Wisconsin Closing Statement

What this document covers

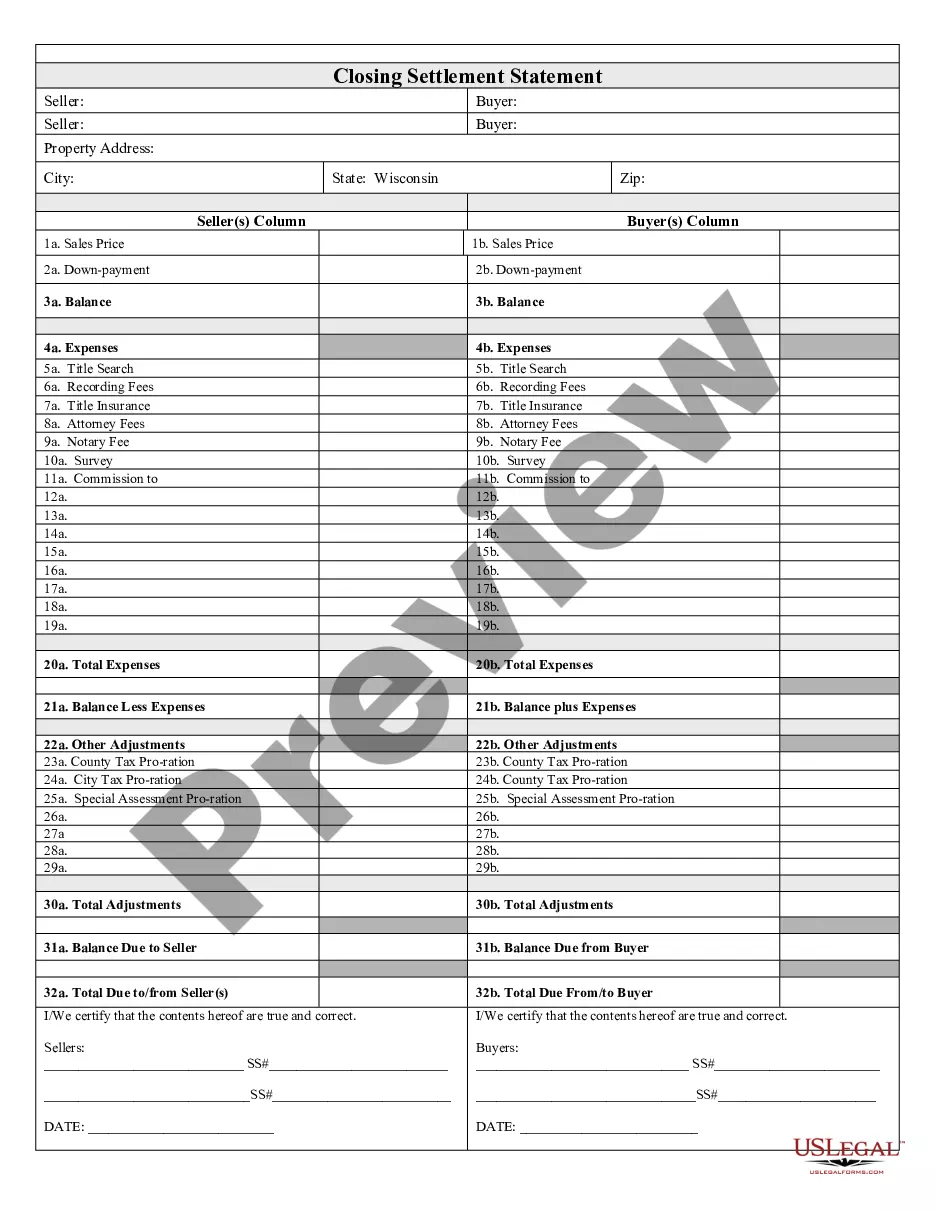

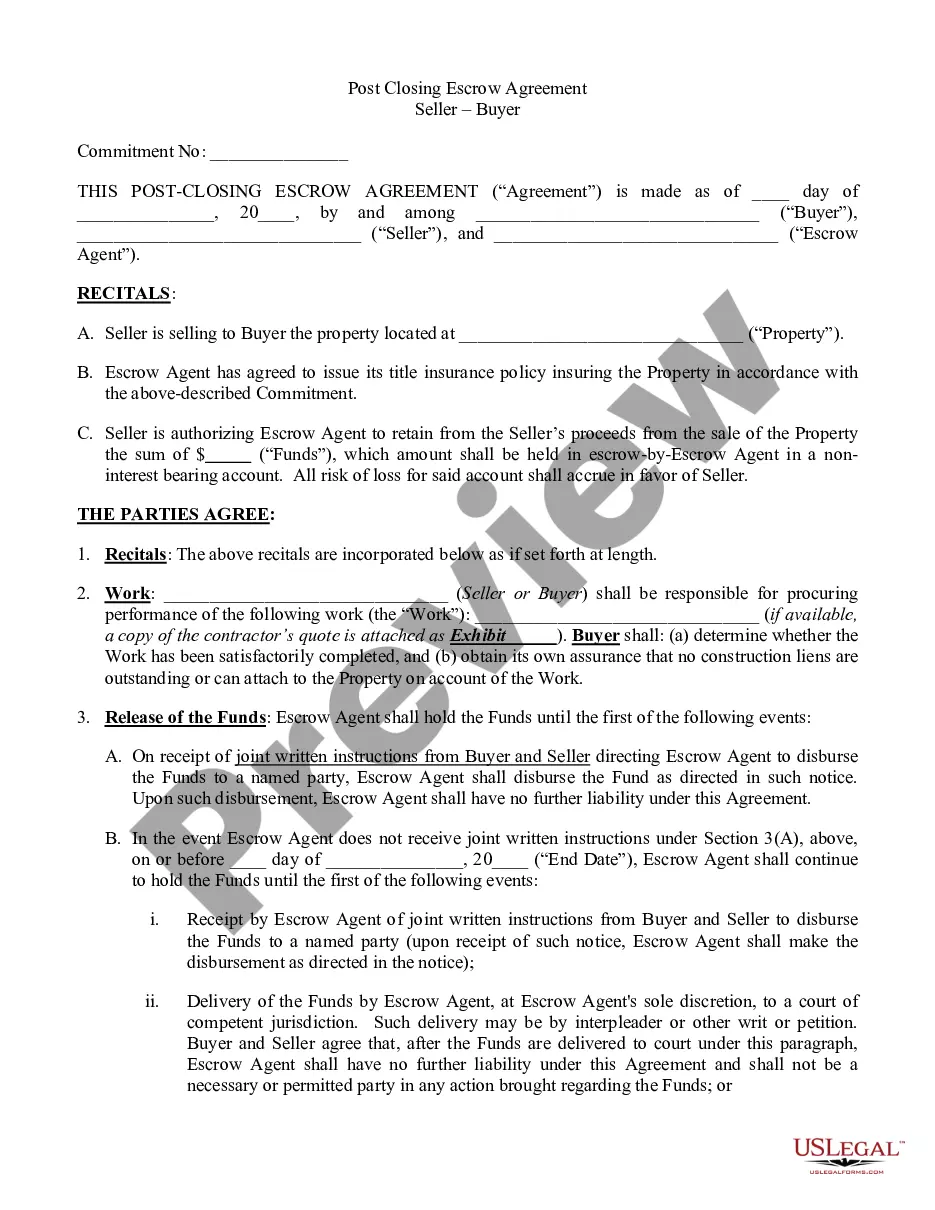

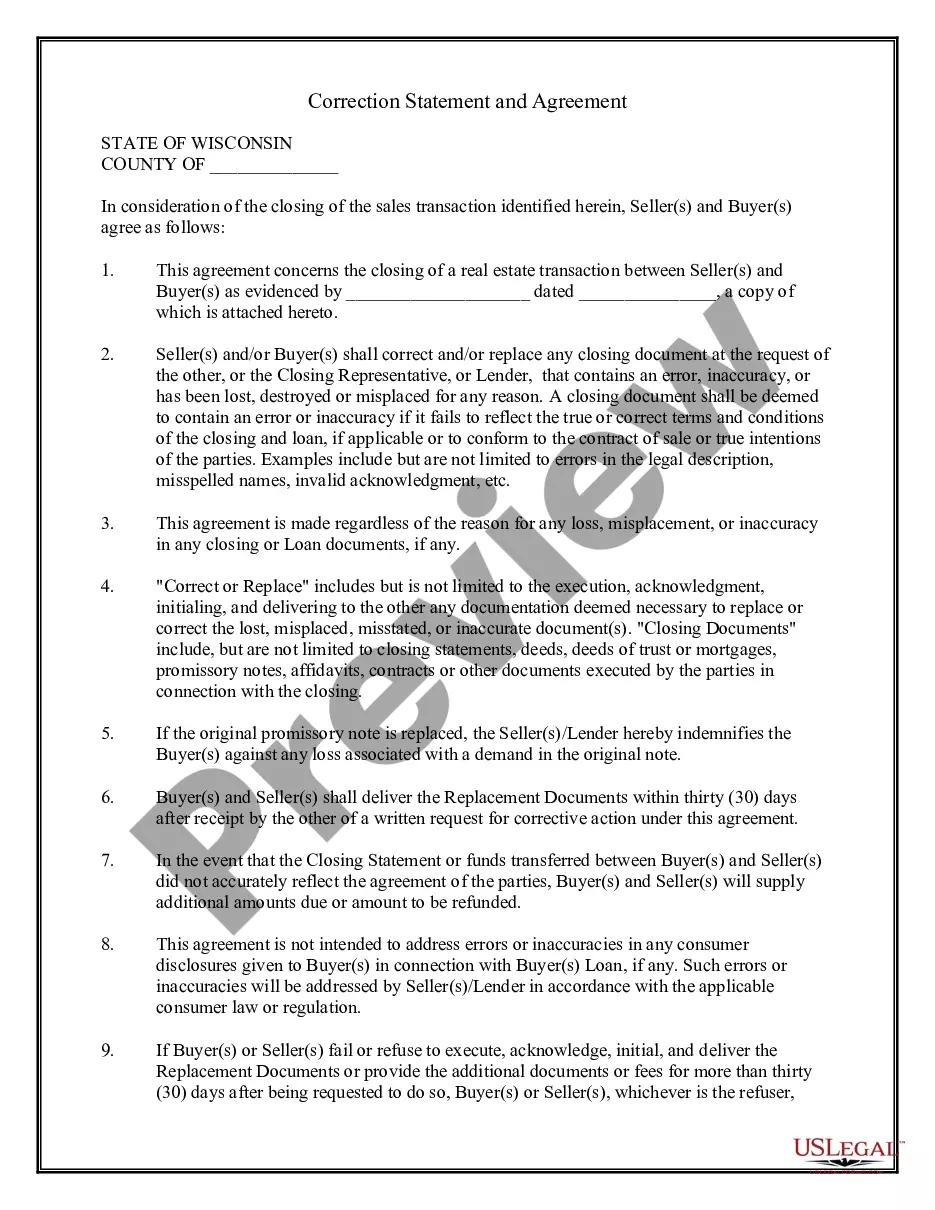

The Closing Statement is a crucial document for real estate transactions, particularly in cash sales or owner financing scenarios. This form outlines the financial details of the sale, including expenses, adjustments, and balances. It serves as a final summary of all amounts involved, distinguishing it from other real estate forms that may not cover specific financial aspects of the transaction.

What’s included in this form

- Balance summary for both buyer and seller.

- Breakdown of expenses, including title search, closing costs, and attorney fees.

- Adjustment calculations for prorated taxes and assessments.

- Certification by both parties confirming the accuracy of the statement.

When to use this form

This form should be used during the finalization of a real estate sale, especially if the transaction involves cash payments or financing provided by the seller. It is essential when both parties need a clear account of all financial details to ensure a smooth closing process.

Who this form is for

- Home buyers and sellers engaged in a real estate transaction.

- Real estate agents or brokers facilitating the sale.

- Title companies involved in the closing process.

Instructions for completing this form

