Indiana Warranty Deed - Two Individuals or Husband and Wife, one acting through attorney in fact, to an Individual.

About this form

This Warranty Deed form is a legal document used to transfer ownership of property from two individuals or a husband and wife, with one party acting through an attorney in fact, to an individual. This form ensures that the grantors convey and warrant the described property to the grantee, providing legal assurance regarding the title's validity. It is distinct from other transfer forms as it involves the use of a power of attorney, allowing one party to act on behalf of another in the transaction.

Key components of this form

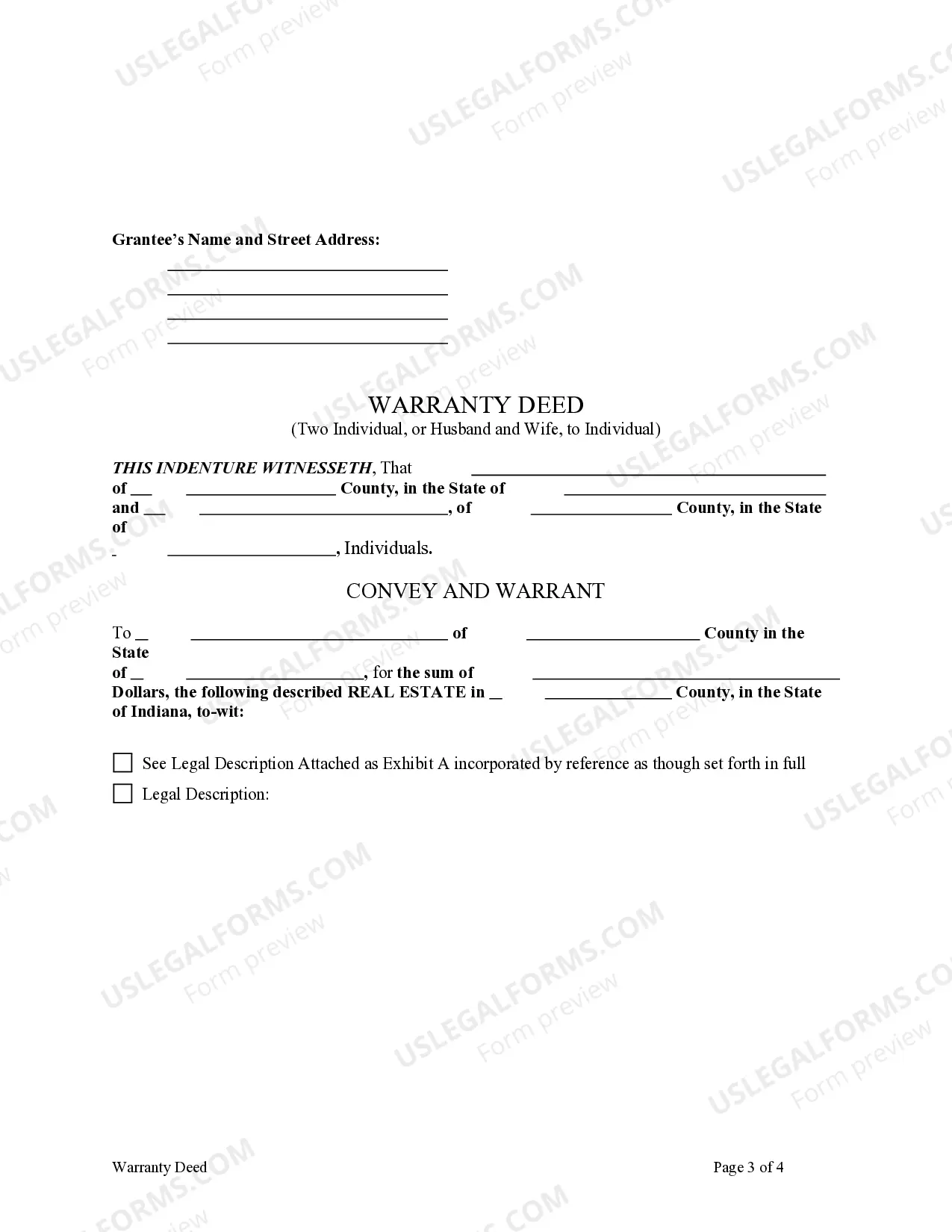

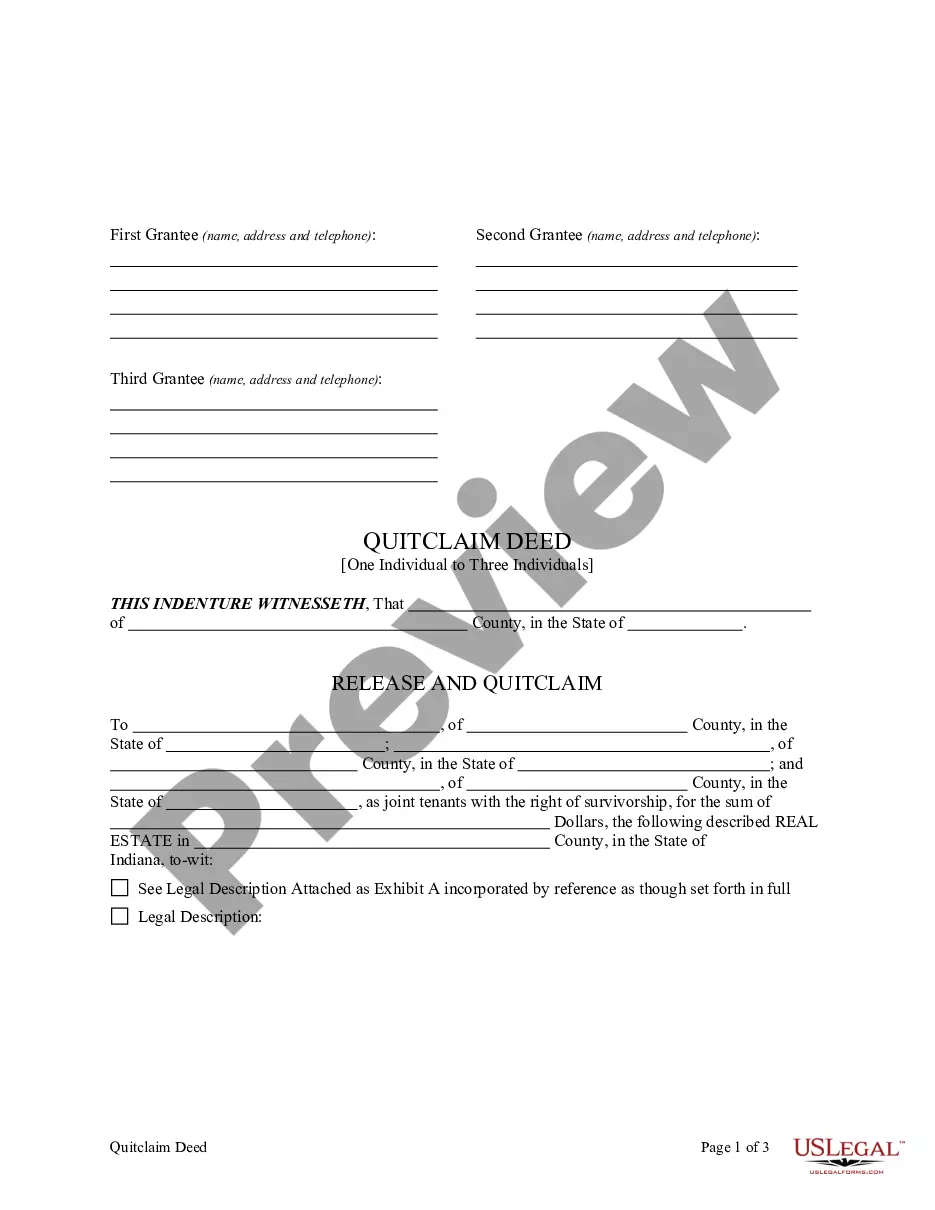

- Identification of the grantors (the individuals or husband and wife) and the grantee (the recipient of the property).

- Details about the property being transferred, including a legal description.

- Inclusion of the power of attorney information, ensuring it is recorded properly.

- A warranty clause that guarantees the title is free from claims or encumbrances.

