Idaho Affidavit in Lieu of Administration

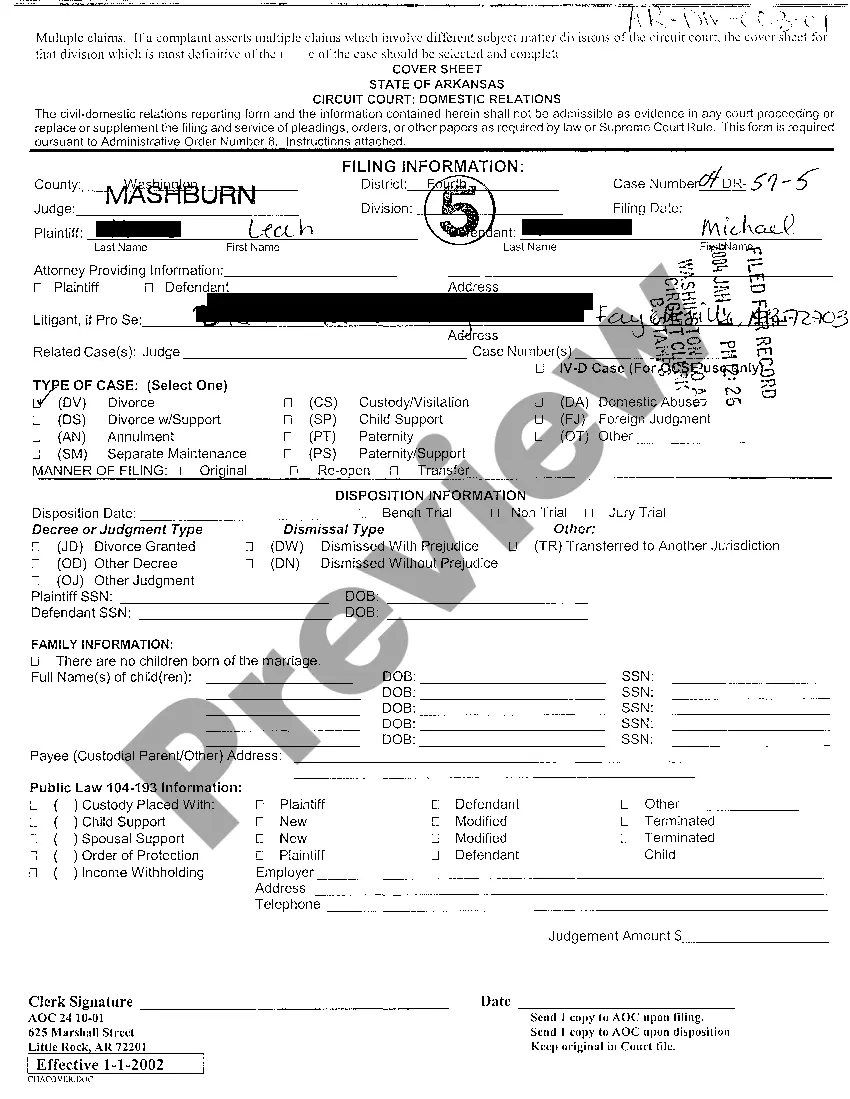

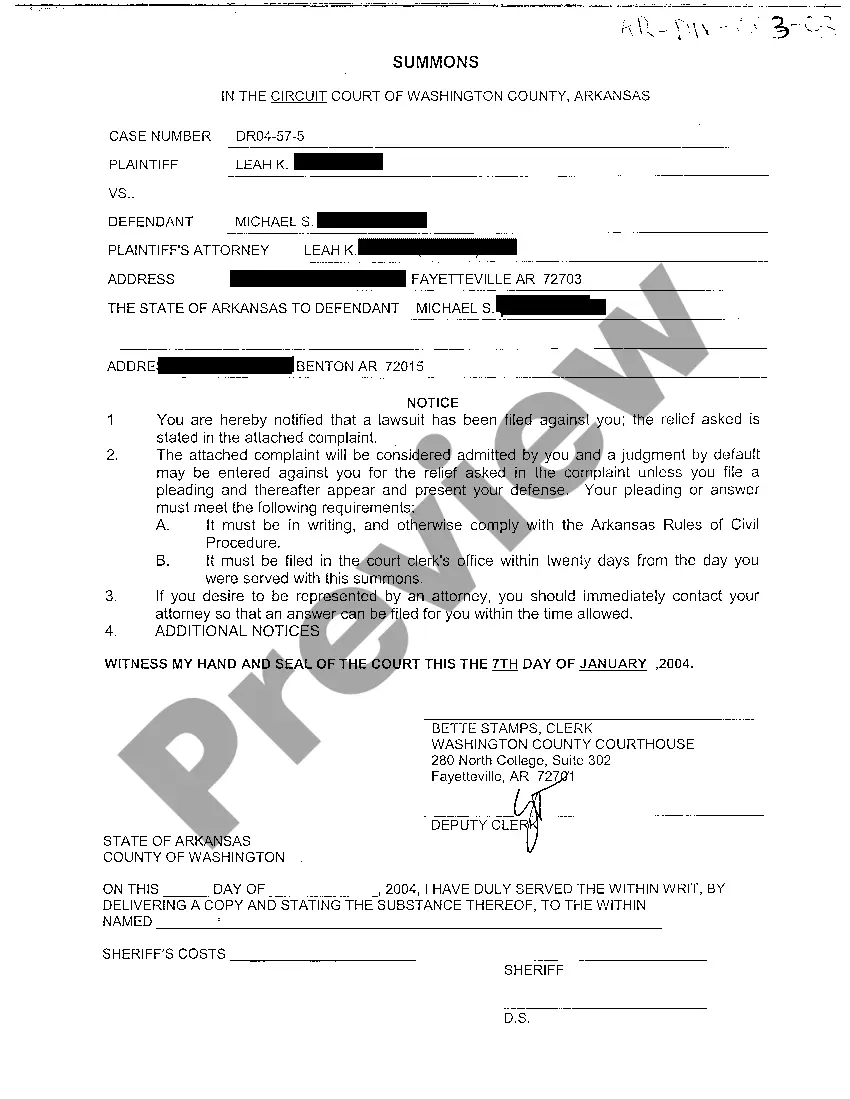

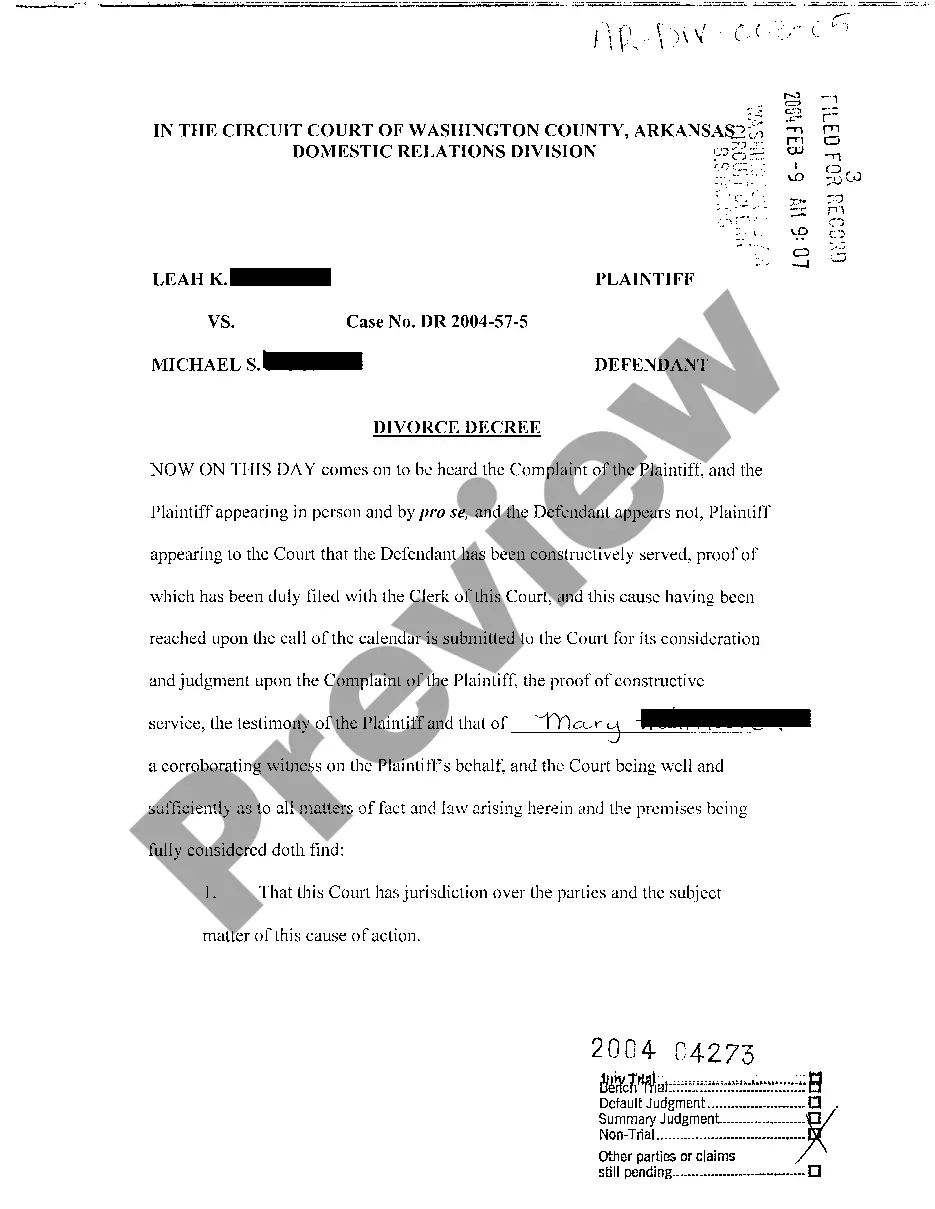

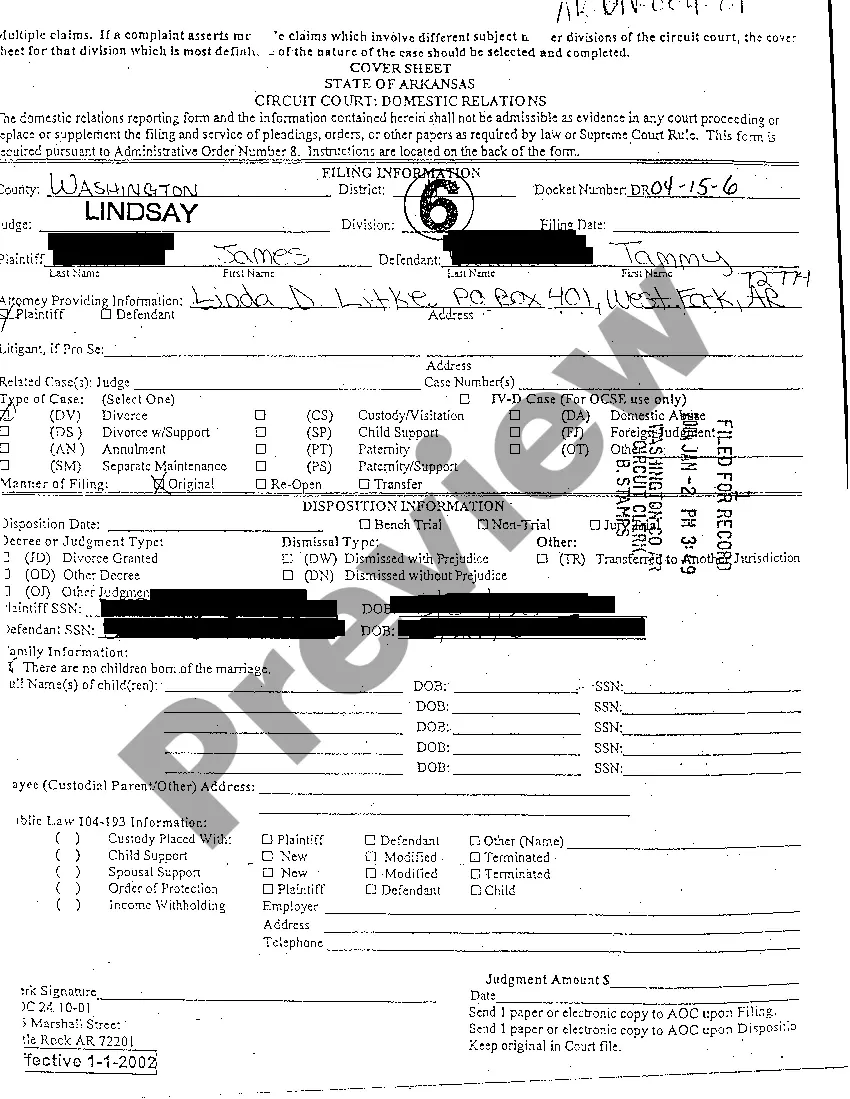

Description

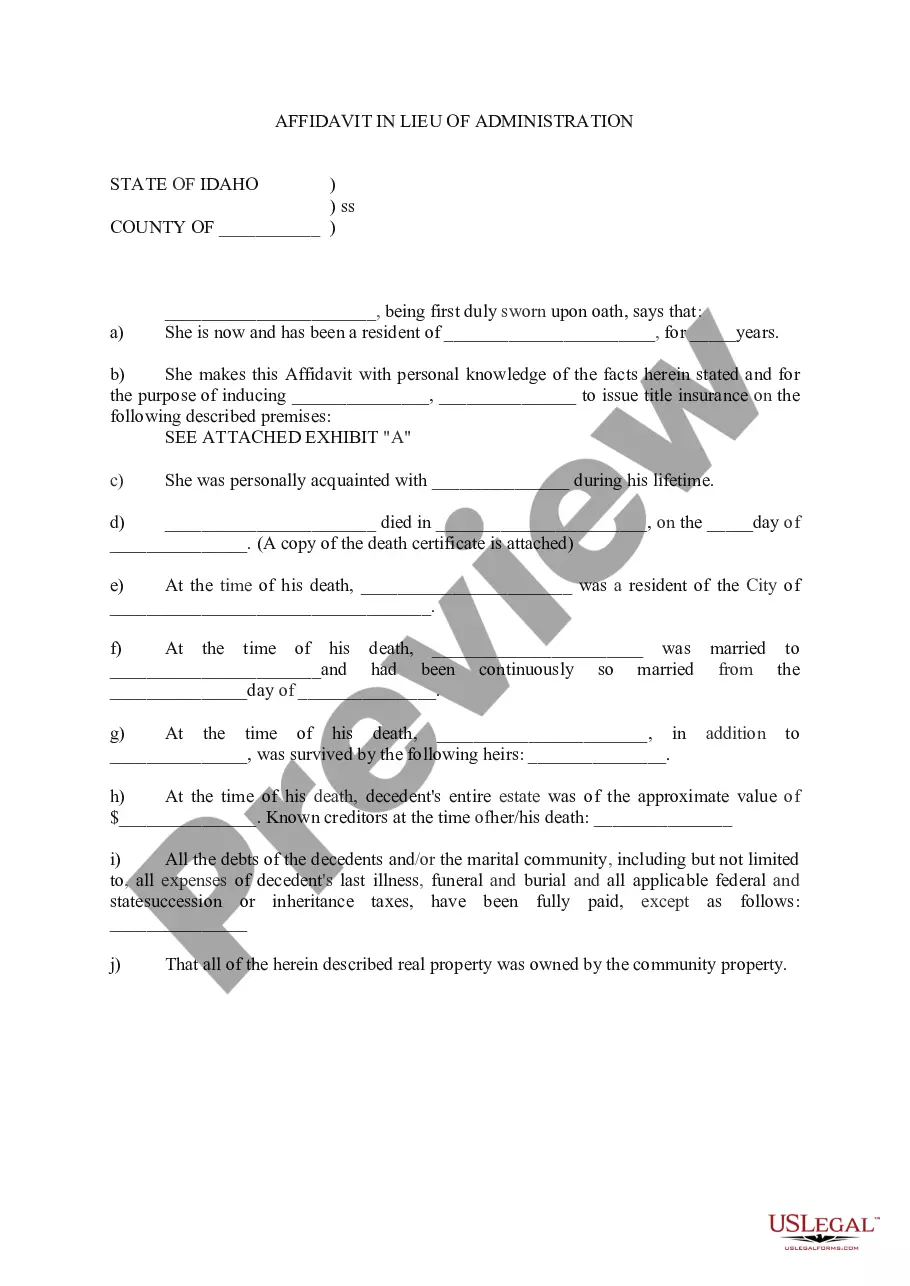

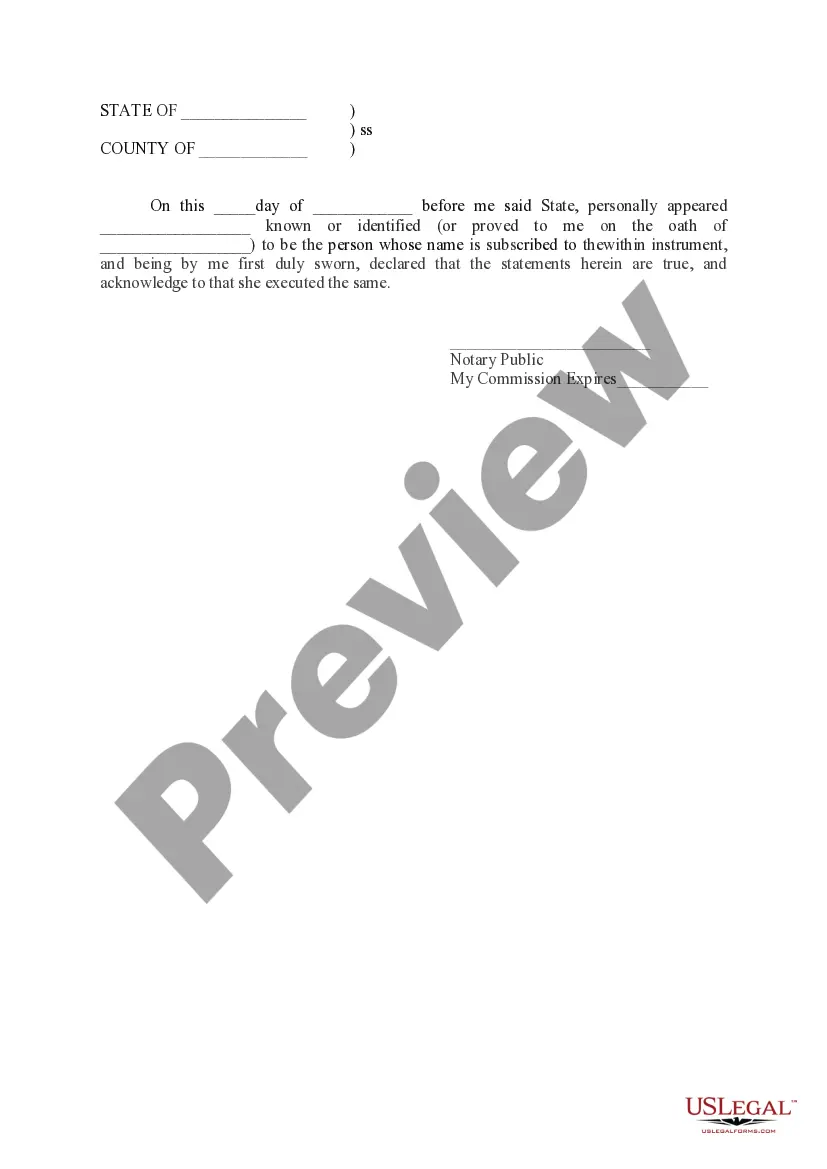

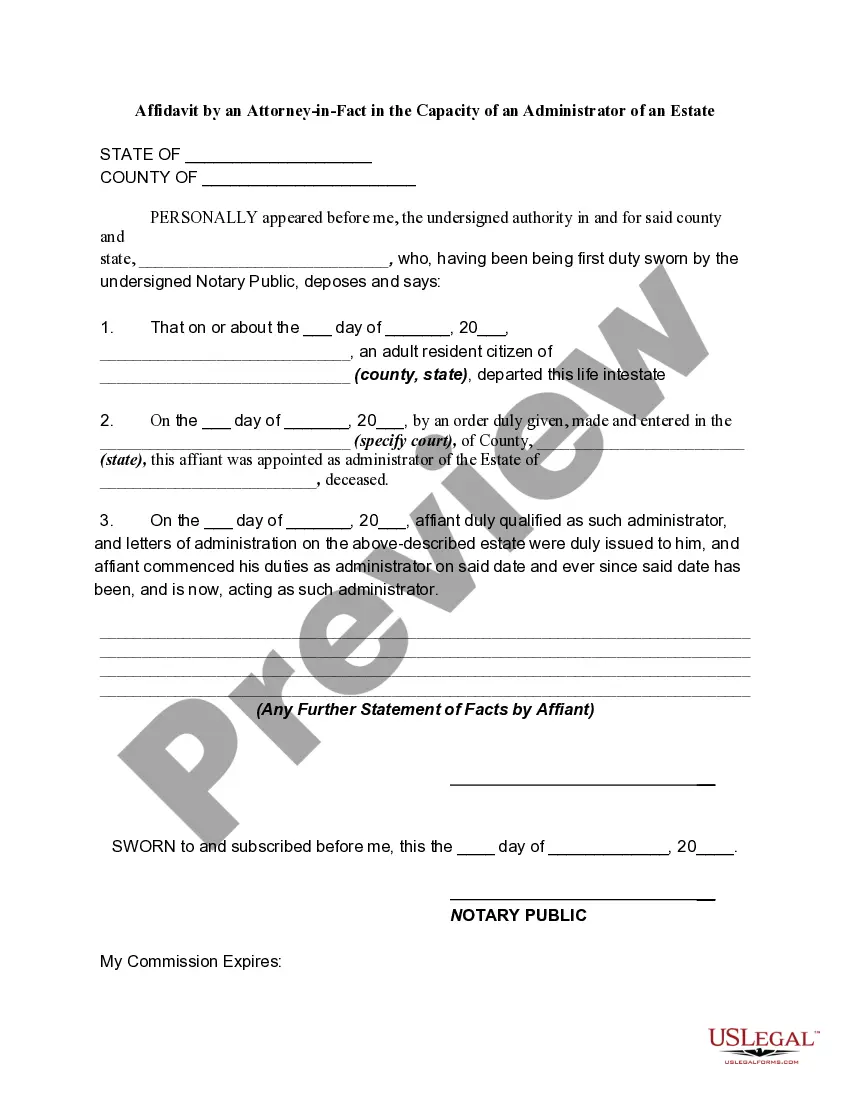

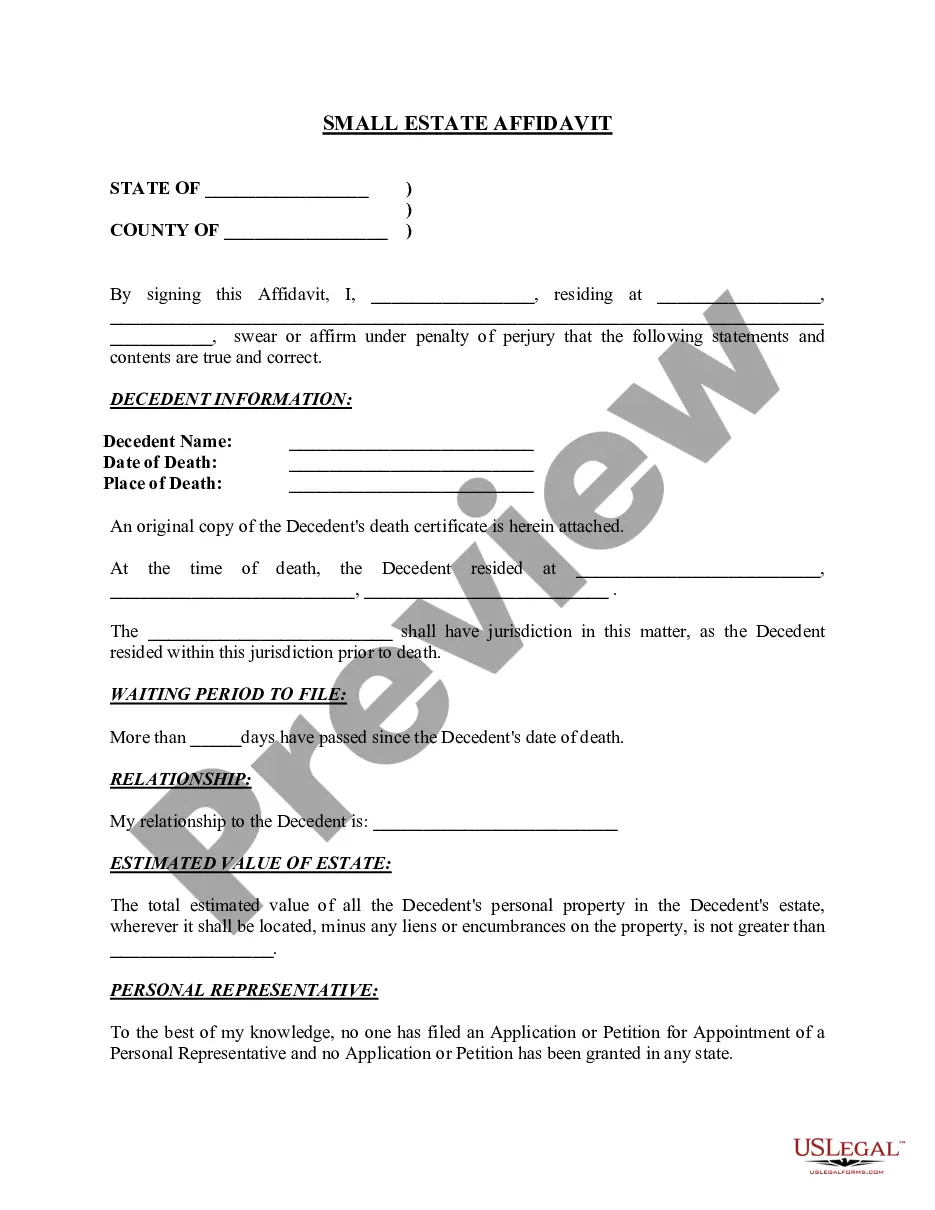

How to fill out Idaho Affidavit In Lieu Of Administration?

