This is an official Hawaii court form for use in a garnishment case, a Garnishee Calculation. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Garnishee Calculation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Calculation?

Access one of the most extensive collections of approved documents.

US Legal Forms is truly a resource to discover any state-specific document in mere clicks, such as Hawaii Garnishee Calculation forms.

No need to waste hours of your time searching for a court-recognized document.

After selecting a pricing option, establish your account. Pay using credit card or PayPal. Download the document to your device by clicking Download. That's it! You need to submit the Hawaii Garnishee Calculation document and review it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and easily browse over 85,000 useful templates.

- To utilize the document library, choose a subscription and establish an account.

- If you have created it, simply Log In and click on the Download button.

- The Hawaii Garnishee Calculation file will promptly save in the My documents section (a section for every document you save on US Legal Forms).

- To create a new account, follow the straightforward suggestions below.

- If you're planning to use a state-specific template, ensure you select the correct state.

- If it’s feasible, review the description to understand all aspects of the document.

- Utilize the Preview feature if available to check the information of the document.

- If everything seems correct, click Purchase Now.

Form popularity

FAQ

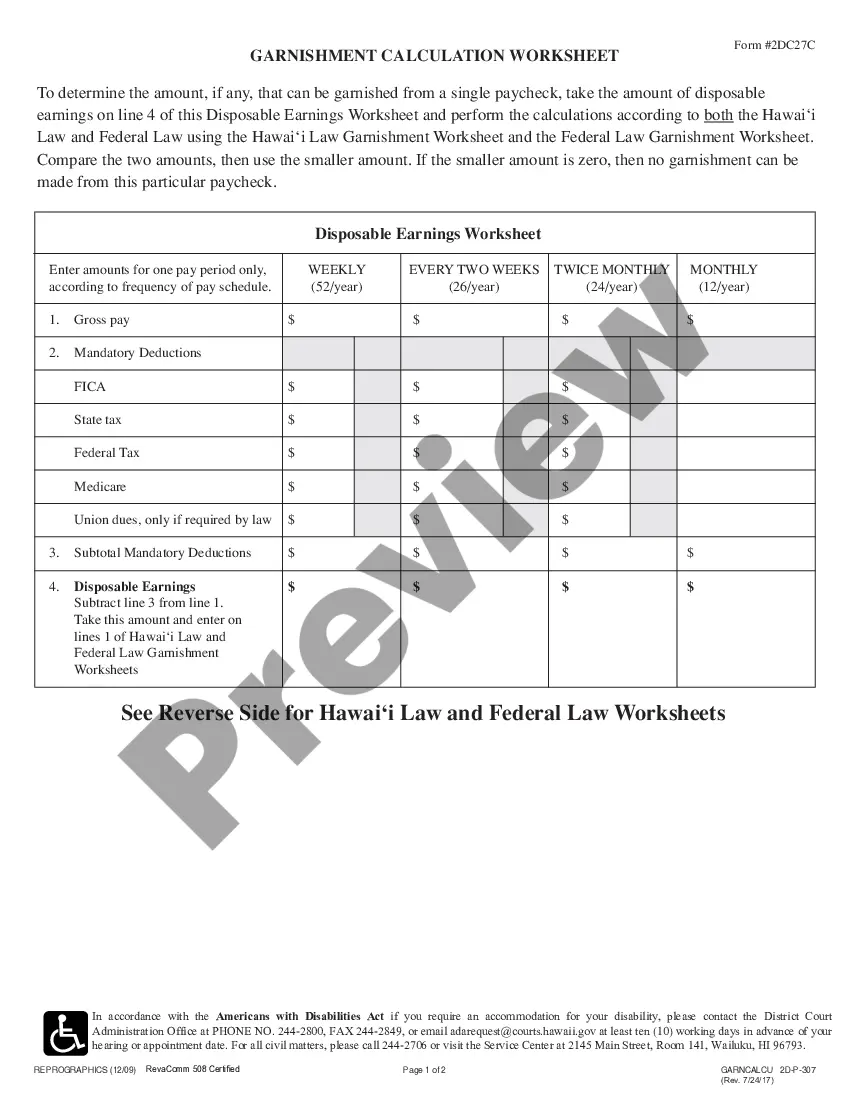

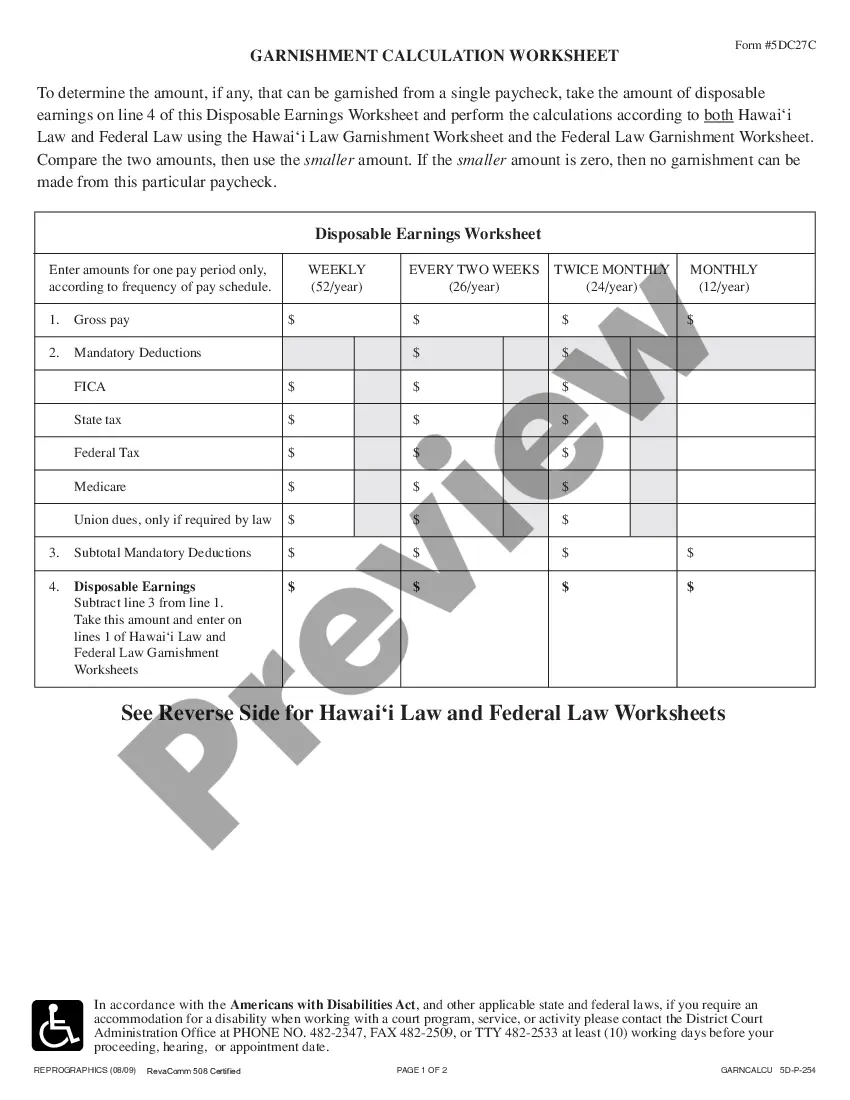

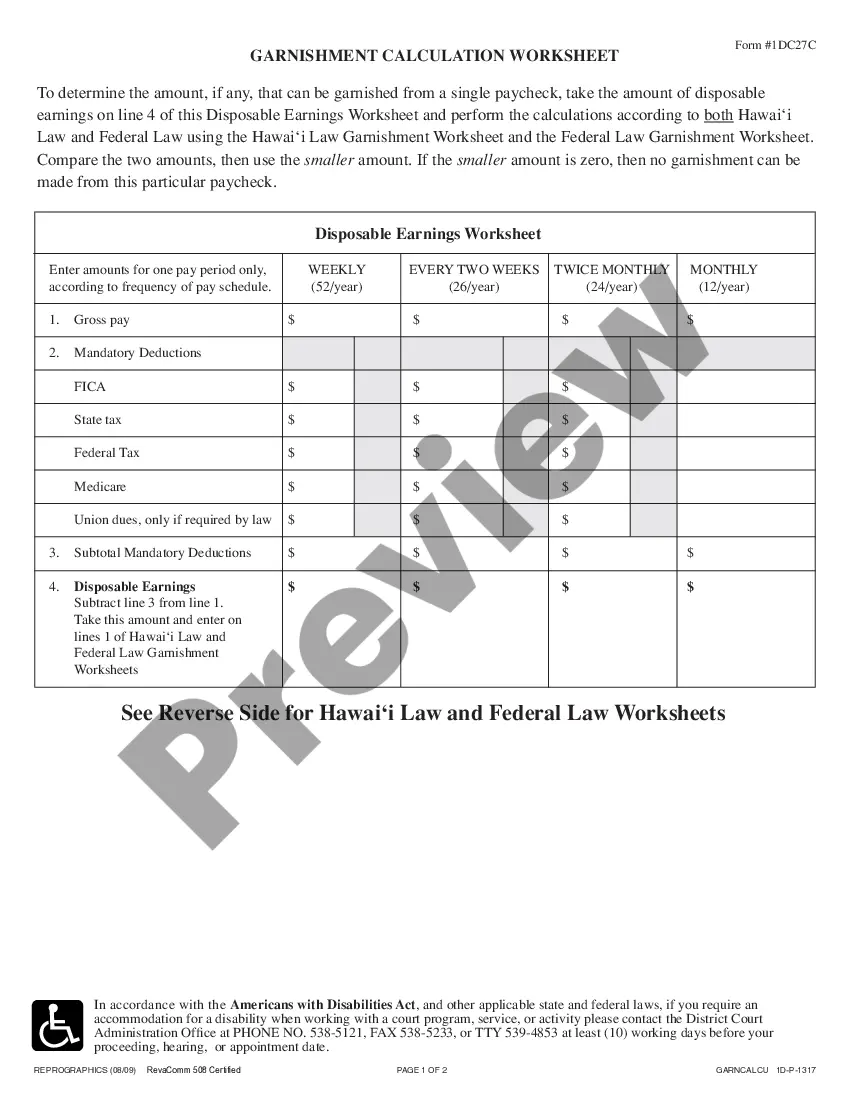

