Illinois Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

Are you currently in a location where you require documents for either business or personal purposes almost every day? There are numerous legal document templates available online, but finding ones you can rely on isn't simple.

US Legal Forms offers a vast array of template formats, such as the Illinois Drafting Agreement - Self-Employed Independent Contractor, that are created to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Illinois Drafting Agreement - Self-Employed Independent Contractor template.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Illinois Drafting Agreement - Self-Employed Independent Contractor at any time if needed. Just click the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service offers expertly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct area/state.

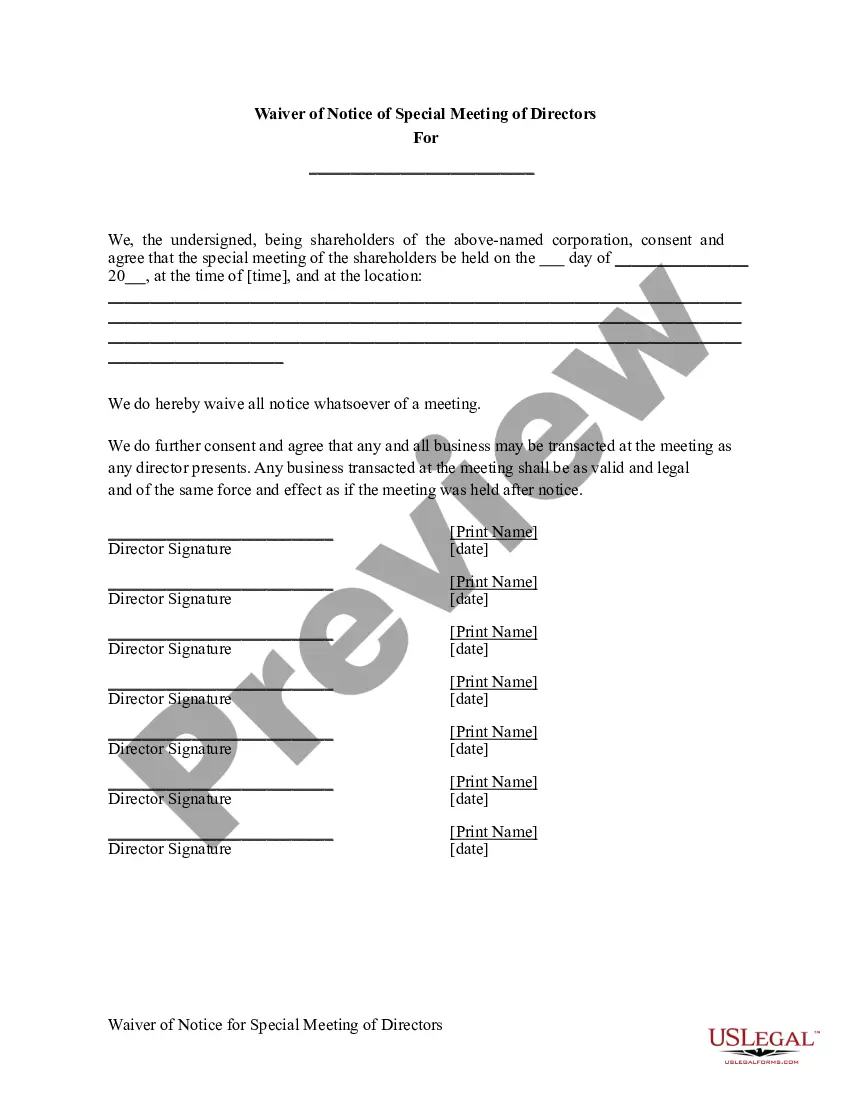

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn't what you are looking for, utilize the Search field to locate the form that suits your needs and requirements.

- Once you find the right form, click Get now.

- Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

Typically, either party can draft the independent contractor agreement, but it's advisable for the hiring entity to create the initial document. They often know the project requirements best and can tailor the agreement to fit specific needs. Additionally, using a reliable service like US Legal ensures you have access to expert templates for your Illinois Drafting Agreement - Self-Employed Independent Contractor, which can save time and reduce potential disputes.

