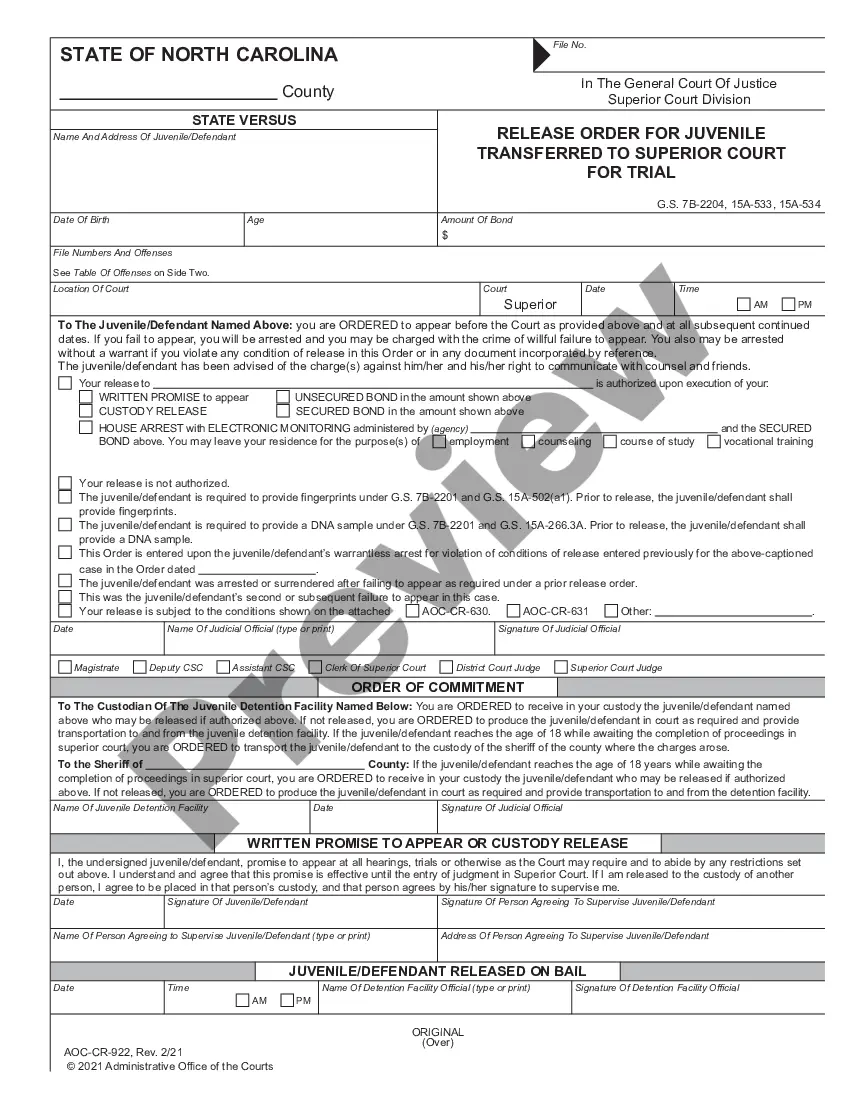

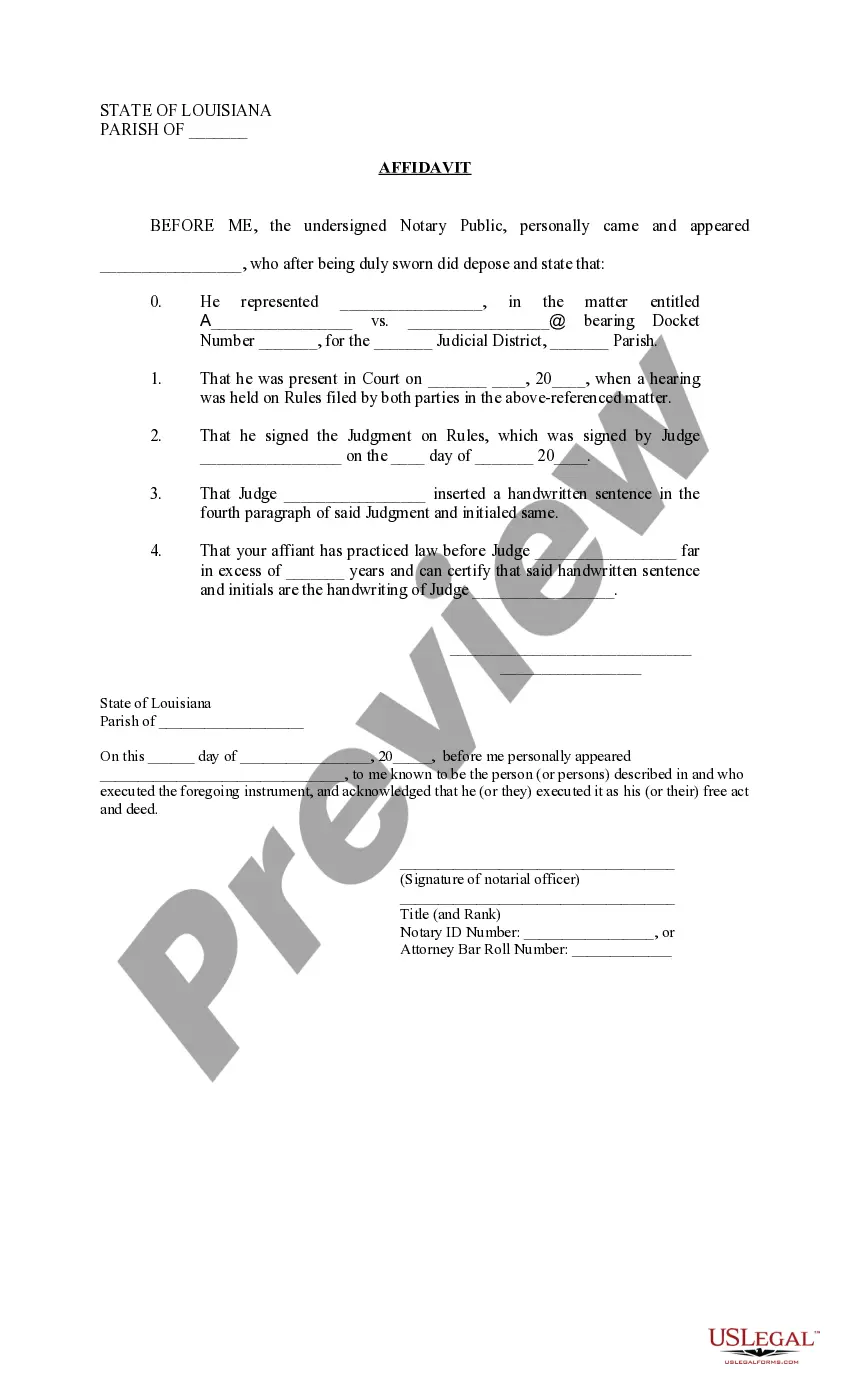

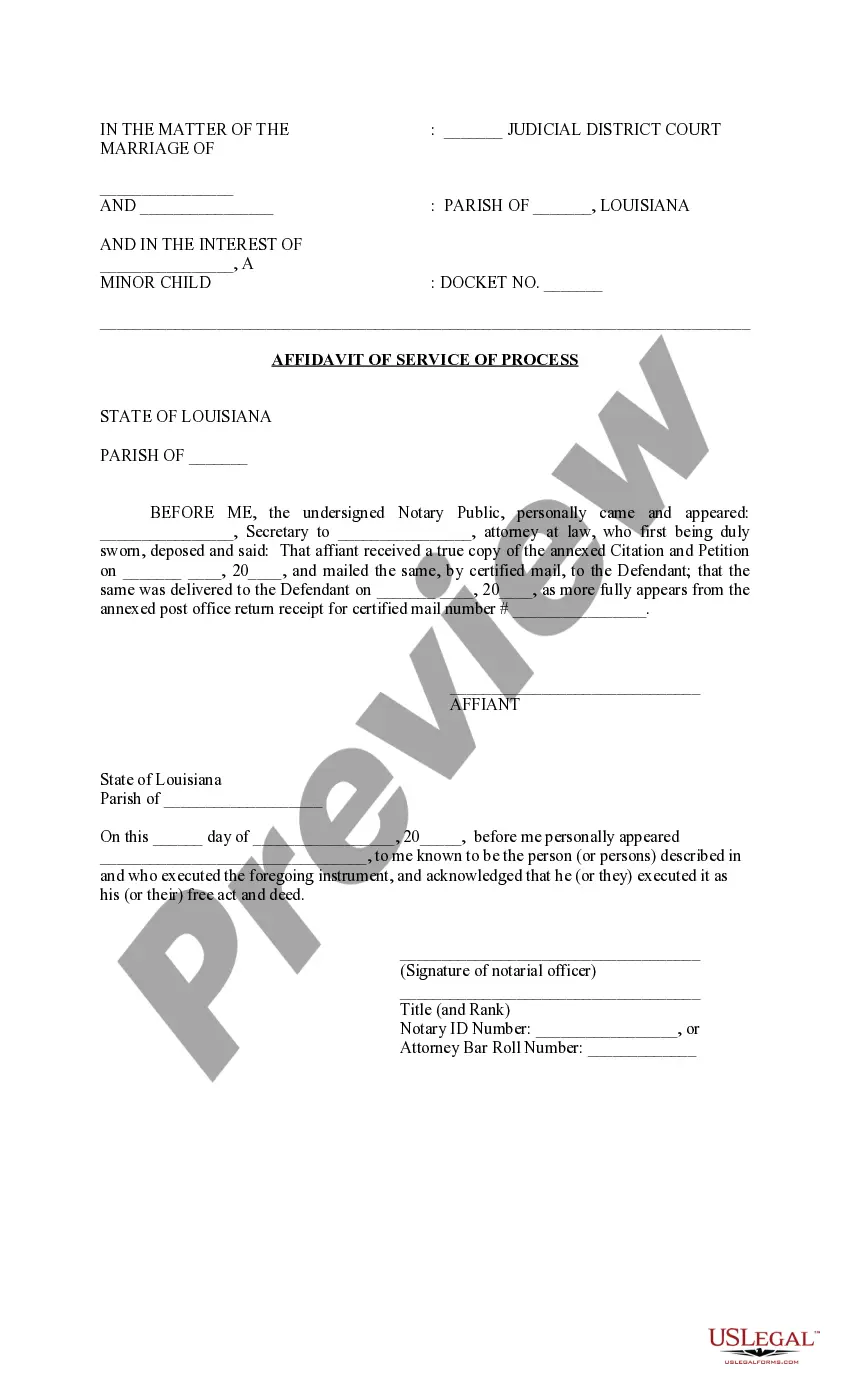

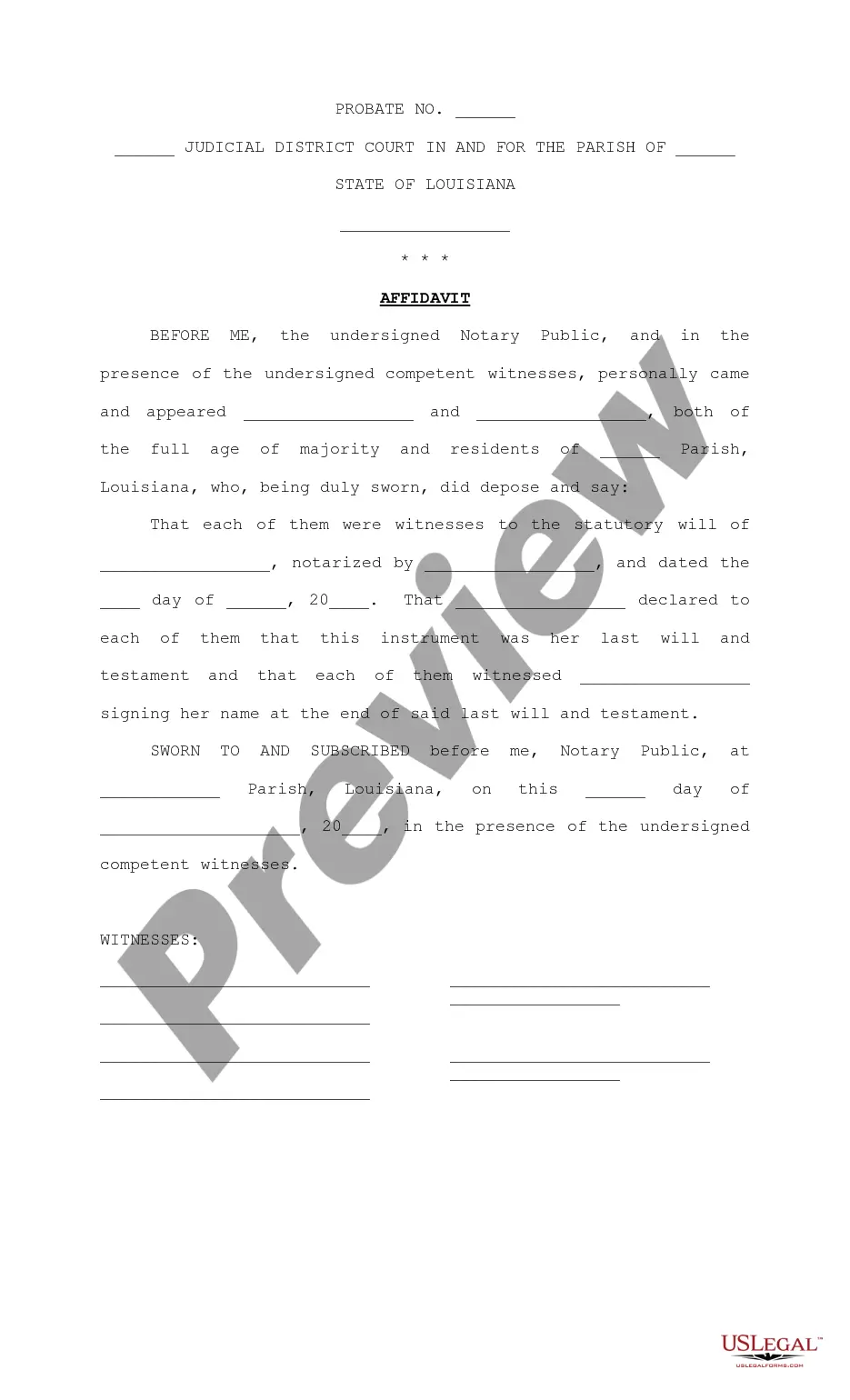

Indiana Final Order in Garnishment is a legal document issued by Indiana state courts in order to collect money owed by a debtor. This document permits a creditor to garnish or seize the debtor’s assets, such as wages, bank accounts, and other personal property. The Final Order in Garnishment is typically a last resort for creditors to collect money owed when other attempts at collection have failed. There are two types of Indiana Final Order in Garnishment: wage garnishment and bank garnishment. Wage garnishment occurs when a creditor obtains a court order to have the debtor’s wages withheld from his/her paycheck and sent to the creditor. Bank garnishment, on the other hand, occurs when a creditor obtains a court order to seize funds from the debtor’s bank account. Both types of garnishment require the debtor to appear in court in order to contest the Final Order in Garnishment.

Indiana Final Order in Garnishment (PDF)Opens a New Window.

Description

How to fill out Indiana Final Order In Garnishment (PDF)Opens A New Window.?

US Legal Forms is the simplest and most economical method to locate suitable legal templates.

