Illinois Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

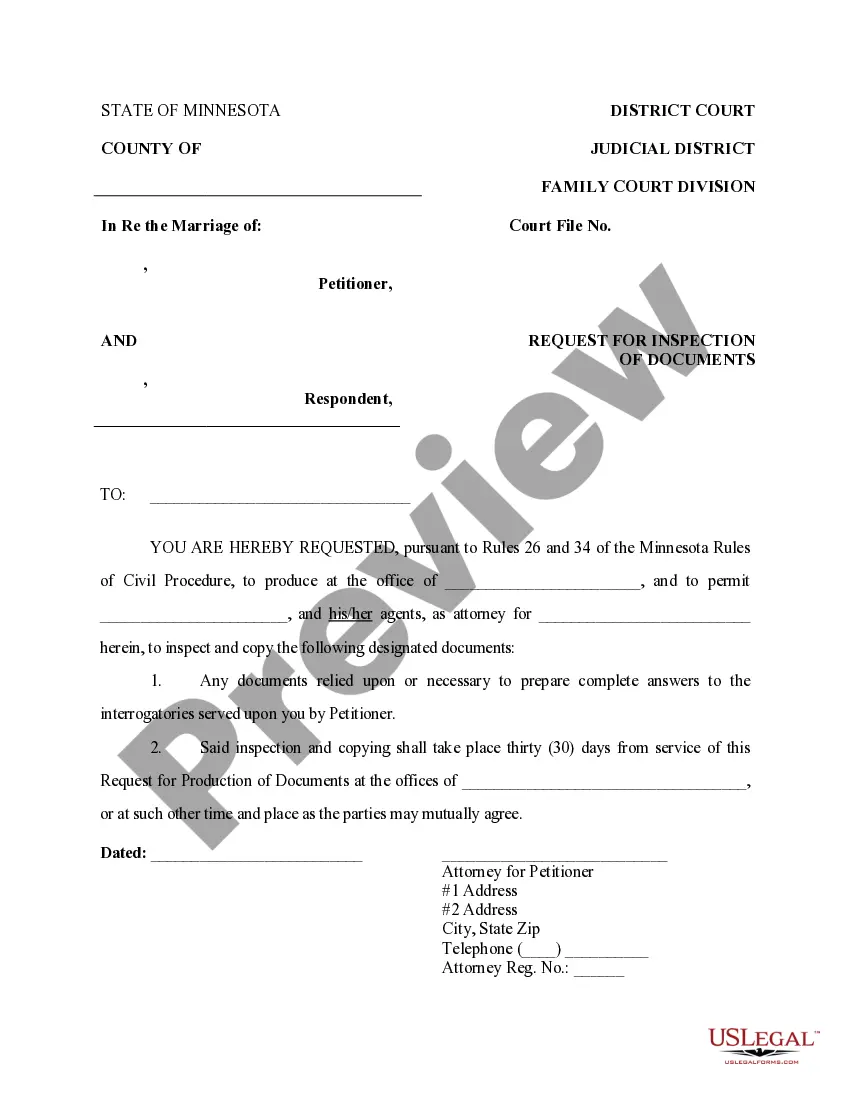

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

If you have to full, acquire, or print legal record themes, use US Legal Forms, the most important variety of legal types, that can be found on-line. Take advantage of the site`s simple and hassle-free research to find the papers you will need. A variety of themes for organization and personal purposes are sorted by categories and claims, or keywords. Use US Legal Forms to find the Illinois Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease in a handful of click throughs.

In case you are presently a US Legal Forms customer, log in to your accounts and then click the Download switch to obtain the Illinois Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. You can also access types you in the past downloaded from the My Forms tab of your accounts.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your proper area/land.

- Step 2. Use the Review choice to look through the form`s content. Don`t neglect to see the information.

- Step 3. In case you are not satisfied using the kind, take advantage of the Research discipline near the top of the monitor to discover other variations of the legal kind web template.

- Step 4. Once you have located the shape you will need, click on the Get now switch. Choose the costs program you prefer and add your credentials to sign up to have an accounts.

- Step 5. Approach the deal. You can utilize your bank card or PayPal accounts to complete the deal.

- Step 6. Select the file format of the legal kind and acquire it in your system.

- Step 7. Total, revise and print or sign the Illinois Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Every legal record web template you get is your own forever. You possess acces to each kind you downloaded inside your acccount. Select the My Forms section and choose a kind to print or acquire yet again.

Remain competitive and acquire, and print the Illinois Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms. There are many specialist and express-certain types you can use for your personal organization or personal needs.

Form popularity

FAQ

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

As ownership of land changes, NPRIs are commonly created and assigned to whoever the owners want. The amount of revenue the mineral and surface rights generate can make present and past owners want to share in the future resources of their royalty payments.

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

Non-Apportionment Rule The rule?followed in the majority of states?that royalties accruing under a lease on property that has been subdivided after the lease grant are not to be shared by the owners of the various subdivisions but belong exclusively to the owner of the subdivision where the producing well is located.