Arkansas Affidavit of Personal Property Division

Description

Key Concepts & Definitions

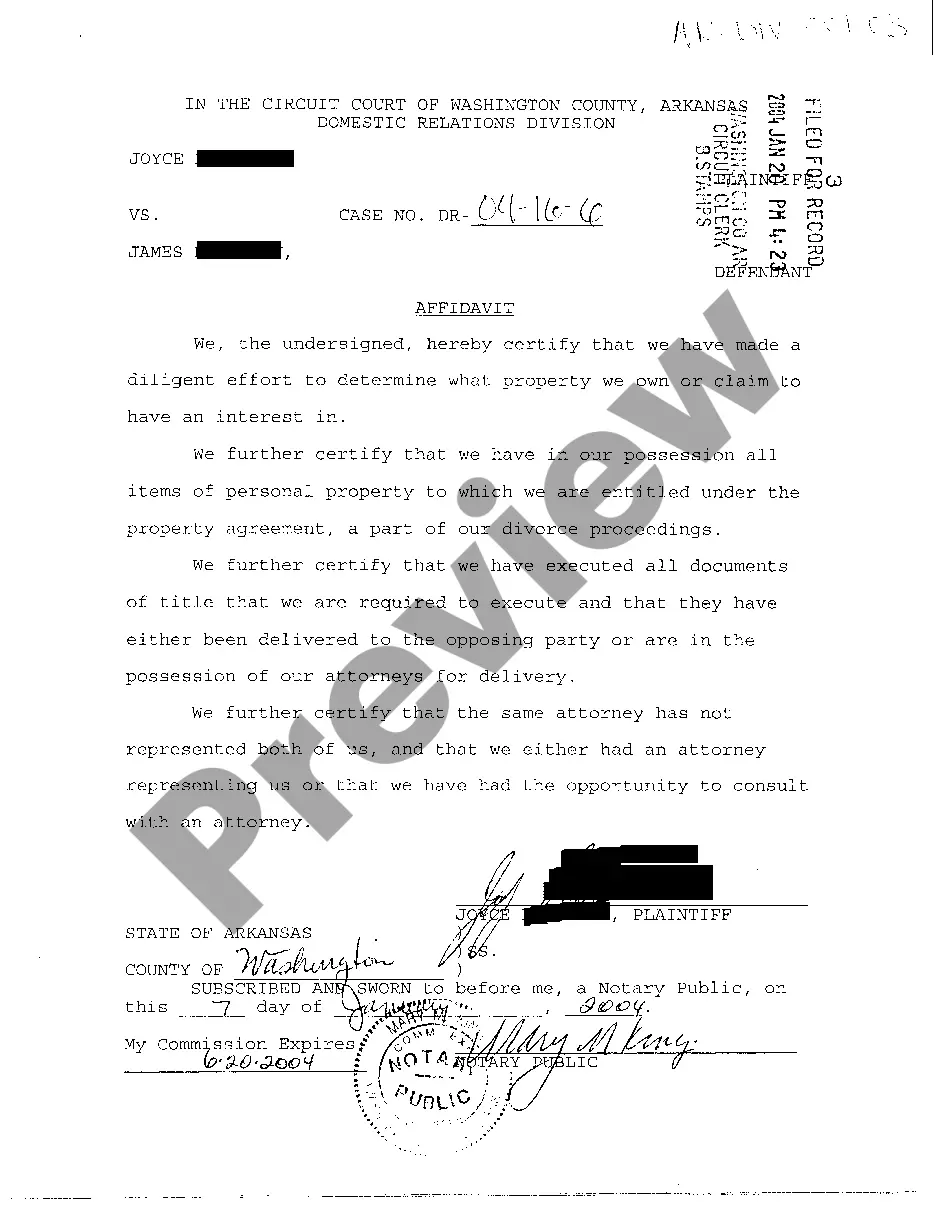

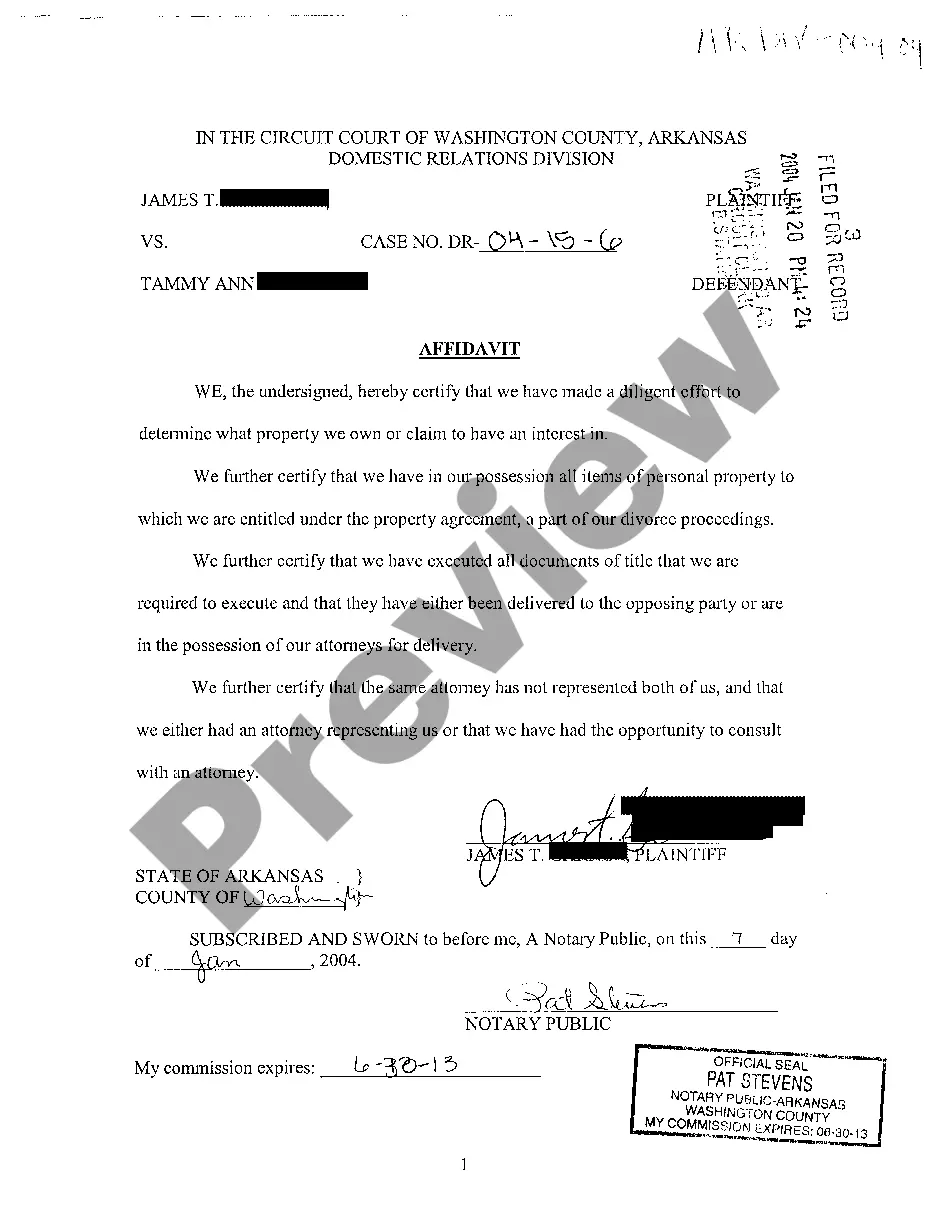

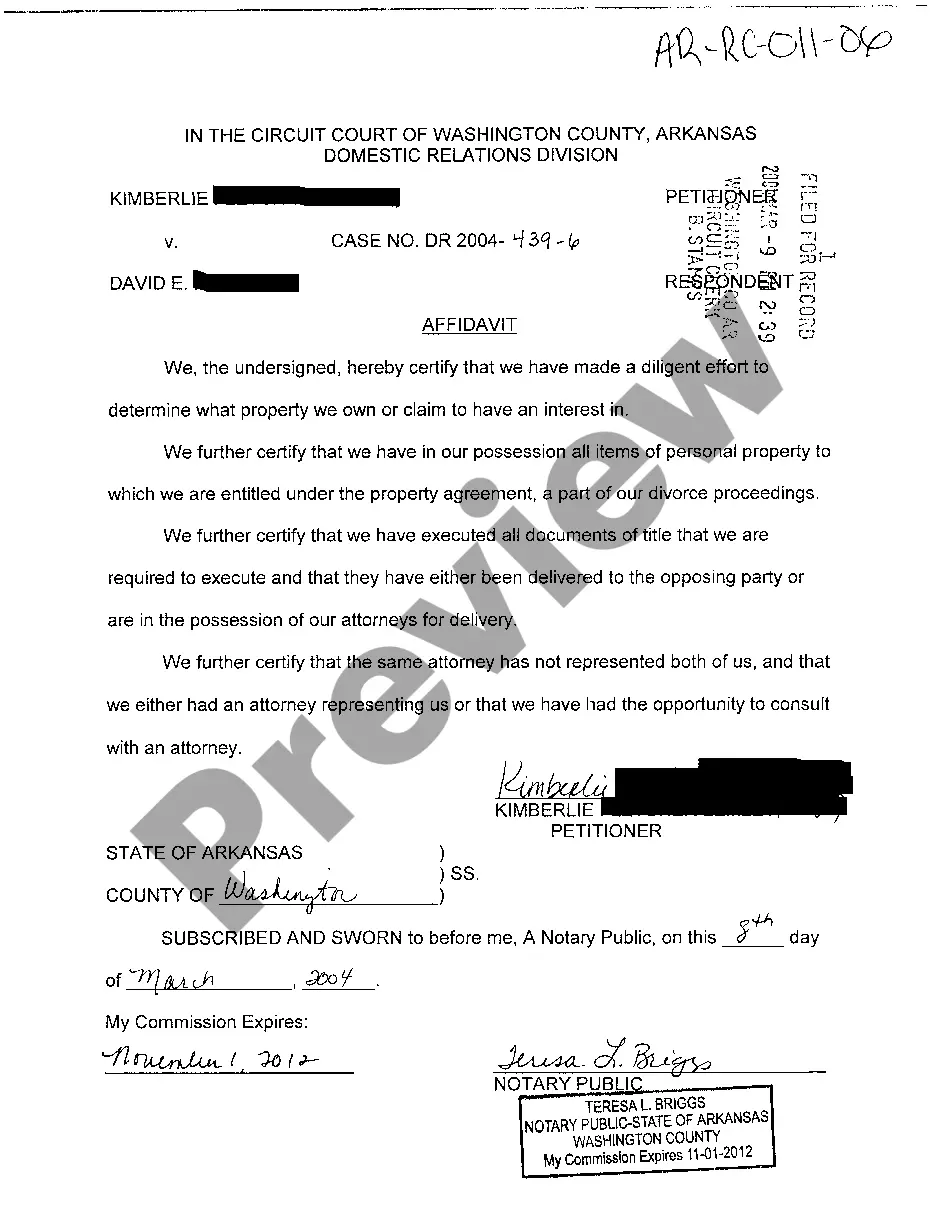

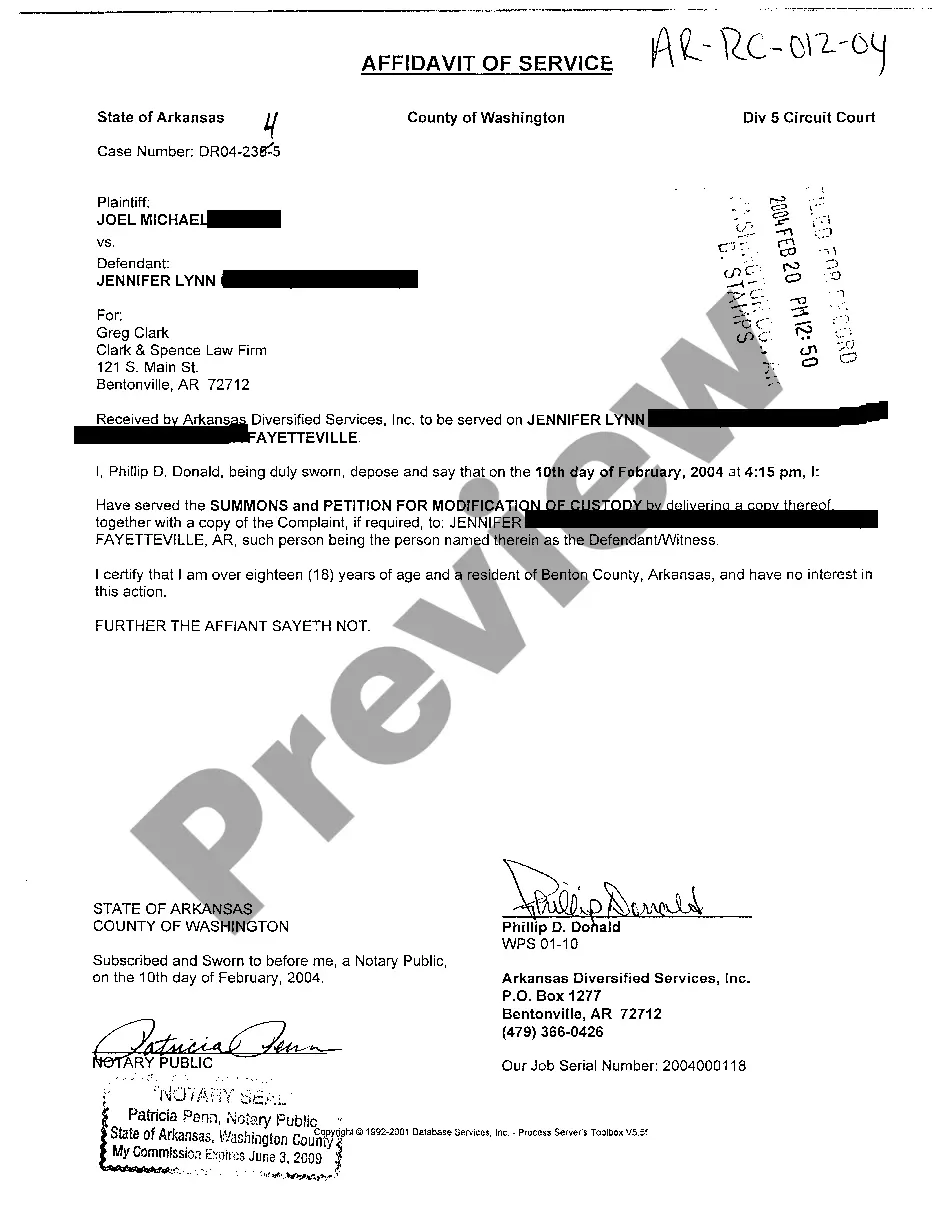

A03 Affidavit of Personal Property Division is a legal document primarily used in the United States during divorce proceedings. The affidavit lists personal properties owned by the parties and suggests a division of these assets. It must be submitted to and approved by the court handling the divorce case. The document addresses assets such as furniture, electronics, jewelry, and vehicles, detailing who should retain ownership post-divorce.

Step-by-Step Guide

- Inventory All Personal Property: List all items of value owned individually or jointly. Include descriptions and approximate values.

- Determine Ownership: Mark items clearly if owned individually (pre-marriage or inherited).

- Propose Division: Suggest who retains each item, considering both party's needs and legal entitlements.

- Complete the A03 Form: Fill out the form meticulously, recording all details as required.

- Sign and Notarize: Both parties must sign the affidavit in front of a notary public.

- Submit to Court: File the affidavit with the court handling your divorce case.

- Legal Review: Await court review and approval of your proposed asset division.

Risk Analysis

- Inaccurate Reporting: Failing to report all assets or their true value can lead to legal repercussions or future disputes.

- Non-compliance: Incorrect filing of the form or non-compliance with state laws could invalidate the document.

- Dispute from Opposing Party: If one party views the division as unfair, it may lead to extended legal battles which can prolong the divorce process.

