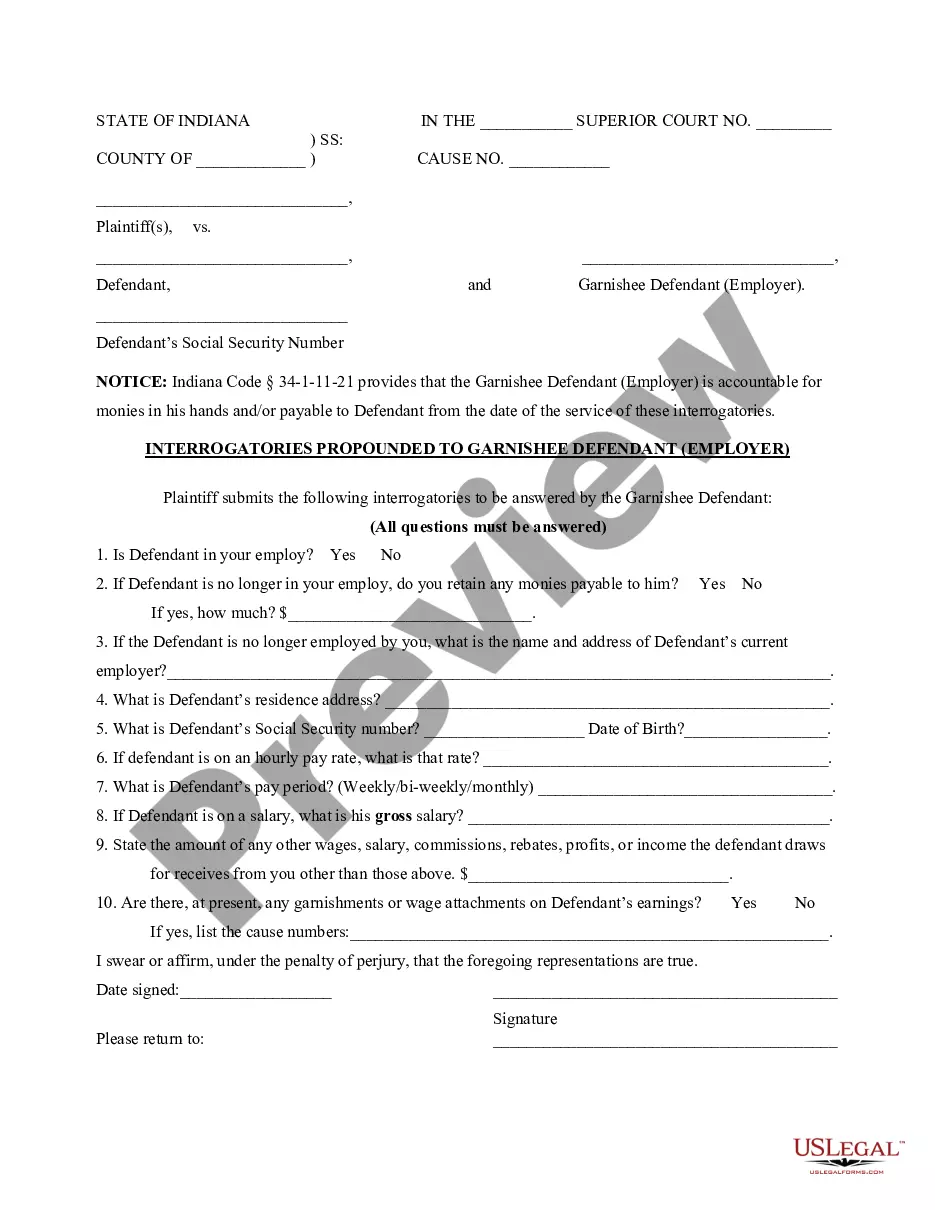

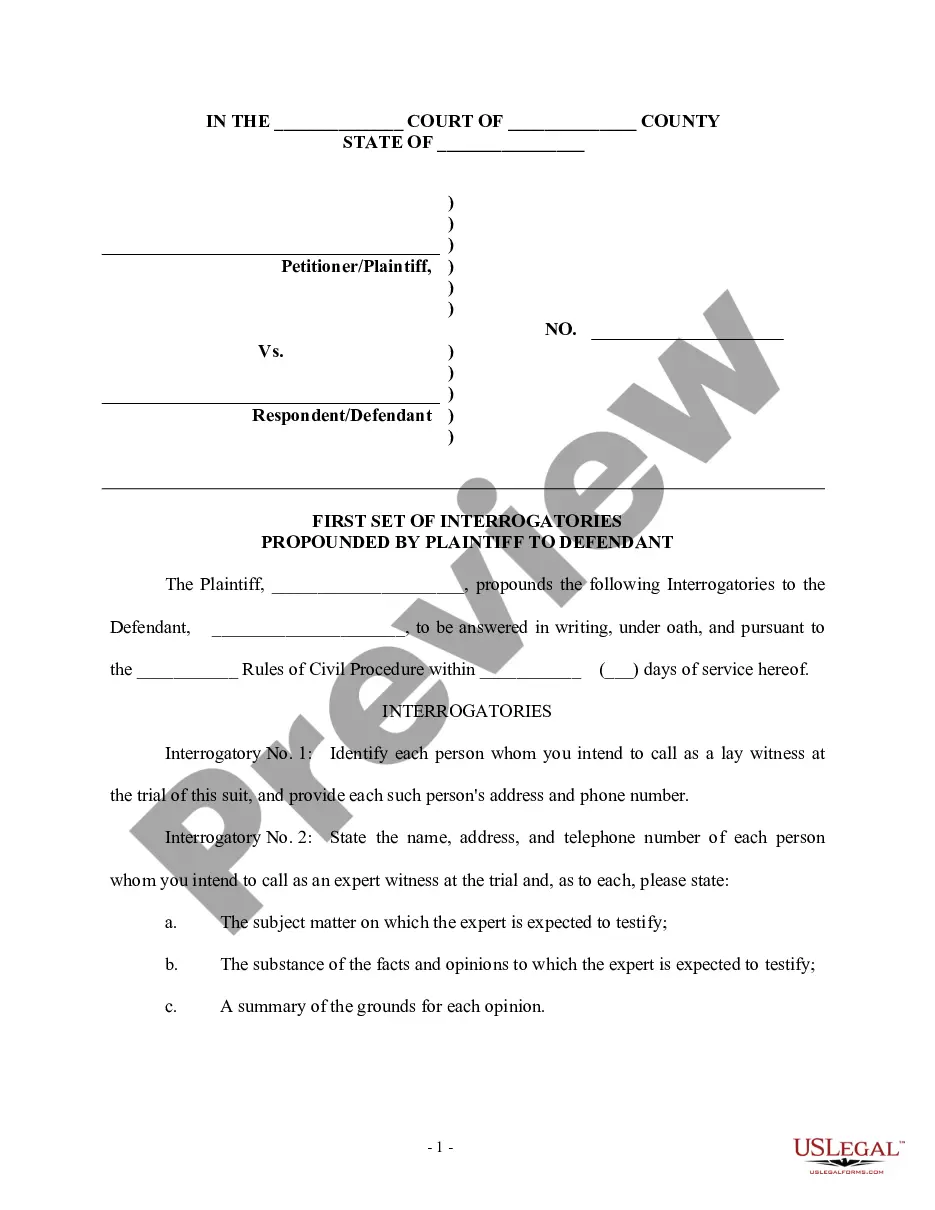

These are sample interrogatories given to a Garnishee Defendant's Employer. The Plaintiff demands information from the Employer concerning the Judgment Debtor. They are to be used simply as a model and should be modified to fit your particular cause of action.

Indiana Interrogatories Propounded to Garnishee Defendant - Employer

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Indiana Interrogatories Propounded To Garnishee Defendant - Employer?

Searching for Indiana Interrogatories Proposed to Garnishee Defendant - Employer templates and filling them out could be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our lawyers prepare all documents, so you only need to complete them. It is truly that straightforward.

Select your plan on the pricing page and establish an account. Choose your payment method via card or PayPal. Save the document in your preferred format. You can print the Indiana Interrogatories Proposed to Garnishee Defendant - Employer form or complete it using any online editor. Don't worry about making mistakes because your template can be used and submitted, and printed as many times as necessary. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to save the example.

- All your saved templates are stored in My documents and are available at any time for future use.

- If you haven't registered yet, you should enroll.

- Review our comprehensive instructions on how to obtain the Indiana Interrogatories Proposed to Garnishee Defendant - Employer form within a few minutes.

- To acquire a relevant sample, verify its relevance for your state.

- Examine the sample using the Preview option (if available).

- If there's a description, read through it to comprehend the details.