Yes, you can create your own legally binding contract by following specific legal guidelines. Ensure that both parties agree to the terms and that the contract includes all necessary components, such as signatures and dates. However, using resources like US Legal can guide you through the process of Illinois Drafting Agreement - Self-Employed Independent Contractor, providing templates to enhance your document's legality and enforceability.

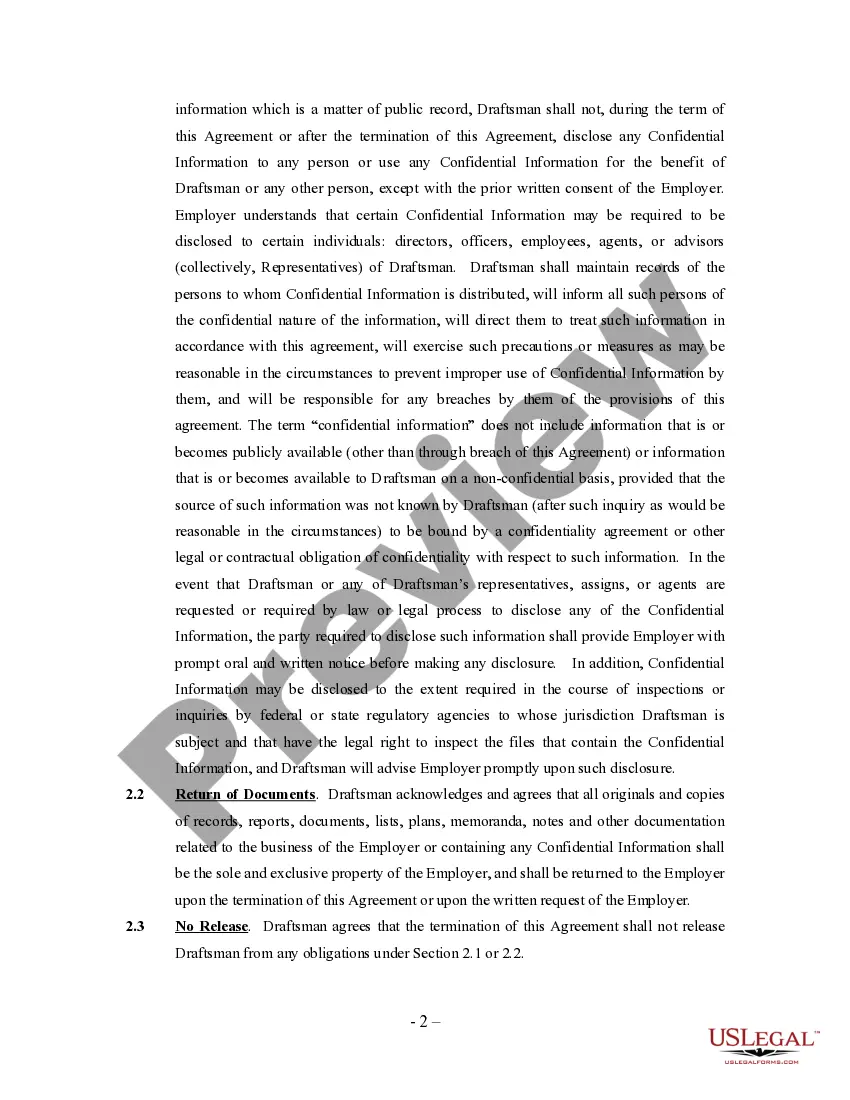

