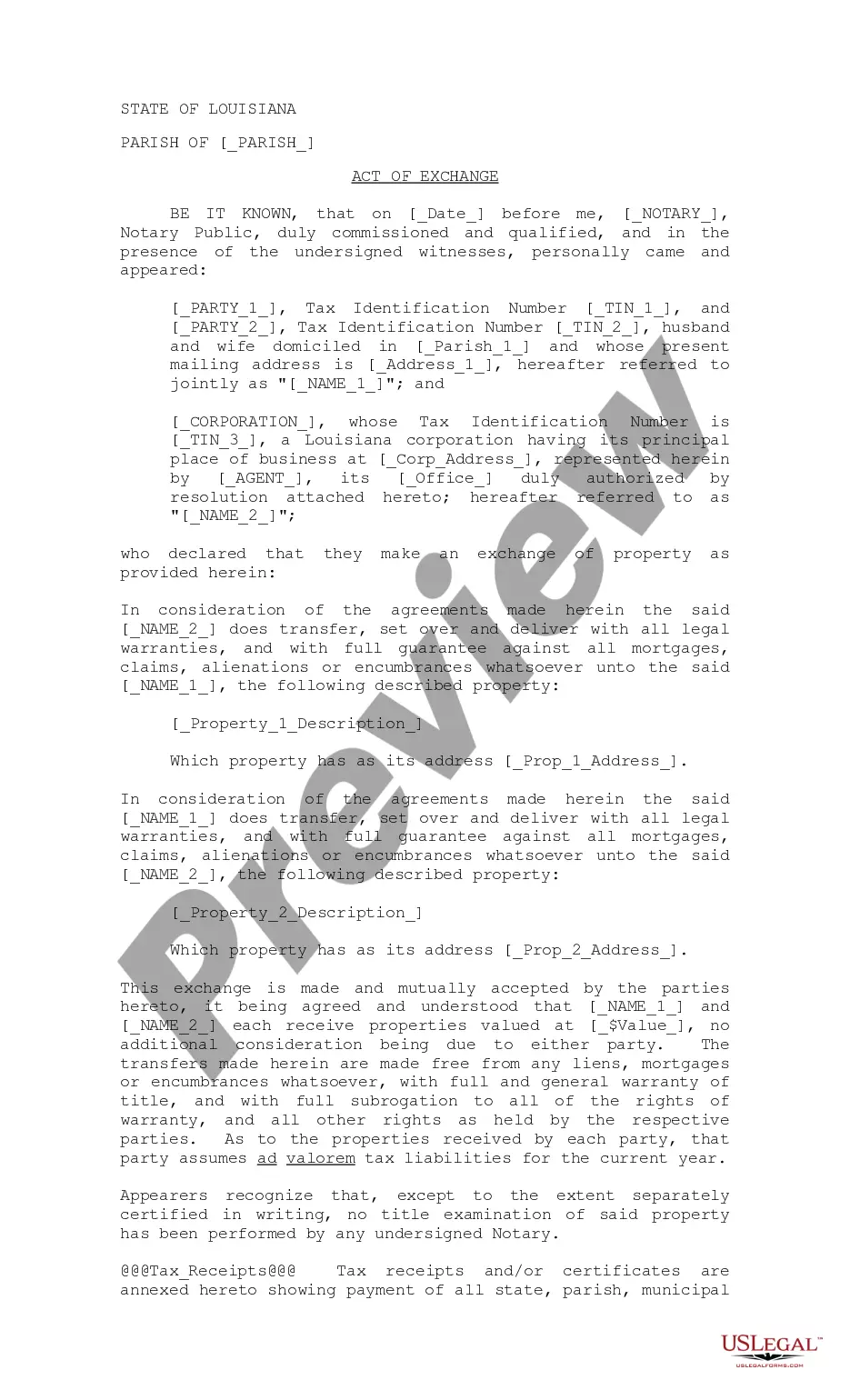

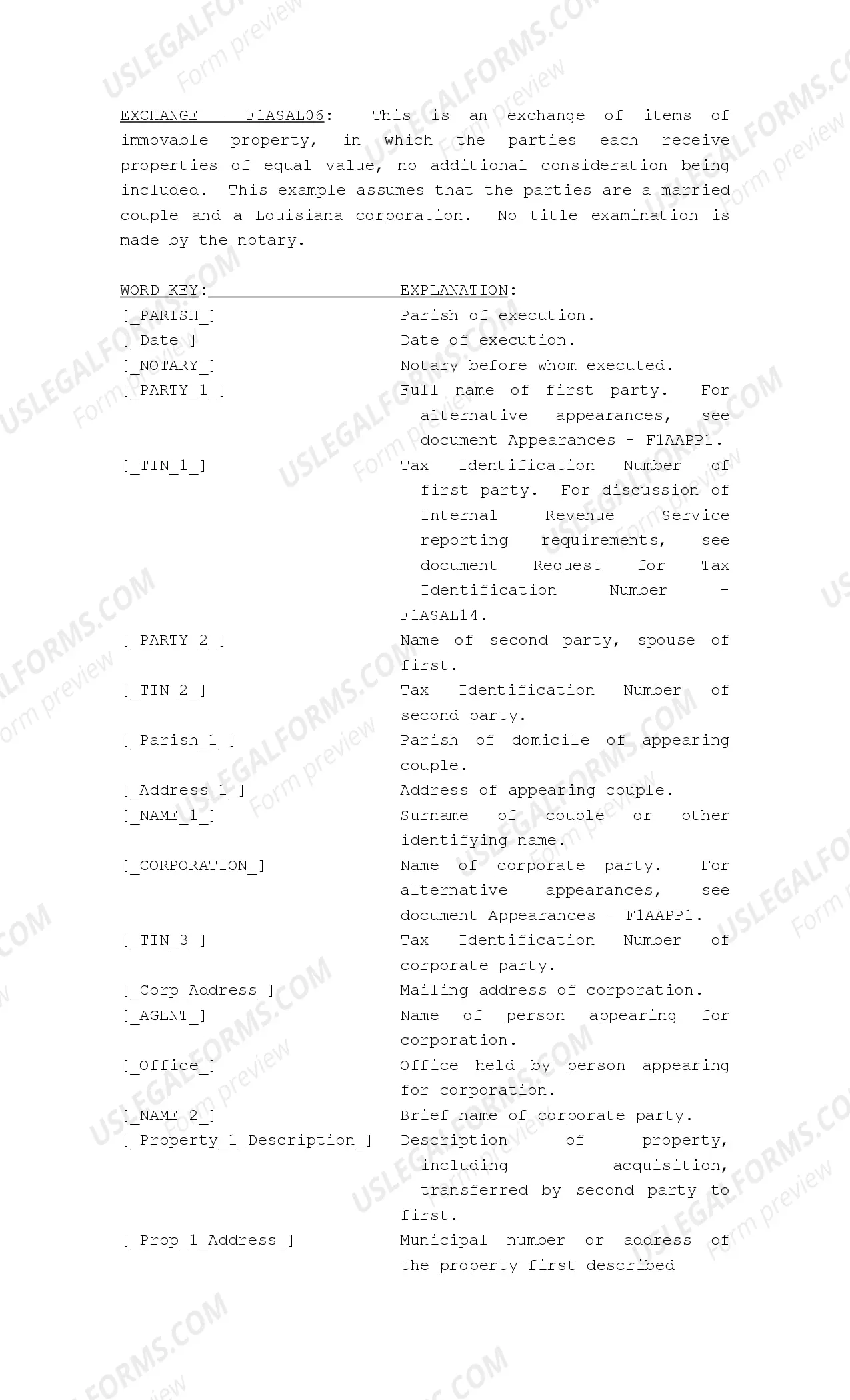

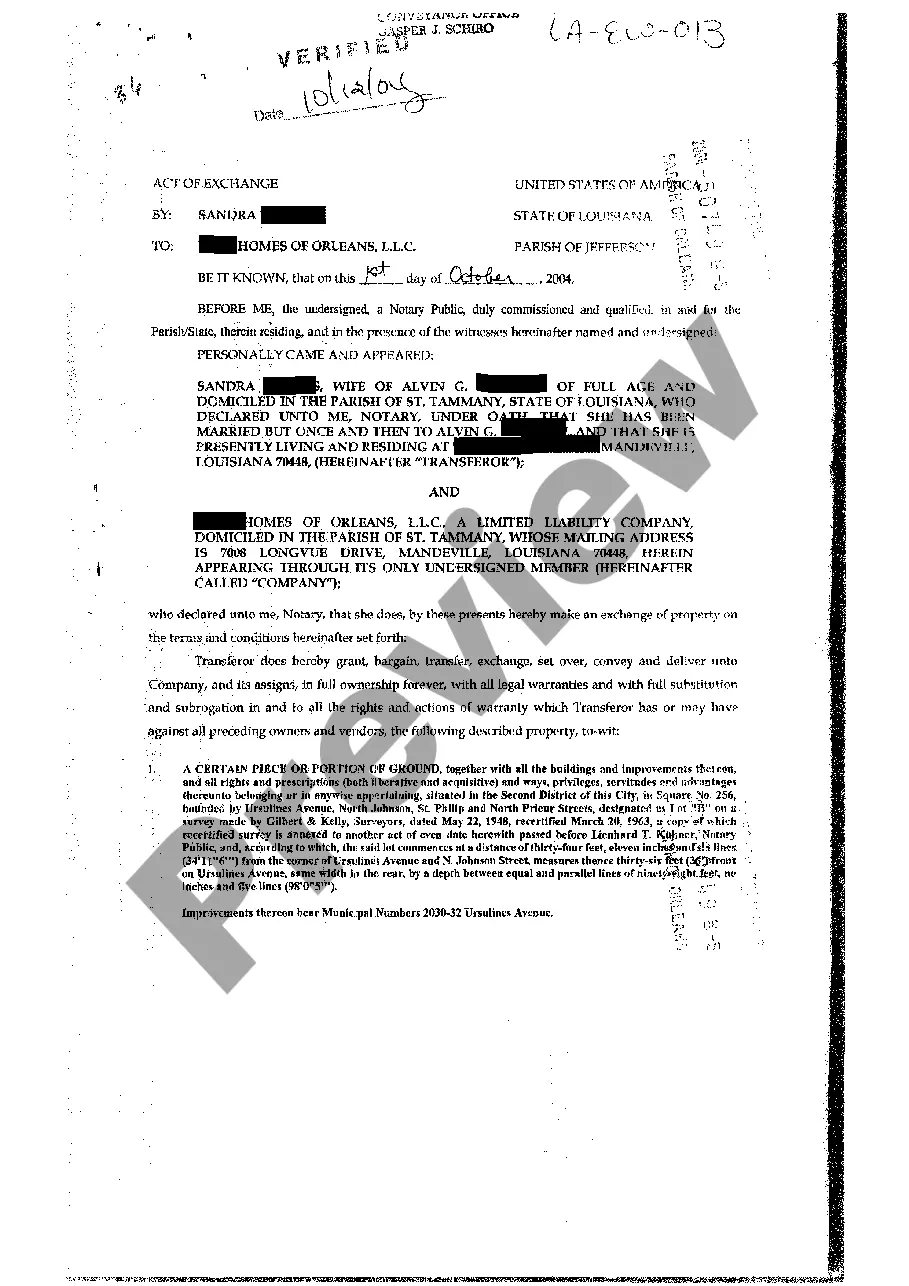

Louisiana Act of Exchange

Description

How to fill out Louisiana Act Of Exchange?

Attempting to locate Louisiana Act of Exchange documents and completing them may be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable example specifically for your state in just a few clicks.

Our attorneys prepare every document, so you merely need to complete them.

Select your payment method via credit card or PayPal. Download the sample in your preferred file format. You can now print the Louisiana Act of Exchange template or complete it using any online editor. Don’t worry about making mistakes, as your form can be used, submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- Your downloaded templates are stored in My documents and are accessible anytime for future use.

- If you haven’t subscribed yet, you ought to register.

- Review our comprehensive instructions on how to obtain your Louisiana Act of Exchange template quickly.

- To get an eligible example, verify its relevance for your state.

- Examine the sample using the Preview feature (if available).

- If there is a description, read it to understand the essential points.