Garnishments are calculated based on the debtor's disposable income, which is the earnings left after mandatory deductions, such as taxes and retirement contributions. In Hawaii, the calculation follows specific state laws, which limit the amount that can be withheld from a paycheck. Typically, this amount cannot exceed 25% of disposable income or the amount by which disposable earnings exceed 30 times the federal minimum wage, whichever is lower. Utilizing tools like US Legal Forms can simplify understanding and calculating Hawaii Garnishee Calculation accurately.

To garnish wages in Hawaii, you need to obtain a court order that specifies the garnishment amount based on your Hawaii Garnishee Calculation. Start by filing a complaint and obtaining a judgment in court. Once you have the judgment, you can request a garnishment order, which your employer must comply with. Utilizing platforms like US Legal Forms can simplify this process by providing you with the necessary forms and guidance.

Figuring out what you are being garnished for involves reviewing your court documents and any notices you received. Typically, the garnishment is a result of a legal judgment against you due to unpaid debts. It's important to understand the details behind the Hawaii Garnishee Calculation to ensure that the correct amount is being deducted from your income. You can also consult legal resources or use platforms like US Legal Forms for guidance.

Your employer generally cannot refuse to garnish your wages if a legitimate court order is in place. Employers are legally obligated to comply with valid garnishment orders, and ignoring such orders can lead to legal repercussions. Understanding this aspect of Hawaii Garnishee Calculation can empower you to ensure that the process works smoothly. Remember, having the right resources, like USLegalForms, can help you navigate these legal requirements more effectively.

To calculate a garnishment amount in Hawaii, start by identifying your disposable earnings, which is your income after mandatory deductions. Then, apply the formula for Hawaii Garnishee Calculation, which allows the lesser of 25% of your disposable income or the amount over the legal minimum threshold. Accurate calculation is crucial for both creditors and debtors to ensure compliance with state laws. You can simplify this process with tools from USLegalForms for more clarity.

