Idaho Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

How to fill out Consultant Agreement With Sharing Of Software Revenues?

Are you in a situation where you will require documents for potential business or personal reasons almost every workday.

There are numerous standardized document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, such as the Idaho Consultant Agreement with Sharing of Software Revenues, which can be downloaded to comply with state and federal regulations.

Once you obtain the correct form, click Buy now.

Select the pricing plan you prefer, provide the necessary information to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Idaho Consultant Agreement with Sharing of Software Revenues template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for your correct city/county.

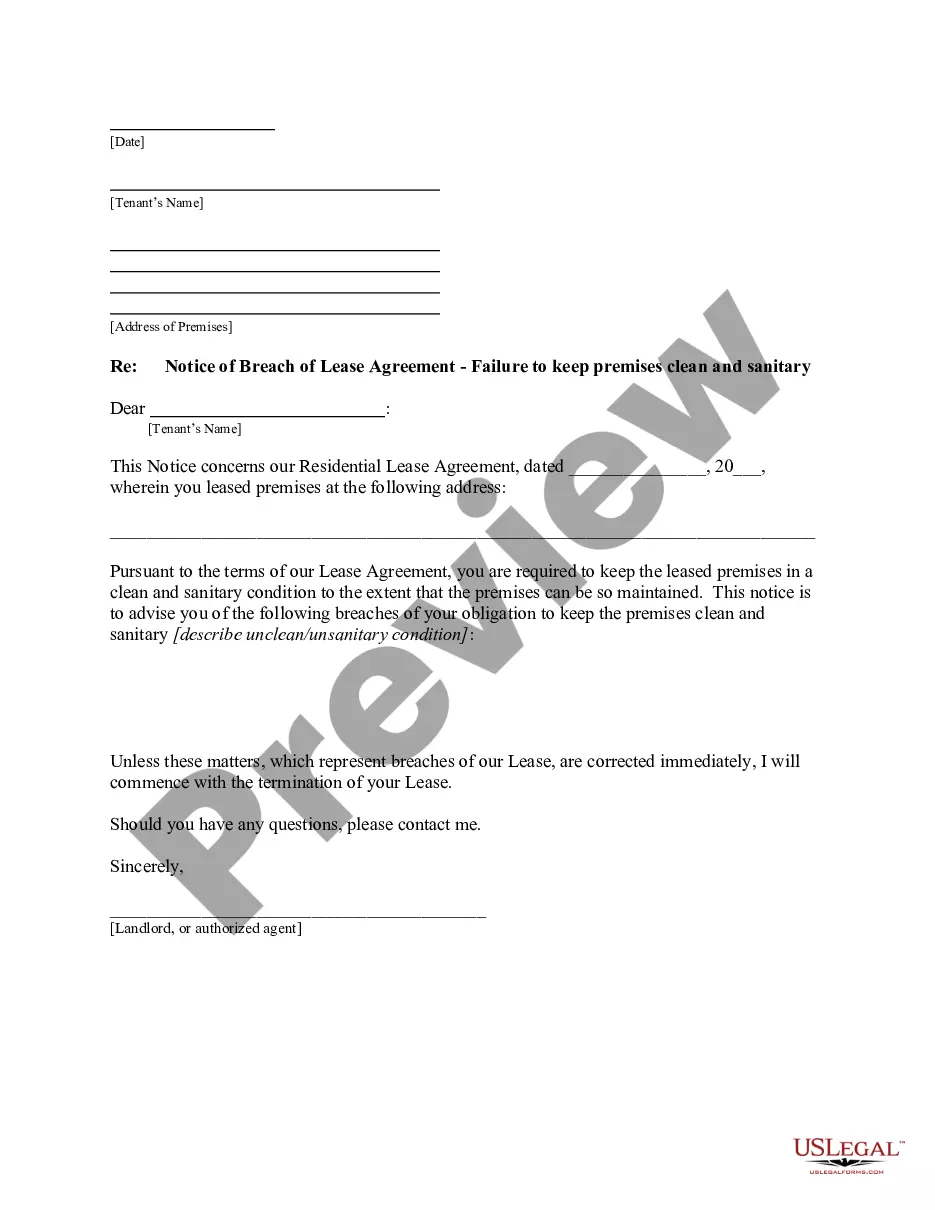

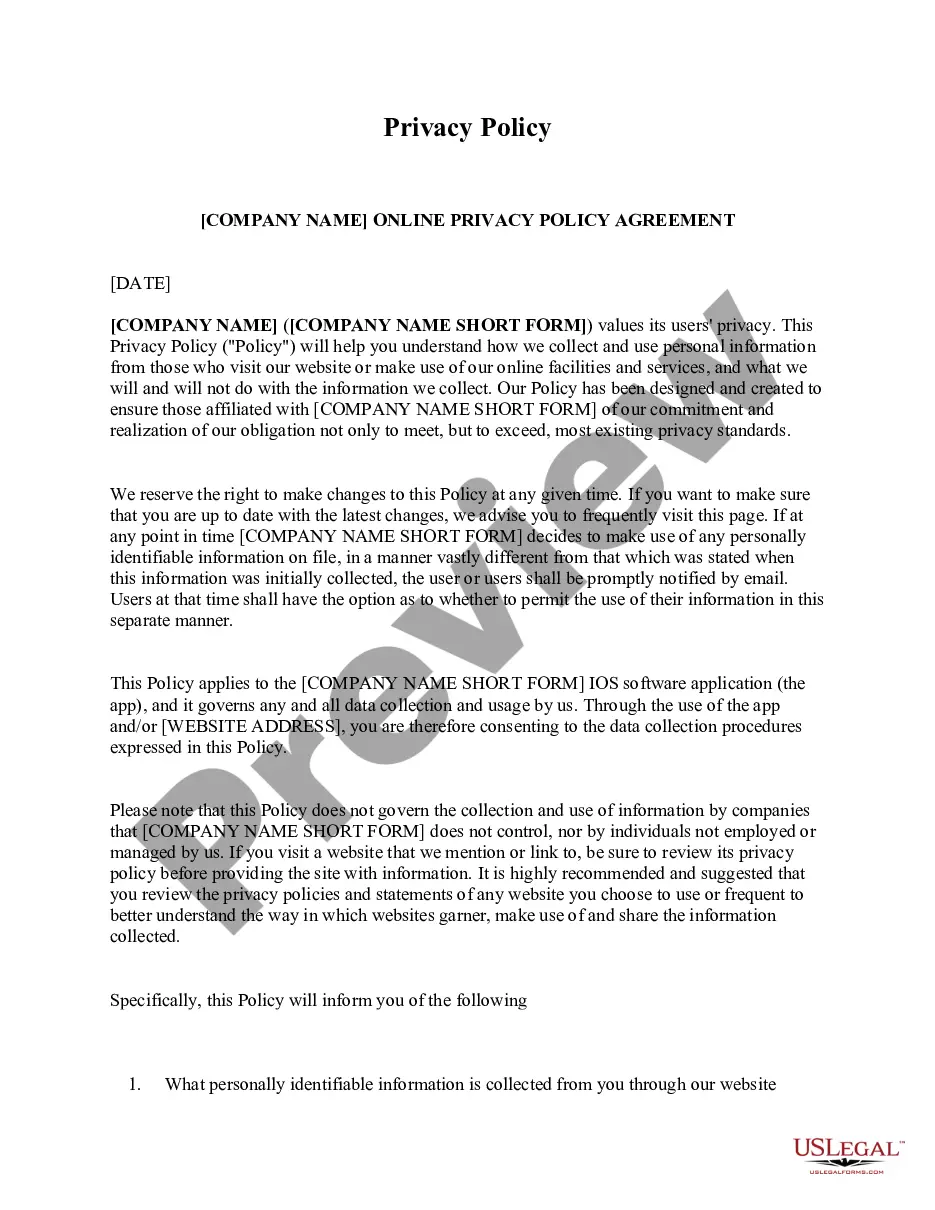

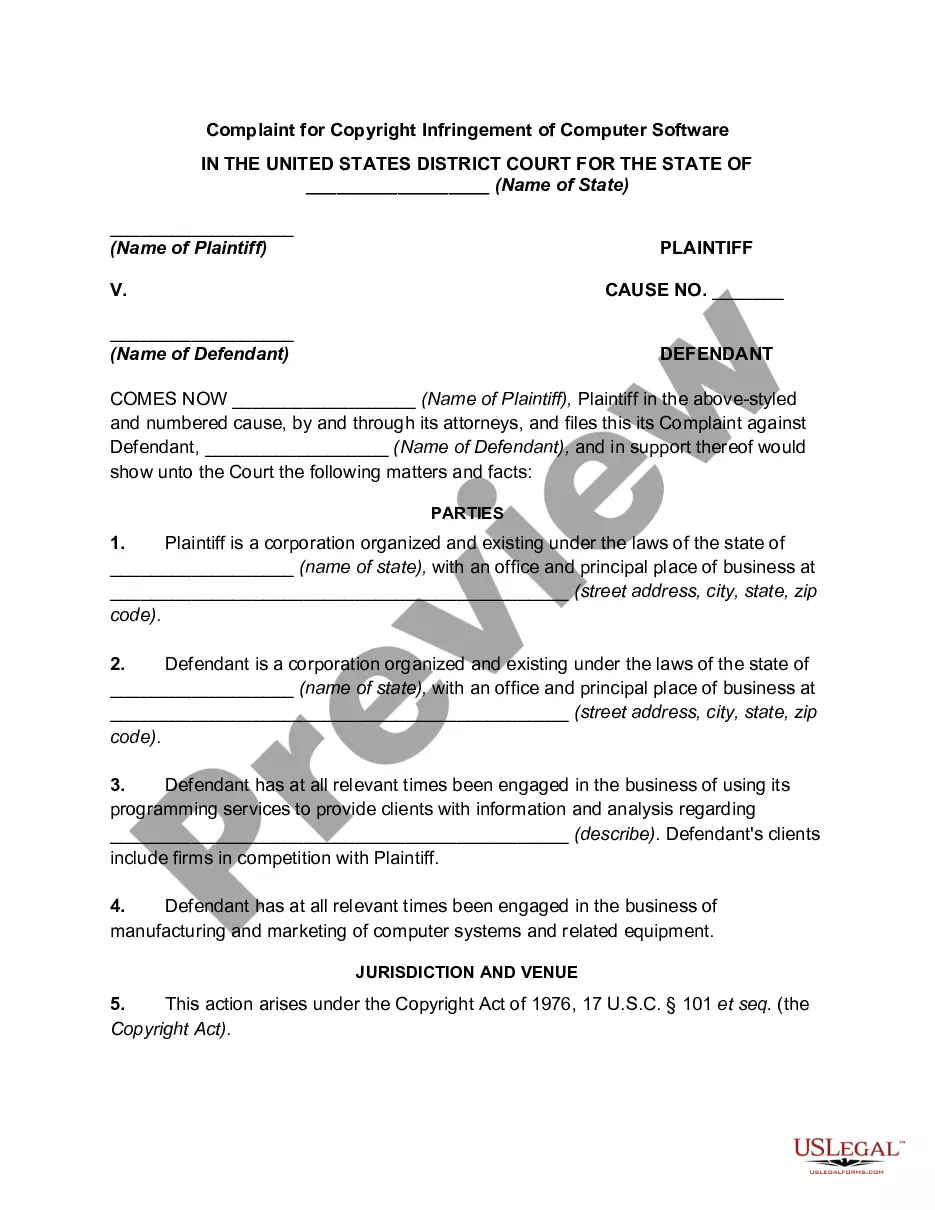

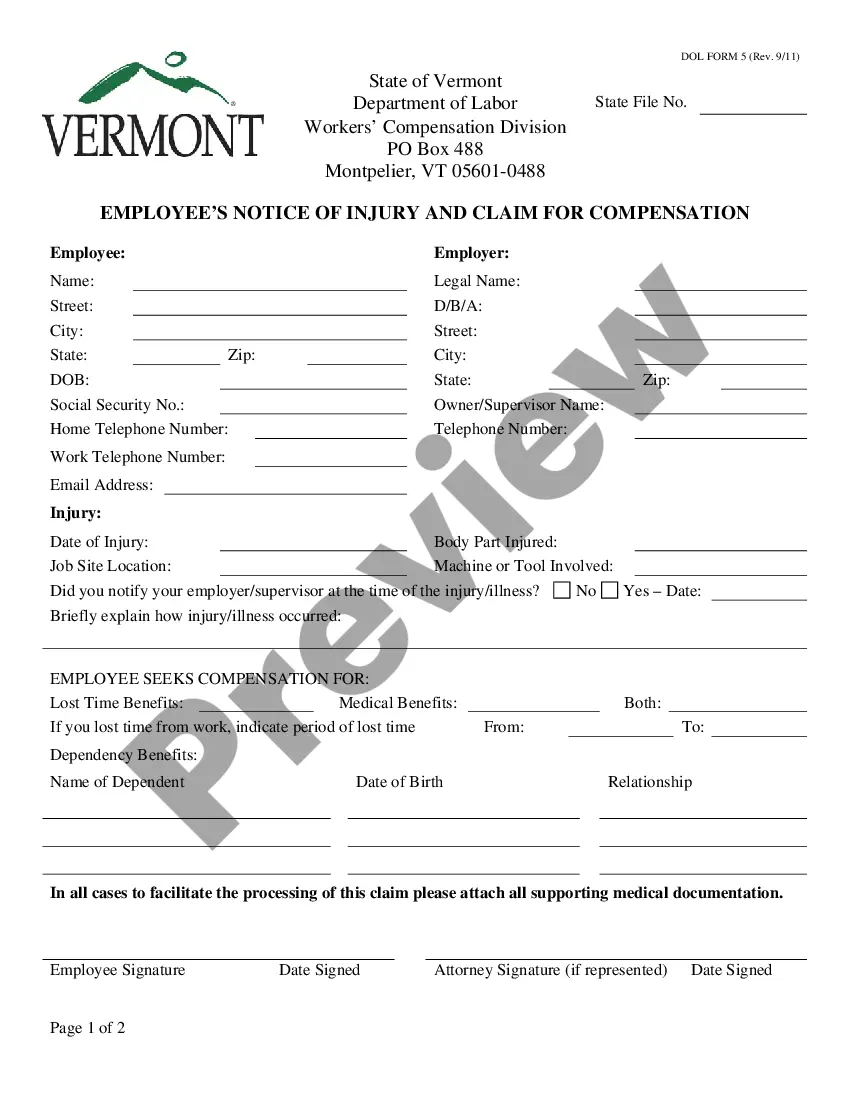

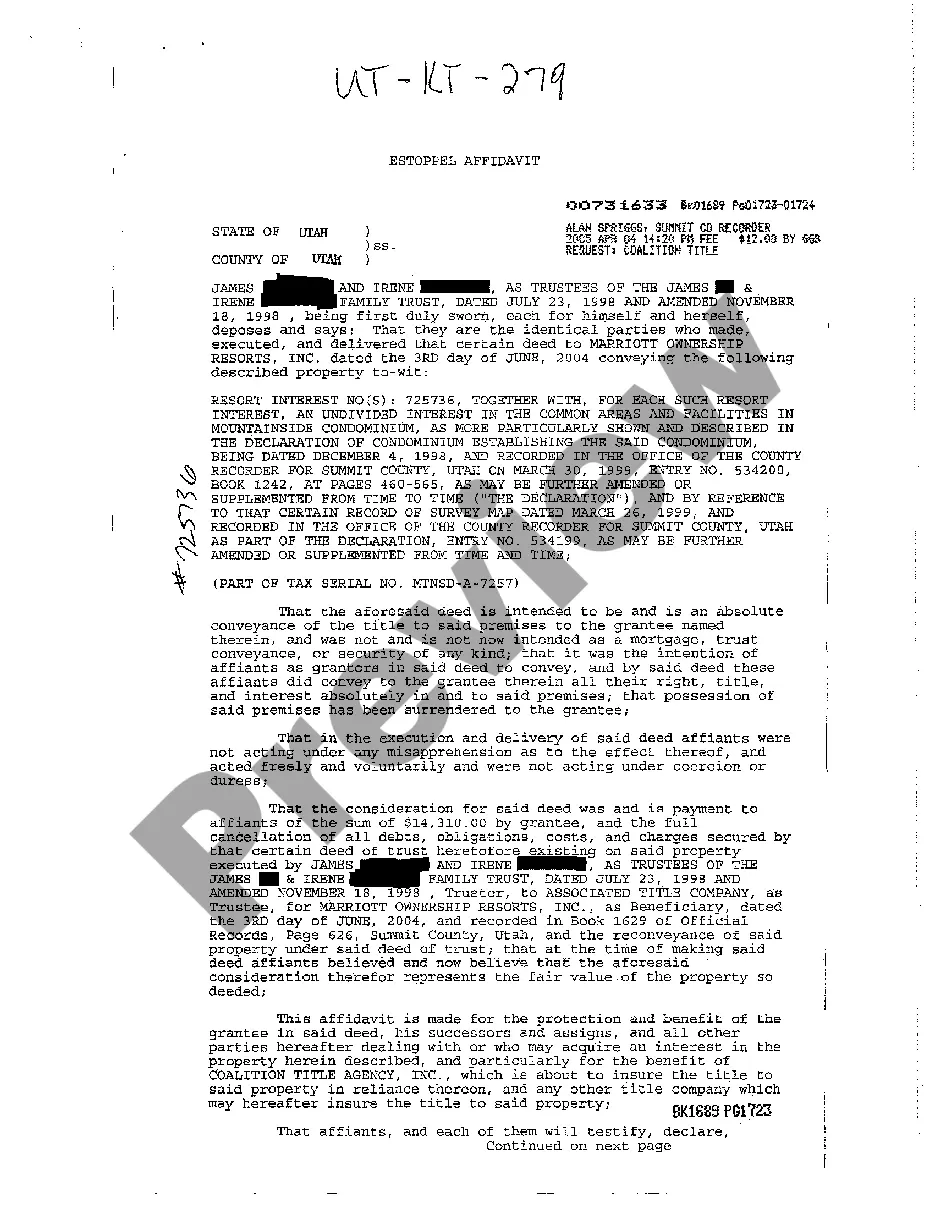

- Use the Preview button to review the document.

- Check the details to confirm that you have selected the right form.

