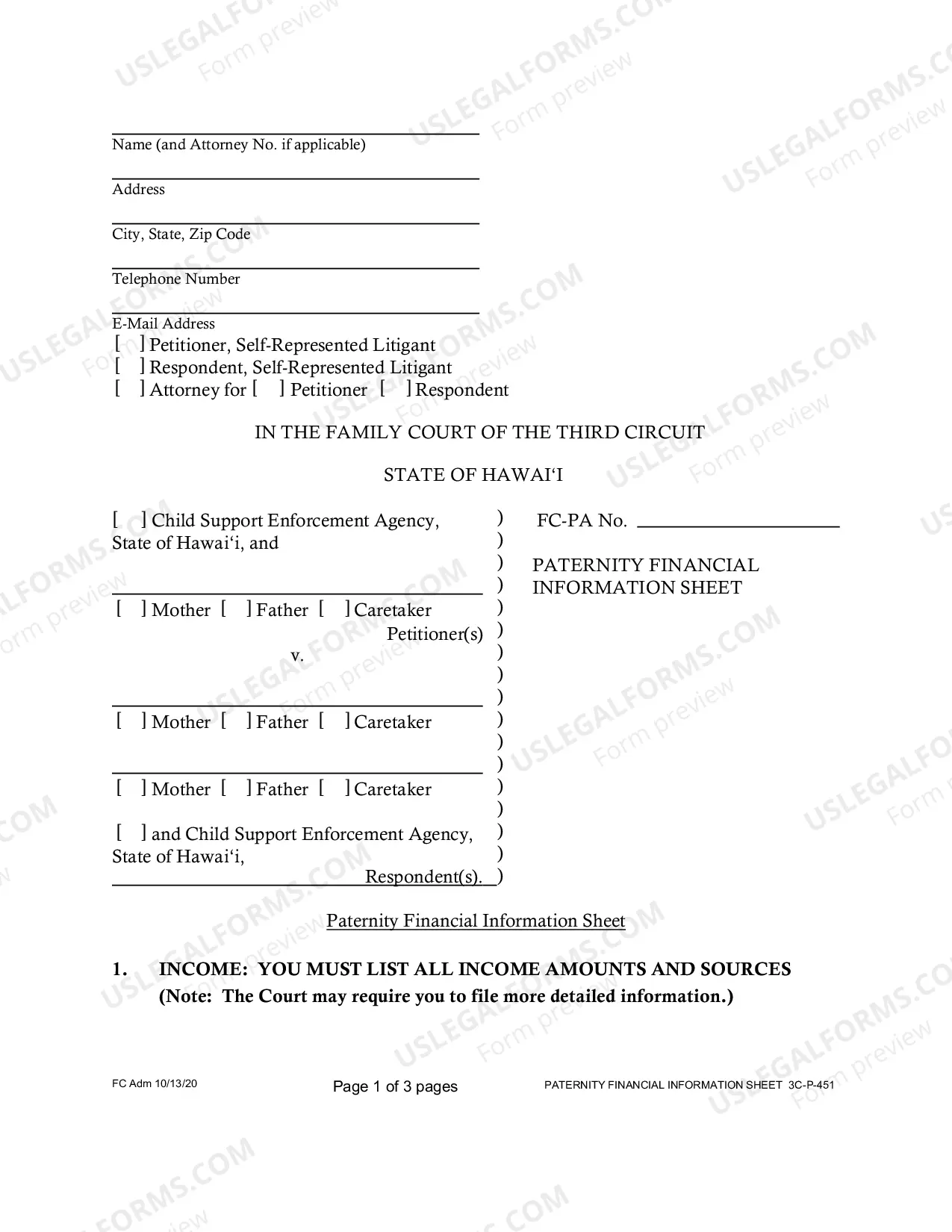

The Hawaii Financial Information Sheet (HIS) is a document issued by the State of Hawaii Department of Taxation that summarizes a taxpayer’s financial information. It includes an overview of the taxpayer’s total income, deductions, credits, and other relevant financial information. The is used to help determine the taxpayer’s Hawaii state income tax liability. There are two types of HIS: the Personal HIS and the Business HIS. The Personal HIS covers information such as wages, salaries, pensions, interest income, and other sources of income. It also includes information on deductions such as charitable contributions, medical expenses, and reimbursed business expenses. The Business HIS covers information such as business income, deductions, and credits. It also includes information on employer paid taxes, self-employment taxes, and other business expenses. Both types of HIS are used to calculate the taxpayer’s Hawaii state income tax liability.

