This is an official Hawaii court form for use in a garnishment case, a Garnishee Calculation. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Garnishee Calculation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Calculation?

Obtain entry to the most extensive collection of sanctioned forms.

US Legal Forms serves as a resource to locate any state-specific document in just a few clicks, including Hawaii Garnishee Calculation templates.

There's no need to waste several hours of your time searching for a court-approved form.

If everything appears correct, click Buy Now. After selecting a pricing plan, register an account. Pay via credit card or PayPal. Download the sample to your device by clicking Download. That's it! You should complete the Hawaii Garnishee Calculation template and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and effortlessly access over 85,000 useful forms.

- To utilize the document library, select a subscription, and set up an account.

- If you have registered, simply Log In and then select Download.

- The Hawaii Garnishee Calculation document will automatically be saved in the My documents tab (a section for all forms you save on US Legal Forms).

- To establish a new profile, follow the straightforward instructions outlined below.

- If you intend to use a state-specific sample, make sure to specify the correct state.

- If feasible, review the description to grasp all the details of the form.

- Utilize the Preview feature if available to review the document's content.

Form popularity

FAQ

To find out what you are being garnished for, refer to the notice you received regarding the garnishment. This notice typically details the nature of the debt, such as unpaid loans or child support. If the information is unclear, you can consult with the court or your creditor to gain a better understanding.

