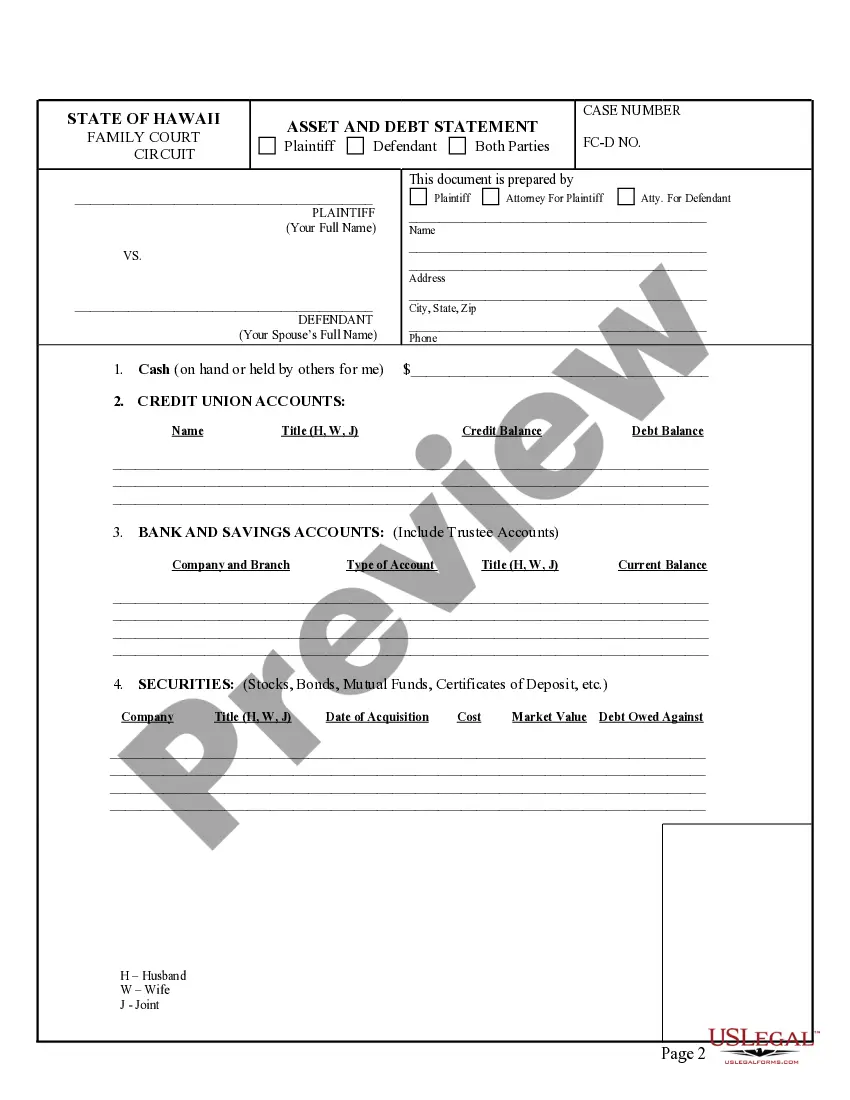

Hawaii Asset and Debt Statement is a financial form that is used to disclose and track assets and debts in the State of Hawaii. The purpose of this form is to provide a comprehensive overview of the financial situation of a person or business, thereby helping them to make informed decisions in regard to their finances. There are two types of Hawaii Asset and Debt Statement: the Individual Hawaii Asset and Debt Statement and the Business Hawaii Asset and Debt Statement. The Individual Hawaii Asset and Debt Statement requires disclosure of all assets, liabilities, and net worth of an individual. The Business Hawaii Asset and Debt Statement requires disclosure of all assets, liabilities, and net worth of a business. Both forms require disclosure of all sources of income, including wages, investments, and other sources. Both forms also require disclosure of all debts incurred, including mortgages, credit cards, and other obligations.

Hawaii Asset and Debt Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

What Is an Asset and Debt Statement?

Asset and Debt Statement is a critical component of financial statements, providing a detailed snapshot of an individual's or an organization's financial position at a specific point in time. This statement lists all assets (what you own) and liabilities (what you owe), helping in the accurate assessment of net worth.

Key Concepts & Definitions

- Assets: Economic resources owned by the business or individual, such as cash, real estate, and investments.

- Liabilities: Financial obligations or debts owed to other parties, including loans and credit card balances.

- Equity: The difference between total assets and total liabilities, representing the owner's stake in the business.

- Balance Sheet: Another term for asset and debt statement, commonly used in commercial banking and accounting.

Step-by-Step Guide to Creating an Asset and Debt Statement

- Collect accurate data on all assets including bank statements, property evaluations, and investment summaries.

- Gather all liability information like loan documents and credit card statements.

- Organize assets and liabilities into current (short-term) and non-current (long-term) categories.

- Calculate total assets and total liabilities.