- Click on the Buy Now button if you found what you are looking for.

Form popularity

FAQ

The actalso known as the "Truth in Securities" law, the 1933 Act, and the Federal Securities Actrequires that investors receive financial information from securities being offered for public sale. This means that prior to going public, companies have to submit information that is readily available to investors.

SEC Form N-1A is the required registration form for establishing open-end management companies. The form can be used for registering both open-end mutual funds and open-end exchange traded funds (ETFs).

SEC Form S-1 is the initial registration form for new securities required by the SEC for public companies that are based in the U.S. Any security that meets the criteria must have an S-1 filing before shares can be listed on a national exchange, such as the New York Stock Exchange.

The Securities and Exchange Commission (SEC) requires public companies, certain company insiders, and broker-dealers to file periodic financial statements and other disclosures. Finance professionals and investors rely on SEC filings to make informed decisions when evaluating whether to invest in a company.

What Is SEC Form N-2? SEC Form N-2 is a filing with the Securities and Exchange Commission (SEC) that must be submitted by closed-end management investment companies to register under the Investment Company Act of 1940 and to offer their shares under the Securities Act of 1933.

SEC Form S-3 is a regulatory filing that provides simplified reporting for issuers of registered securities. An S-3 filing is utilized when a company wishes to raise capital, usually as a secondary offering after an initial public offering has already occurred.

Among the most common SEC filings are: Form 10-K, Form 10-Q, Form 8-K, the proxy statement, Forms 3,4, and 5, Schedule 13, Form 114, and Foreign Investment Disclosures.

SEC Form 3: Initial Statement of Beneficial Ownership of Securities is a document filed by a company insider or major shareholder with the Securities and Exchange Commission (SEC).Filing Form 3 helps disclose who these insiders are and track any suspicious behaviors.

This SEC Form 17-A shall be used for annual reports filed pursuant to Section 17 of the Securities Regulation Code (SRC) and paragraph (1)(A) of SRC Rule 17.1 thereunder.Reports filed on this Form shall be deemed to satisfy Section 141 of the Corporation Code of the Philippines.