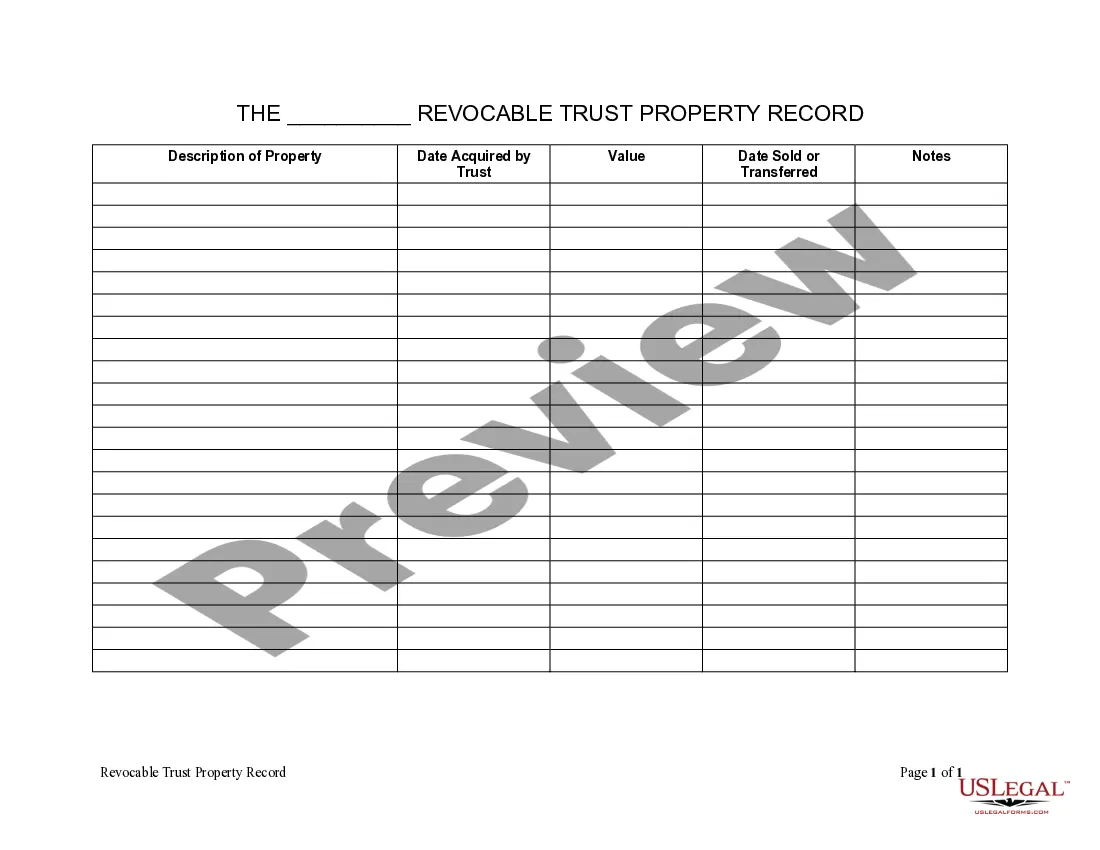

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Wisconsin Living Trust Property Record

Description

How to fill out Wisconsin Living Trust Property Record?

Out of the multitude of platforms that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms before buying them. Its complete catalogue of 85,000 samples is categorized by state and use for simplicity. All the forms on the service have already been drafted to meet individual state requirements by accredited lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, press Download and get access to your Form name in the My Forms; the My Forms tab holds your downloaded forms.

Follow the guidelines listed below to obtain the document:

- Once you find a Form name, make sure it is the one for the state you really need it to file in.

- Preview the template and read the document description before downloading the template.

- Look for a new template through the Search field if the one you’ve already found isn’t proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

Once you have downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor that you pick. Any document you add to your My Forms tab might be reused many times, or for as long as it remains the most updated version in your state. Our platform provides easy and fast access to templates that fit both attorneys and their clients.

Form popularity

FAQ

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.

When you set up a Living Trust, you fund the trust by transferring your assets from your name to the name of your Trust. Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee.

Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

Revocable living trust: When you have a living trust, the title of your real estate can be held in the name of the trustee of your trust.Because the title is no longer in your individual name (or joint names if married), there will be no need for court interference.

Trusts Are Not Public Record.However, trusts aren't recorded. Not having to file the trust with the court is one of the biggest benefits of a trust because it keeps the settlement a private matter between the successor trustees and trust beneficiaries.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.