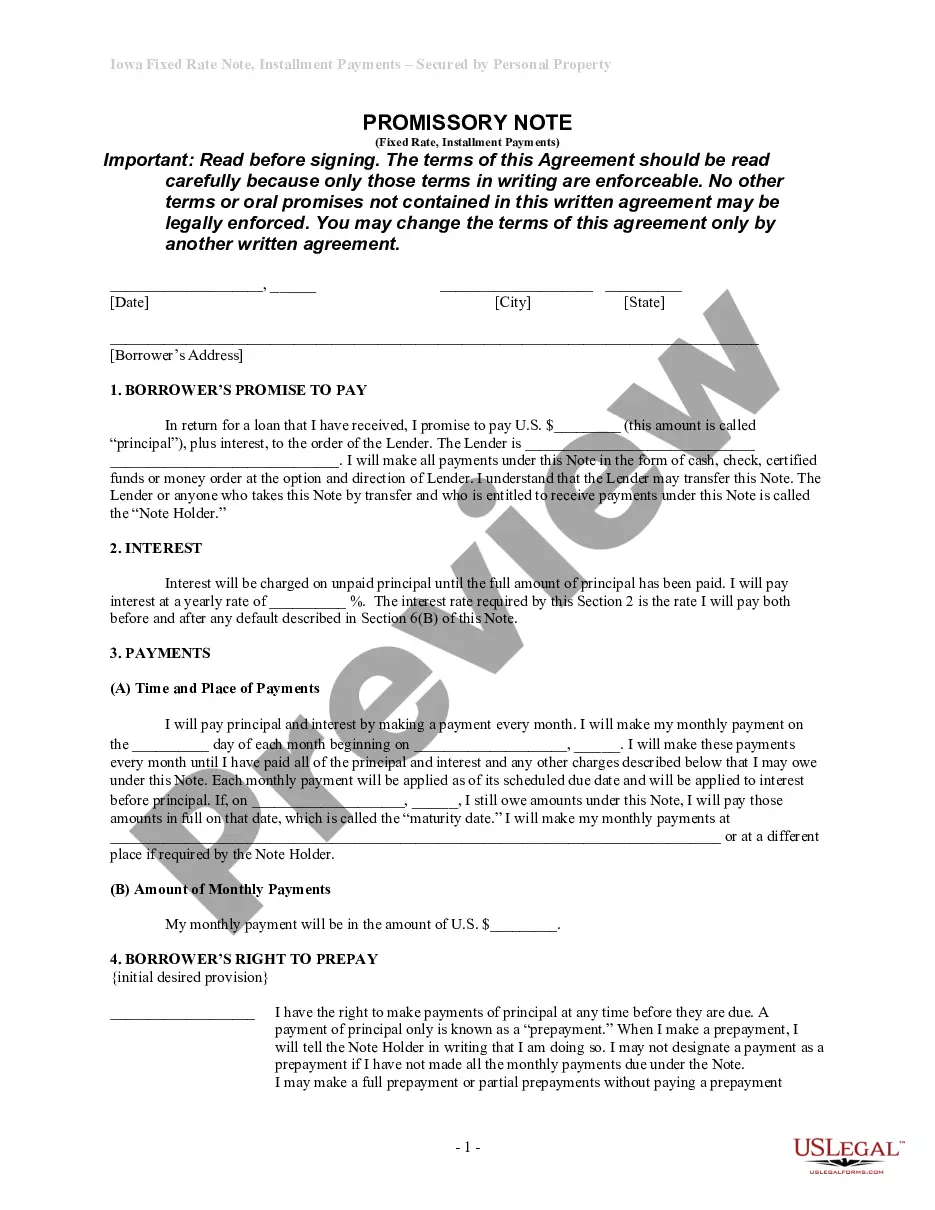

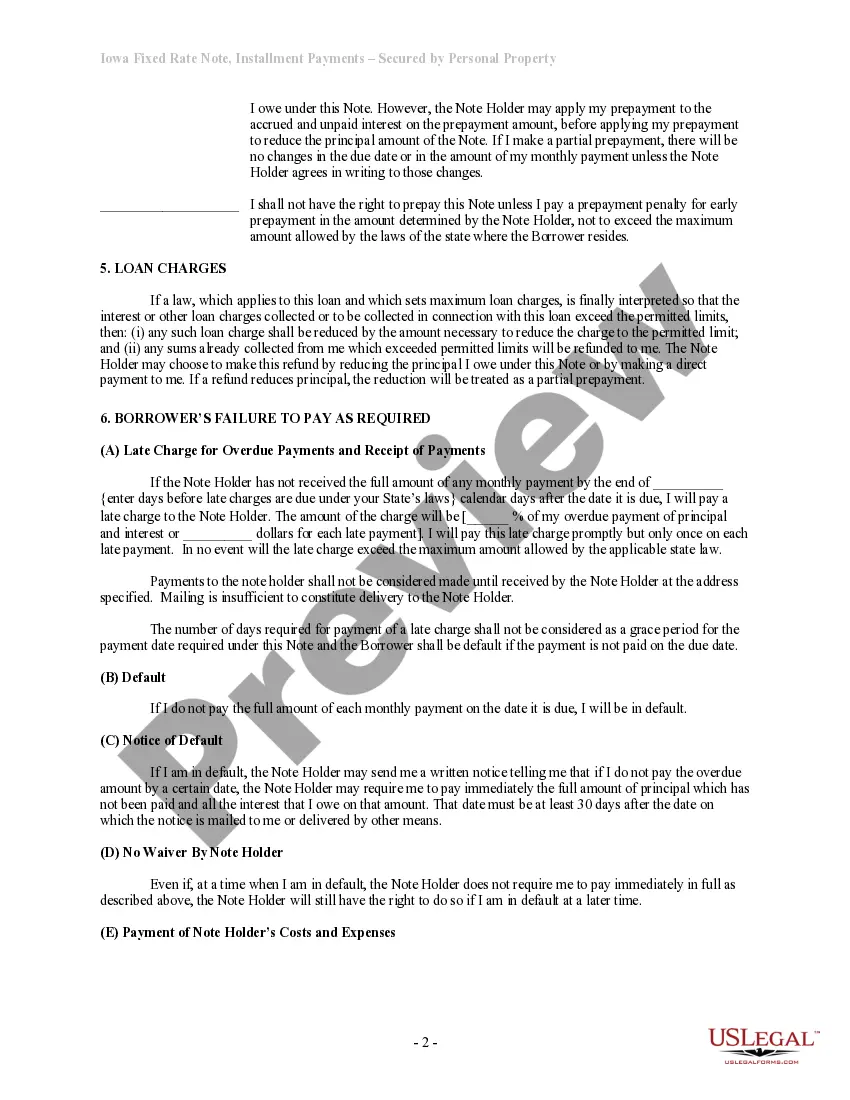

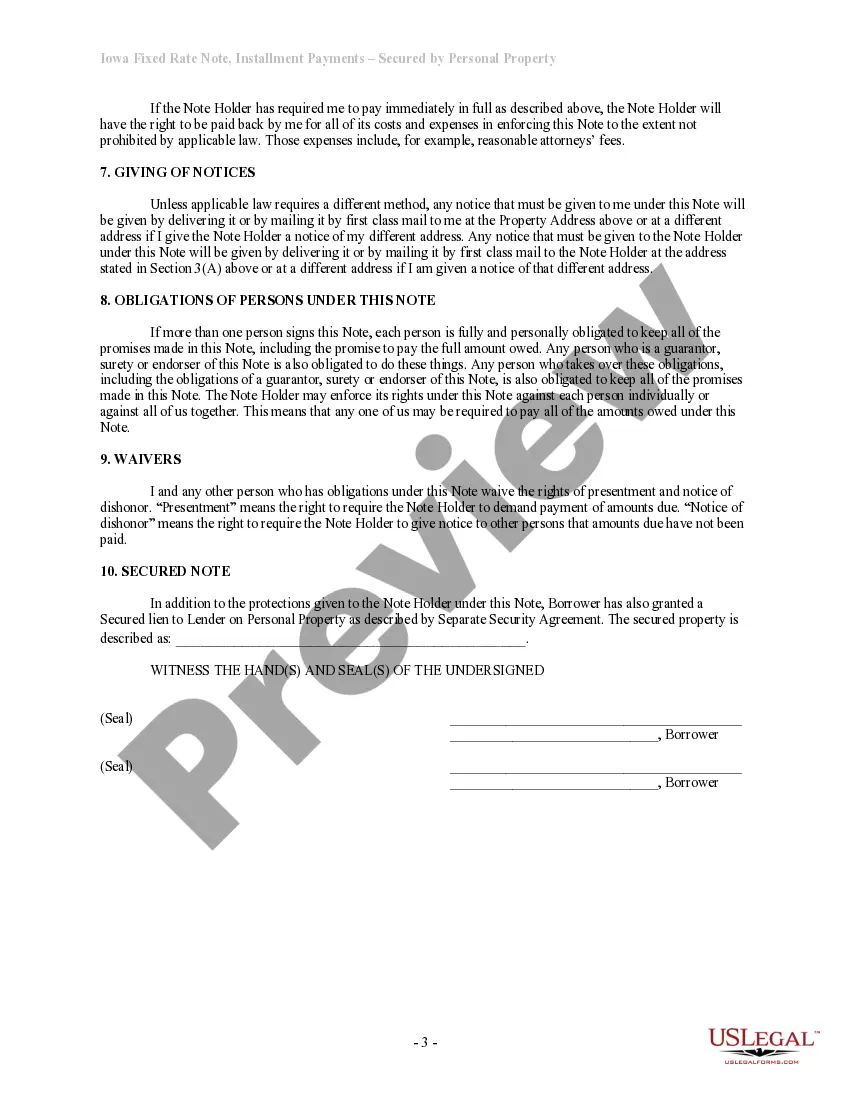

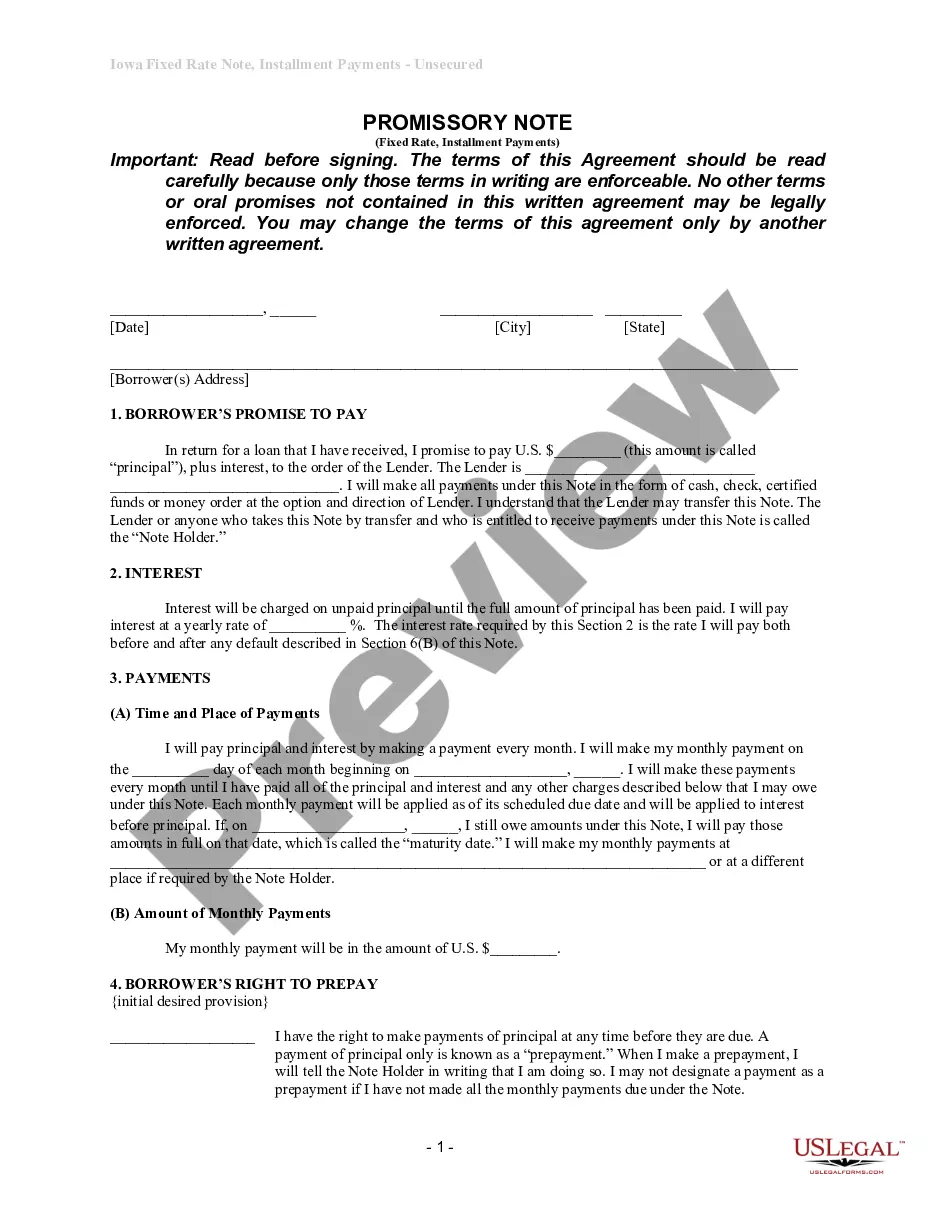

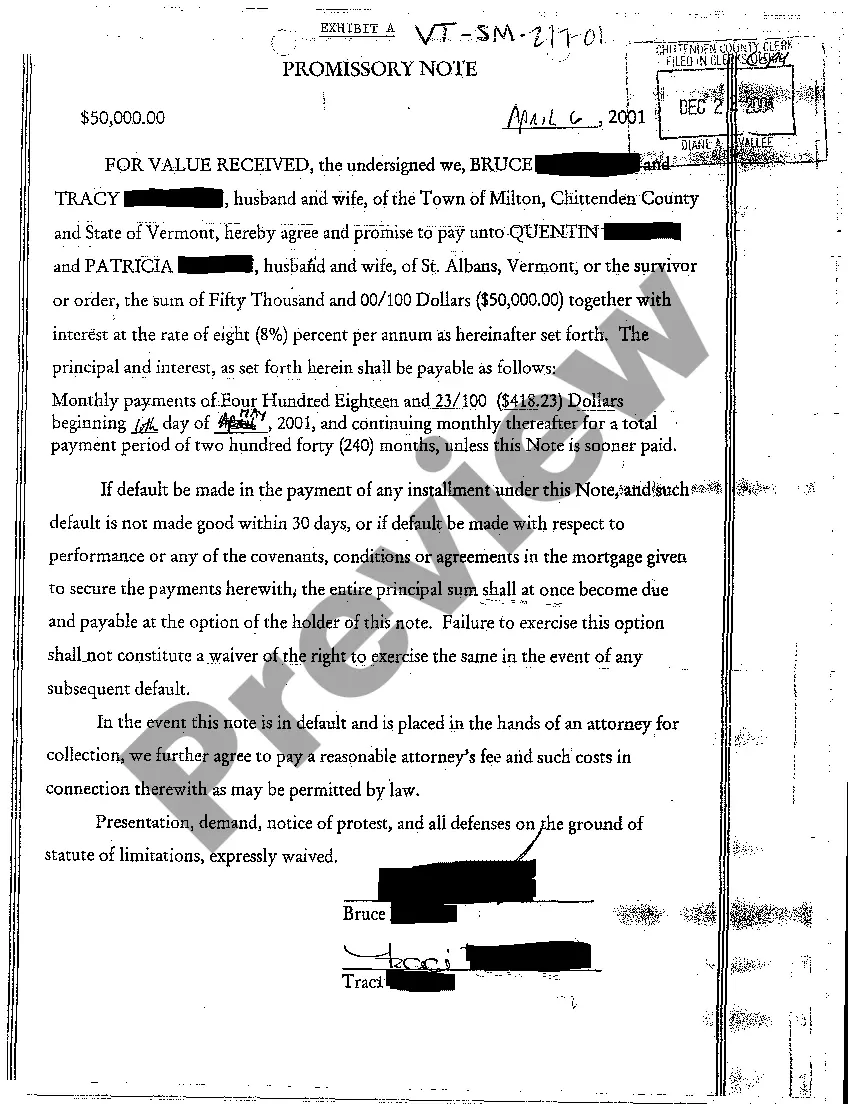

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Iowa Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Installments Fixed Rate Promissory Note Secured By Personal Property?

Access one of the most comprehensive collections of authorized forms.

US Legal Forms is a platform where you can locate any state-specific document in just a few clicks, such as samples for Iowa Installments Fixed Rate Promissory Note Secured by Personal Property.

No need to waste your time searching for a court-acceptable template.

After selecting a pricing plan, create your account. Pay using a card or PayPal. Download the template to your device by clicking on the Download button. That's it! You should complete the Iowa Installments Fixed Rate Promissory Note Secured by Personal Property template and review it. To ensure accuracy, consult your local legal counsel for assistance. Sign up and easily browse through over 85,000 helpful templates.

- To take advantage of the document library, select a subscription and create your account.

- If you have done this, simply Log In and then click Download.

- The Iowa Installments Fixed Rate Promissory Note Secured by Personal Property template will automatically be saved in the My documents tab (a section for all forms you download from US Legal Forms).

