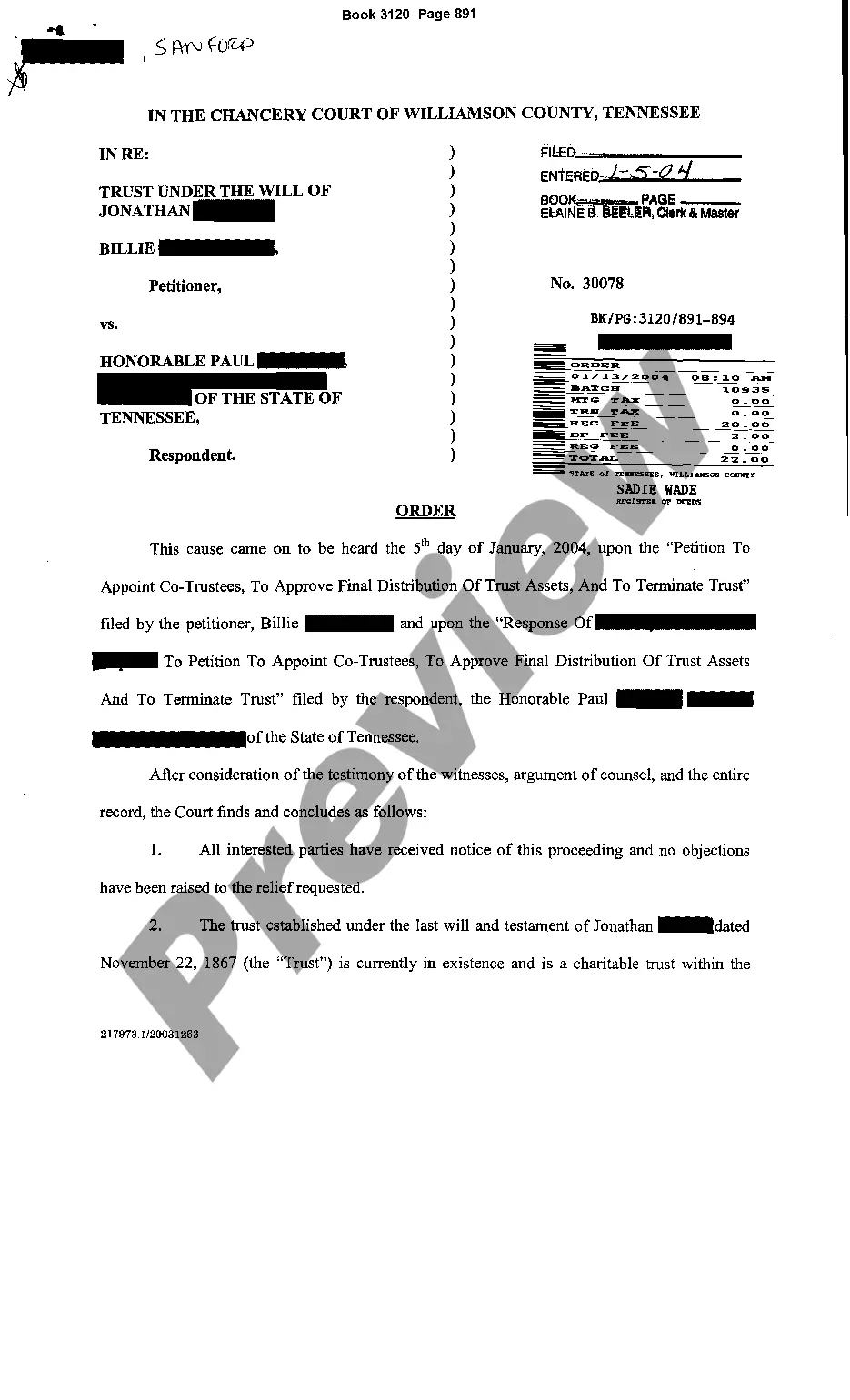

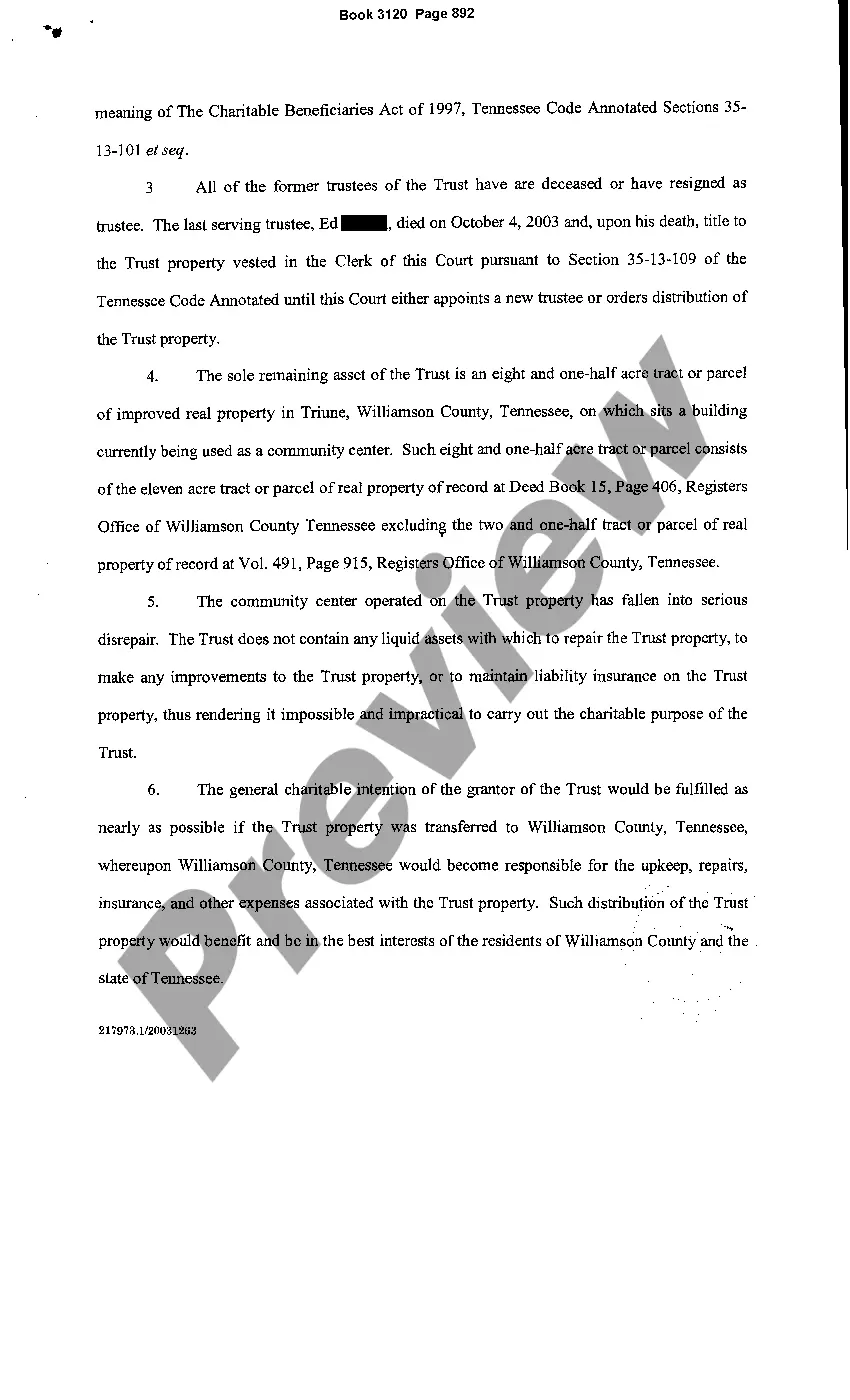

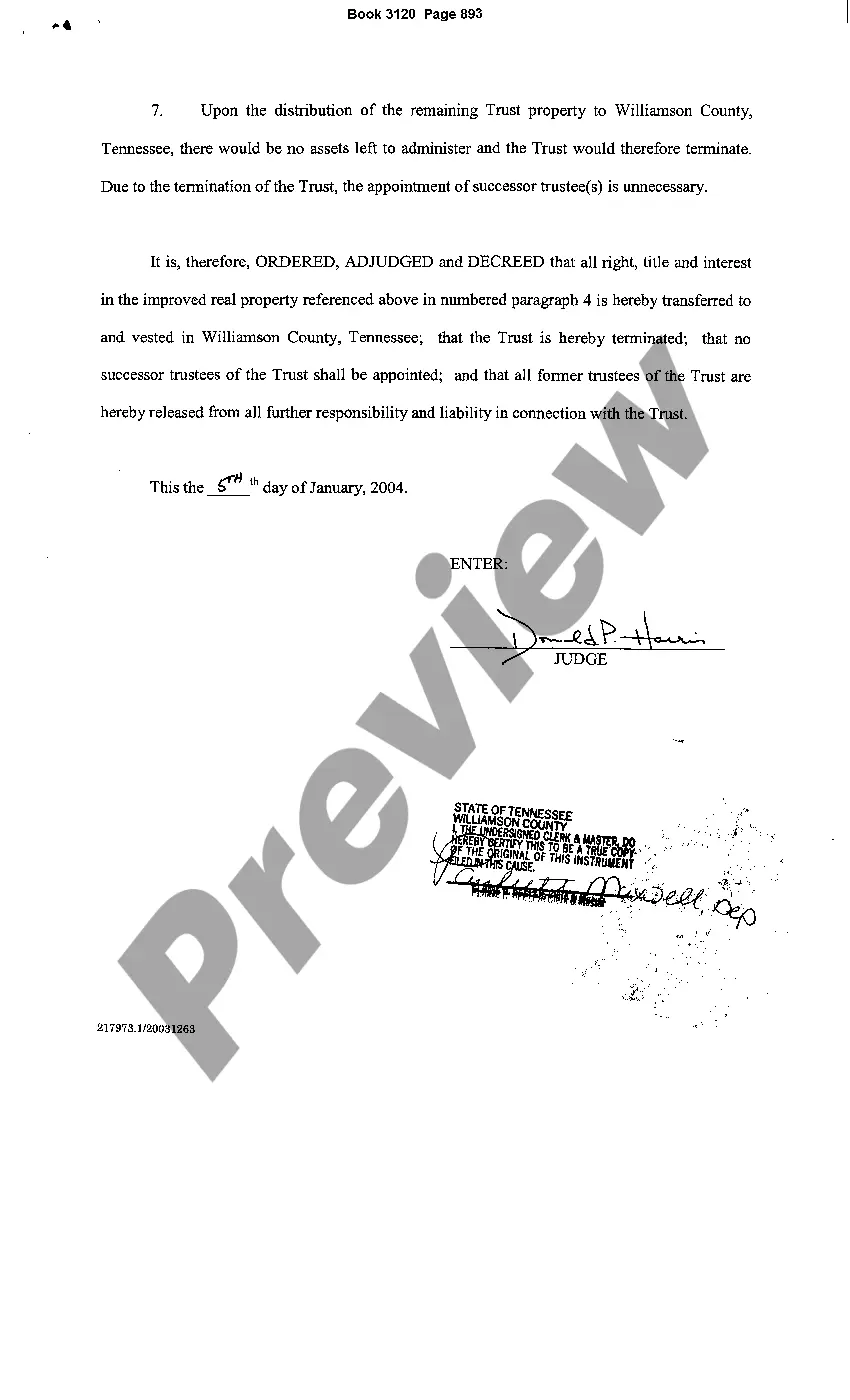

Tennessee Order to Terminate Charitable Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Order To Terminate Charitable Trust?

Get access to top quality Tennessee Order to Terminate Charitable Trust samples online with US Legal Forms. Steer clear of days of misused time seeking the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find over 85,000 state-specific legal and tax samples that you can save and complete in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The document will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Check if the Tennessee Order to Terminate Charitable Trust you’re looking at is suitable for your state.

- Look at the sample utilizing the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by credit card or PayPal to finish creating an account.

- Pick a favored file format to download the document (.pdf or .docx).

