Judgment of Confirmation of Title

Description

How to fill out Judgment Of Confirmation Of Title?

Aren't you sick and tired of choosing from hundreds of samples every time you want to create a Judgment of Confirmation of Title? US Legal Forms eliminates the lost time countless Americans spend searching the internet for perfect tax and legal forms. Our professional team of lawyers is constantly updating the state-specific Templates library, so it always offers the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription need to complete quick and easy actions before being able to download their Judgment of Confirmation of Title:

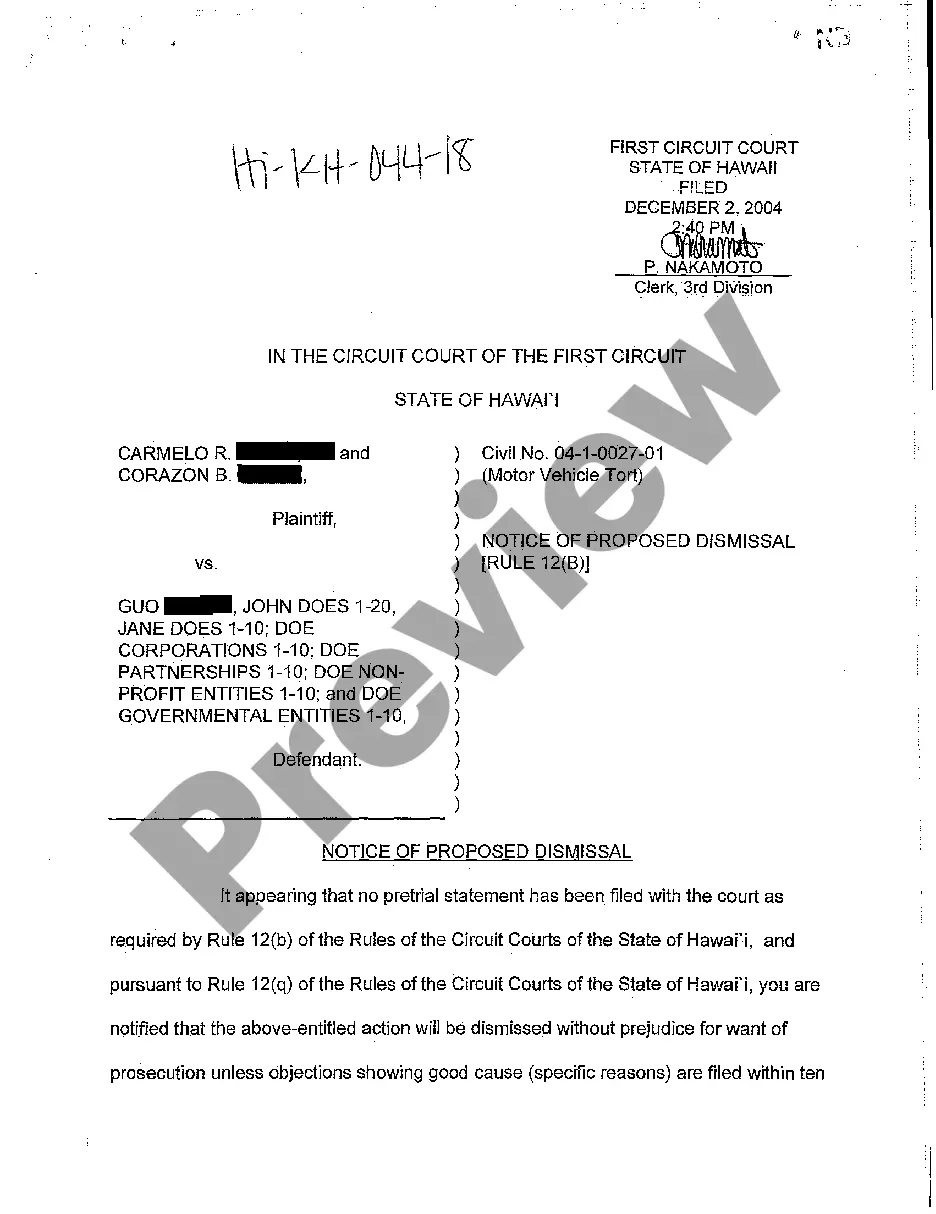

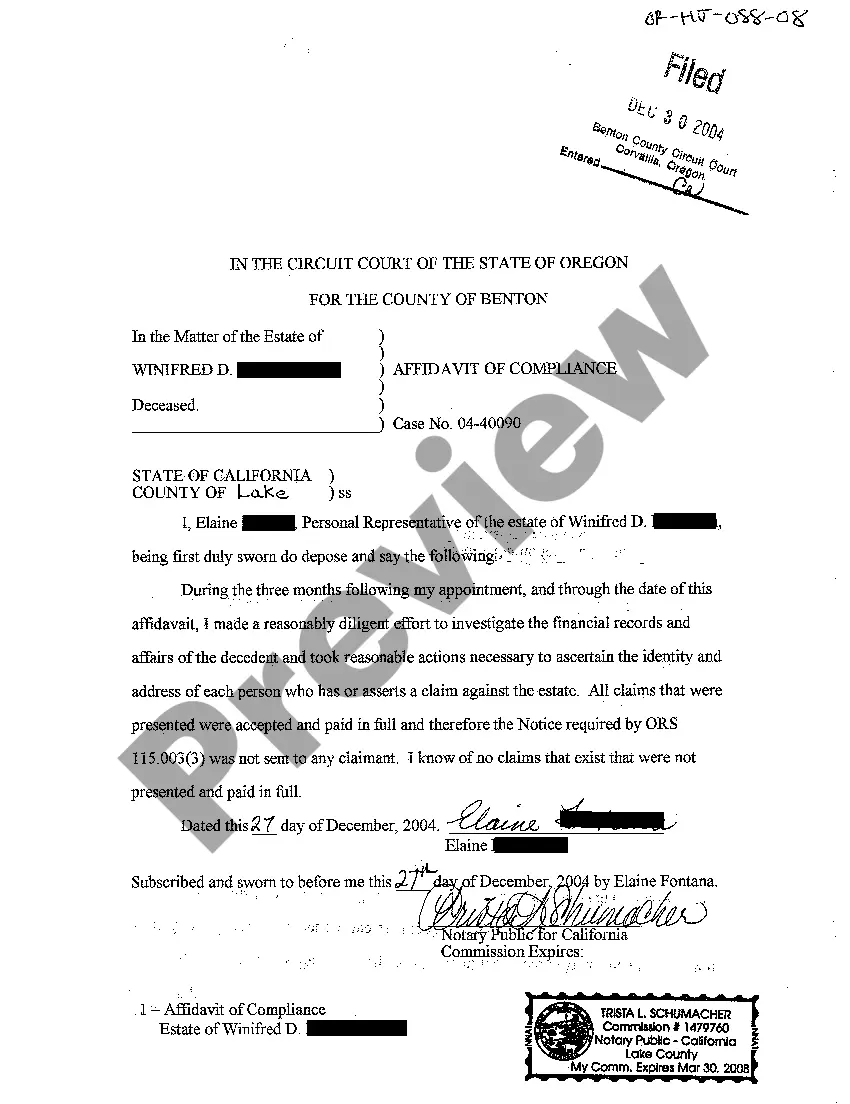

- Utilize the Preview function and look at the form description (if available) to be sure that it is the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample to your state and situation.

- Use the Search field on top of the webpage if you have to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your template in a required format to complete, create a hard copy, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always have the ability to sign in and download whatever document you want for whatever state you want it in. With US Legal Forms, finishing Judgment of Confirmation of Title samples or any other legal files is easy. Begin now, and don't forget to examine your samples with accredited attorneys!

Form popularity

FAQ

The lien or judgment may have to be paid off at closing in order to give the buyer clear title. If needed, obtain a payoff letter from the judgment creditor.If the buyer has a lender, the lien may or may not have to be paid off depending on whether or not the loan is a purchase money mortgage.

The role of a title company is to verify that the title to the real estate is legitimately given to the home buyer. Essentially, they make sure that a seller has the rights to sell the property to a buyer.

A judgment against a home buyer or home seller automatically attaches as a lien against their real property.This is why the title company is asking for your Social Security number to try to determine that the judgments that showed up in the records are not against you.

If the original owner does not redeem the property in three years from the filing of the tax sale certificate, the new purchaser may file a lawsuit to quiet the title to obtain full ownership. (LA R.S. 66) In simple terms, the purchaser sues the former owner for ownership.

The short answer is, yes, selling a house with a judgment can be done. But most homebuyers expect the title report to come back clean. So you'll need to be upfront about the property lien and have a plan for how you'll address it. You have options for satisfying the judgment creditors.

Pay the judgment voluntarily; Ask the creditor or the court to set up an installment payment plan; File an appeal; or. Fill out and send the creditor a Judgment Debtor's Statement of Assets (Form SC-133).

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

Mortgage lenders will not generally close on a home with an unpaid judgment. They know that if they do, their mortgage lien might be subject to getting wiped out by a foreclosure. For a smooth closing, taking the steps to remove the judgment is needed.