- To establish a new profile, follow the straightforward instructions outlined below.

- If you intend to use a state-specific template, ensure you specify the correct state.

- If possible, review the description to understand all aspects of the form.

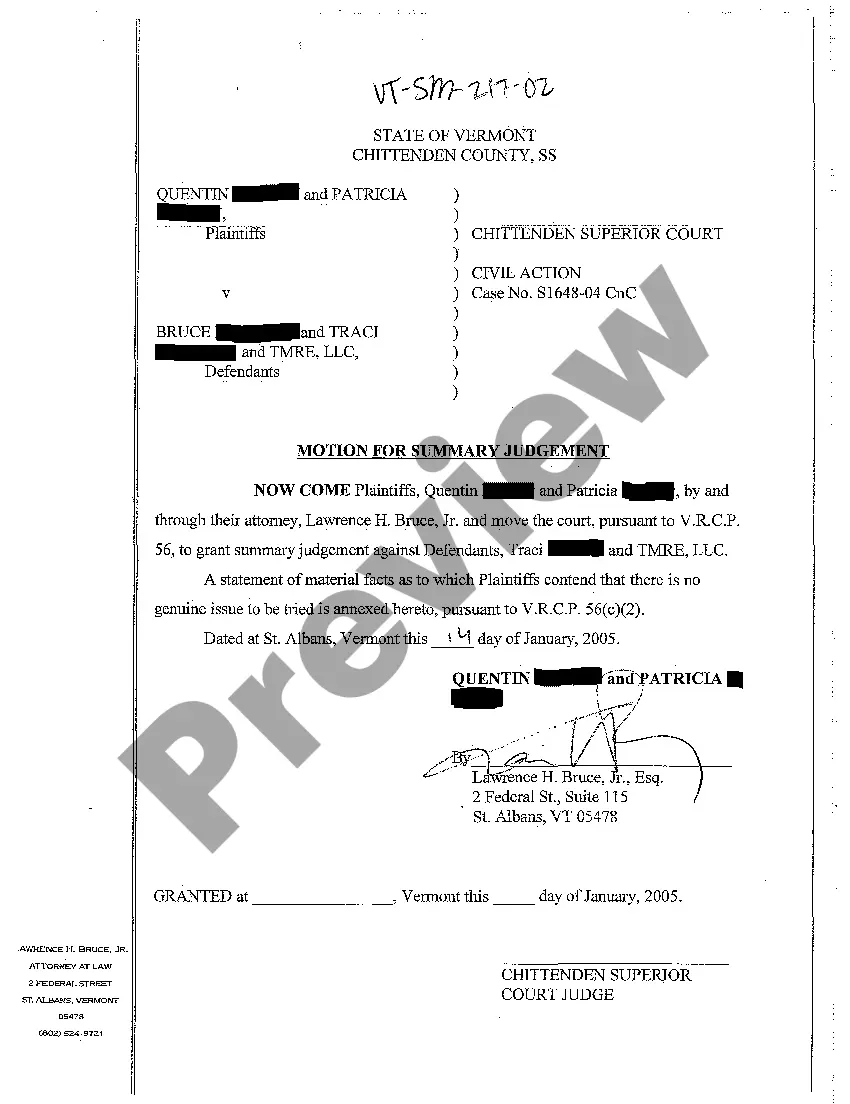

- Utilize the Preview option if it is available to verify the document's details.

- If everything looks correct, click Buy Now.

Form popularity

FAQ

The document that secures the promissory note to the real property is known as a security agreement. This agreement outlines the terms and conditions regarding the collateral used to back the Iowa Installments Fixed Rate Promissory Note Secured by Personal Property. It provides legal assurance that the lender has claim over the specified collateral in case of default. Therefore, understanding the security agreement is essential for both lenders and borrowers.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.Final Amount After Addition of Interest - In case interest is being charged, the note must clearly mention the final amount which is to be repaid after the interest is applied.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

A simple promissory note is a legal document that evidences a loan. The individual or entity executing the note is promising to repay the debt to the lender. The terms of the promissory note include: Parties to the contract.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

If you are owed money under a promissory note that has not been repaid in full, it may be necessary to file a breach of contract lawsuit.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The lender can then take the promissory note to a financial institution (usually a bank, albeit this could also be a private person, or another company), that will exchange the promissory note for cash; usually, the promissory note is cashed in for the amount established in the promissory note, less a small discount.