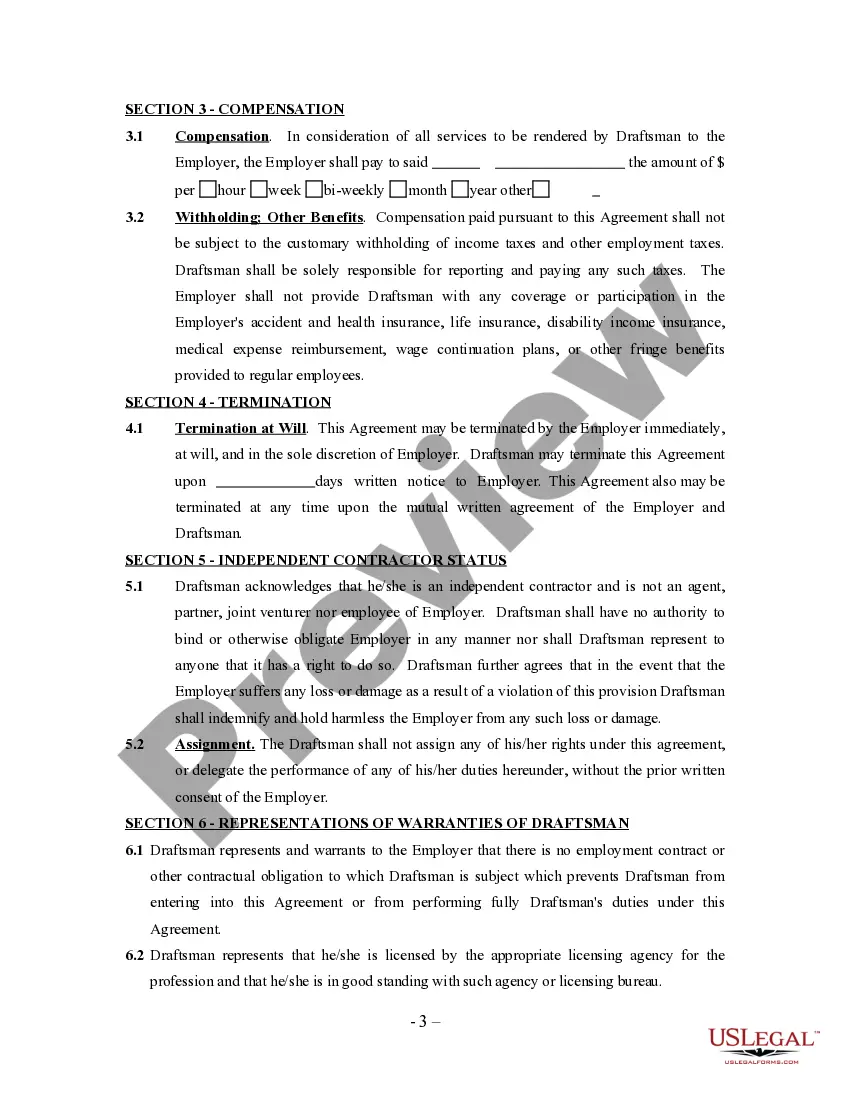

Creating an independent contractor agreement involves several key steps. First, define the scope of work and outline the expectations clearly. Then, incorporate essential elements such as compensation, deadlines, and termination clauses. For ease and legal compliance, you can utilize the US Legal platform to access templates specifically designed for Illinois Drafting Agreement - Self-Employed Independent Contractor.

