Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock

About this form

This Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock is a critical tool designed to help businesses gather necessary documents and information during the due diligence process of acquiring assets or stocks. This checklist is distinct from similar forms as it provides a comprehensive overview of the specific items that should be reviewed, making it easier for stakeholders to navigate the complex acquisition process.

Main sections of this form

- Charter documents and regulatory status

- Audited financial statements and financial data

- Tangible assets, including real estate

- Intangible property, including intellectual property

- Labor and benefits matters

- Environmental matters and hazardous materials

- Federal, state, local, and foreign taxes

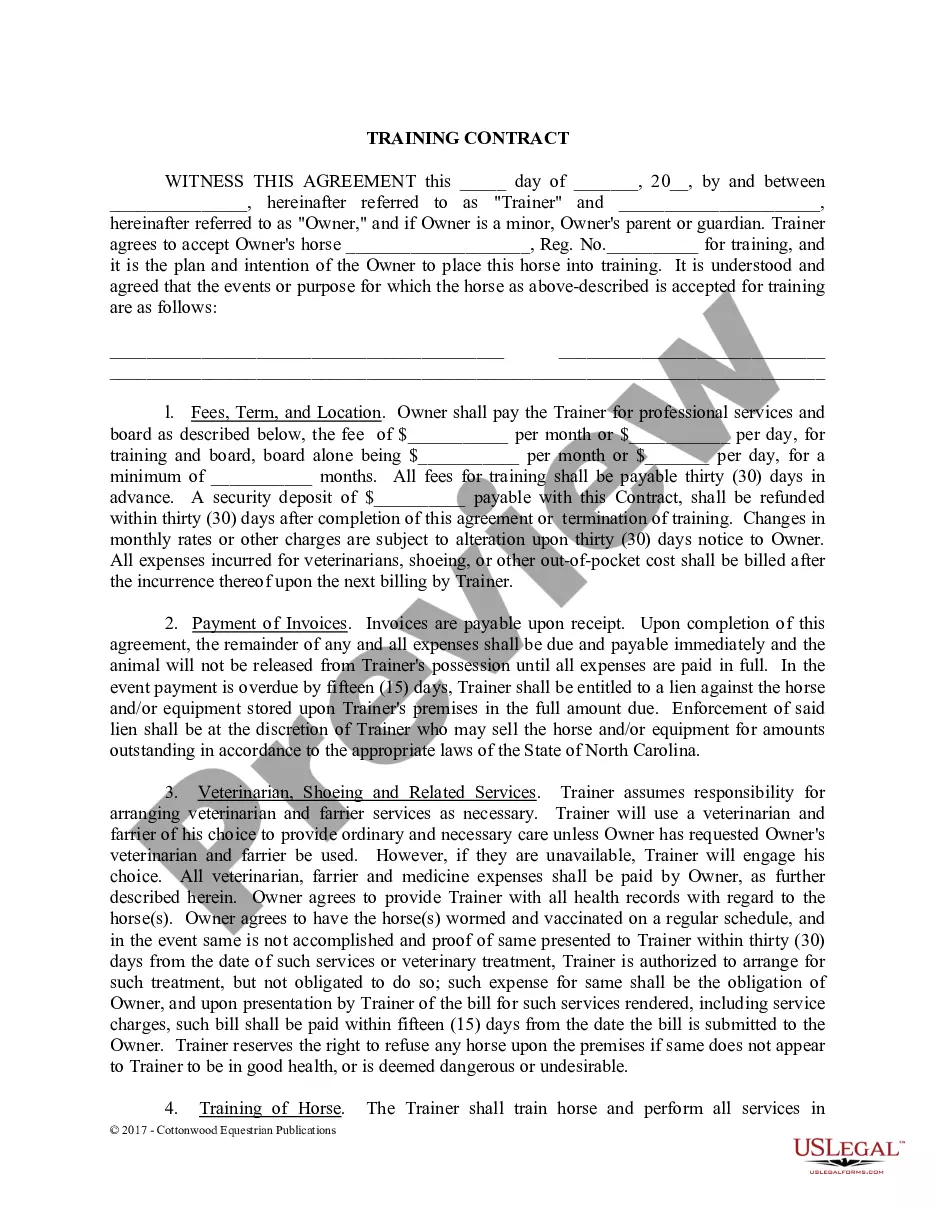

- Agreements and contracts

- Dispute-related proceedings

Situations where this form applies

This due diligence checklist should be utilized when a company intends to acquire ongoing operations either through assets or stock. It is crucial in ensuring that all legal, financial, and operational aspects are reviewed thoroughly, mitigating the risks associated with such transactions.

Who this form is for

- Business owners considering an acquisition

- Corporate lawyers involved in mergers and acquisitions

- Financial analysts conducting due diligence

- Investors interested in evaluating potential acquisitions

Instructions for completing this form

- Gather all charter documents and regulatory papers.

- Compile audited financial statements for the past three-to-five years.

- List tangible and intangible assets, ensuring to include relevant documents.

- Collect information regarding labor and benefits matters.

- Document all agreements, contracts, and any dispute-related proceedings.

Is notarization required?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to compile all relevant financial statements.

- Neglecting to list all significant contracts and agreements.

- Overlooking environmental assessments and permits.

- Not documenting labor and benefits matters thoroughly.

Why complete this form online

- Convenient access to a comprehensive checklist.

- Editable templates allow for customization per acquisition needs.

- Reliability of documents drafted by licensed attorneys.

- Immediate downloads to assist in urgent acquisition processes.

Looking for another form?

Form popularity

FAQ

Due Diligence Examples Conducting thorough inspections on a property before buying it in order to make sure that it is a good investment. An underwriter auditing an issuer's business and operations prior to selling it.

Company information. Who owns the company? Finances. Where are the company's quarterly and annual financial statements from the past several years? Products and services. What are the company's current and future products and services? Customers. Technology assets. IP assets. Physical assets. Legal issues.

Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.

Due diligence is the investigation of every aspect of a property that could affect its value and suitability as a home or investment. Unfortunately for many buyers, due diligence involves little more than a building and pest inspection and contract review. These steps are essential, but only form part of the process.

The report will include a list of key findings and valid recommendations, as well as a reasoned conclusion with a financial analysis explaining the feasibility of our recommendations, and its impact on the company.

Target Company Overview. Understanding why the owners of the company are selling the business Financials. Technology/Patents. Strategic Fit. Target Base. Management/Workforce. Legal Issues. Information Technology.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

Due diligence is a process of verification, investigation, or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information. These three core statements are, and to verify anything else that was brought up during an M&A deal.

Step 1: Company Capitalization. Step 2: Revenue, Margin Trends. Step 3: Competitors & Industries. Step 4: Valuation Multiples. Step 5: Management and Ownership. Step 6: Balance Sheet Exam. Step 7: Stock Price History. Step 8: Stock Options & Dilution.