Hawaii Financial Information Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Financial Information Sheet?

How much time and resources do you typically allocate to crafting formal documents.

There's a better chance to obtain such forms than to employ legal professionals or spend countless hours looking for a suitable template.

Another advantage of our service is that you can retrieve previously purchased documents securely stored in your profile under the My documents tab. Access them anytime and re-complete your paperwork as many times as needed.

Conserve time and effort when preparing legal documents with US Legal Forms, one of the most trusted online services. Register with us today!

- Browse through the form content to guarantee it aligns with your state regulations. For this purpose, review the form description or utilize the Preview option.

- If your legal template doesn't fulfill your needs, find another one using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Hawaii Financial Information Sheet. If not, move to the next steps.

- Click Buy now when you identify the correct document. Choose the subscription plan that best fits your needs to access our library’s full offerings.

- Create an account and complete your subscription payment. You can transact with your credit card or through PayPal - our service ensures absolute security for that.

- Download your Hawaii Financial Information Sheet onto your device and complete it on a printed version or electronically.

Form popularity

FAQ

Filling out a financial statement involves gathering financial data such as revenues and expenditures. Begin by organizing your information into sections like income, expenses, assets, and liabilities. To enhance accuracy and understanding, the Hawaii Financial Information Sheet is an excellent resource for completing this task efficiently.

To fill out a personal financial statement, begin by compiling your income sources and outlining all your expenses. Then, list your assets and liabilities to evaluate your financial health. The Hawaii Financial Information Sheet can guide you through this process, ensuring that you include all relevant information and calculations.

Answering a statement of financial position requires you to analyze your financial standing. First, accurately report your total assets and total liabilities. The difference will reflect your net worth, and using the Hawaii Financial Information Sheet helps you present this information in a clear and organized manner.

To fill out a financial report, gather all necessary financial documents and data for the reporting period. Begin by outlining your income and expenses, then classify them appropriately. Ensure you review each section carefully and utilize the Hawaii Financial Information Sheet as a guide to ensure accuracy and completeness.

On your tax return, use the P.O. Box 259, Honolulu, HI 96809-0259 for state tax returns and follow IRS guidance for federal tax returns. It's vital to write these addresses accurately to ensure proper processing. Having a Hawaii Financial Information Sheet can assist in documenting your addresses and other essential details accurately.

If you're in Hawaii, mail your IRS tax return to the address specified for residents in the instructions, usually it is IRS, P.O. Box 937, Honolulu, HI 96808. Ensure your tax return is complete and correctly signed to avoid any issues. A Hawaii Financial Information Sheet can streamline your filing and ensure you include everything necessary.

To write a check to the Hawaii state tax collector, make it payable to the State of Hawaii Department of Taxation. Include your tax identification number in the memo section for clear identification. Using a Hawaii Financial Information Sheet could help you confirm the exact amount required before issuing the check.

When mailing your Hawaii tax return, use P.O. Box 259, Honolulu, HI 96809-0259 as the mailing address. It’s important to ensure that all your forms are adequately filled out and folded for efficient delivery. Utilizing a Hawaii Financial Information Sheet can assist you in preparing your documents thoroughly.

Your Hawaii state tax return should be sent to the Department of Taxation at P.O. Box 259, Honolulu, HI 96809-0259. Make sure to verify that you have signed your return and included all schedules. A properly completed Hawaii Financial Information Sheet can simplify this process and improve your accuracy.

You can obtain a Hawaii tax ID number by applying through the Hawaii Department of Taxation. This process is straightforward and can often be done online for ease. Remember, once you have your Hawaii Financial Information Sheet prepared, it will help you in gathering the needed data for your application.