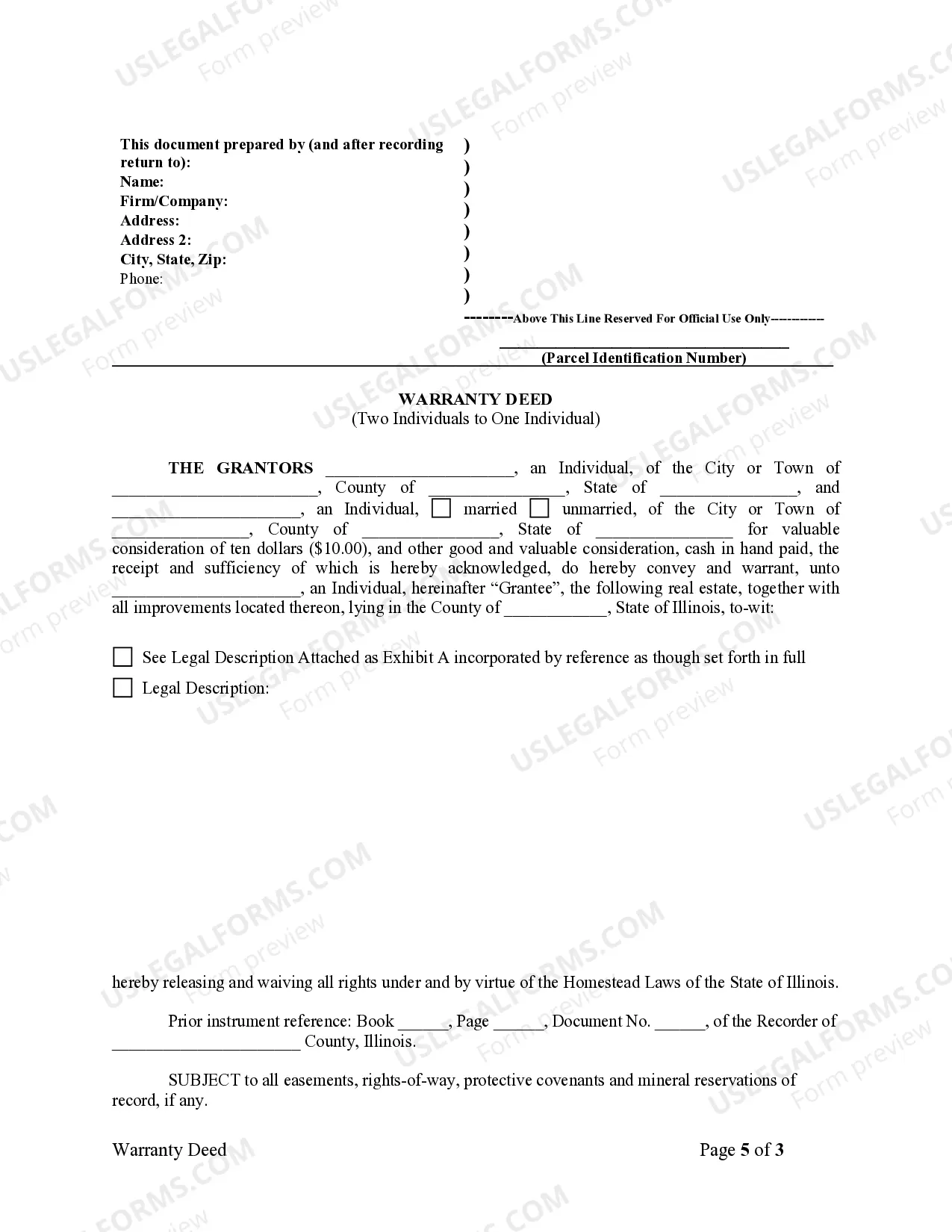

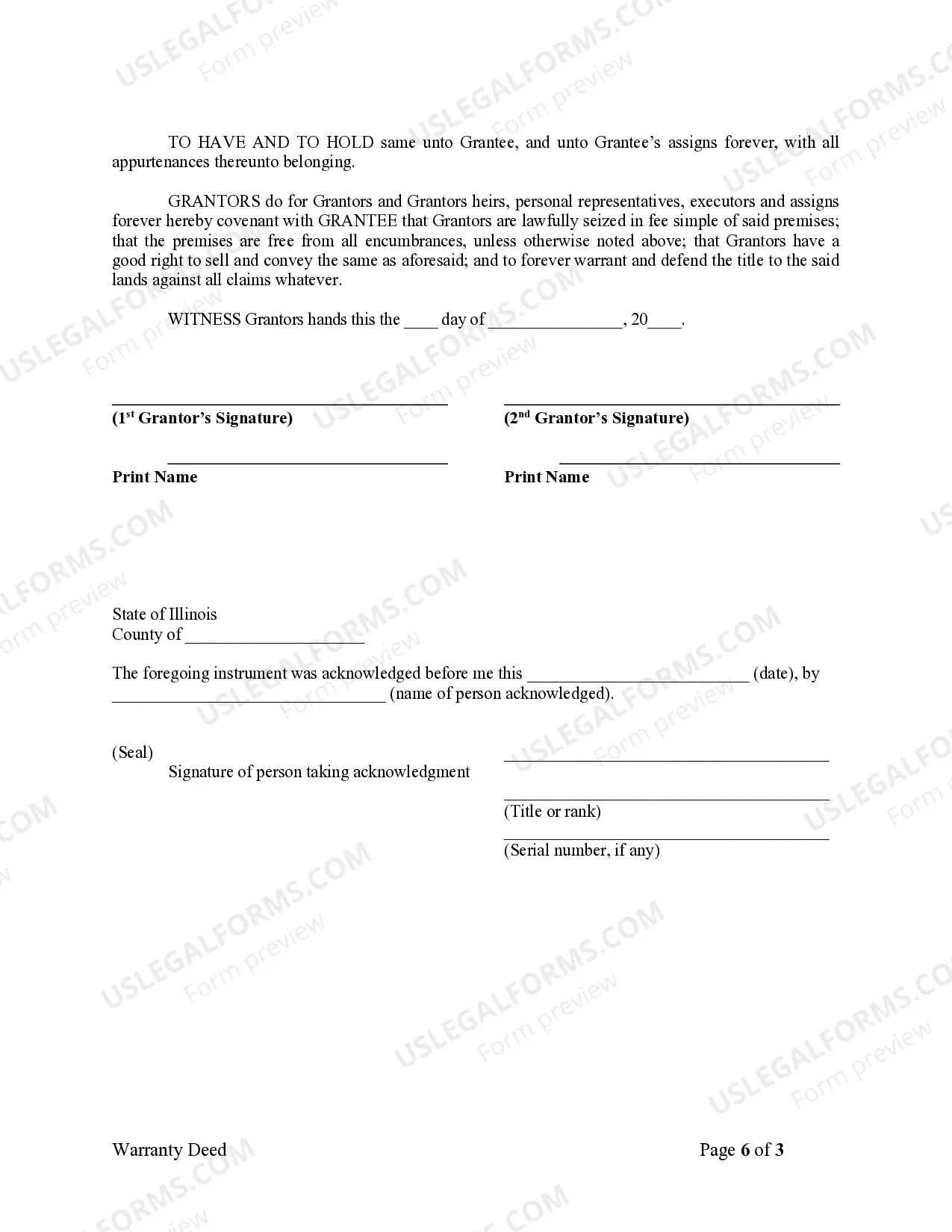

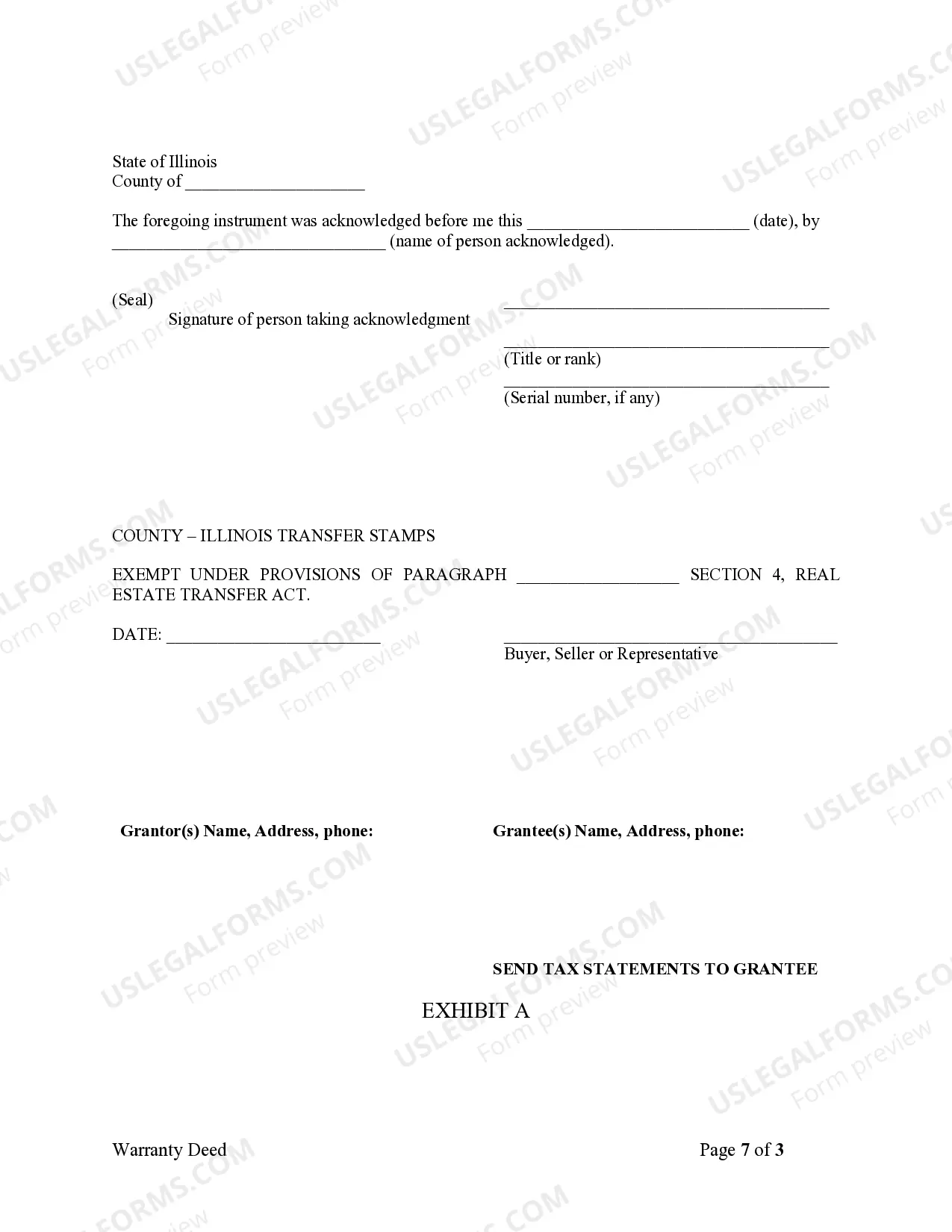

Illinois Warranty Deed from two Individuals to One Individual

Description

How to fill out Illinois Warranty Deed From Two Individuals To One Individual?

Among numerous paid and complimentary instances that you can discover online, you cannot be assured about their trustworthiness.

For instance, who developed them or if they possess the expertise to handle what you require those for.

Always remain composed and utilize US Legal Forms!

Click Buy Now to initiate the buying process or search for another template utilizing the Search field located in the header. Select a pricing plan and create an account. Complete the subscription payment with your credit/debit card or Paypal. Download the form in your desired format. Upon signing up and purchasing your subscription, you can utilize your Illinois Warranty Deed from two Individuals to One Individual as frequently as needed or for as long as it remains active in your state. Edit it in your preferred editor, complete it, sign it, and print a hard copy of it. Achieve more for less with US Legal Forms!

- Find Illinois Warranty Deed from two Individuals to One Individual templates prepared by experienced attorneys and avoid the costly and time-consuming task of searching for a lawyer and subsequently paying them to create a document for you that you can easily obtain yourself.

- If you have a subscription, sign in to your account and locate the Download button adjacent to the file you’re attempting to find.

- You will also be able to access your previously saved examples in the My documents section.

- If you’re using our service for the first time, heed the guidelines listed below to obtain your Illinois Warranty Deed from two Individuals to One Individual swiftly.

- Ensure that the file you locate is applicable in your state.

- Review the file by assessing the details using the Preview function.

