This is an official Hawaii court form for use in a garnishment case, a Garnishee Calculation. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Garnishee Calculation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Calculation?

Access the most extensive collection of approved documents.

US Legal Forms is truly a platform to locate any state-specific template in just a few clicks, including Hawaii Garnishee Calculation examples.

There's no need to waste hours searching for a legally acceptable document.

After selecting a pricing plan, create your account. Pay using a credit card or PayPal. Download the document to your device by clicking on Download button. That's all! You need to submit the Hawaii Garnishee Calculation template and review it. To ensure that all is accurate, consult your local legal advisor for assistance. Register and simply discover over 85,000 useful forms.

- To utilize the documents library, select a subscription and create your account.

- If you have already set it up, just Log In and click on Download button.

- The Hawaii Garnishee Calculation file will be quickly saved in the My documents section (a section for each form you acquire from US Legal Forms).

- To establish a new account, adhere to the brief directions provided below.

- If you're planning to use a state-specific template, make sure to indicate the correct state.

- If possible, review the description to understand all of the specifics of the document.

- Utilize the Preview option if it's available to verify the document's details.

- If everything appears accurate, click on Buy Now button.

Form popularity

FAQ

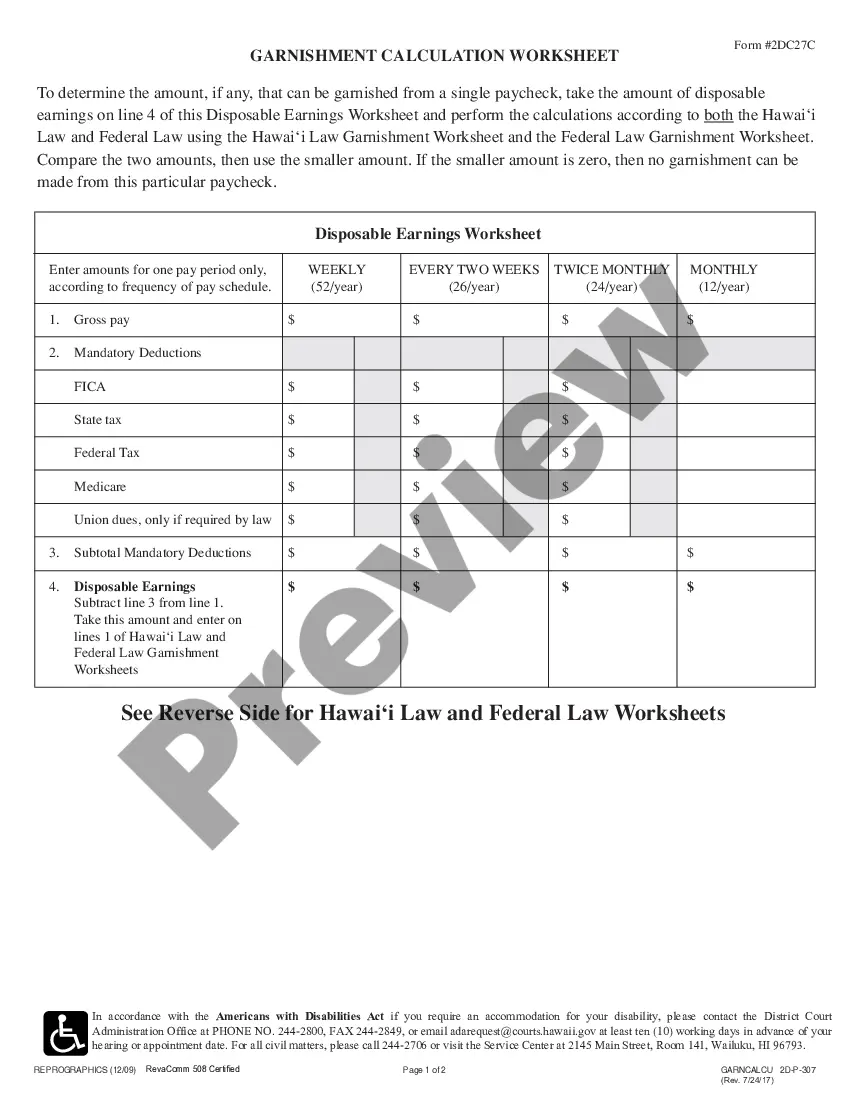

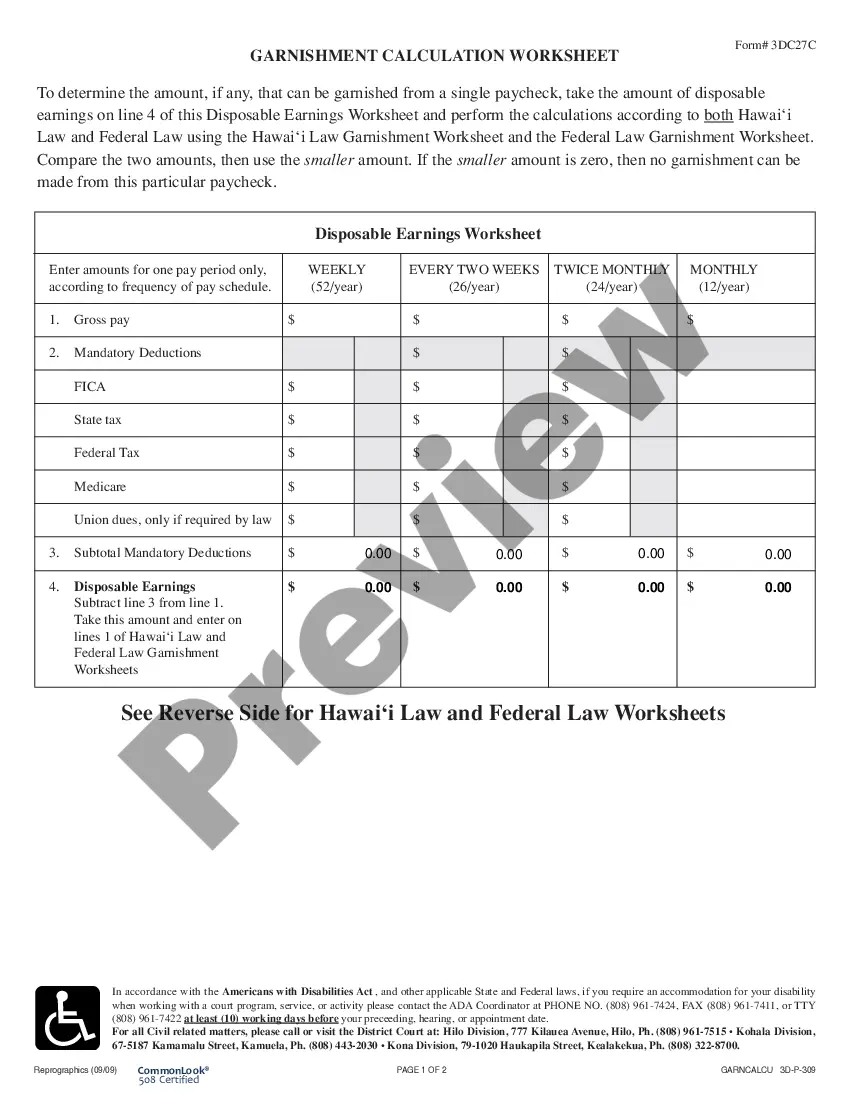

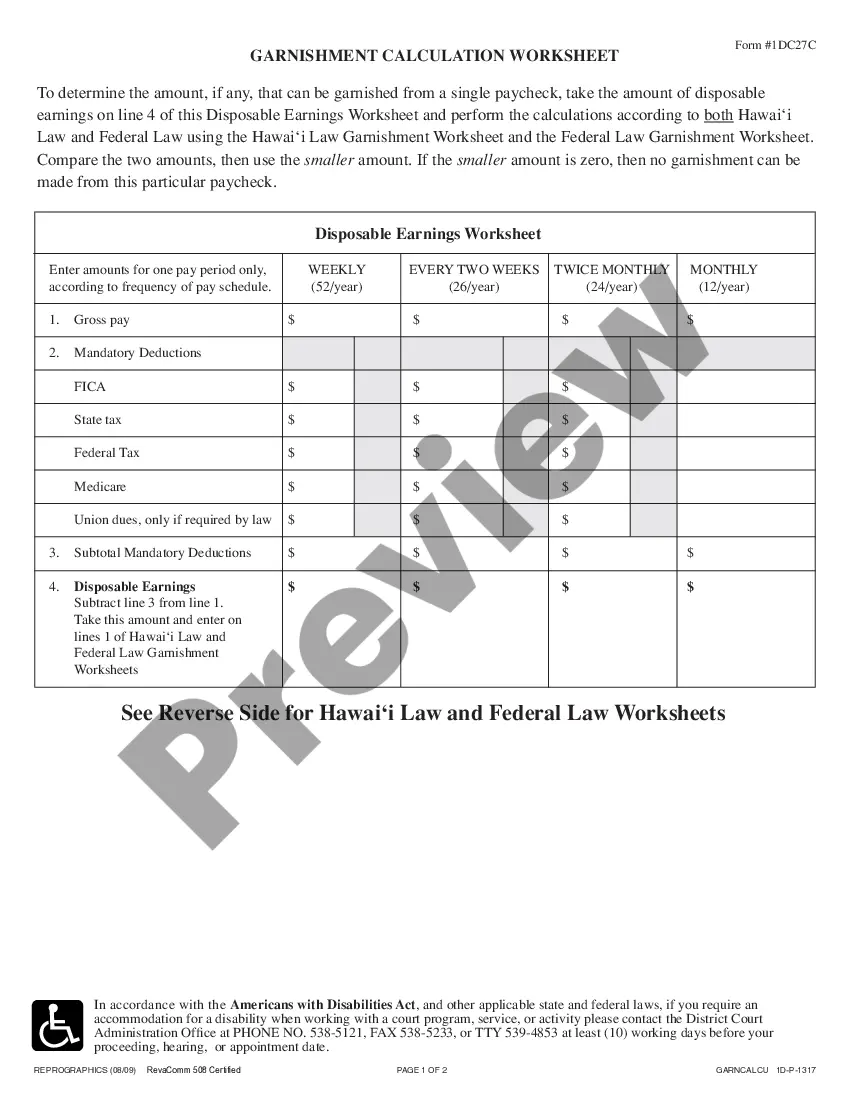