- If the template is not what you are looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

An independent consultant agreement is a contract that specifies the relationship between a consultant and a client, detailing the work to be performed, compensation, and other important factors. This agreement is essential for establishing boundaries and expectations, particularly when revenue sharing is involved, such as in the Idaho Consultant Agreement with Sharing of Software Revenues. Utilizing resources from uslegalforms can simplify the drafting of this essential document.

The primary purpose of a consulting agreement is to clearly define the expectations and obligations between a consultant and a client. This legally binding document protects both parties by outlining deliverables, payment terms, and confidentiality. For those entering into agreements like the Idaho Consultant Agreement with Sharing of Software Revenues, a well-crafted consulting agreement is crucial for a successful partnership.

An independent service agreement outlines the terms under which an independent contractor provides services to a client. This type of agreement specifies the deliverables, timelines, responsibilities, and payment details. In discussions around an Idaho Consultant Agreement with Sharing of Software Revenues, it's beneficial to have a solid independent service agreement to avoid misunderstandings between parties.

To set up a consulting agreement, you should start by defining the scope of work, payment structure, and duration of the engagement. It’s also important to include confidentiality clauses and terms for revenue sharing, especially in an Idaho Consultant Agreement with Sharing of Software Revenues. Platforms like uslegalforms offer templates to help you establish clear terms and protect your interests.

A consulting agreement typically focuses on the provision of expert advice and recommendations, while an independent contractor agreement is more general and can apply to a variety of services beyond consulting. Both agreements define the relationship and outline the scope of work, payment terms, and responsibilities. When entering into an Idaho Consultant Agreement with Sharing of Software Revenues, it's essential to ensure you understand the specific terms relevant to consulting versus contracting.

