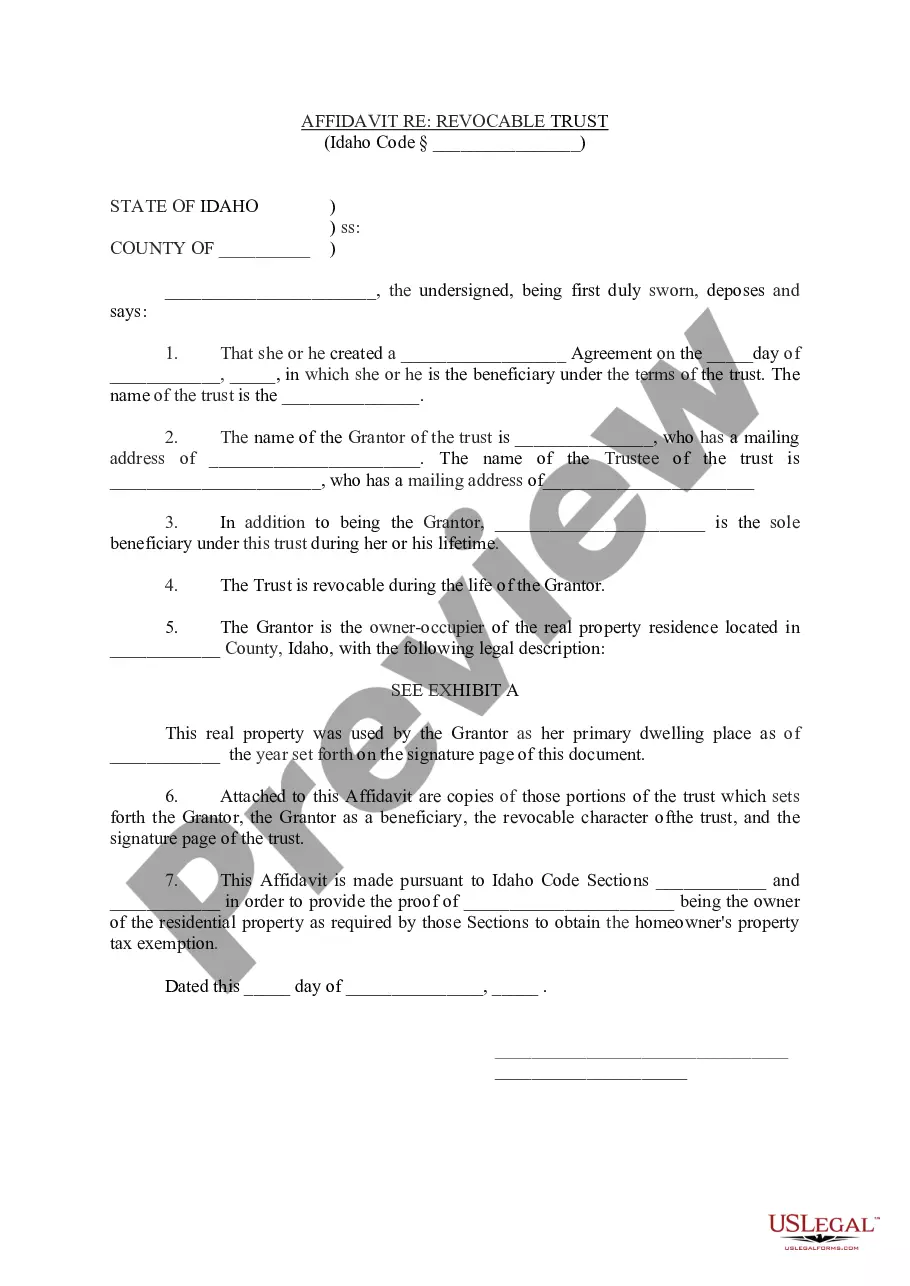

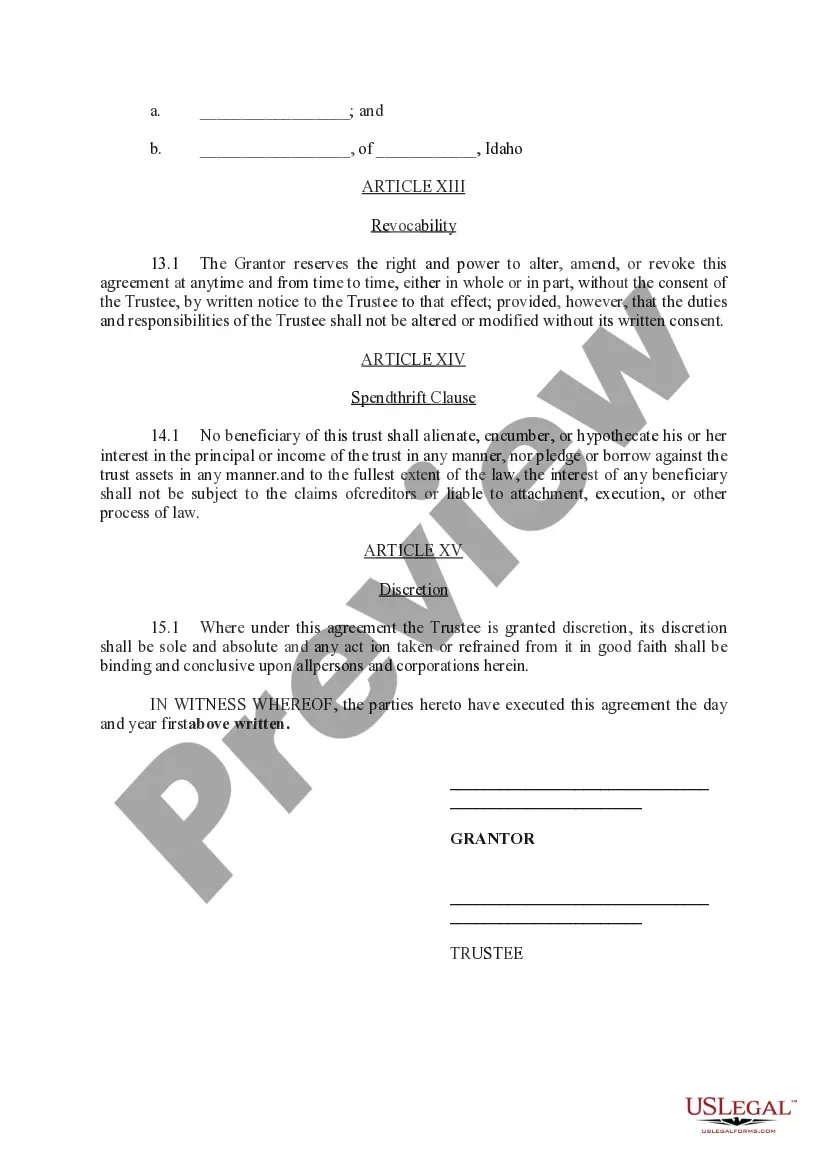

Idaho Affidavit RE: Revocable Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Affidavit RE: Revocable Trust?

Utilize US Legal Forms to secure a downloadable Idaho Affidavit concerning a Revocable Trust. Our court-recognizable forms are crafted and frequently refreshed by proficient attorneys.

Ours is the most comprehensive collection of Forms available online, offering budget-friendly and precise templates for clients, legal professionals, and small to medium-sized businesses.

The templates are organized into state-specific categories, and some can be previewed prior to downloading.

US Legal Forms provides thousands of legal and tax templates and packages for both business and personal requirements, including the Idaho Affidavit regarding a Revocable Trust. Over three million users have successfully engaged with our platform. Choose your subscription plan and acquire high-quality forms in mere moments.

- To access samples, users must have a subscription and Log In to their account.

- Click Download next to any required form and locate it in My documents.

- For those lacking a subscription, follow the guidelines below to effortlessly find and download the Idaho Affidavit concerning a Revocable Trust.

- Ensure you select the accurate template for the specific state it is intended for.

- Examine the document by reviewing the description and using the Preview function.

- Select Buy Now if it is the document you require.

- Establish your account and complete payment via PayPal or credit/debit card.

- Download the template to your device and feel free to utilize it multiple times.

- Employ the Search engine if you wish to locate another document template.