In Hawaii, garnishments are calculated based on specific legal guidelines. The process typically involves assessing your disposable income, which includes salary or wages after mandatory deductions. Additionally, Hawaii law sets limits on the percentage of income that can be garnished. Using our platform, US Legal Forms, simplifies the Hawaii Garnishee Calculation, ensuring that calculations are accurate and compliant with local regulations.

The maximum amount that can be garnished from your income depends on various factors, including your total wages and any existing debts. Under the Hawaii Garnishee Calculation rules, certain protections exist to shield a portion of your income from garnishment. Familiarizing yourself with these regulations can help you manage your finances better. For tailored assistance, consider using uslegalforms to navigate the complexities of garnishment effectively.

In Hawaii, the maximum amount that can be garnished from your paycheck is determined by the Hawaii Garnishee Calculation laws. Generally, creditors can garnish up to 25% of your disposable earnings, but specific exemptions may apply. To ensure you understand how this affects your finances, it's wise to review your situation carefully. Consulting with a legal expert can provide clarity and help safeguard your rights.

Employers typically cannot refuse to garnish your wages if they receive a valid court order or legal notice. The process falls under the Hawaii Garnishee Calculation guidelines, which aim to ensure compliance with court decisions. However, if the garnishment affects their employee’s ability to work or if they believe the order is incorrect, they may have grounds to contest it. It's essential to consult with a qualified professional if you find yourself in this situation.