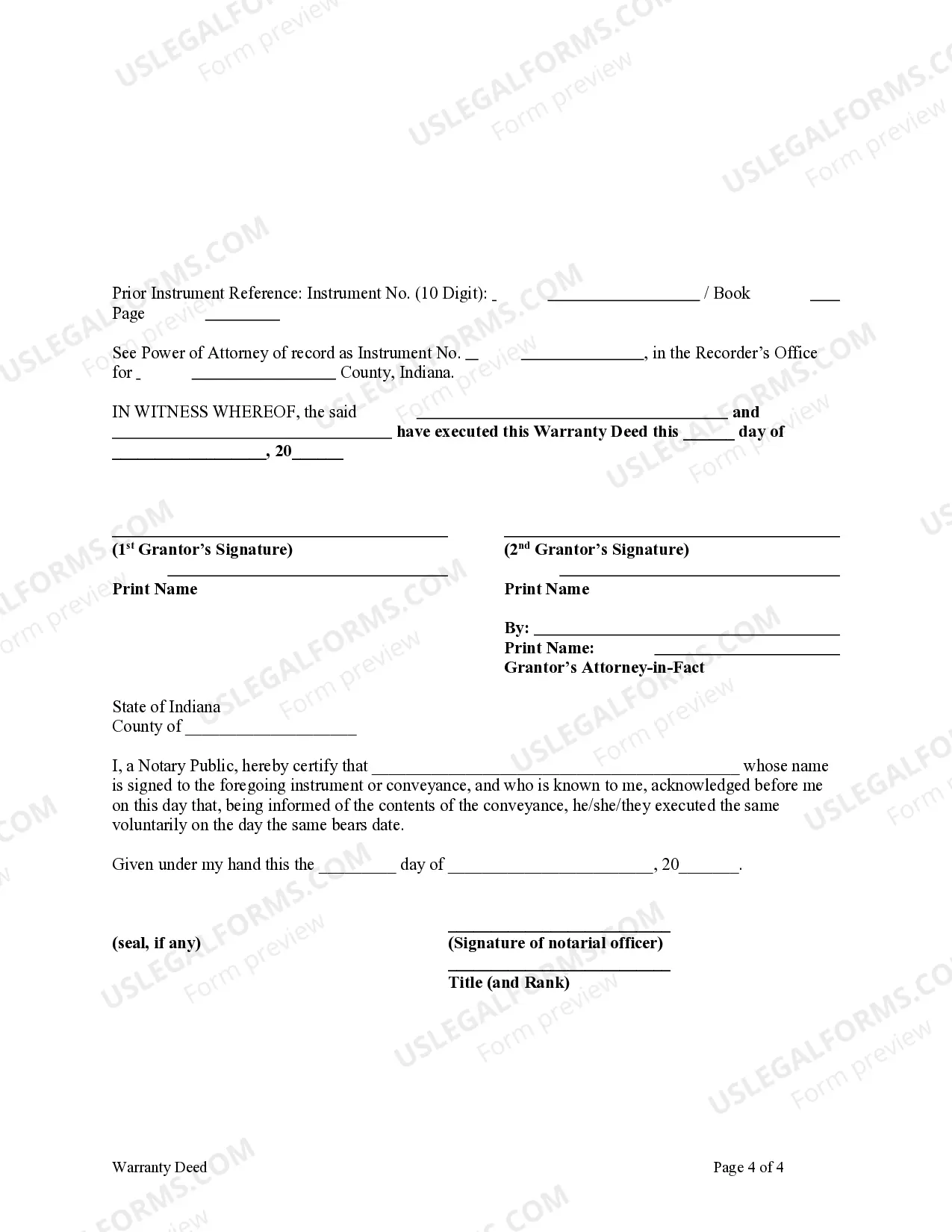

- Signature lines for the grantors and acknowledgment of the notarization, if required.

Legal requirements by state

This form complies with the statutory laws of the relevant state, ensuring that the requirements for property conveyance are met. Specific documentation related to the power of attorney must be recorded alongside this deed.

When to use this form

You should use this Warranty Deed when you are transferring ownership of property from two individuals or from a husband and wife to another individual, where one of the grantors is utilizing a power of attorney. This form is commonly used in situations such as selling jointly owned property or transferring assets upon divorce proceedings. It provides legal clarity and ensures that the transaction adheres to state laws.

Who needs this form

- Individuals or couples who own property jointly and need to transfer it.

- One spouse who is acting on behalf of the other through a power of attorney.

- Anyone involved in real estate transactions requiring a formal deed transfer.

