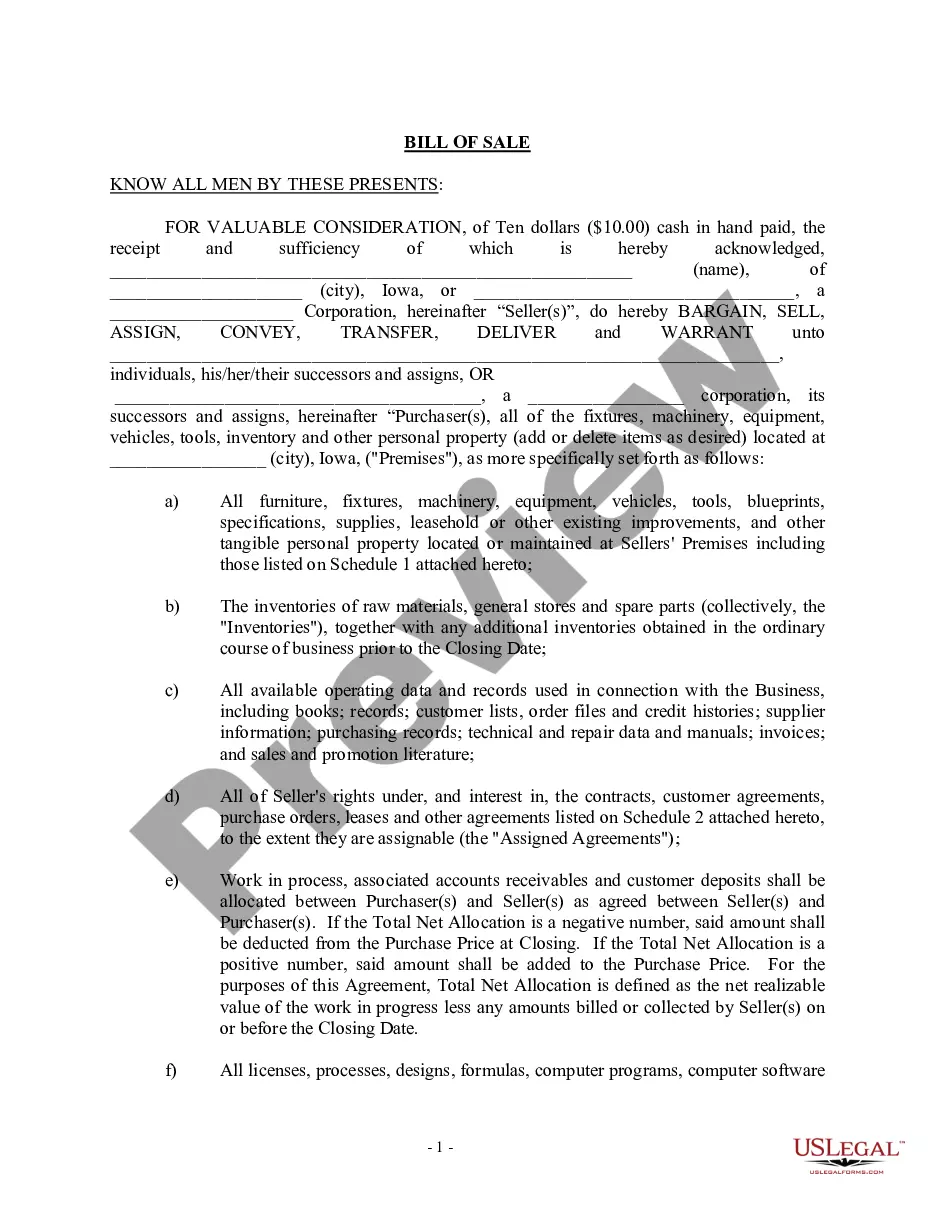

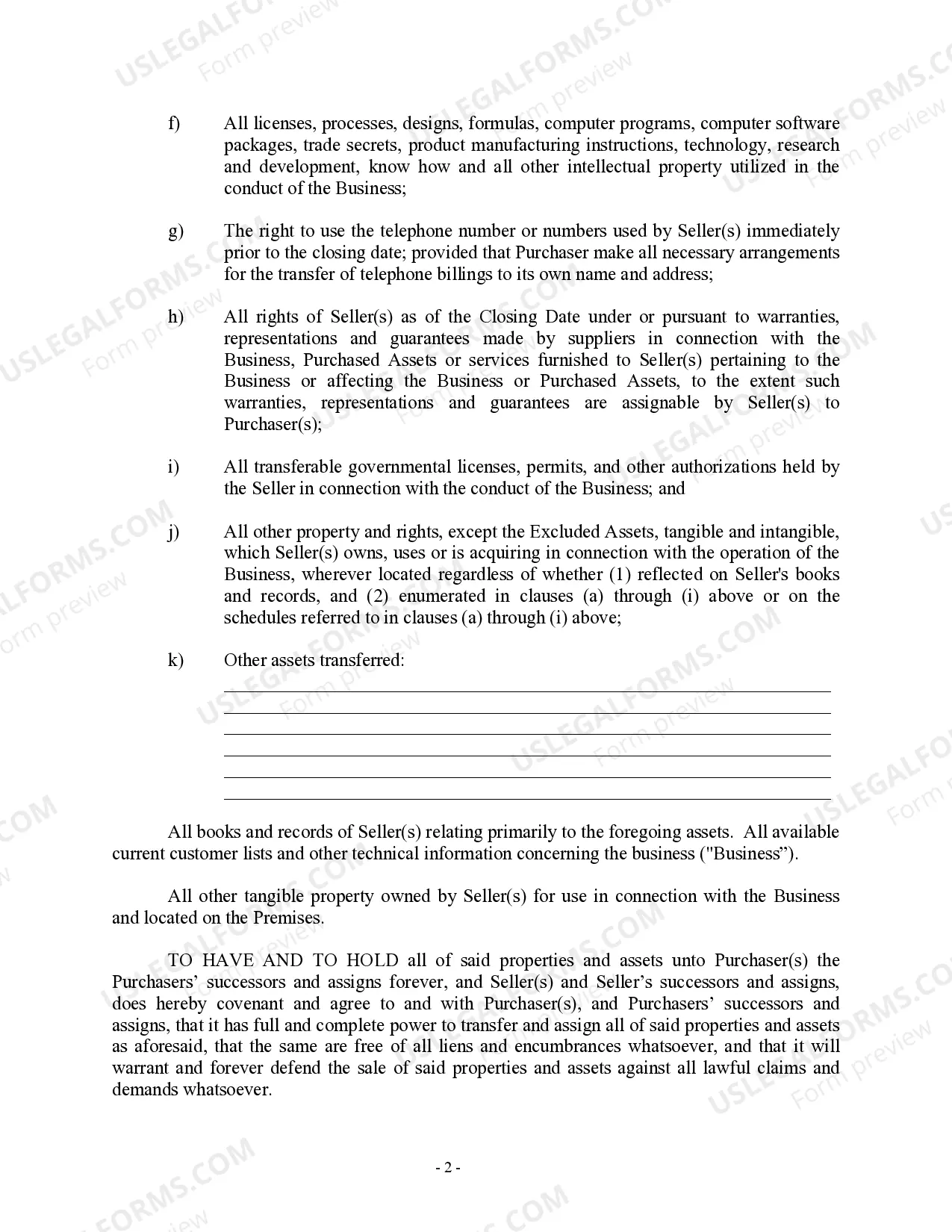

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Iowa Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Obtain access to one of the most extensive collections of approved forms. US Legal Forms serves as a platform to locate any state-specific form in just a few clicks, including examples of the Iowa Bill of Sale in Relation to Business Sale by Individual or Corporate Seller.

There's no need to squander several hours searching for a court-acceptable template. Our certified professionals guarantee that you receive current documents each time.

To utilize the forms library, choose a subscription and create an account. If you have already registered, simply Log In and then click Download. The Iowa Bill of Sale in Relation to Business Sale by Individual or Corporate Seller file will be promptly saved in the My documents tab (a section for all forms you download on US Legal Forms).

That's it! You should complete the Iowa Bill of Sale in Relation to Business Sale by Individual or Corporate Seller template and check it out. To ensure everything is correct, consult your local attorney for assistance. Sign up and effortlessly browse over 85,000 useful forms.

- When planning to use state-specific documents, make sure you select the appropriate state.

- If possible, examine the description to understand all the details of the document.

- Utilize the Preview option if available to review the document's details.

- If everything looks correct, click on the Buy Now button.

- After selecting a pricing plan, create an account.

- Pay using a card or PayPal.

- Download the template to your device by clicking on the Download button.

Form popularity

FAQ

The bill of sale serves as a legal record of the transaction between buyers and sellers. Specifically, an Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller outlines essential details such as the identities of both parties, a description of the item sold, and the payment terms. This document protects both the buyer and seller by providing proof of ownership transfer.

In the context of the Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it is typically the seller who files the bill of sale. The seller will provide the necessary documentation to the purchaser to confirm the terms of the sale. It is important to keep copies for your records, so make sure you have everything organized. If you need guidance on this process, consider using the uSlegalforms platform to simplify the bill of sale creation and filing.

While Iowa does not universally require a bill of sale for all transactions, it is required for certain types of sales, such as vehicles and specific business assets. Utilizing a bill of sale is strongly recommended for documenting transactions, especially in business. Creating an Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can enhance transparency and provide legal protection for your sale.