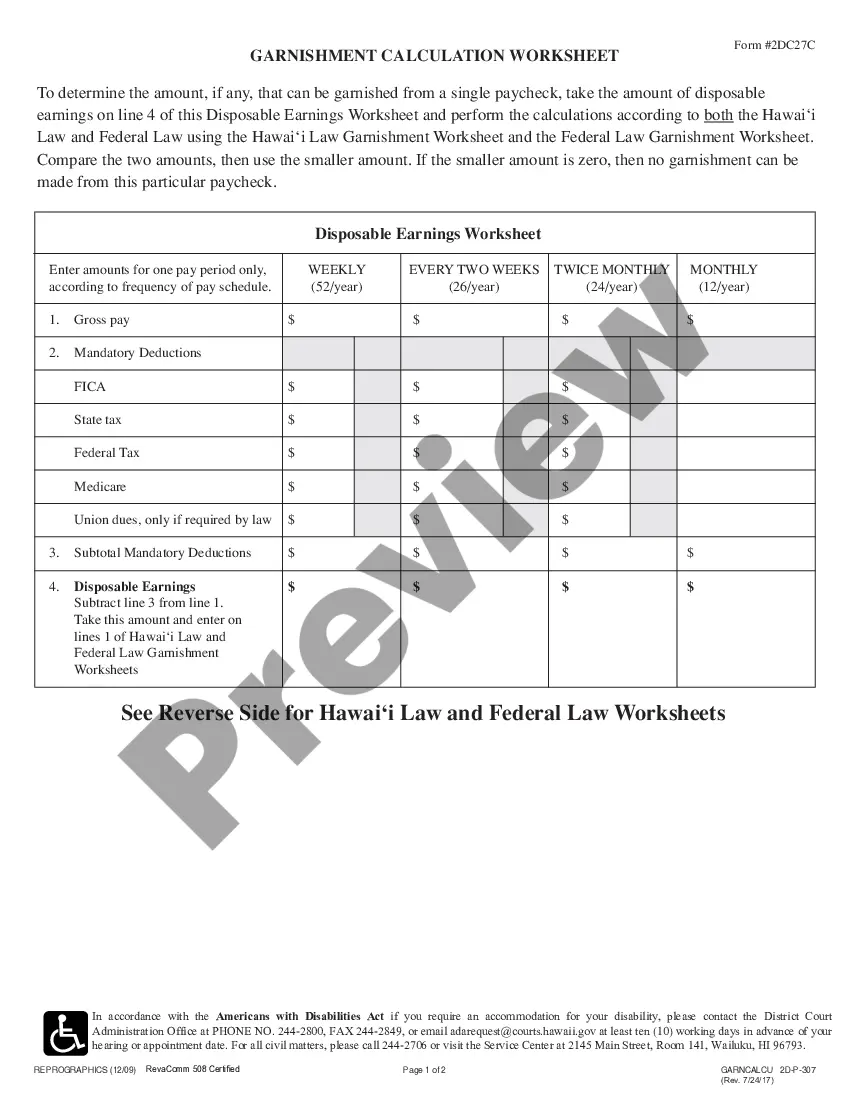

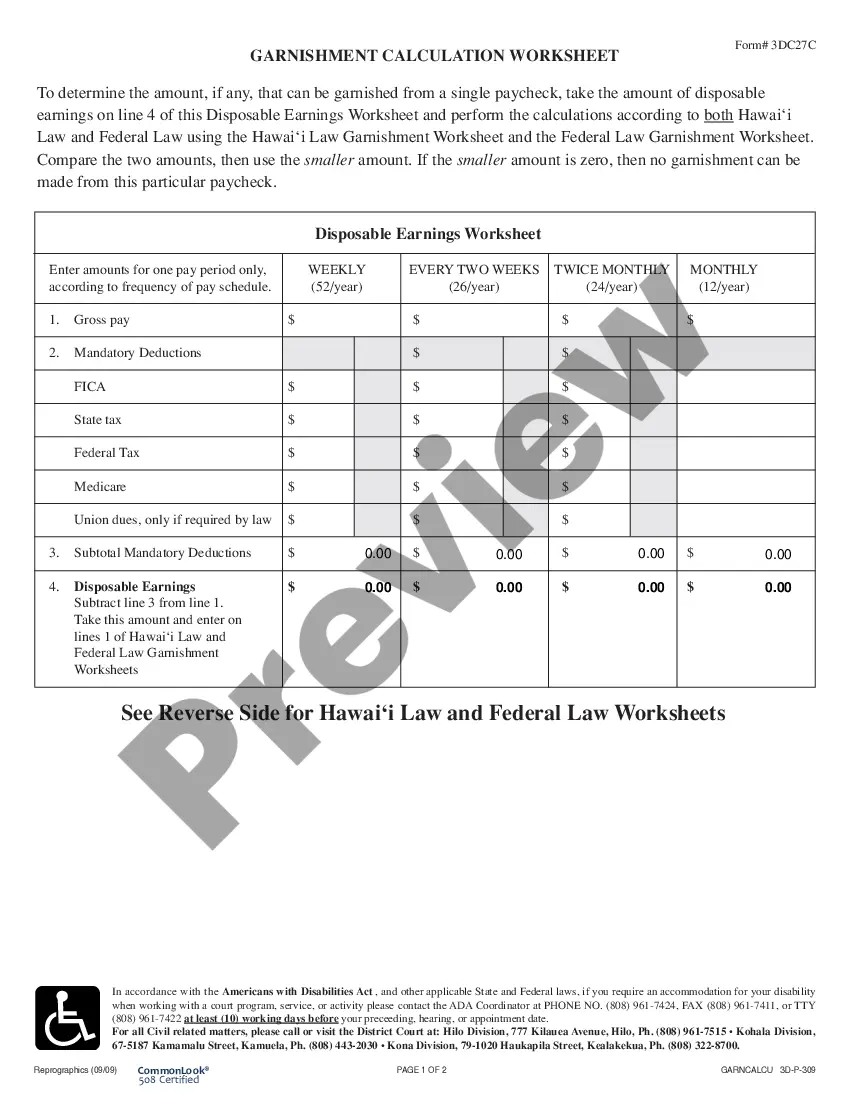

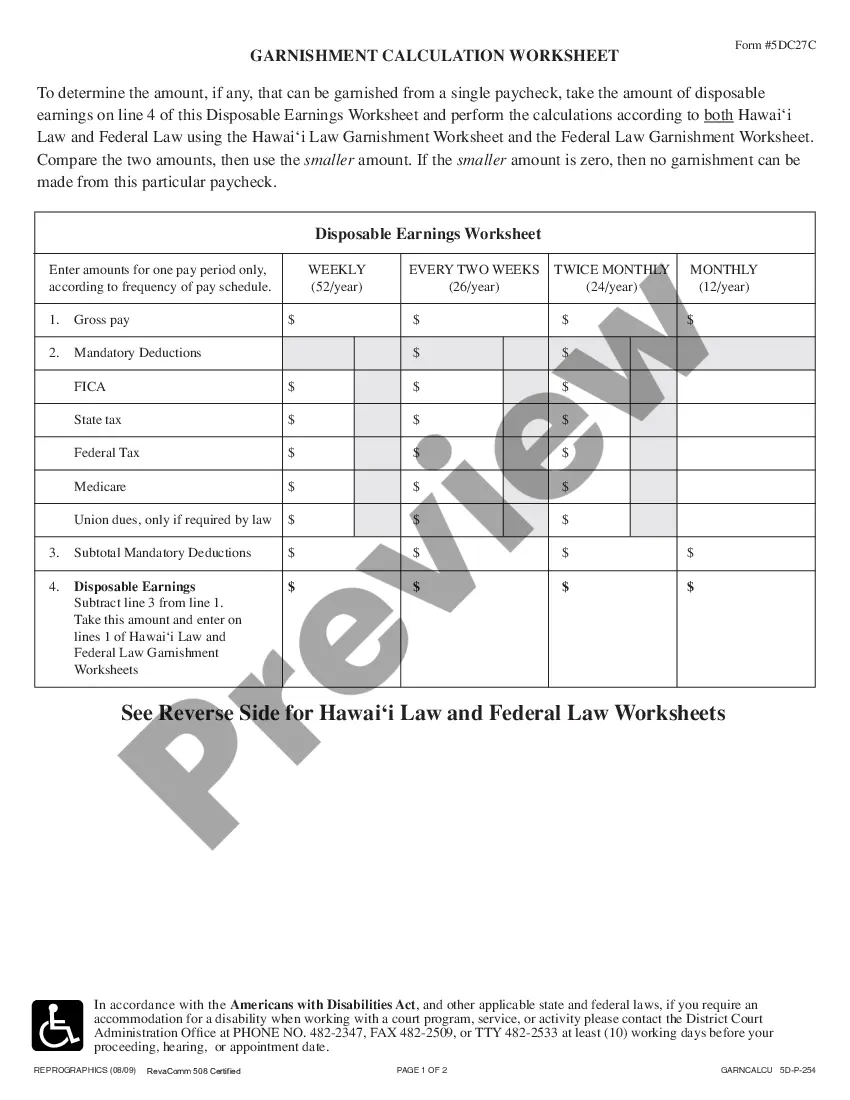

Garnishments in Hawaii are calculated based on the debtor's income and applicable state laws. The Hawaii Garnishee Calculation outlines how to determine disposable income, which is the amount left after mandatory deductions. These calculations help ensure that the garnishment amount is fair and compliant with legal guidelines.

Yes, garnishments are generally considered public records, meaning anyone can request information regarding them. This includes details about the debtor and the creditor, along with the amount being garnished. However, specific details about your financial situation might not be disclosed unless you take legal action.

You can find out what your garnishment is for by reviewing any legal documents served to you or by contacting the court where the garnishment was filed. If you still have questions, reach out to the creditor involved. Understanding the reason behind the garnishment can help you take appropriate actions moving forward.

To determine what you are being garnished for, check the court documents related to your garnishment. These documents usually contain details about the original debt and the reason for the garnishment. If you need further clarification, contact your creditor or the court for more information regarding your specific situation.

To garnish wages in Hawaii, you need to obtain a court order allowing the garnishment. This process typically starts with a judgment against the debtor. Once you have the court order, you can submit it to the employer along with a completed Hawaii Garnishee Calculation to ensure compliance with state regulations.