To find 25% of your disposable income, simply take your disposable income amount and multiply it by 0.25. This calculation reveals the maximum amount that could be garnished from your wages in Hawaii. Understanding this figure aids you in making informed financial decisions about your obligations.

To lower the garnishment percentage, you may negotiate with your creditors or seek legal assistance. Providing them with a detailed account of your financial situation may help in reducing the garnishment amount. Using platforms like US Legal Forms can provide helpful resources and guidance for navigating this process.

In Hawaii, garnishments can take up to 25% of your disposable income. This cap ensures that you retain enough of your earnings to cover basic living needs. Knowing this limit can help you prepare for your financial obligations without excessive strain.

A good percentage of disposable income varies by personal situation, but generally, keeping your garnishment at or below 25% is advisable. This allows you to maintain essential living expenses while repaying debts. Reviewing your finances ensures you remain stable during this process.

To calculate disposable income, subtract your mandatory expenses from your total income. Mandatory expenses typically include taxes, social security, and other necessary deductions. This basic calculation provides a clear view of your finances and will help you in the Hawaii Garnishee Calculation process.

Calculating a 25% garnishment involves first determining your disposable income. Once you have that figure, multiply it by 0.25 to find out how much can be garnished. Understanding the Hawaii Garnishee Calculation helps you manage your finances and avoid surprises.