Completing this form step by step

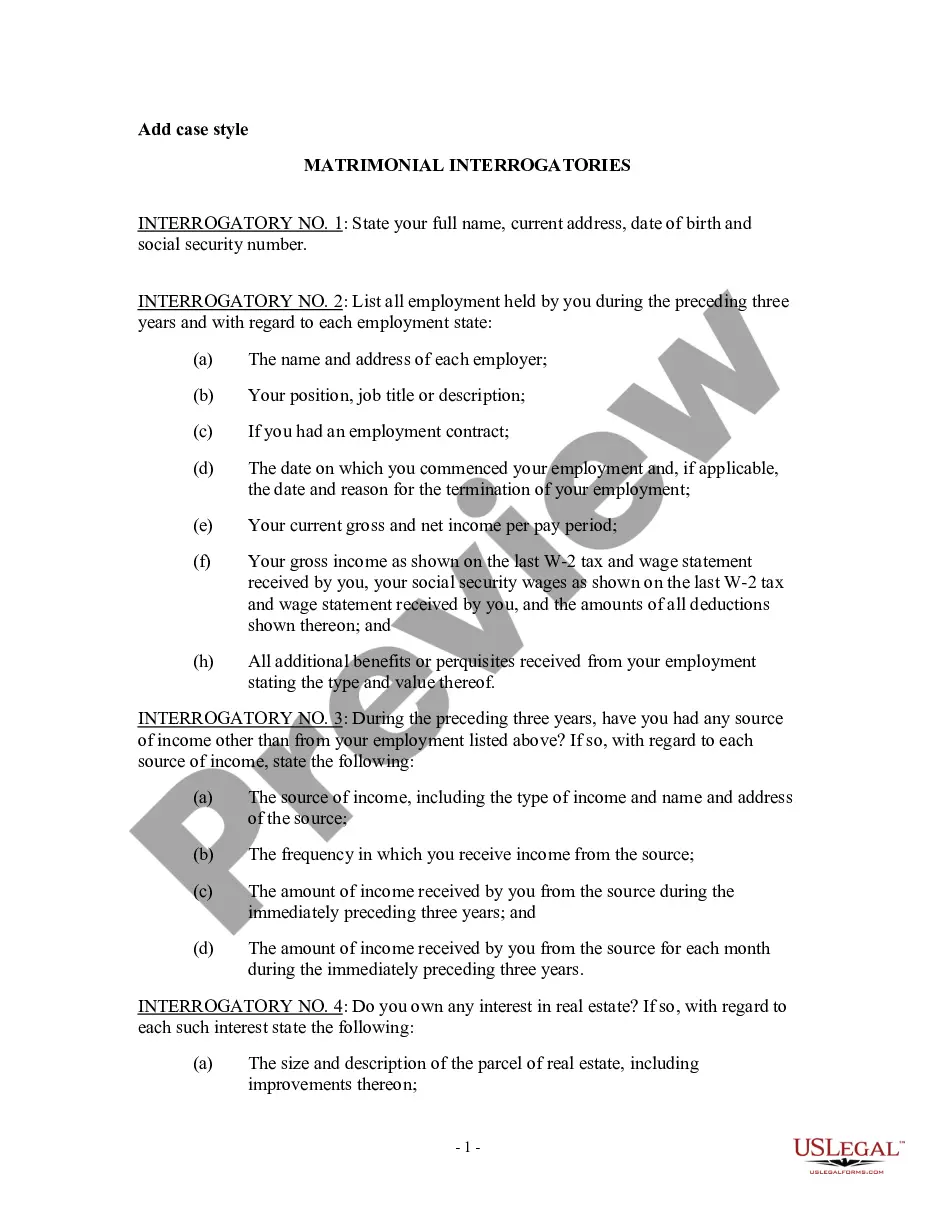

- Identify the parties involved: list the names of the grantors and the grantee.

- Specify the property being transferred by including a complete legal description.

- Record the details of the power of attorney, including Book and Page or Instrument Number.

- Obtain signatures from all grantors to validate the deed.

- Include a self-addressed envelope for the Recorder's office to return the original deed after filing.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Failing to include the recorded power of attorney information.

- Poorly describing the property, leading to ambiguity.

- Not obtaining all necessary signatures before submission.

Why complete this form online

- Convenience of filling out the form at your own pace, anytime and anywhere.

- Editability allows you to make changes quickly without starting from scratch.

- Reliable access to attorney-drafted documents, ensuring legal compliance.

Form popularity

FAQ

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Yes, you can name more than one person on your durable power of attorney, but our law firm generally advise against it under most circumstances.With multiple named attorneys-in-fact, there is always the ability for people to conflict on decisions.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

A warranty deed can be revoked. In most situations, the person signing the deed needs the cooperation of the person who received the deed to revoke it.If the deed was prepared for a property transfer as part of a typical sale, though, you probably will have to take legal action to revoke the deed.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

In all fifty states, a deed must be signed and acknowledged by the grantor. Additional signatures may also be required, such as a grantee's signature, witnesses, a notary public, and the document preparer.