Installment Promissory Note and Security Agreement

What this document covers

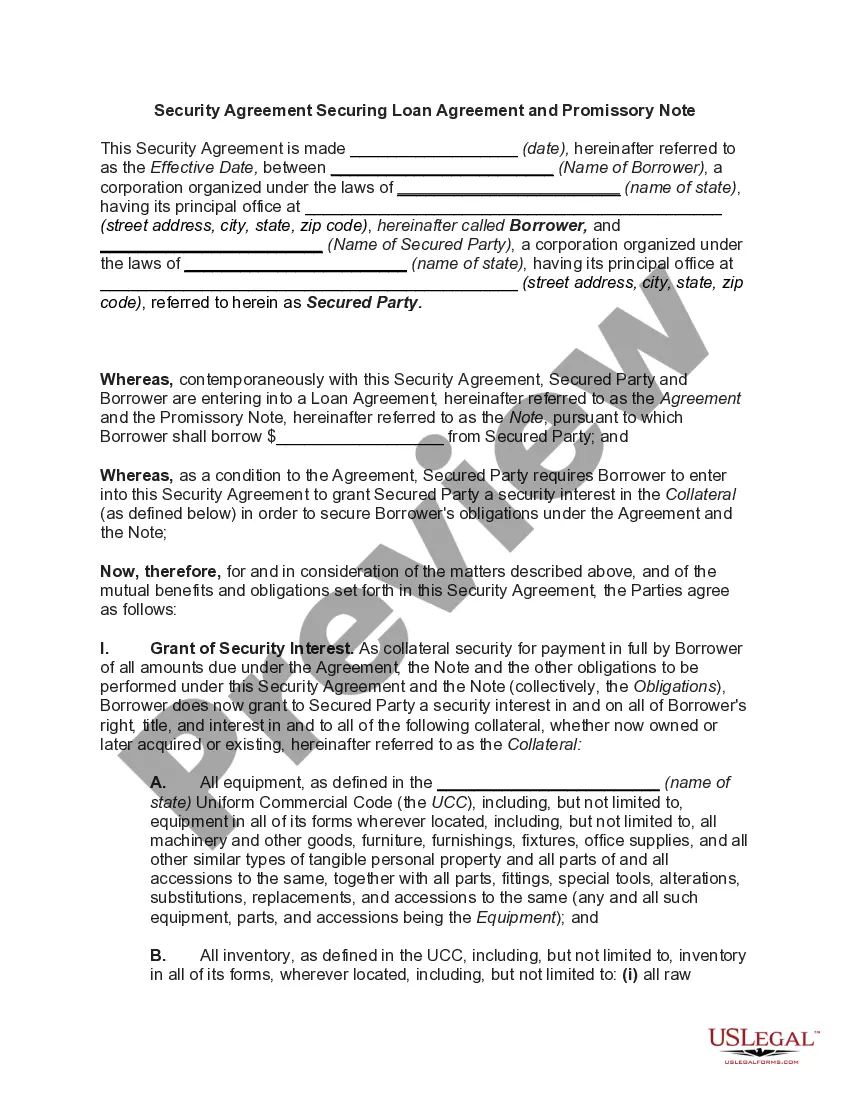

The Installment Promissory Note and Security Agreement is a legal document that outlines an agreement between a borrower and a lender. This form details the borrower's obligation to repay the loan in monthly installments, including interest. It also specifies the collateral that secures the loan, ensuring that the lender has a claim to the specified assets in case of default. This form is critical for setting clear terms of repayment unlike standard promissory notes, as it includes a security agreement that establishes a lien on the borrower's property.

Key components of this form

- Date of the agreement.

- Details of the lender and borrower.

- Loan amount and interest rate.

- Monthly installment payment schedule.

- Collateral description for securing the loan.

- Default conditions and remedies for the lender.