Utilize US Legal Forms to obtain a printable Idaho Affidavit in Lieu of Administration.

Our court-acceptable forms are created and routinely revised by experienced lawyers.

Ours is the most comprehensive Forms database on the internet, offering affordable and precise samples for individuals, attorneys, and small to medium-sized businesses (SMBs).

Select Buy Now if it’s the template you desire. Create your account and complete the payment through PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search bar if you need to locate another document template. US Legal Forms provides thousands of legal and tax samples and packages for both business and personal requirements, including the Idaho Affidavit in Lieu of Administration. More than three million users have successfully utilized our service. Choose your subscription plan and acquire high-quality documents with just a few clicks.

- Documents are organized into state-specific categories with many available for preview before downloading.

- To access templates, users need to have a subscription and must Log In to their account.

- Click Download next to the desired template and find it in My documents.

- For those without a subscription, refer to the following guidelines to easily locate and download the Idaho Affidavit in Lieu of Administration.

- 1. Verify that you have the correct template for the required state.

- 2. Evaluate the form by reviewing the description and utilizing the Preview feature.

Form popularity

FAQ

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

In Idaho, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

First, a probate is required in Idaho anytime an estate has a value of $100,000 or more regardless of the property that is contained in the estate.Second, a probate is required in Idaho anytime an estate holds any real property, regardless of the value of the real property. (Idaho Code § 15-3-711.)

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

With Informal probate, an Application (along with the decedent's original will) and Acceptance are typically filed with the court by the person nominated as Personal Representative, and then the court signs and issues (without a formal hearing) a Statement and Letters Testamentary (if the decedent had a will) or

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

Children (or grandchildren if children have died) Parents. Siblings (or nieces and nephews over 18 if siblings have died) Half-siblings (or nieces and nephews over 18 if half-siblings have died) Grandparents. Aunts or uncles.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

If you die without a will in Idaho, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Idaho must consider them your children, legally.