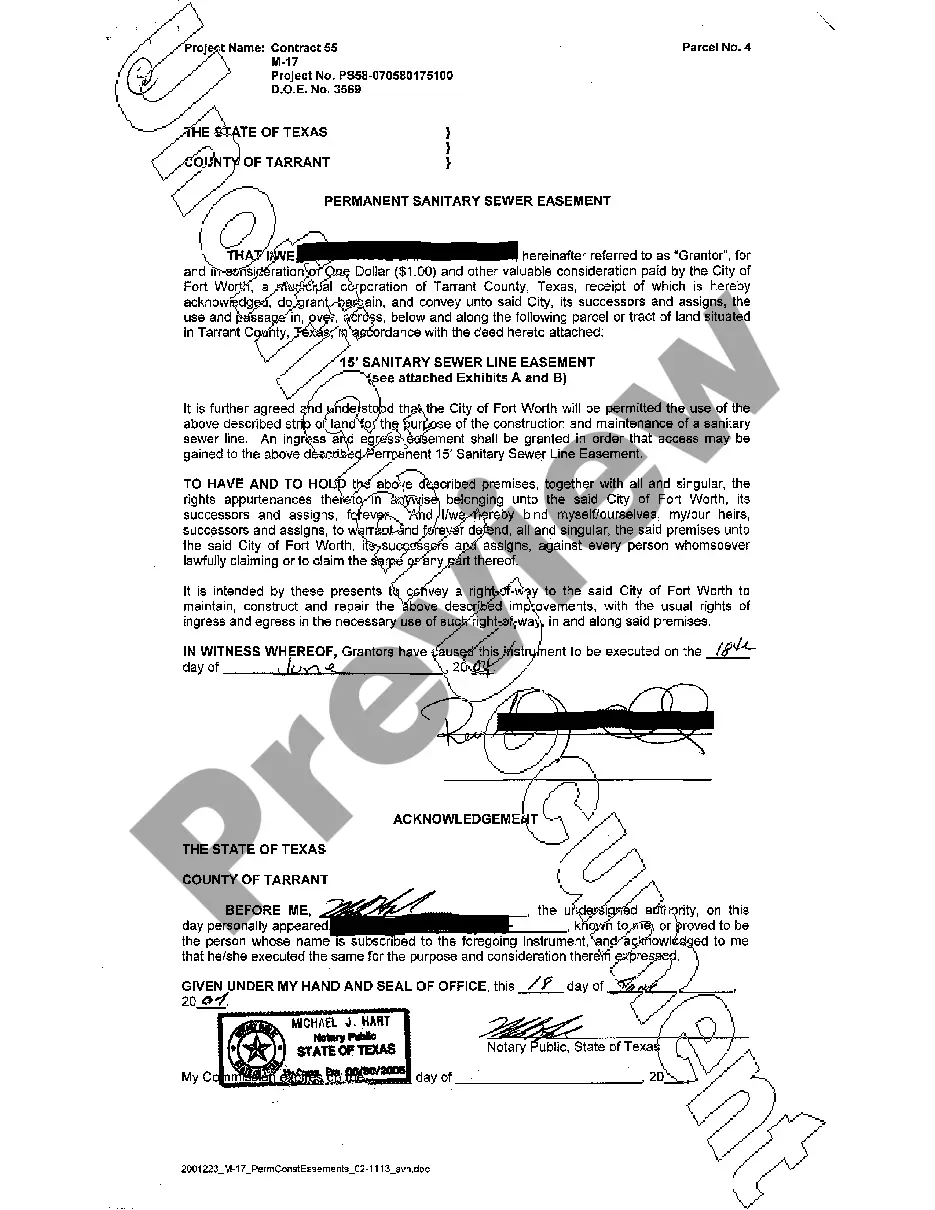

The Indiana Final Order in Garnishment (PDF) is a legal document issued by a court of law in the state of Indiana ordering a third party to pay a creditor a portion of a debtor's wages or bank account earnings. This document is used by creditors to collect money owed to them by debtors. There are two types of Indiana Final Order in Garnishment (PDF). The first type, known as a Wage Garnishment, is used to recover money owed from the debtor’s wages. The court orders the employer to withhold a portion of the debtor’s wages and send them directly to the creditor. The second type, known as a Bank Account Garnishment, is used to recover money owed from the debtor’s bank account. The court orders the bank to withhold a portion of the debtor’s money and send it directly to the creditor. Both types of Indiana Final Order in Garnishment (PDF) require the debtor to provide proof that the debt is valid and that the debtor has not already paid it off. The court also requires the debtor to provide proof of income and financial information. The court will then issue a Final Order in Garnishment (PDF) and send it to the employer or bank to begin the garnishment process.

Indiana Final Order in Garnishment (PDF)Opens a New Window.

Description

How to fill out Indiana Final Order In Garnishment (PDF)Opens A New Window.?

If you're looking for a method to properly finalize the Indiana Final Order in Garnishment (PDF)Opens a New Window. without recruiting a legal expert, then you've come to the perfect destination.

US Legal Forms has demonstrated itself as the most comprehensive and respected collection of official templates for every personal and business scenario. Each document you discover on our web platform is crafted in accordance with federal and state regulations, so you can be assured that your paperwork is in order.

Another significant benefit of US Legal Forms is that you will never misplace the paperwork you purchased - you can access any of your downloaded templates in the My documents section of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal requirements and state regulations by reviewing its text description or examining the Preview mode.

- Input the form title in the Search tab located at the top of the page and select your state from the dropdown menu to find an alternative template should there be any discrepancies.

- Repeat the content verification and click Buy now when you are assured of the document's compliance with all stipulations.