Form popularity

FAQ

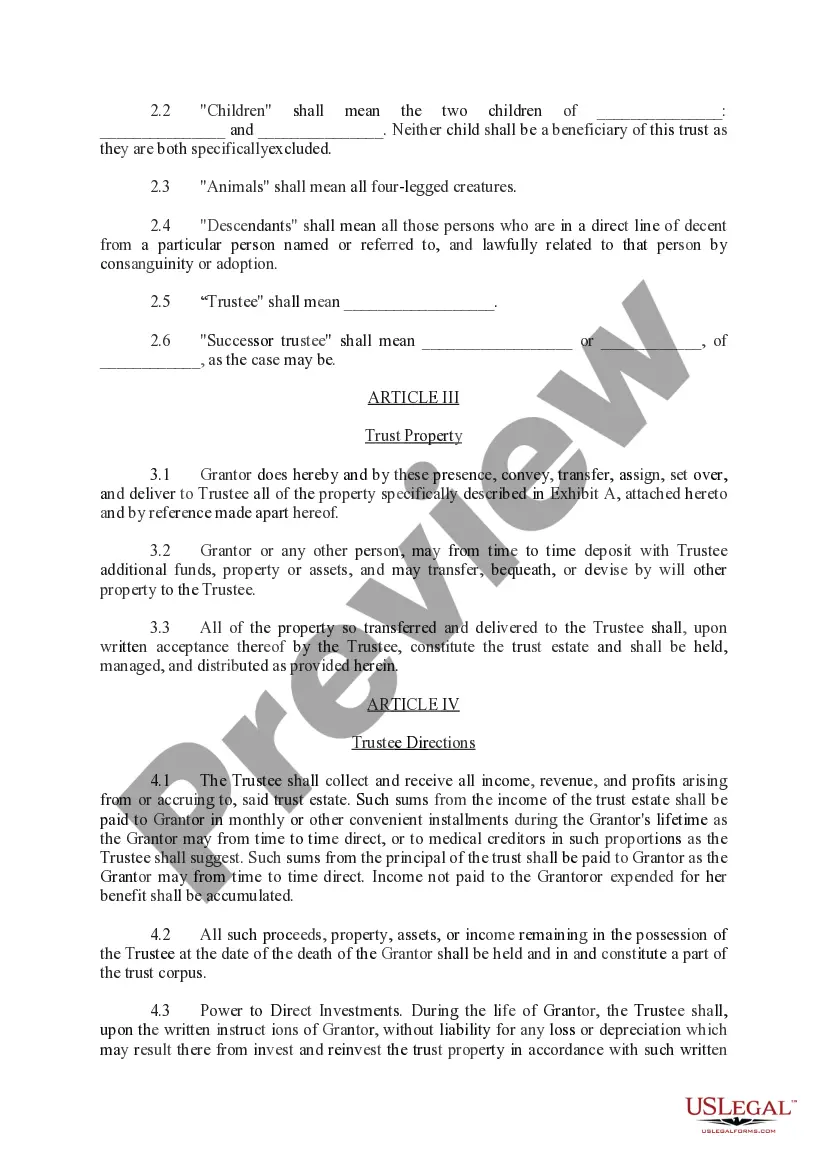

The need for a lawyer to help with your estate has nothing to do with a Revocable Living Trust. If your executor could handle your estate alone, then there is no need for a lawyer even if you had no Revocable Living Trust.For example, with filing inheritance and estate tax returns or obtaining beneficiary releases.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Most people can create a living trust without an attorney using software or an online service.