- Identify the parties involved in the transaction, including buyer and seller.

- Detail the property being sold, including the address and legal description.

- List all applicable expenses associated with the transaction.

- Calculate and enter any required adjustments for taxes or assessments.

- Ensure both parties review and sign the statement for verification.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to accurately list all expenses, which could lead to disputes.

- Omitting signatures from either the buyer or seller, invalidating the form.

- Neglecting to verify the total balance due which might affect payment processing.

Why complete this form online

- Convenience of immediate access and download from anywhere.

- Editability allows customization to fit specific transaction details.

- Reliability of forms drafted by licensed attorneys ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

A pass-through entity is required to make quarterly withholding tax payments on a nonresident member's share of income attributable to Wisconsin. The pass-through entity must make quarterly payments of withholding tax on or before the 15th day of the 3rd, 6th, 9th, and 12th month of the taxable year.

Wisconsin Exemption Certificates do not expire but are recommended to be updated at least once every three years.

Payment. Current beneficiaries have the right to distributions as set forth in the trust document. Right to information. Right to an accounting. Remove the trustee. Termination of the trust.

Complete Close Account (under I want to2026) in My Tax Account. Email DORWithholdingTax@wisconsin.gov, or. Call (608) 266-2776.

Beneficiaries' right to information enables them to act upon another right: to petition the court to remove the trustee if they are not properly carrying out their duties, or to terminate the trust altogether under some circumstances.

Complete the Request to Close Account in My Tax Account, or. Email DORBusinessTax@wisconsin.gov, or. Call (608) 2662776.

You may claim exemption from withholding of Wisconsin income tax if you had no liability for income tax last year, and you expect to incur no liability for income tax this year. To claim complete exemption from withholding use Wisconsin Form WT-4, Employee's Wisconsin Withholding Exemption Certificate.

Wisconsin does not levy an inheritance tax or an estate tax. However, if you are inheriting property from another state, that state may have an estate tax that applies. You will also likely have to file some taxes on behalf of the deceased. If the estate is large enough, it might be subject to the federal estate tax.

Here are the basic rules on Wisconsin state income tax withholding for employees. If your small business has employees working in Wisconsin, you'll need to withhold and pay Wisconsin income tax on their salaries. This is in addition to having to withhold federal income tax for those same employees.