Arkansas Assignment to Living Trust

What this document covers

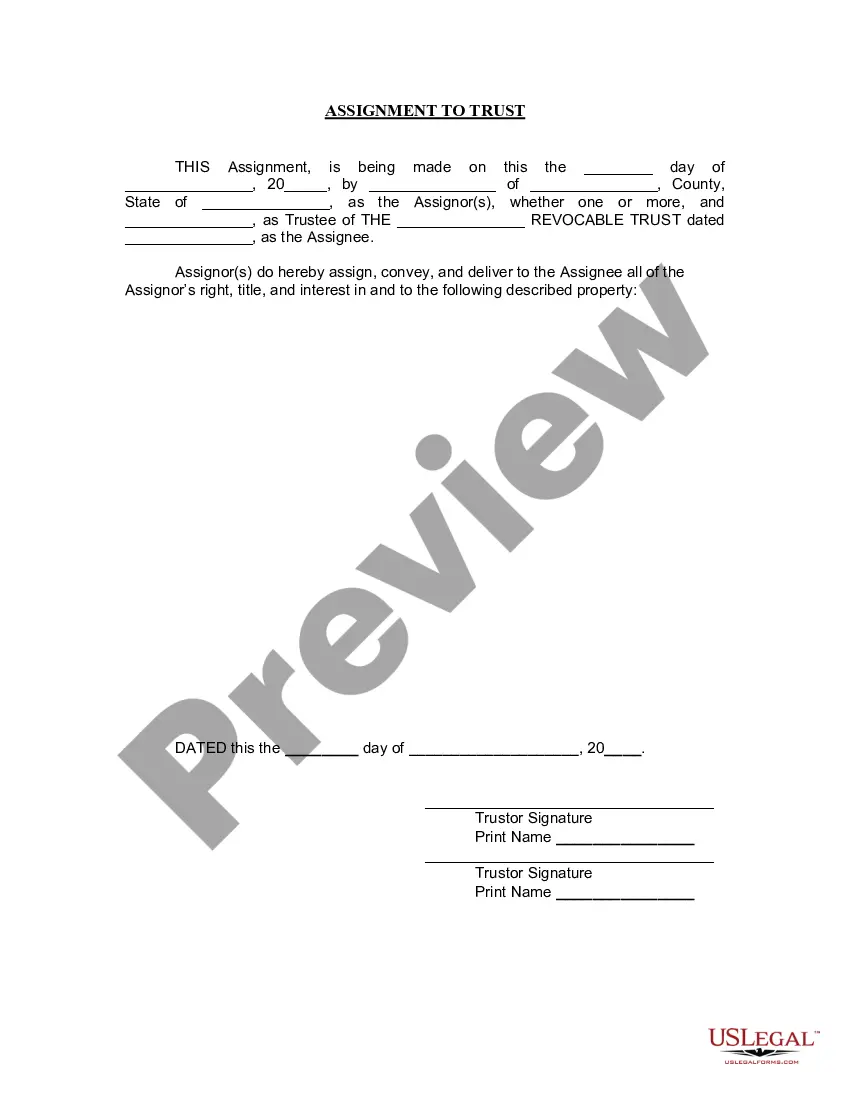

The Assignment to Living Trust form is used to transfer ownership of specific property to a living trust. This form ensures that assets are managed under the trust's terms, making it an essential tool for estate planning. Unlike other property transfer documents, this form is specifically designed for the context of a living trust, which is established during the owner's lifetime to manage assets efficiently.

Form components explained

- Details of the Assignor who is transferring the property.

- Information about the Trustee managing the living trust.

- Specific description of the property being assigned.

- Date of the assignment.

- Signature of the Assignor, which must be notarized.

Situations where this form applies

This form is necessary when an individual wants to place their property into a living trust, which can help avoid probate and streamline the distribution of assets after death. It is particularly useful when updating estate plans or when acquiring new assets that the individual wishes to keep within the trust framework.

Who can use this document

This form is intended for:

- Individuals creating or modifying a living trust.

- Trustees who need to officially receive assets in the trust.

- Estate planners and legal representatives assisting clients with asset management.

How to prepare this document

- Identify the Assignor and Trustee, including their full legal names and addresses.

- Clearly describe the specific property being transferred to the living trust.

- Enter the date of the assignment.

- Have the Assignor sign the form in the presence of a notary public.

- Ensure that the notary public completes the notarization section with their signature and seal.

