Pennsylvania Acknowledgment for Plaintiff (for Marital Property Settlement Agreement)

Description

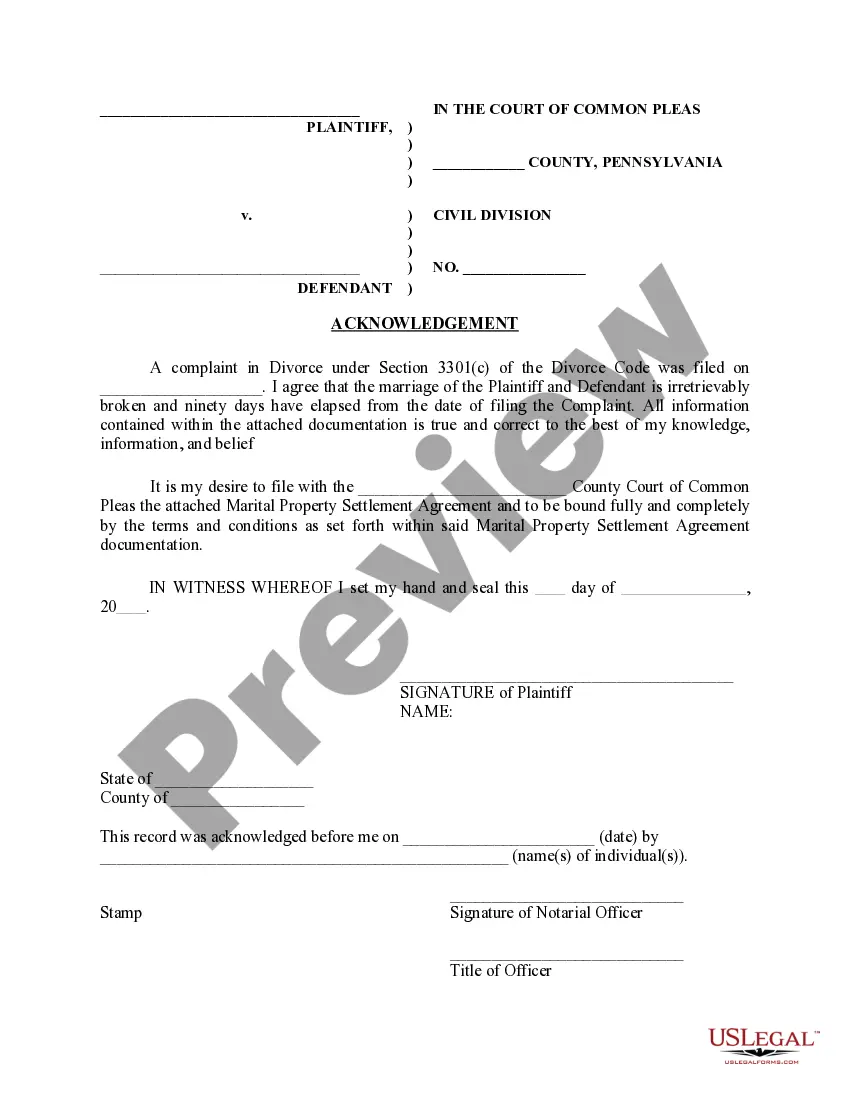

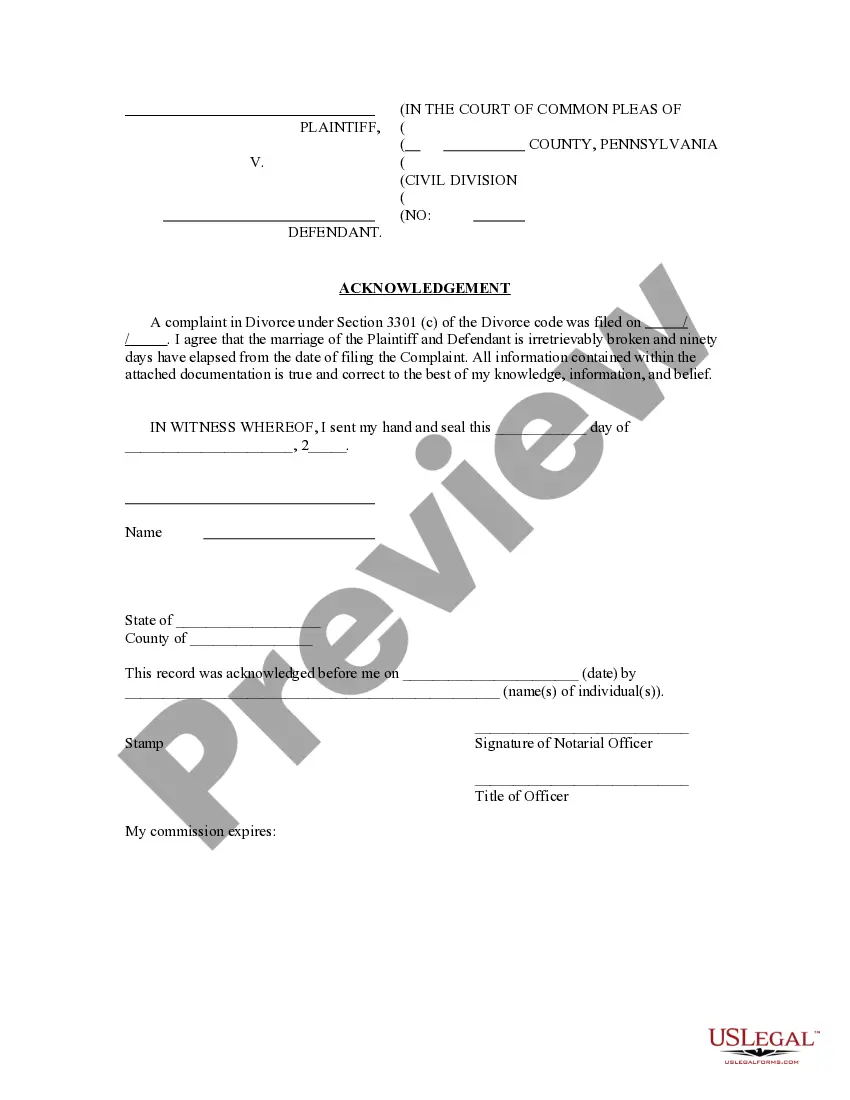

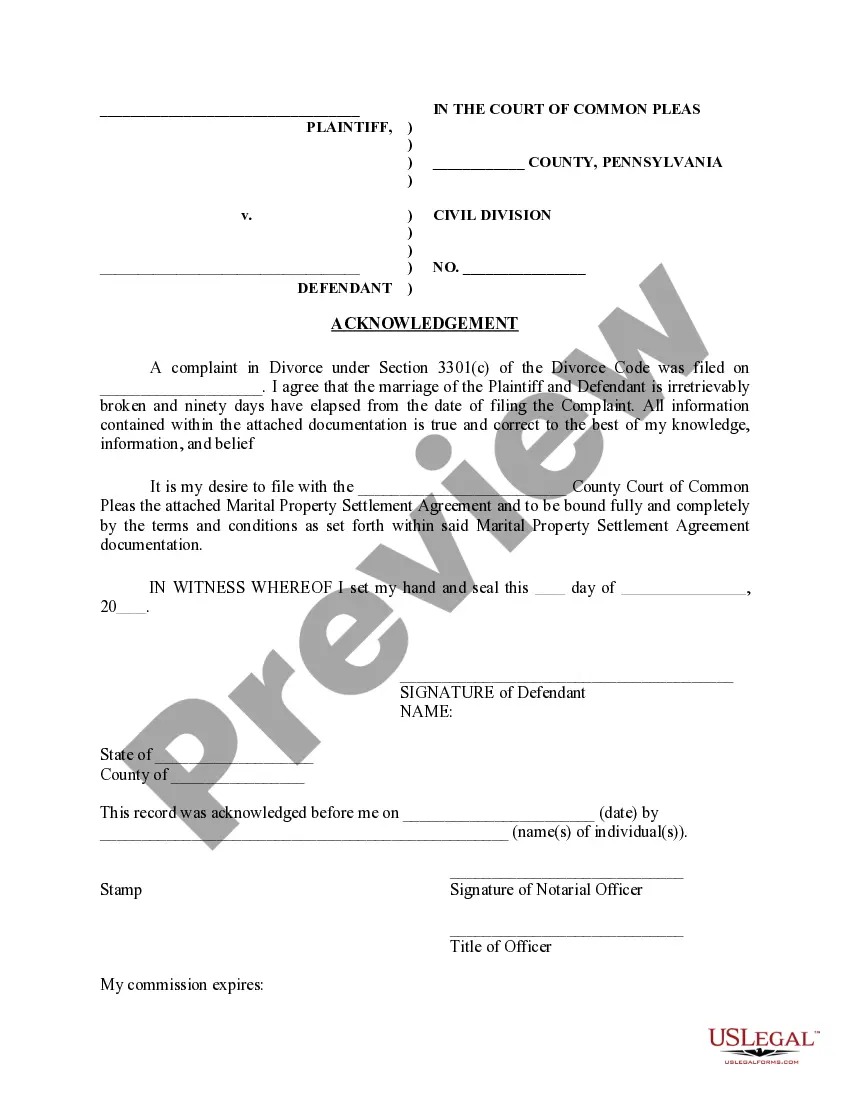

How to fill out Pennsylvania Acknowledgment For Plaintiff (for Marital Property Settlement Agreement)?

The work with documents isn't the most simple job, especially for those who almost never work with legal papers. That's why we advise using accurate Pennsylvania Acknowledgment for Plaintiff (for Marital Property Settlement Agreement) samples made by skilled lawyers. It allows you to eliminate difficulties when in court or dealing with official organizations. Find the templates you need on our site for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the file page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Customers with no an activated subscription can easily create an account. Utilize this brief step-by-step help guide to get the Pennsylvania Acknowledgment for Plaintiff (for Marital Property Settlement Agreement):

- Make sure that the document you found is eligible for use in the state it is needed in.

- Verify the file. Use the Preview option or read its description (if available).