Form popularity

FAQ

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the Illinois land records.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.A quitclaim deed requires trust on the part of the person receiving the deed, because the person transferring it, also known as the grantor, isn't guaranteeing they actually own the property.

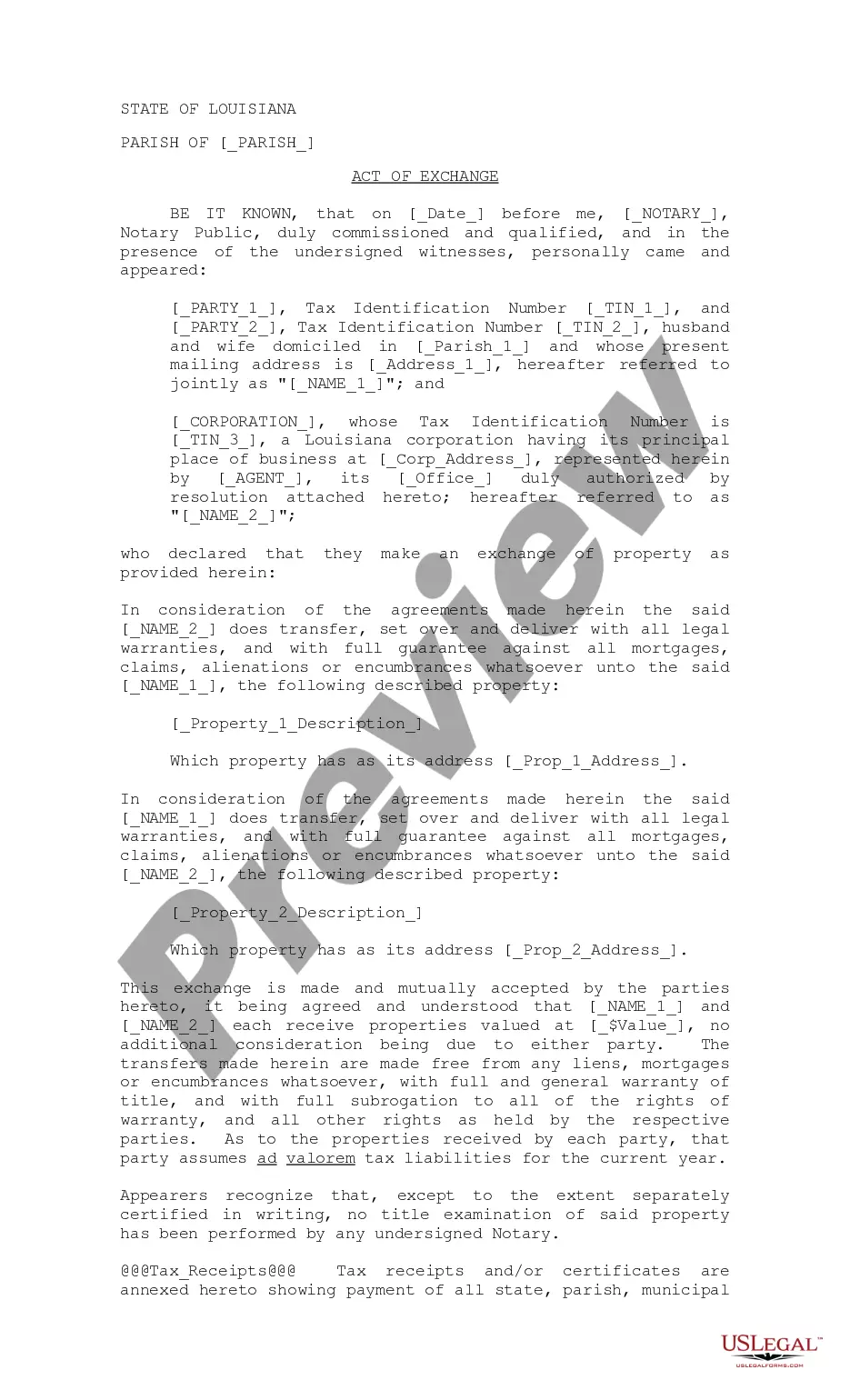

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

The Illinois TOD deed form form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Discuss the terms of the deed with the new owners. Hire a real estate attorney to prepare the deed. Review the deed. Sign the deed in front of a notary public, with witnesses present. File the deed on public record.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.