Key Takeaways

Understanding and properly executing an A03 Affidavit of Personal Property Division is crucial in ensuring a fair and legally compliant division of assets during a divorce. This document not only aids in the organization and clarity of property division but also provides a legal record that can prevent future disputes.

Best Practices

- Be Meticulous: Ensure every detail is accurately captured on the affidavit.

- Seek Legal Advice: Consult a lawyer to understand better state laws and ensure compliance.

- Maintain Integrity: Honesty in reporting will help prevent future legal complications.

Common Mistakes & How to Avoid Them

- Omitting Assets: Double-check your list to ensure no assets are overlooked or purposely omitted. A complete audit can help avoid this issue.

- Underestimating Asset Value: Consider professional appraisals for high-value items to provide accurate figures.

- Ignoring State Laws: Each state may have specific requirements about divorce and property division. Review your state's laws or consult a lawyer.

FAQ

- What qualifies as personal property in an A03 Affidavit? Any tangible items acquired before or during the marriage that can be moved and are owned by either spouse.

- How detailed should the A03 Affidavit be? It should include comprehensive lists, descriptions, and proposed divisions of all significant personal properties.

- What happens if the spouses cannot agree on the division? If both parties cannot resolve disagreements independently, the court may step in to dictate the property division.

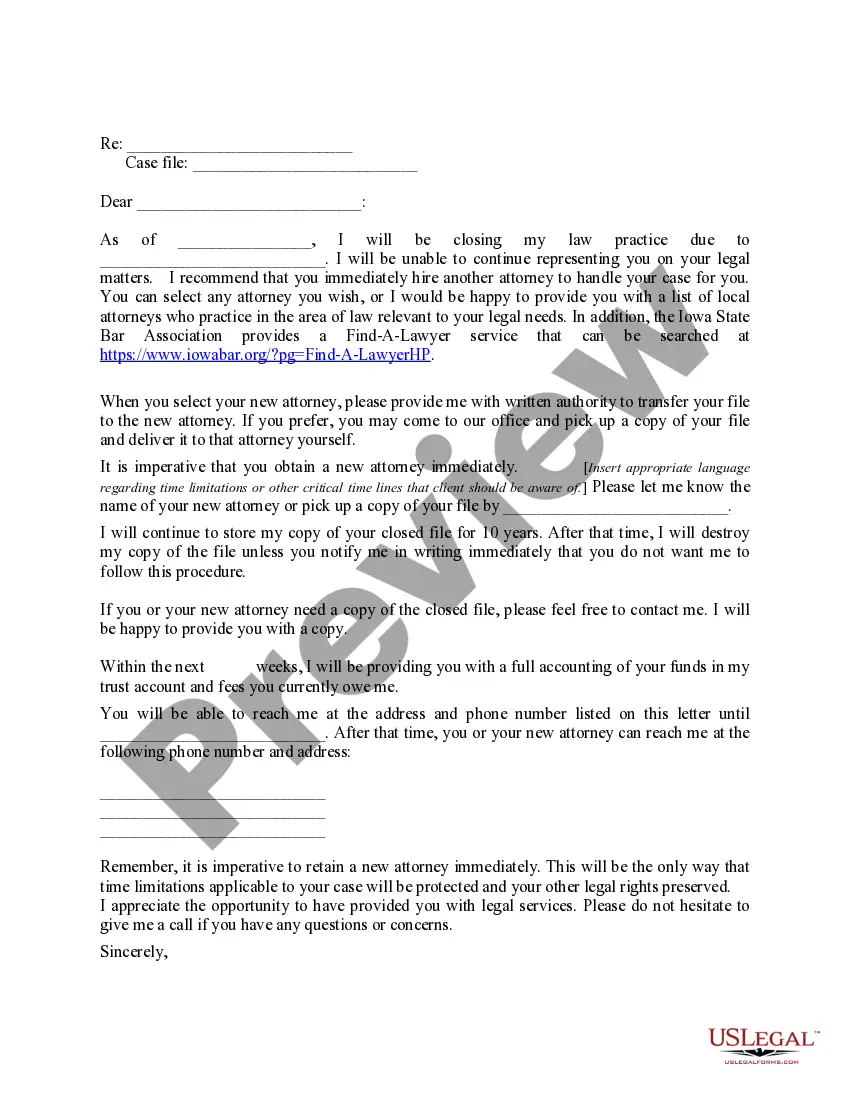

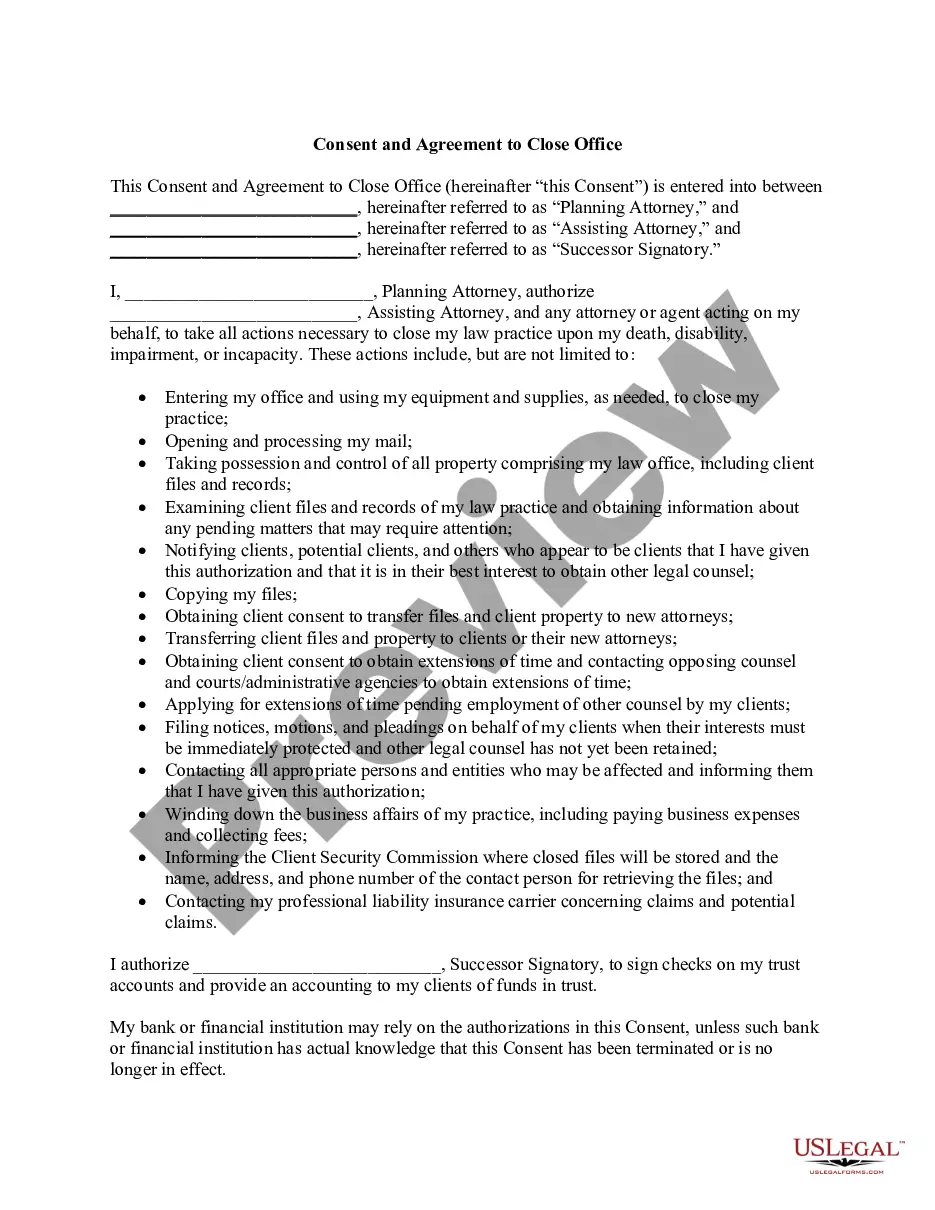

How to fill out Arkansas Affidavit Of Personal Property Division?