- Click Buy Now if this form is the thing you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After completing these easy steps, you are able to complete the form in an appropriate editor. Double-check filled in data and consider asking a lawyer to review your Pennsylvania Acknowledgment for Plaintiff (for Marital Property Settlement Agreement) for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

Pennsylvania is an equitable distribution state. It divides property in a divorce based on a judge's determination of what's fair under the circumstances of each case.Community property states, on the other hand, attempt an equal 50-50 distribution between the spouses.

Is Pennsylvania a Community Property State? No. Pennsylvania divides marital property under the theory of equitable distribution.

Any assets acquired before the marriage are considered separate property, and are owned only by that original owner.Spouses can also comingle their separate property with community property, for example, by adding funds from before the marriage to the community property funds.

California's separate property laws apply to a house owned before marriage.(b) A married person may, without the consent of the person's spouse, convey the person's separate property." Therefore, you should have a separate property interest during the divorce in that premarital asset which is your house.

Pennsylvania divides marital property under the theory of equitable distribution.Community property states attempt a 50-50 distribution, as best as possible. Equitable distribution states divide property based on a determination of what's fair under the circumstances of each case.

Marital property includes all property that was acquired during the marriage, regardless of how it is titled (in whose name it is). Gifts from one spouse to another are marital property if they were purchased with marital funds.

Marital property includes real estate and other property a couple buys together during their marriage, such as a home or investment property, cars, boats, furniture, or artwork, when not acquired by either as separate property.

Pennsylvania is an equitable distribution state. It divides property in a divorce based on a judge's determination of what's fair under the circumstances of each case.Community property states, on the other hand, attempt an equal 50-50 distribution between the spouses.