- Subtract total liabilities from total assets to determine equity.

- Review the statement for accuracy and update regularly to reflect any changes in financial status.

Risk Analysis

Maintaining an accurate asset and debt statement is crucial. Risks include misrepresentation of financial status, errors due to outdated information, and potential for fraud if confidentiality is compromised. Regular updates and stringent verification of entries can mitigate these risks.

Best Practices

Adhere to the following best practices for effective financial statements preparation:

- Use software tools for efficient data management and error reduction.

- Understand basic accounting principles to correctly classify assets and liabilities.

- Engage with professionals periodically to audit and verify the statements.

- Utilize online courses in financial modeling and equity valuation to enhance statement accuracy and usability.

Common Mistakes & How to Avoid Them

Frequent errors include mixing personal and business finances, overlooking small liabilities, and infrequent updates. Avoid these by maintaining separate accounts for business and personal transactions, being meticulous in recording all debts, and scheduling regular financial reviews.

Case Studies / Real-World Applications

Many successful businesses and individuals routinely leverage asset and debt statements for various purposes including securing loans, investment analysis, and strategic financial planning. Regular financial assessment has shown to significantly contribute to better fiscal discipline and decision-making.

How to fill out Hawaii Asset And Debt Statement?

Managing official documents necessitates focus, accuracy, and utilizing well-structured templates.

US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Hawaii Asset and Debt Statement template from our collection, you can be assured it complies with federal and state regulations.

Choose the format in which you would like to receive your document and click Download. You can print the blank form or upload it to a professional PDF editor for electronic submission. All documents are designed for multiple uses, just like the Hawaii Asset and Debt Statement displayed on this page. If you need them again, you can fill them out without additional payment - simply access the My documents tab in your profile and complete your document whenever needed. Experience US Legal Forms and prepare your business and personal paperwork quickly and in full legal adherence!

- Ensure to carefully examine the form content and its alignment with general and legal standards by previewing it or reviewing its description.

- Look for another official template if the one currently opened does not fit your circumstances or state laws (the tab for that is located in the top corner of the page).

- Log in to your account and download the Hawaii Asset and Debt Statement in your preferred format.

- If this is your first time using our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay using your credit card or PayPal account.

Form popularity

FAQ

An example of a custody modification could include a parent requesting increased visitation rights due to a job change that allows for more availability. Another common modification is to change primary custody based on a significant change in circumstances, such as relocating for work. In these cases, presenting relevant evidence, including a Hawaii Asset and Debt Statement, can be crucial in supporting your request.

The timeline to modify a parent plan in Hawaii can vary, but you can generally expect several months for the process to unfold. After filing your motion and serving the other parent, the court will schedule a hearing. Factors like court backlog and any required evaluations can affect the timeline. Having well-organized documents, including your Hawaii Asset and Debt Statement, can help expedite the process.

In Hawaii, children age 14 and older can express their preferences regarding custody arrangements. However, the court considers these preferences as one of several factors when making a decision. It’s essential to present a comprehensive view of your custody situation, including the findings from your Hawaii Asset and Debt Statement, to support your case.

When in a custody battle, avoid making negative remarks about the other parent in front of your child or during court proceedings. Statements that undermine the other parent’s character can be detrimental to your case. Focus on facts and express your commitment to your child's well-being. A thoughtful approach, supported by your Hawaii Asset and Debt Statement, can strengthen your position.

Modifying child custody in Hawaii involves submitting a motion to the family court, along with a completed Hawaii Asset and Debt Statement. You must provide evidence demonstrating a significant change in circumstances since the original custody order. After filing, you will have a court hearing where you can present your case. It's important to have supporting documentation to ensure the best outcome.

To fill an assets and liabilities form, first understand the sections clearly. Enter your assets like homes and savings in one section, while detailing your debts in another. Utilizing uslegalforms can streamline this process, providing templates that guide you in accurately completing a Hawaii Asset and Debt Statement.

To prepare an asset and liability statement, start by listing all your assets alongside their estimated values. Next, itemize all your liabilities, detailing the amounts owed. This thorough approach allows you to create an effective Hawaii Asset and Debt Statement, which can be invaluable for various financial assessments.

In Hawaii, assets are typically divided using the principle of equitable distribution. This means that the assets are shared fairly, not necessarily equally, based on various factors such as the duration of the marriage and each spouse's financial situation. Preparing an accurate Hawaii Asset and Debt Statement can aid in these negotiations and ensure that both parties understand their financial standing.

Assets include items like real estate, cars, savings accounts, and investments. On the other hand, liabilities consist of mortgages, loans, credit card debts, and other obligations. Understanding these can help you create a comprehensive Hawaii Asset and Debt Statement that portrays your financial health.

Filling out an asset and liability form begins with gathering all necessary financial documents. Make sure to include your income sources, property, debts, and other financial commitments. By organizing this information, you can create a clear Hawaii Asset and Debt Statement that truly reflects your financial situation.