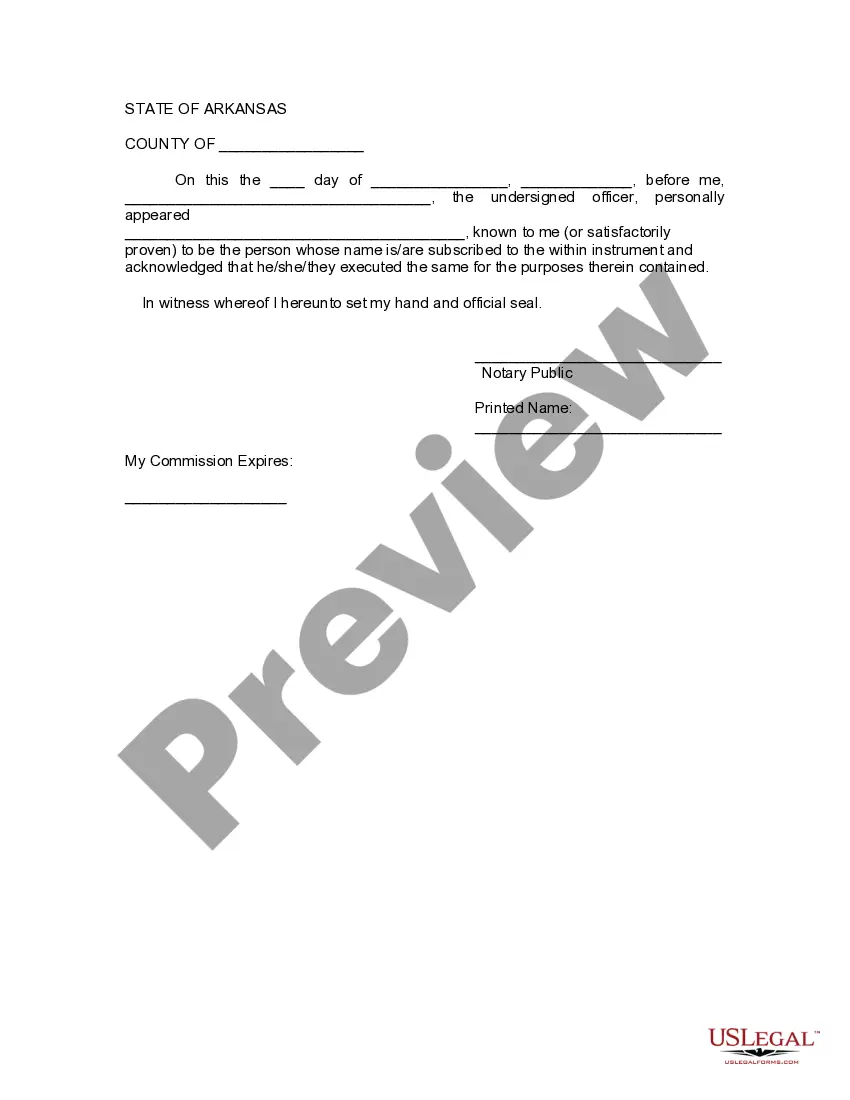

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide a complete and accurate description of the property.

- Not signing the form in front of a notary public.

- Leaving out important details about the Assignor or Trustee.

Advantages of online completion

- Convenient access to customizable templates from anywhere.

- Ability to complete the form at your own pace.

- Designed by licensed attorneys to ensure legal compliance.

Main things to remember

- The Assignment to Living Trust form is essential for transferring property into a trust.

- It requires notarization for legal validity.

- Ensures that assets are managed according to the terms of the living trust.

Looking for another form?

Form popularity

FAQ

To start a living trust in Arkansas, first, determine what assets you want to place into the trust. Next, draft a trust document that outlines your wishes and the beneficiaries of the trust. You can find resources online, such as uslegalforms, to assist in creating an Arkansas Assignment to Living Trust. Finally, transfer your assets to the trust to ensure they are managed according to your instructions.

Yes, you can set up a trust in Arkansas without an attorney, especially with the help of available resources. However, doing so effectively requires careful attention to state laws and documentation requirements. The Arkansas Assignment to Living Trust can be efficiently managed using online platforms that provide guidance and templates for creating trusts. Ensure that you thoroughly research and understand the process before proceeding.

An assignment to a trust involves transferring your assets into the trust for management according to your wishes. This step is crucial as it ensures that the trust holds the assets and can distribute them as you intended upon your passing. The Arkansas Assignment to Living Trust typically includes property, investments, and other valuable items. Proper assignment prevents issues and secures your estate for beneficiaries.

You can create your own living trust in Arkansas, but it is critical to ensure that the document meets all state requirements. Using templates or online tools can simplify this process, but consulting an expert may provide additional assurance. Remember, the Arkansas Assignment to Living Trust involves specific legal language that must be correctly drafted to be effective. Ensure you fully understand the implications and requirements.

In Arkansas, a trust can offer benefits that a will may not provide. A trust allows for the direct transfer of assets upon your passing, which can help avoid probate delays. Additionally, a trust can keep your estate matters private, while a will becomes public record. Therefore, considering an Arkansas Assignment to Living Trust can be a strategic move for effective estate planning.

Transferring items into a trust involves formally changing the ownership of each asset. For real estate, you typically need to execute a new deed reflecting the trust as the owner. For financial accounts, you can often fill out a form to retitle the account. Using a service like US Legal Forms makes it easier to handle the details of an Arkansas Assignment to Living Trust, guiding you through the necessary steps.

While placing assets in a trust can provide benefits, there are some downsides to consider. For instance, there may be initial costs associated with creating the trust, such as legal fees. Additionally, maintaining a living trust requires ongoing management and updates, especially as your financial situation changes. It is crucial to weigh these factors when considering an Arkansas Assignment to Living Trust.

Setting up a living trust in Arkansas involves several steps. First, choose a reliable trustee and decide what assets to include. Next, create a formal trust document that outlines your wishes. Utilizing resources like US Legal Forms can guide you through the entire process of establishing an Arkansas Assignment to Living Trust, ensuring your goals are met efficiently.

To assign assets to a trust, you must identify the assets you want to transfer, then complete the necessary legal documents. This process often includes changing the title of real estate, updating financial accounts, or re-titling personal property. An Arkansas Assignment to Living Trust can simplify this process, ensuring a smooth transition. It is essential to keep accurate records throughout to verify this assignment.

Filling out a living trust requires careful attention to detail and an understanding of your assets. First, gather all necessary information, including property deeds and account numbers, and then, follow the guidelines in your Arkansas Assignment to Living Trust document. You'll need to specify the assets being transferred, the beneficiaries, and the trustee's authority. For a streamlined experience, consider utilizing UsLegalForms to ensure you complete the trust correctly.