In general, a buyer can back out of a bill of sale if both parties agree to it or if certain conditions are not met. However, if the bill of sale is signed and there is no provision for cancellation, the buyer may face legal consequences. Using the Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller helps clarify these conditions upfront, protecting both buyer and seller.

For a bill of sale to be binding, it must clearly outline the terms of the transaction, including the seller's and buyer's information and details of the items sold. Both parties should sign the document to indicate their agreement. When drafting an Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, including these elements will ensure that your bill is legally enforceable.

A bill of sale can be deemed invalid due to missing signatures, lack of necessary details, or failure to comply with state regulations. Additionally, if the equipment sold is misrepresented, or there are indications of fraud, the bill can lose its validity. To avoid issues, ensure that your Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is thorough and accurate.

A bill of sale can hold up in court if it includes all necessary details and complies with legal requirements. It acts as evidence of the transaction and ownership, making it important for both buyers and sellers. When utilizing the Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, having a well-prepared document can strengthen your legal standing.

Including a seller's address in a bill of sale is not a strict requirement in Iowa, but it is highly recommended. Specifically, for an Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, having the seller’s address helps establish identity and makes the document more complete. This detail can be particularly useful in case of future disputes or for record-keeping purposes. Overall, including more information can strengthen the reliability of the bill.

Yes, you can absolutely write your own bill of sale in Iowa. As long as it contains all the required elements, a self-written document is valid. When drafting an Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, clarity is key, so make sure to specify all terms and conditions clearly. If you need assistance or a template, consider checking out uslegalforms for comprehensive resources.

Yes, you can handwrite a bill of sale in Iowa, and it is often an acceptable method. However, for an Iowa Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it's important that the handwritten document is clear and legible. Make sure to include all necessary details, such as the names of both parties, a description of the business being sold, and any terms of the sale. A well-organized document ensures both parties are on the same page.