In Hawaii, the maximum amount that can be garnished depends on your disposable earnings. Typically, the law allows creditors to garnish up to 25% of your disposable income or the amount by which your income exceeds 40 times the federal minimum wage. Understanding the Hawaii Garnishee Calculation can help you determine the exact amount. It's essential to stay informed to ensure that you know your rights.

While quitting your job may seem like a way to avoid wage garnishment, it often complicates your financial situation and may not eliminate your debt. Instead, consider focusing on negotiating with your creditor for more favorable terms. Addressing issues directly with the help of resources familiar with the Hawaii Garnishee Calculation will be much more beneficial in the long run.

Yes, you can negotiate after wage garnishment has begun. It is important to reach out to your creditor to discuss your financial situation and explore options for reducing the garnishment amount. Using tools or services like UsLegalForms can guide you through this negotiation process, ensuring that you leverage the Hawaii Garnishee Calculation effectively.

In Hawaii, creditors can garnish up to 25% of your disposable wages after deductions. This amount is capped by federal and state laws to protect workers from excessive garnishment. Utilizing the Hawaii Garnishee Calculation helps ensure that you know exactly how much can be withheld from your paychecks.

To calculate the garnishment amount, you must first determine your disposable income by subtracting taxes and necessary expenses from your gross income. Once you have that figure, apply the appropriate percentage as dictated by the Hawaii Garnishee Calculation. This will provide you with the amount that can legally be garnished from your wages.