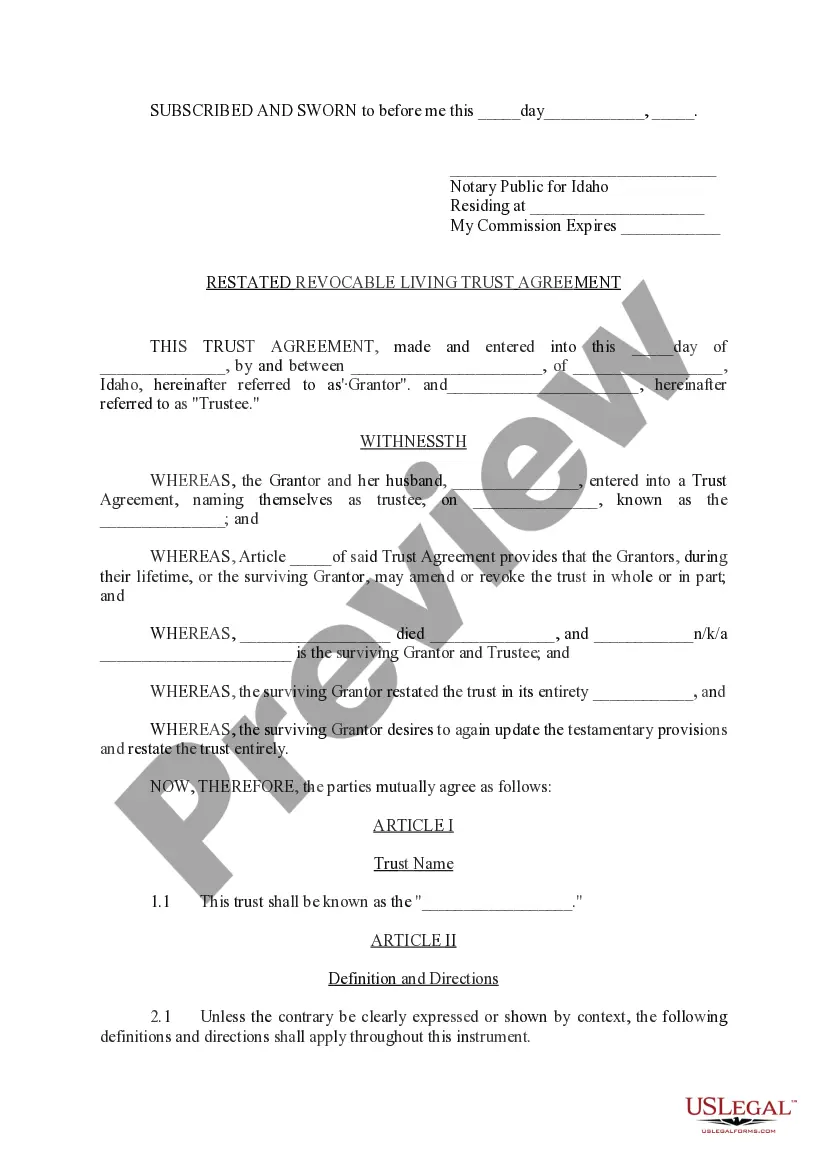

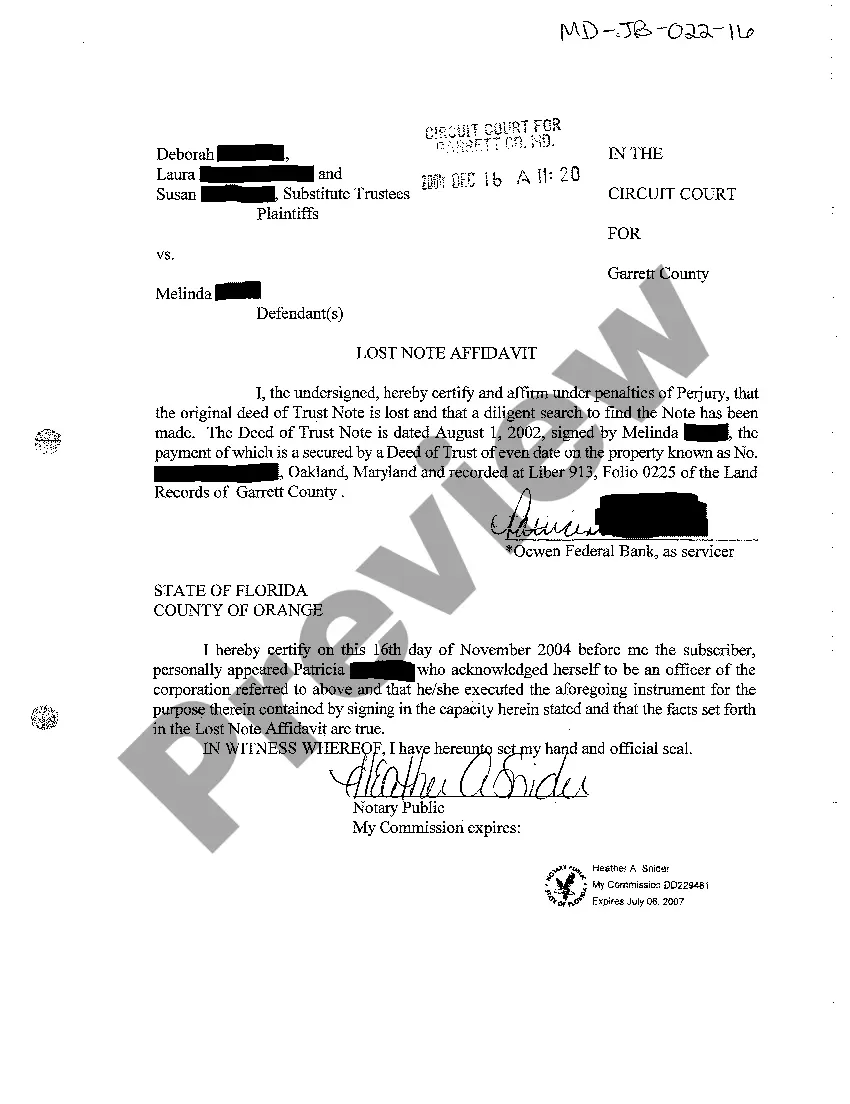

The signing of estate planning documents, including revocable trusts, are frequently witnessed and the signatures notarized as a matter of custom.Although there may be no such requirements under state law, it is a good idea to at least have the document notarized.

Establishing a trust requires serious legal help, which is not cheap. A typical living trust can cost $2,000 or more, while a basic last will and testament can be drawn up for about $150 or so.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.