An independent consultant is a professional who provides specialized services to clients without being an employee of those clients. They usually work on a contractual basis, which provides both flexibility and autonomy. In the context of an Idaho Consultant Agreement with Sharing of Software Revenues, the independent consultant can engage with a software company to offer insights, strategies, or support in exchange for a share of the generated revenue.

Structuring a profit sharing agreement involves creating a clear framework outlining each party's contributions and profit distribution. Start with an introduction that describes the purpose and parties involved. Detail the profit-sharing percentage, payment schedules, and conditions that might impact distribution. A well-structured Idaho Consultant Agreement with Sharing of Software Revenues can provide a strong foundation for your partnership, ultimately fostering a productive business relationship.

Writing a profit sharing agreement begins with defining the scope of the partnership and the specific profits to be shared. Specify the percentage of profits for each party, the timeline for distribution, and any conditions that may apply. Clarity in communication is vital; therefore, describe the responsibilities of each party thoroughly. Using a tailored Idaho Consultant Agreement with Sharing of Software Revenues can simplify the drafting process and ensure coverage of all necessary components.

To write a data sharing agreement, start by outlining the purpose of the data sharing and the types of data involved. Clearly define how the data will be used, shared, and protected. Include the roles and responsibilities of each party, as well as terms for confidentiality and data privacy. Utilizing an Idaho Consultant Agreement with Sharing of Software Revenues template can help streamline this process and ensure compliance with legal standards.

A revenue sharing agreement outlines how revenue generated from collaboration will be divided between the parties involved. In the context of an Idaho Consultant Agreement with Sharing of Software Revenues, this type of agreement establishes clear terms to distribute software revenue. It ensures that all stakeholders understand their share and responsibilities, promoting fairness and transparency. Having a well-drafted revenue sharing agreement can prevent disputes and enhance partnership longevity.