- Click Buy Now once you identify what you're looking for.

Form popularity

FAQ

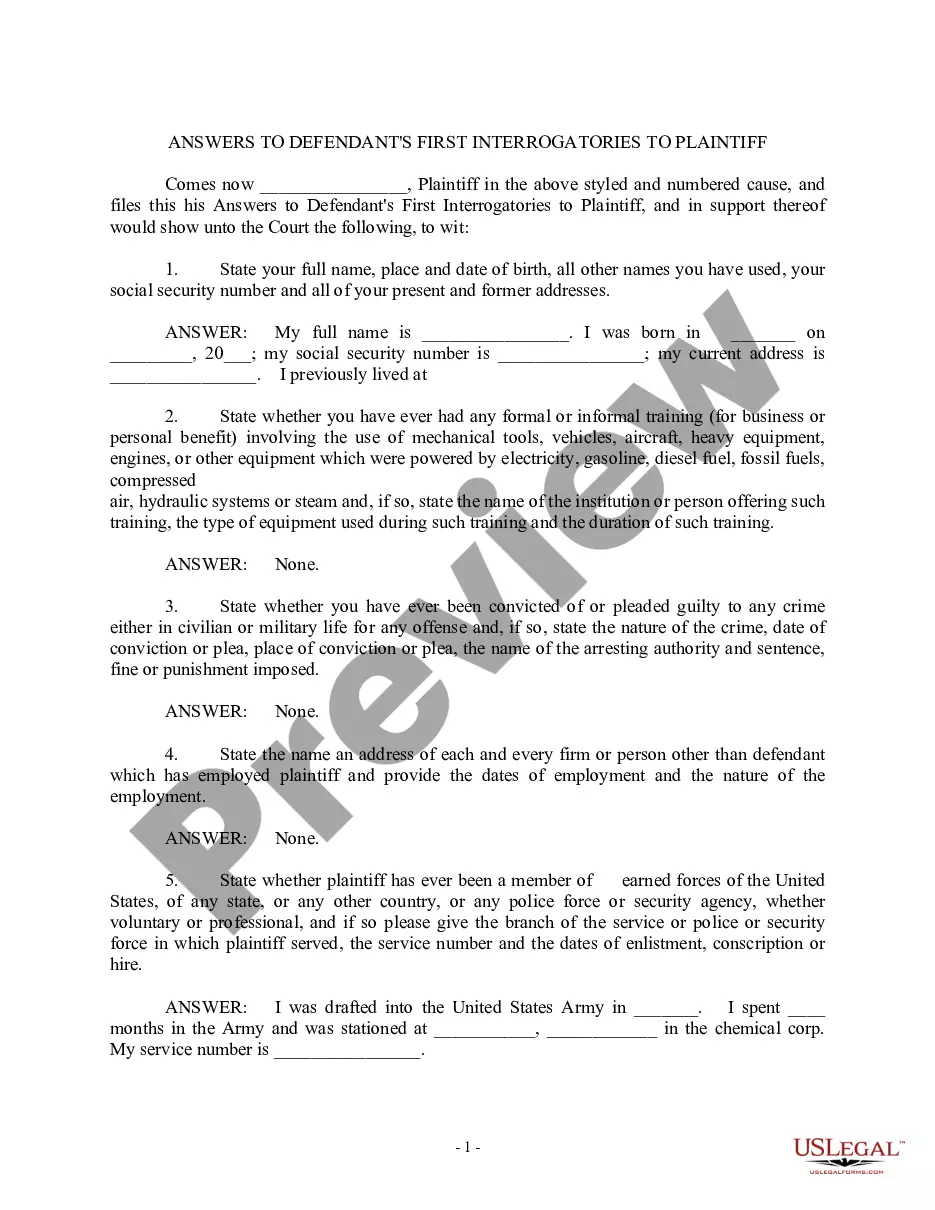

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.

When there is a court judgment against you, the creditor has the right to garnish your wages.With the exception of a student loan debt or a debt owed the government, garnishment can take place only after the creditor obtains a court judgment against you.