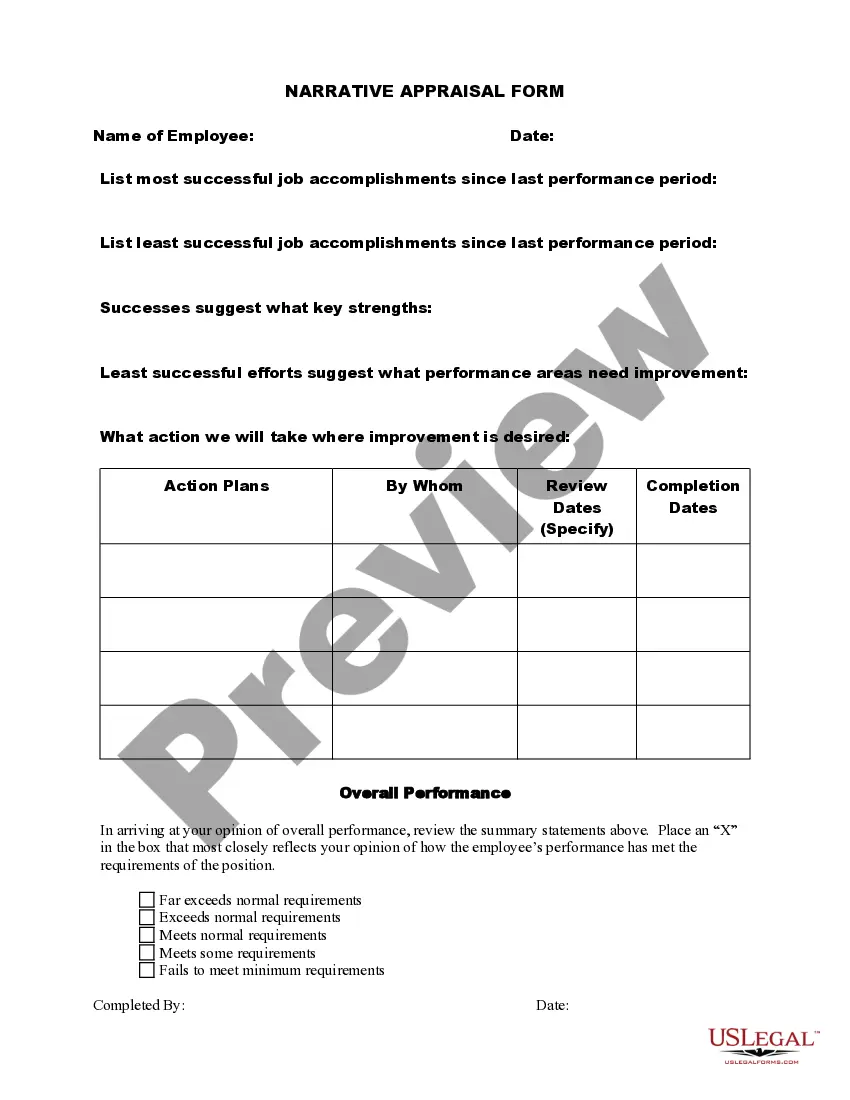

An independent contractor typically needs to fill out an agreement outlining their services and payment terms, as well as tax forms like the W-9 for reporting income. Additionally, they may need to complete any relevant declarations to clarify their status. The Illinois Drafting Agreement - Self-Employed Independent Contractor is a valuable resource for identifying all necessary paperwork and ensuring compliance.

Filling out a declaration of independent contractor status form requires you to declare the working relationship between the business and the contractor clearly. Include statements that confirm the contractor's independence and the terms agreed upon. Using templates from the Illinois Drafting Agreement - Self-Employed Independent Contractor will streamline this task and enhance accuracy.

To fill out an independent contractor form, provide your business information, as well as details about the contractor's services and payment. This ensures proper classification for tax purposes and compliance with regulations. Accessing the Illinois Drafting Agreement - Self-Employed Independent Contractor will ensure you don’t miss critical information during this process.

Filling out an independent contractor agreement involves completing sections that specify the contractor's role, the job scope, and payment details. Be sure to include any legal requirements and signatures from both parties. Using the Illinois Drafting Agreement - Self-Employed Independent Contractor can help guide you through these sections effectively.

To write an independent contractor agreement, start by outlining the services the contractor will provide and defining the terms of the relationship. Include important elements such as payment terms, deadlines, and responsibilities. Utilizing resources like the Illinois Drafting Agreement - Self-Employed Independent Contractor can streamline this process, ensuring you cover all necessary legal aspects.

In Illinois, the law defines an independent contractor as a person who provides services to another, typically under a contract. The Illinois Drafting Agreement - Self-Employed Independent Contractor is essential for establishing clear terms between the contractor and employer. It helps protect both parties by outlining roles, responsibilities, and payment structures. Utilizing a platform like US Legal Forms can greatly simplify the drafting process and ensure compliance with state regulations.