Maine Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

How to fill out Consultant Agreement With Sharing Of Software Revenues?

Are you currently in the location where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides an extensive collection of form templates, including the Maine Consultant Agreement with Sharing of Software Revenues, which is crafted to comply with state and federal regulations.

When you find the appropriate form, click Acquire now.

Choose the payment plan you prefer, complete the necessary information to create your account, and pay for the order using PayPal or your Visa/MasterCard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Maine Consultant Agreement with Sharing of Software Revenues template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Obtain the form you require and confirm it is for the correct city/region.

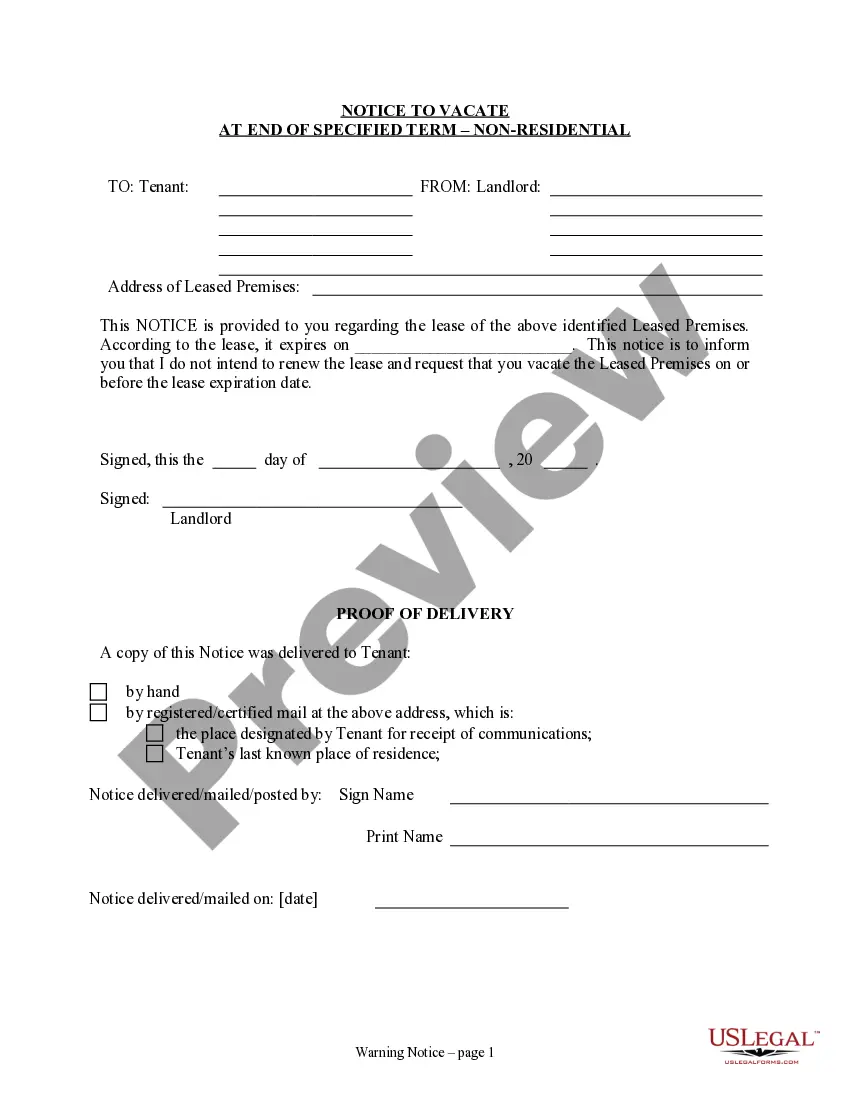

- Use the Preview button to review the form.

- Examine the details to ensure you have selected the right form.

- If the form does not meet your needs, use the Search field to find the form that aligns with your requirements.

Form popularity

FAQ

An independent consultant agreement is a legal document that defines the terms and conditions between a consultant and a client who operates independently. This kind of agreement covers aspects like scope of work, payment terms, and intellectual property rights. When creating a Maine Consultant Agreement with Sharing of Software Revenues, it's crucial to ensure clarity on how revenues will be shared. Uslegalforms offers templates to assist you in drafting a precise agreement that meets your needs.

A consulting agreement specifically details the relationship between a consultant and a client, focusing on the services provided and compensation. In contrast, a contract is a broader term that refers to any legal agreement between parties. In the context of the Maine Consultant Agreement with Sharing of Software Revenues, this type of agreement outlines not only the consultant's services but also how revenue from software will be divided. Using uslegalforms can help you create a clear and favorable agreement.

Yes, in most cases, software licenses are taxable in Maine. When a software license provides access to a product or service, it typically qualifies for sales tax. As you create a Maine Consultant Agreement with Sharing of Software Revenues, clarity on tax obligations regarding software licenses will benefit both parties involved. For further assistance, consider using USLegalForms to guide you through drafting compliant agreements.

Software can be considered a taxable item in Maine when it is transferred for consideration. The state's tax regulations require businesses to evaluate the sales tax implications of software transactions. If you are drafting a Maine Consultant Agreement with Sharing of Software Revenues, including tax obligations can prevent future misunderstandings. You should seek legal advice to ensure compliance with state laws.

In Maine, whether software is taxable depends on its nature. Generally, Maine imposes sales tax on software that is delivered electronically or on physical medium. When establishing your Maine Consultant Agreement with Sharing of Software Revenues, it’s crucial to consider how the software is classified and whether sales tax applies. Always consult with a tax professional for specific guidance tailored to your situation.

You do not need an LLC to start consulting, but forming one can provide liability protection and may enhance your professional credibility. An LLC can also offer tax benefits, making it a wise choice as your consulting business grows. Regardless, you can effectively use a Maine Consultant Agreement with Sharing of Software Revenues to formalize your consulting relationship without requiring an LLC at the outset.

Writing a simple consulting agreement involves clearly stating the purpose of the agreement and the services to be performed. Use straightforward language to define payment terms, deadlines, and deliverables. Incorporating a Maine Consultant Agreement with Sharing of Software Revenues provides a ready-made template that can streamline this process for you.

A consultant contract should include vital elements such as the project description, payment terms, duration of the agreement, and termination clauses. Additionally, it should outline confidentiality provisions and ownership of work produced. Utilizing a Maine Consultant Agreement with Sharing of Software Revenues ensures you incorporate these elements effectively.

Structuring a revenue sharing agreement begins with detailing how profits will be distributed among stakeholders. Specify the percentage each party will receive and outline the criteria for revenue calculation. A Maine Consultant Agreement with Sharing of Software Revenues can serve as a valuable framework to ensure fairness and transparency in this arrangement.

To set up a consulting agreement, start by defining the roles and responsibilities of each party involved. It's essential to outline the scope of work, payment structure, and timeframe for the project. Using a Maine Consultant Agreement with Sharing of Software Revenues can simplify this process, providing clarity and legal protection for both parties.