Calculating a garnishment involves determining the debtor's disposable income and applying Hawaii's garnishment laws. Generally, you subtract mandatory deductions, such as taxes and health insurance, from the total earnings. By using the Hawaii Garnishee Calculation guidelines, you can ensure that the correct amount is withheld while adhering to state laws.

To calculate a garnishment amount, you must first determine your disposable income, which is your earnings after mandatory deductions. Next, apply the applicable percentage set by law, keeping in mind both federal and state guidelines. Calculating this amount correctly can be complex, and it’s important to ensure accuracy to avoid potential issues. For comprehensive help with Hawaii Garnishee Calculation, turn to USLegalForms, where you can find resources to guide you through the process.

The maximum amount that can be garnished from your wages in Hawaii typically follows federal guidelines, which allow for up to 25% of your disposable income. However, you may also be protected by state laws that provide additional benefits. Understanding the specifics of your situation is key, as certain factors can influence how much can be legally withheld. For accurate Hawaii Garnishee Calculation, explore USLegalForms for assistance and tools that can help clarify the details.

In most cases, your employer cannot refuse to garnish your wages if they receive a valid court order. Under Hawaii law, employers are obligated to comply with garnishment orders for specific debts. If your employer hesitates or denies this obligation, it is crucial to discuss your situation with a legal professional, who can help you understand your rights. For clear guidance on Hawaii Garnishee Calculation, consider visiting USLegalForms for resources that can assist you.