- Log in to your account and tap Download. Register for the service and choose a subscription plan if you haven't already done so.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format in which you wish to save your Indiana Final Order in Garnishment (PDF)Opens a New Window. and download it by clicking the corresponding button.

- Import your template into an online editor to complete and sign it swiftly or print it out to prepare a physical copy manually.

Form popularity

FAQ

To collect a judgment in Indiana, you should start by obtaining a certified copy of the judgment from the court. Once you have this document, you can utilize various methods such as garnishment, bank levies, or property liens. Using the Indiana Final Order in Garnishment (PDF)Opens a New Window can streamline the garnishment process. If you need assistance, consider utilizing platforms like USLegalForms to access the necessary materials.

To claim exemption from wage garnishment in Indiana, you must file a claim with the court. You will need to complete the appropriate paperwork, which can often be found in an Indiana Final Order in Garnishment (PDF)Opens a New Window. Ensure you provide correct and complete information regarding your financial situation. It is advisable to seek legal guidance to navigate this process effectively.

To get a wage garnishment in the state of Indiana, a creditor first needs to sue you in court for the debt you owe. If you don't show up to the court to challenge the creditor's lawsuit, then the court will issue a default judgment against you.

Limits on Wage Garnishment in Indiana For any given workweek, creditors are allowed to garnish the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

A garnishment order instructs a third-party who owes money to the defendant, typically the defendant's employer or the defendant's bank, to pay some or all of that money to the plaintiff instead of the defendant. This third party is called a garnishee.

In Indiana, if you owe money to a creditor, like a credit card company, they can take money directly out of your paycheck to collect the overdue debt. This process is called wage garnishment, and it's often used when borrowers stop making payments on their loans or credit card debt.

Wage garnishment in Indiana is allowed under Indiana Code Title 34, Article 25, Chapter 3: Garnishment, and IC 24-4.5-5-105, and federal law 15 U.S.C. 1673(a). A judgment-creditor may seek wage garnishment if it is aware of the debtor's place of employment.

If you reasonably believe that your employer took an adverse action against you based upon the Wage Garnishment Order or the income withholding process, you may file a lawsuit against the employer in a court with jurisdiction.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.