Illinois Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

If you want to download, retrieve, or print sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms accessible online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal needs are organized by types and regions, or keywords. Use US Legal Forms to discover the Illinois Carpentry Services Contract - Self-Employed Independent Contractor with just a few clicks.

All legal document templates you obtain are your property permanently. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay competitive and download, and print the Illinois Carpentry Services Contract - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- If you are a current US Legal Forms user, sign in to your account and click on the Download button to access the Illinois Carpentry Services Contract - Self-Employed Independent Contractor.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for your specific city/state.

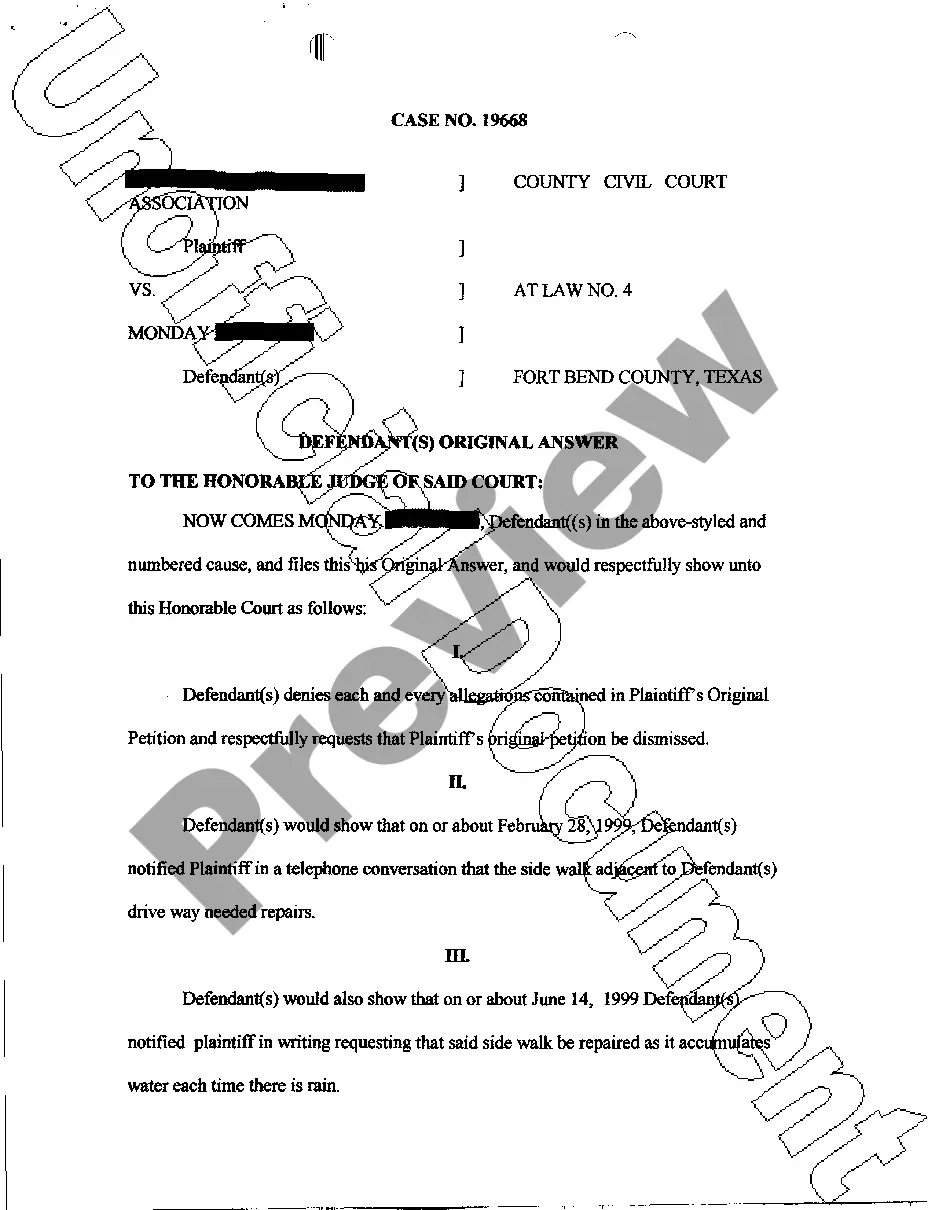

- Step 2. Use the Preview option to review the form's details. Remember to check the information carefully.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the page to find other versions of the legal form template.

- Step 4. Once you locate the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Illinois Carpentry Services Contract - Self-Employed Independent Contractor.

Form popularity

FAQ

The independent contractor law in Illinois establishes criteria that differentiate independent contractors from employees. To be classified correctly, you must meet certain conditions regarding control over your work and the provision of your tools. An Illinois Carpentry Services Contract - Self-Employed Independent Contractor can be a foundational document that supports your status as an independent contractor. Understanding these laws helps you navigate your rights and responsibilities.

Proving your status as an independent contractor involves demonstrating that you have control over how you perform your work. This includes showing evidence of a separate business entity, investment in tools, and an Illinois Carpentry Services Contract - Self-Employed Independent Contractor that outlines your role. Documenting your work relationships and contract terms can also strengthen your position as an independent contractor in the eyes of clients and tax authorities.

As a self-employed individual, having a contract is not legally mandatory, but it is highly recommended. An Illinois Carpentry Services Contract - Self-Employed Independent Contractor can clearly outline the services to be performed and define the payment terms. A contract can also help prevent potential disputes with clients by providing a written agreement. This added layer of protection is invaluable.

You can be classified as a 1099 employee without a formal contract, but it may complicate your relationship with clients. Without clear terms outlined, you might face challenges in proving your work agreements and terms. Moreover, having an Illinois Carpentry Services Contract - Self-Employed Independent Contractor can clarify your status and help you maintain professional boundaries with clients. This clarity benefits everyone involved.

While a contract may not be legally required, having one as an independent contractor is highly advisable. A well-drafted Illinois Carpentry Services Contract - Self-Employed Independent Contractor clearly defines the scope of work, payment terms, and project timelines. This clarity can prevent misunderstandings and provide you with legal recourse if issues arise. It's a smart move to protect your interests.

Independent contractors in Illinois must comply with specific legal requirements, such as obtaining necessary licenses and permits for carpentry work. Moreover, staying compliant with tax regulations is crucial. Remember, using an Illinois Carpentry Services Contract - Self-Employed Independent Contractor helps outline responsibilities, ensuring you meet all legal criteria. Doing so safeguards both you and your clients.

If you find yourself working without a contract, your rights may become unclear. However, in Illinois, you might still have the right to claim unpaid wages for services you provided as an independent contractor. It's essential to document your work and communication with clients to establish the extent of your rights. Utilizing an Illinois Carpentry Services Contract - Self-Employed Independent Contractor can protect your interests and clarify these rights.