Among countless complimentary and paid examples that you can discover online, you cannot be assured of their precision and dependability.

For instance, who created them or if they possess the necessary expertise to handle what you require them for.

Always remain composed and utilize US Legal Forms!

Click Buy Now to commence the purchasing process or search for an alternate example using the Search bar located in the header.

- Uncover Arkansas Affidavit of Personal Property Division templates crafted by proficient legal professionals and steer clear of the expensive and laborious task of searching for a lawyer and subsequently compensating them to draft a document for you that you can conveniently find yourself.

- If you possess a membership, Log In to your profile and locate the Download button adjacent to the form you are looking for.

- You will also be able to access all your previously downloaded files in the My documents section.

- If you are utilizing our service for the first time, adhere to the following guidelines to acquire your Arkansas Affidavit of Personal Property Division promptly.

- Ensure that the document you locate is applicable in the state where you reside.

- Review the file by perusing the information utilizing the Preview feature.

Form popularity

FAQ

Not every will has to go through probate in Arkansas, but most do if the estate value warrants it. If the estate is small or specific conditions apply, alternatives such as an Arkansas Affidavit of Personal Property Division may be feasible. This solution can help streamline the process and respect the intentions laid out in the will without unnecessary delays. Understanding your options can ease estate management.

In Arkansas, there isn't a specific minimum estate value for probate; rather, the process is often required if the estate value is significant. Estates exceeding $100,000 usually necessitate formal probate proceedings. For estates below this amount, using an Arkansas Affidavit of Personal Property Division allows for efficient asset distribution without the complexities of probate. It's wise to assess your estate's value during planning.

The threshold for probate in Arkansas is primarily determined by the value of the estate. If the total value of the estate exceeds $100,000, it generally requires the probate process. However, utilizing an Arkansas Affidavit of Personal Property Division can help those with smaller estates manage the transfer of assets effectively without probate. Knowing this threshold can guide your estate planning decisions.

In Arkansas, certain assets can bypass the probate process. Assets like life insurance policies, joint bank accounts, and property held with a right of survivorship are typically exempt. Additionally, small estates may benefit from an Arkansas Affidavit of Personal Property Division to simplify the transfer of assets without going through probate. Understanding what qualifies as exempt can save time and resources.

Filling out an affidavit for collection of a small estate involves gathering information about the deceased's assets and heirs. You must complete the Arkansas Affidavit of Personal Property Division form accurately, including details such as asset descriptions and heir statements. Be sure to have the form notarized before filing it with the court. This process simplifies the transfer of smaller estates considerably.

To file an affidavit of heirship in Arkansas, first complete the required form, which you can find through various online resources like US Legal Forms. Gather all necessary supporting documentation to substantiate your claims regarding the deceased's estate and heirs. Once your affidavit is ready, file it with the appropriate court or the Probate Clerk in your area. This step is crucial for ensuring a speedy estate resolution.

In Arkansas, the order of heirship generally follows a hierarchy: surviving spouse, children, parents, and then siblings. If a person passes without a will, this order helps determine how their property gets distributed. Understanding this hierarchy is vital for beneficiaries navigating the Arkansas Affidavit of Personal Property Division, ensuring a fair allocation of the estate.

Typically, a family member or heir files an affidavit of heirship in Arkansas. This individual must have knowledge of the deceased's relationships and the distribution of their assets. Filing this affidavit informs the court and facilitates the transfer process. The Arkansas Affidavit of Personal Property Division is essential for making this step smoother.

Not having an affidavit of heirship can complicate the transfer of property after someone's death. Without this document, heirs may face challenges proving their ownership and rights to the deceased's assets. This can lead to disputes among family members and delays in accessing property. Utilizing the Arkansas Affidavit of Personal Property Division can help clarify these issues.

To obtain a small estate affidavit in Arkansas, you must complete the Arkansas Affidavit of Personal Property Division form. You can find this form on local government websites or through legal document services like US Legal Forms. After completing the form, you should have it notarized and submit it to the appropriate court or Probate Clerk in your county. This process helps streamline the management of small estates effectively.