When to use this document

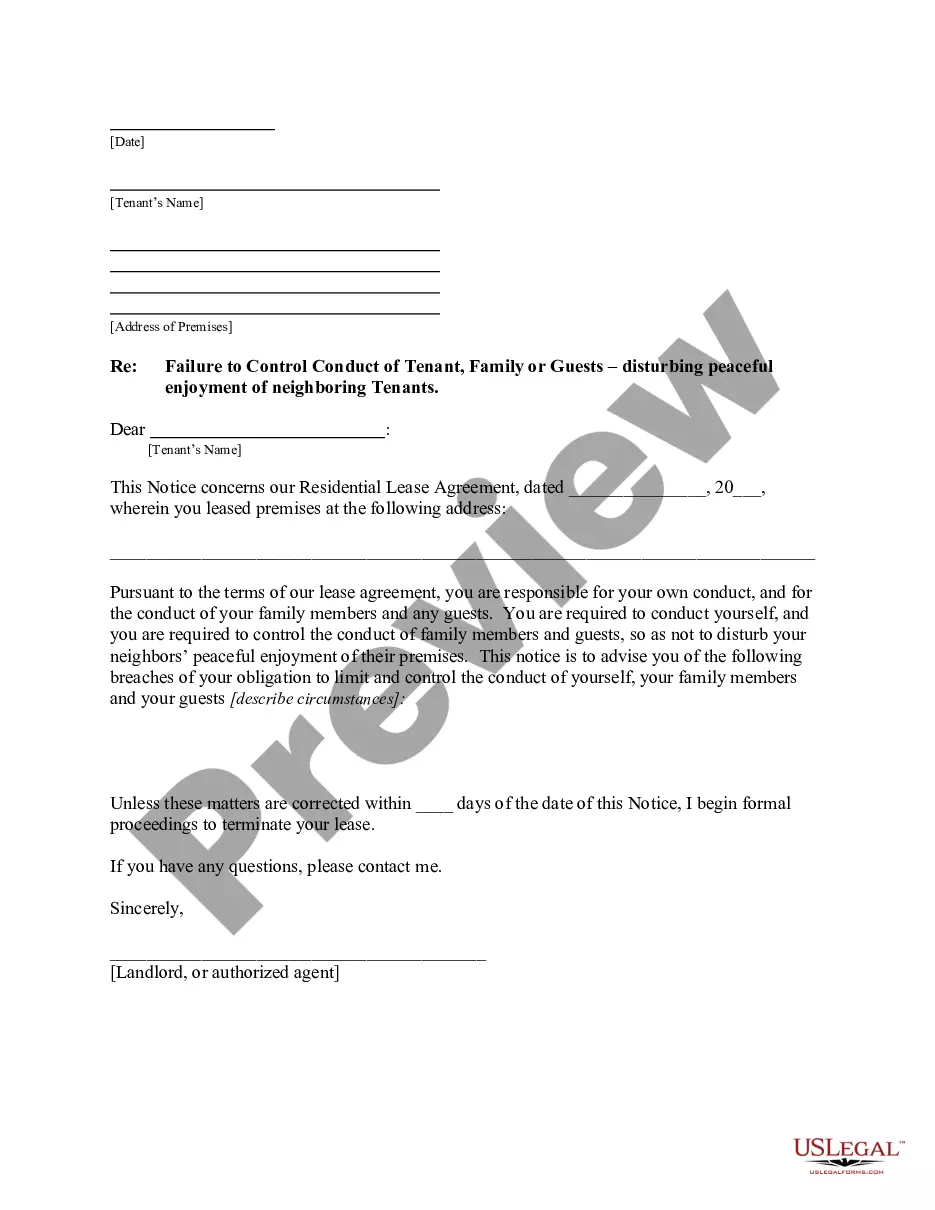

This form is useful in various scenarios, such as when an individual or business needs a loan and wants to formalize the agreement with a lender. It is applicable when the borrower is required to provide collateral to secure the loan. This form may also be necessary for any loan arrangements that require structured repayment over time, ensuring clear expectations and legal protections for both parties involved.

Who should use this form

This form is suitable for:

- Individuals borrowing money from friends or family.

- Small business owners seeking funding from investors or banks.

- Lenders looking to secure a loan agreement with clear terms.

- Anyone needing to formalize a loan that includes collateral.

