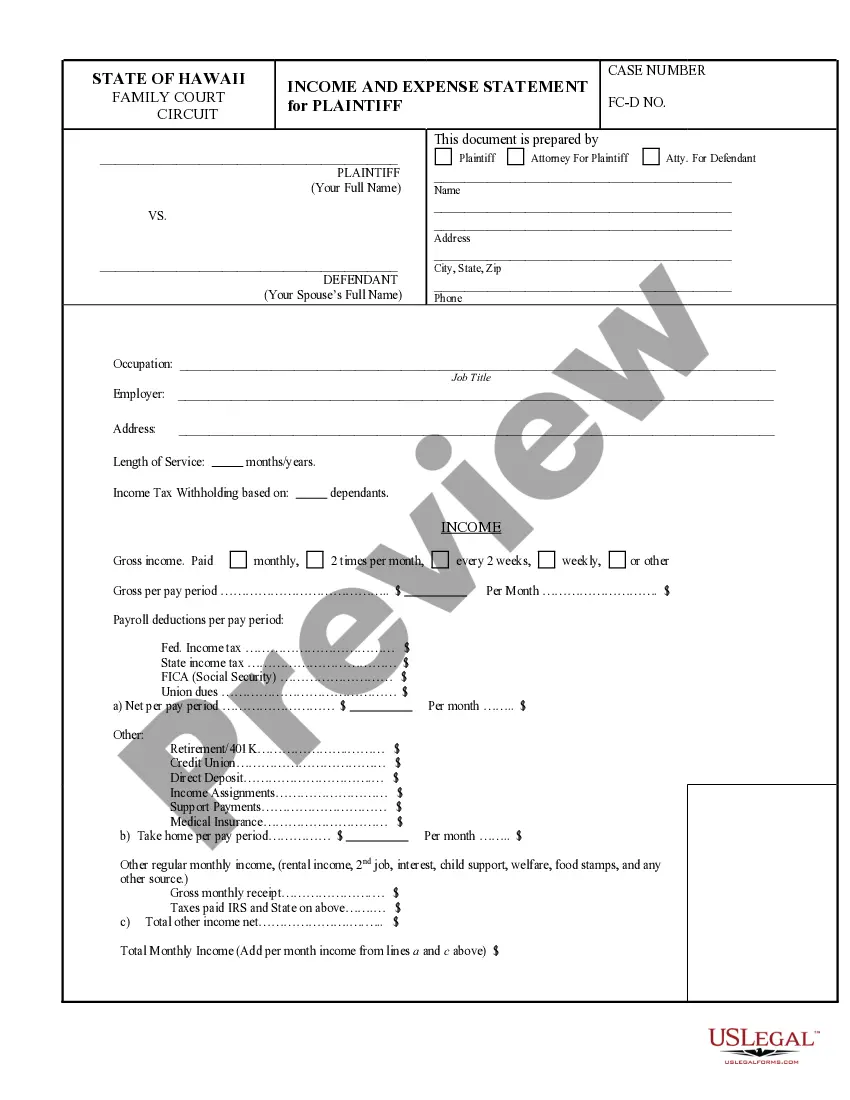

The Hawaii Income and Expense Statement is a form used by Hawaii taxpayers to report their income and deductions for the tax year. This form is used to calculate the taxpayer’s taxable income and the amount of state taxes due. There are two types of Hawaii Income and Expense Statement- Form N-11 and Form N-11H. Form N-11 is used for individuals and Form N-11H is for households. Both forms require taxpayers to provide detailed information about their income sources, deductions, and other expenses. Taxpayers must use the appropriate form for their filing status, as well as provide accurate and complete information. Hawaii Income and Expense Statements are available online or in printable formats.

Hawaii Income and Expense Statement

Description

How to fill out Hawaii Income And Expense Statement?

US Legal Forms is the simplest and most cost-effective method to find appropriate official templates.

It’s the most comprehensive online collection of business and personal legal documents crafted and validated by legal experts.

Here, you can discover printable and fillable forms that adhere to federal and local laws - just like your Hawaii Income and Expense Statement.

Review the form details or preview the document to ensure you’ve identified the one that matches your requirements, or find another using the search feature above.

Click Buy now once you’re confident about its suitability with all the criteria, and select the subscription plan that best fits your needs.

- Acquiring your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the online platform and download the form onto their device.

- Later, they can access it in their profile under the My documents section.

- And here’s how you can secure a correctly crafted Hawaii Income and Expense Statement if you are new to US Legal Forms.

Form popularity

FAQ

On a Hawaii Income and Expense Statement, commonly recorded taxes include sales tax, payroll tax, and any other relevant local, state, or federal taxes. These taxes directly affect your net profit, so it is essential to record them accurately. By gaining a complete picture of tax obligations through this statement, you can better manage your finances and compliance.

Finding total income before taxes is straightforward on a Hawaii Income and Expense Statement. First, locate the total revenue amount, then subtract operating costs and other expenses. This will give you the total income available before taxes, which is vital for assessing your net earnings.

To locate your income before income tax expense on a Hawaii Income and Expense Statement, check the earnings section of the document. Look for the total revenue figure, then subtract any expenses listed. This will provide you with the income figure before tax deductions, enhancing your understanding of your financial position.

Calculating your annual income before tax involves summing all sources of income over the year and excluding any tax liabilities. Review your earnings from wages, investments, and other revenue sources to form a complete picture. Utilizing a Hawaii Income and Expense Statement can assist in organizing this information systematically.

To calculate profit before tax on your Hawaii Income and Expense Statement, take your total income and subtract operational costs and any non-operational expenses. This figure shows how much profit you've generated before accounting for tax obligations. This clarity is crucial for strategic planning and financial assessments.

Writing a Hawaii Income and Expense Statement involves several key steps. Begin by listing all sources of income, followed by detailing all expenses incurred. It's important to categorize these expenses to gain a clear picture of your financial health. Using tools like the Uslegalforms platform can simplify this process, providing templates and guidance to ensure accuracy.

To calculate income before income tax expense on a Hawaii Income and Expense Statement, start with your total revenue. Next, subtract the total operating expenses from this revenue. This calculation helps you see your earnings before taxes, providing clarity about your actual profits.

On a Hawaii Income and Expense Statement, you typically record all sources of income and all expenses incurred during a specific period. This includes wages, dividends, interest, and other revenue streams, as well as operational costs such as rent, utilities, and salaries. By documenting this information, you better understand your financial situation and can make informed decisions moving forward.

To create an income and expense report, gather all financial data, including income sources and regular expenses. Begin by listing all income, followed by all monthly expenditures. Utilizing the Hawaii Income and Expense Statement can streamline this process, making it easier to compile and present your financial information in an organized manner.

The purpose of an income and expense declaration is to provide a clear picture of your financial situation, ensuring that all parties understand their obligations. This document is essential for equitable decisions in legal cases concerning finances. The Hawaii Income and Expense Statement specifically ensures that you include all relevant income and expenses for full disclosure.