Now you can open up the Tennessee Order to Terminate Charitable Trust example and fill it out online or print it out and do it yourself. Take into account giving the file to your legal counsel to make certain all things are filled out appropriately. If you make a error, print and fill application again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and access more samples.

Form popularity

FAQ

A corporate trustee such as a bank trust department, a lawyer, or a financial adviser will typically know more about trust management, investments, and taxes than a family member, so a pro can be a good choice if you have a large trust or complex assets in it.

At the most basic level, a charitable trust is very similar to other types of trust. As such, they are established by a 'settlor', who agrees to transfer assets into the ownership of the trust. The management of these assets is then carried out by trustees, who may or may not include the settlor.

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

In most situations, beneficiaries can remove a trustee who is not doing his or her job. However, you will need to show that certain conditions have been met to warrant removal.

A trust is an arrangement in which one person, called the trustee, controls property for the benefit of another person, called the beneficiary. The person who creates the trust is called the settlor, grantor, or trustor.

An irrevocable trust is a trust with terms and provisions that cannot be changed. However, under certain circumstances, changes to an irrevocable trust can be made and a trust can even be terminated. A material purpose of the trust no longer exists.

Indefinite Beneficiaries The beneficiary of a charitable trust, however, is not any one individual or group, but the public at large. Therefore, an individual beneficiary of a charitable trust has no legal standing to enforce the terms of the trust.

If the settlor and all of the beneficiaries consent, an irrevocable inter vivos trust may be modified or terminated. A testamentary trust can be terminated by consent of all of the beneficiaries as long as a material purpose of the trust does not exist.

Either the trustee or one of the beneficiaries can enforce a trust by filing a petition in state court. The state court judge will review the terms of the trust and will order compliance with those terms.