Steps to complete this form

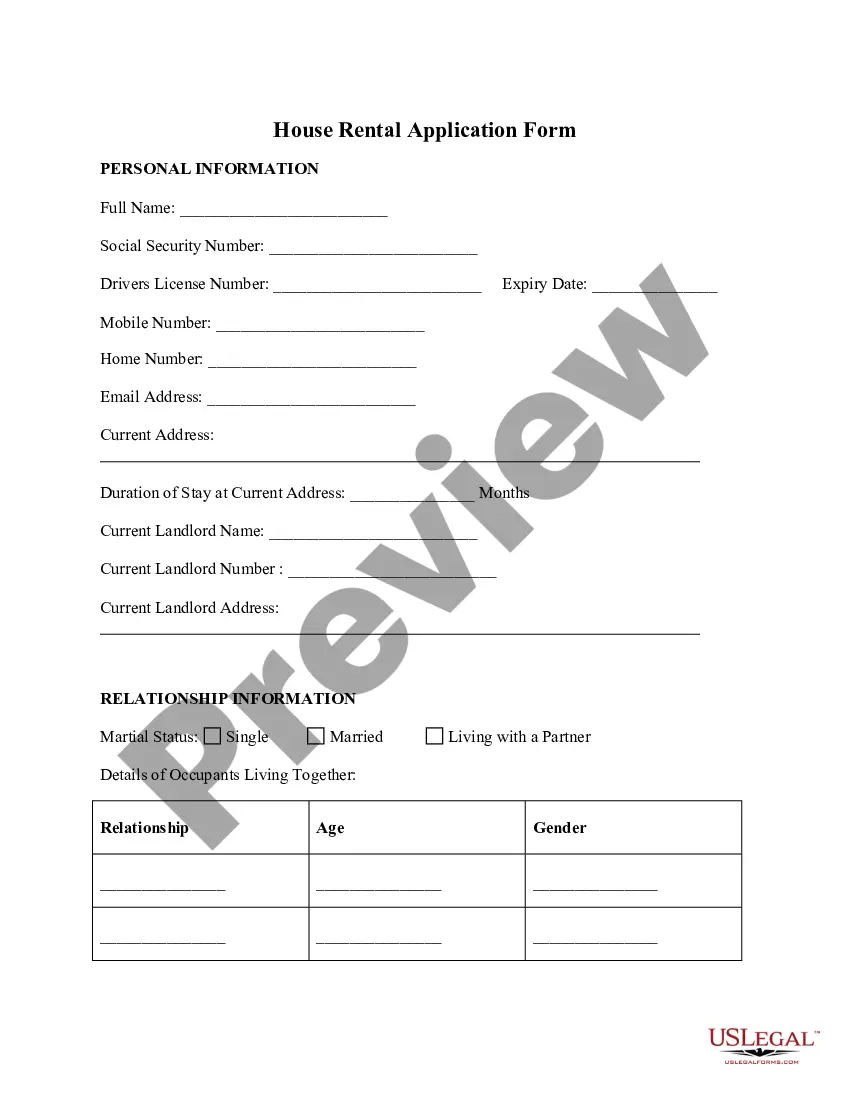

- Enter the date of the agreement.

- Provide the names and addresses of both the lender and borrower.

- Specify the loan amount and the interest rate.

- Detail the payment schedule, including the date of the first payment.

- Describe the collateral being used to secure the loan.

- Ensure that all parties sign and date the agreement.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to specify the terms clearly, including the loan amount and interest rates.

- Not providing a complete description of the collateral.

- Neglecting to include dates for payment schedules.

- Forgetting to have all parties sign the document.

Advantages of online completion

- Convenience of easy access and downloading anytime.

- Editability to customize terms according to your agreement.

- Reliability, as forms are prepared by licensed attorneys.

- Fast completion, reducing time spent on paperwork.

Looking for another form?

Form popularity

FAQ

The promissory note is the first document. It doesn't get a lot of attention but you sign it, agreeing to repay the amount the bank is lending you.The more important legal document is the security instrument. This gives the lender a security interest in the property.

Whether a promissory note is a security is one of the most vexatious issues in US securities laws.In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral.In the event that the borrower defaults, the pledged collateral can be seized by the lender and sold.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Mortgage and security interest are two similar terms, both referring to a collateral created in order to secure a debt by one party to the other.The basic difference is that mortgage is a traditional way of securing obligations under the common law, typically used in property transactions.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

A Promissory Note with Installment Payments specifies and documents the terms of a loan that will be paid back with consistent, equal, payments.You're a borrower and are agreeing to a loan with installments. You're in the business of loans or manage a loan company.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.