answer to Plaintiff's Petition for unopened succession

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

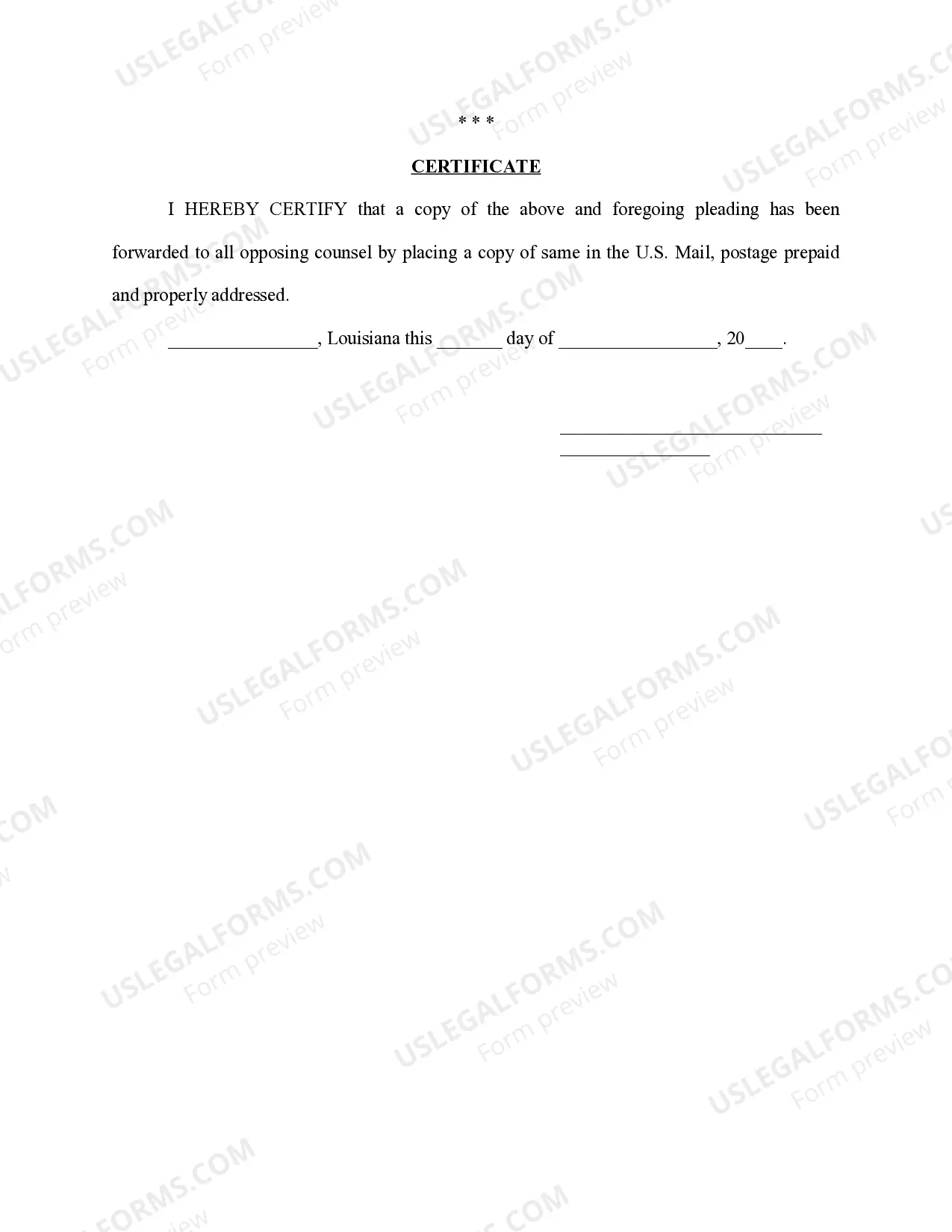

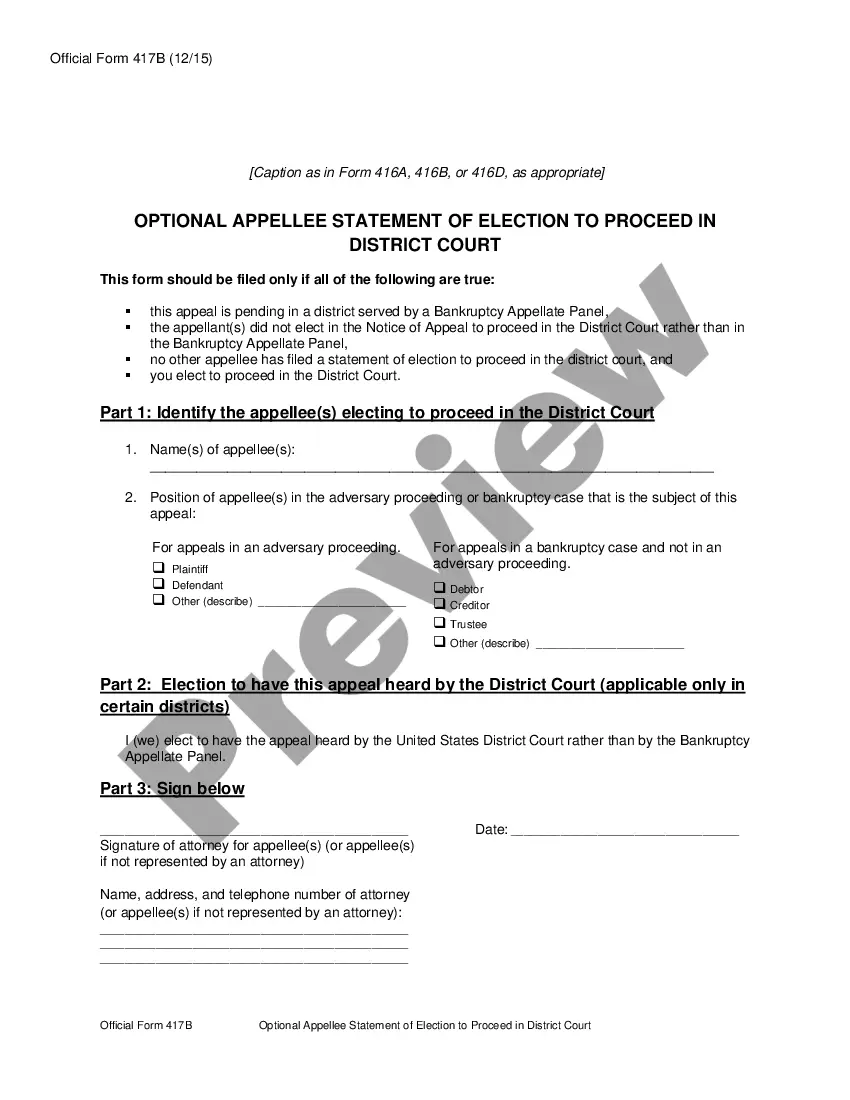

How to fill out Louisiana Answer To Plaintiff's Petition For Unopened Succession?

Locating Louisiana Reply to Plaintiff's Petition for unopened estate forms and completing them can be quite a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you only need to complete them.

Select your payment method via credit card or PayPal. Save the form in your preferred file format. Now you can print the Louisiana Reply to Plaintiff's Petition for unopened estate form or complete it using any online editor. Don’t worry about making mistakes because your sample can be utilized and submitted, and printed out as many times as you wish. Visit US Legal Forms to gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the sample.

- All your stored templates are saved in My documents and are always accessible for future use.

- If you haven't subscribed yet, you need to register.

- Review our comprehensive instructions on how to obtain the Louisiana Reply to Plaintiff's Petition for unopened estate template in just a few minutes.

- To obtain a valid sample, verify its compatibility with your state.

- Examine the form using the Preview option (if it's available).

- Read the description if there is one to understand the key points.

- Click Buy Now if you found what you're looking for.

Form popularity

FAQ

Maximum $125,000 (CCP 3421 Small Successions Defined) Laws CCP 3432. Step 1 Write in the full name of the person who died. Step 2 Write in the State and County or Parish in which the decedent resided at the time of death. Step 3 Write in the names of the two people signing the petition.

If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.Assets in the decedent's name become unavailable to anyone after death until the succession is opened.

As a practical matter, it typically takes two to six months to complete a succession. Some successions remain open for years due to complexity, litigation between the heirs, or a number of other reasons.

Succession costs for smaller estates with cooperative heirs will typically range from $1,500.00 to $3,000.00. Succession costs for larger estates that require administration will typically range from $5,000.00 up to $15,000.00 depending on what needs to be done.

Maximum $125,000 (CCP 3421 Small Successions Defined) Laws CCP 3432. Step 1 Write in the full name of the person who died. Step 2 Write in the State and County or Parish in which the decedent resided at the time of death. Step 3 Write in the names of the two people signing the petition.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

Inheritance Laws in Louisiana. Louisiana does not impose any state inheritance or estate taxes. It's also a community property estate, meaning it considers all the assets of a married couple jointly owned.

If all heirs agree and the property is easy to find; you could be looking at a rate of $1,250-$3,500 plus court costs. Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.