It’s the largest online repository of business and personal legal documentation that has been drafted and reviewed by attorneys.

Here, you can access printable and fillable forms that conform to federal and state laws - just like your Indiana Final Order in Garnishment (PDF)Opens a New Window.

Examine the form description or view a preview of the document to ensure you’ve selected the one that fits your needs, or find another one using the search function above.

Click Buy now when you’re confident of its suitability with all the specifications, and choose the subscription plan that appeals to you the most.

- Acquiring your template entails just a few straightforward steps.

- Users who already possess an account with a valid subscription only need to Log In to the online platform and download the form onto their device.

- Subsequently, they can find it in their profile under the My documents section.

- And here’s how you can obtain a professionally created Indiana Final Order in Garnishment (PDF)Opens a New Window. if you are using US Legal Forms for the first time.

Form popularity

FAQ

Collecting on a judgment in Indiana typically involves garnishing wages or seizing assets. You must file a request with the court to initiate the collection process, which often includes obtaining an Indiana Final Order in Garnishment (PDF)Opens a New Window. Staying informed about your rights and using resources like the uslegalforms platform will help you effectively manage this process and ensure compliance.

Judgments in Indiana generally remain valid for ten years. However, a party can renew the judgment, allowing it to remain enforceable for an additional ten years. This often plays a vital role when dealing with an Indiana Final Order in Garnishment (PDF)Opens a New Window. Knowing the lifespan of a judgment can help you plan your financial strategies more effectively.

In Indiana, certain assets are exempt from judgment collections. These include a portion of your wages, some types of retirement accounts, and specific personal property. Understanding these exemptions is crucial, and you can find more detailed information in the Indiana Final Order in Garnishment (PDF)Opens a New Window.

To collect a judgment in Indiana, you can initiate collection activities such as garnishment, bank levies, or placing liens on property. It’s crucial to follow legal procedures and maintain accurate records, including your Indiana Final Order in Garnishment (PDF)Opens a New Window, which provides important details regarding the judgment. Working with legal professionals or using helpful platforms like USLegalForms can streamline your collection efforts.

Limits on Wage Garnishment in Indiana For any given workweek, creditors are allowed to garnish the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

To get a wage garnishment in the state of Indiana, a creditor first needs to sue you in court for the debt you owe. If you don't show up to the court to challenge the creditor's lawsuit, then the court will issue a default judgment against you.

Pay your debts if you can afford it. Make a plan to reduce your debt. If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union. See if you can settle your debt.Consider bankruptcy.

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

If you reasonably believe that your employer took an adverse action against you based upon the Wage Garnishment Order or the income withholding process, you may file a lawsuit against the employer in a court with jurisdiction.

5 Ways to Stop a Garnishment Pay Off the Debt. If your financial situation is dire, paying off the debt may not be an option.Work With Your Creditor.Challenge the Garnishment.File a Claim of Exemption.File for Bankruptcy.