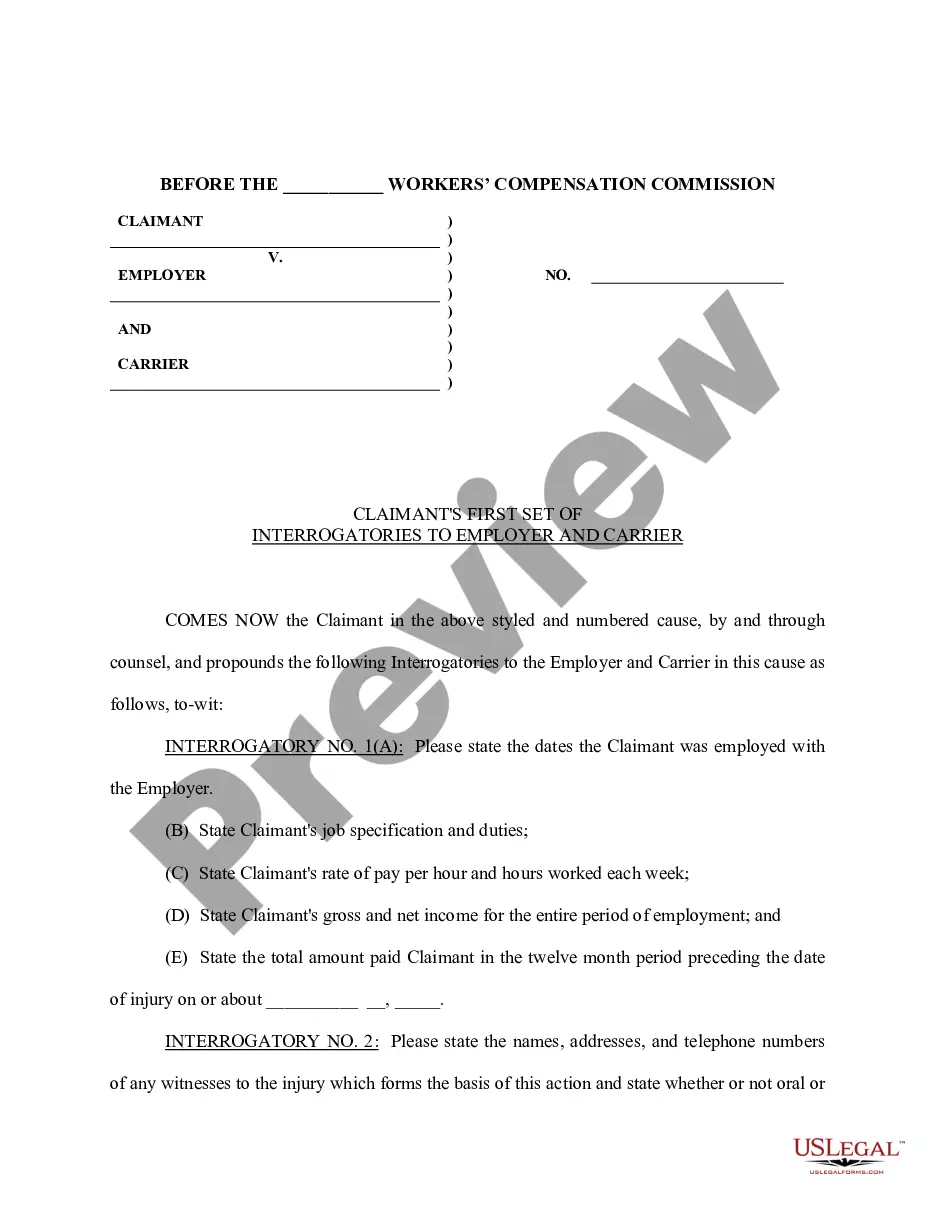

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

A Proceedings Supplemental is a court-ordered meeting between you and the creditor (the person you owe) to determine what your income, savings and property are. Your bank or employer may also have to give information to the creditor and the court.

Pay off the debt. settle the debt. discharge the debt in Chapter 7 bankruptcy. pay some or all of the debt through a Chapter 13 repayment plan, or. successfully ask the state court to stop the garnishment.

When a creditor obtains a writ of garnishment, the employer is the garnishee and the creditor is the garnishor.In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

If your wages are being garnished for tax debt, Bankruptcy will stop the garnishment and in some cases you may not have to pay the tax debt. Filing Bankruptcy on tax debt will allow you to receive future tax refunds. If your wages are being garnished for student loans, filing Bankruptcy will stop the garnishment.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

In general terms, to attempt to have a wage garnishment ended, modified or reversed, you have the following options. First, you could attempt to negotiate a monthly payment agreement with the creditor/collector.Third, you could file an appeal with the court if you do not agree with the garnishment.