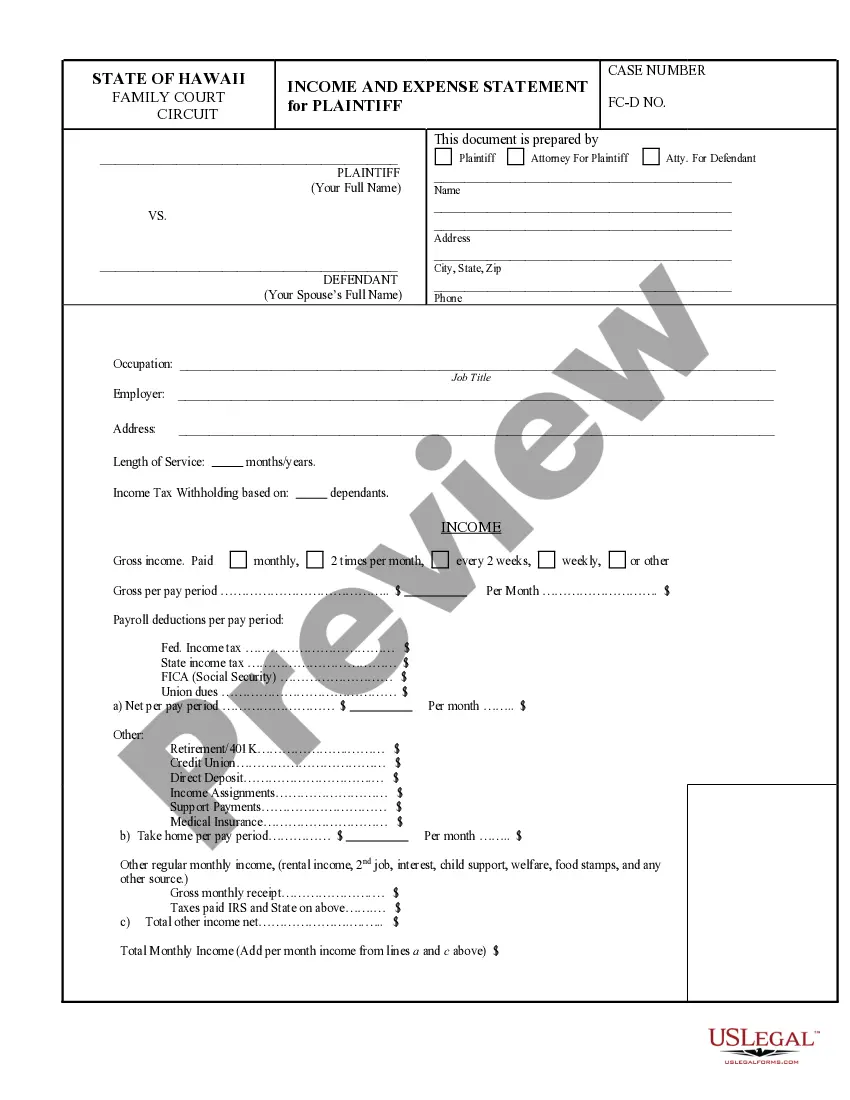

Hawaii Income and Expense Statement

Description

How to fill out Hawaii Income And Expense Statement?

Completing official documents can be quite taxing unless you possess ready-to-use editable templates. With the US Legal Forms online collection of formal papers, you can trust the information you encounter, as all of them adhere to federal and state laws and are verified by our professionals.

Obtaining your Hawaii Income and Expense Statement from our platform is as easy as 1-2-3. Previously registered users with an active subscription just need to Log In and click the Download button once they find the correct template. Later, if necessary, users can access the same form from the My documents section of their account. However, even if you are unfamiliar with our service, signing up with a valid subscription will only require a few moments. Here’s a brief guide for you.

Haven’t you experienced US Legal Forms yet? Register for our service now to acquire any formal document swiftly and effortlessly whenever you need, and maintain your paperwork organized!

- Document compliance assessment. You should carefully inspect the content of the form you desire and ensure that it aligns with your requirements and adheres to your state’s legal regulations. Previewing your document and reviewing its general description will assist you in doing just that.

- Alternative search (optional). If you discover any discrepancies, explore the library using the Search tab above until you locate an appropriate template, and click Buy Now once you find the one you require.

- Account registration and template purchase. Create an account with US Legal Forms. Following account validation, Log In and choose your desired subscription plan. Make a payment to proceed (options include PayPal and credit card).

- Template download and subsequent usage. Choose the file format for your Hawaii Income and Expense Statement and click Download to save it on your device. Print it to complete your documents manually, or utilize a feature-rich online editor to prepare an electronic version more swiftly and effectively.

Form popularity

FAQ

Creating an income and expense report involves collecting detailed records of your finances over a specific time frame. Begin by noting all income amounts, then clearly list your expenses, differentiating between fixed and variable costs. Once you have all the data, calculate totals and ensure accuracy. For your convenience, you can access a user-friendly Hawaii Income and Expense Statement from US Legal Forms, which streamlines the entire process.

To prepare an income and expense statement, gather all your income sources and expenses for the relevant period. Organize this information into categories for clarity. Once you have all your data compiled, ensure that it accurately reflects your financial situation. Using the Hawaii Income and Expense Statement template from US Legal Forms can help you create a well-structured statement that meets legal requirements.

To create a personal income and expense spreadsheet, start by listing all sources of income, such as salary and side jobs. Next, categorize your expenses, including essentials like rent, utilities, and discretionary spending. Ensure you include totals for both income and expenses, which will give you a clear view of your financial situation. Consider using templates available on US Legal Forms, which can guide you in creating your Hawaii Income and Expense Statement.

An income and expense report is a comprehensive document that summarizes all your income and expenses over a specific period. In the context of legal matters, such as family law in Hawaii, the Hawaii Income and Expense Statement serves to present a clear financial picture. This report helps parties and judges understand your financial capabilities and needs. Utilizing tools from US Legal Forms makes generating this report straightforward.

Yes, completing an income and expense declaration is often required in certain legal situations, such as family court cases. The Hawaii Income and Expense Statement allows you to clearly outline your financial situation. By providing this information, you help the court make informed decisions regarding support and financial obligations. Using resources like US Legal Forms can simplify this process.

The statement that shows income and expenses is known as the income statement. It summarizes total revenues and costs to determine net income over time. For residents and businesses in Hawaii, using the Hawaii Income and Expense Statement simplifies financial tracking and enhances clarity regarding financial performance.

Documentation that shows income and expenses includes an income and expense statement, invoices, receipts, and bank statements. These documents collectively provide a detailed account of financial transactions. For complete accuracy, the Hawaii Income and Expense Statement can effectively consolidate and present these details in one place.

Income and expenses are recognized on an income statement, which provides a comprehensive overview of financial activity. This statement is crucial for assessing the profitability and operational efficiency of a business. When using the Hawaii Income and Expense Statement, you can ensure your financial activities align with local requirements.

An income and expense sheet is commonly known as an income statement or profit and loss statement. This essential financial document helps individuals and businesses summarize their financial performance. In Hawaii, using the Hawaii Income and Expense Statement can aid in better financial planning and strategy development.

The report that shows income and expenses is typically referred to as an income and expense statement. This document provides a clear view of revenues and expenditures over a specific period. For those in Hawaii, the Hawaii Income and Expense Statement is crucial for tracking financial health and ensuring compliance with state regulations.