Determining Self-Employed Independent Contractor Status

About this form

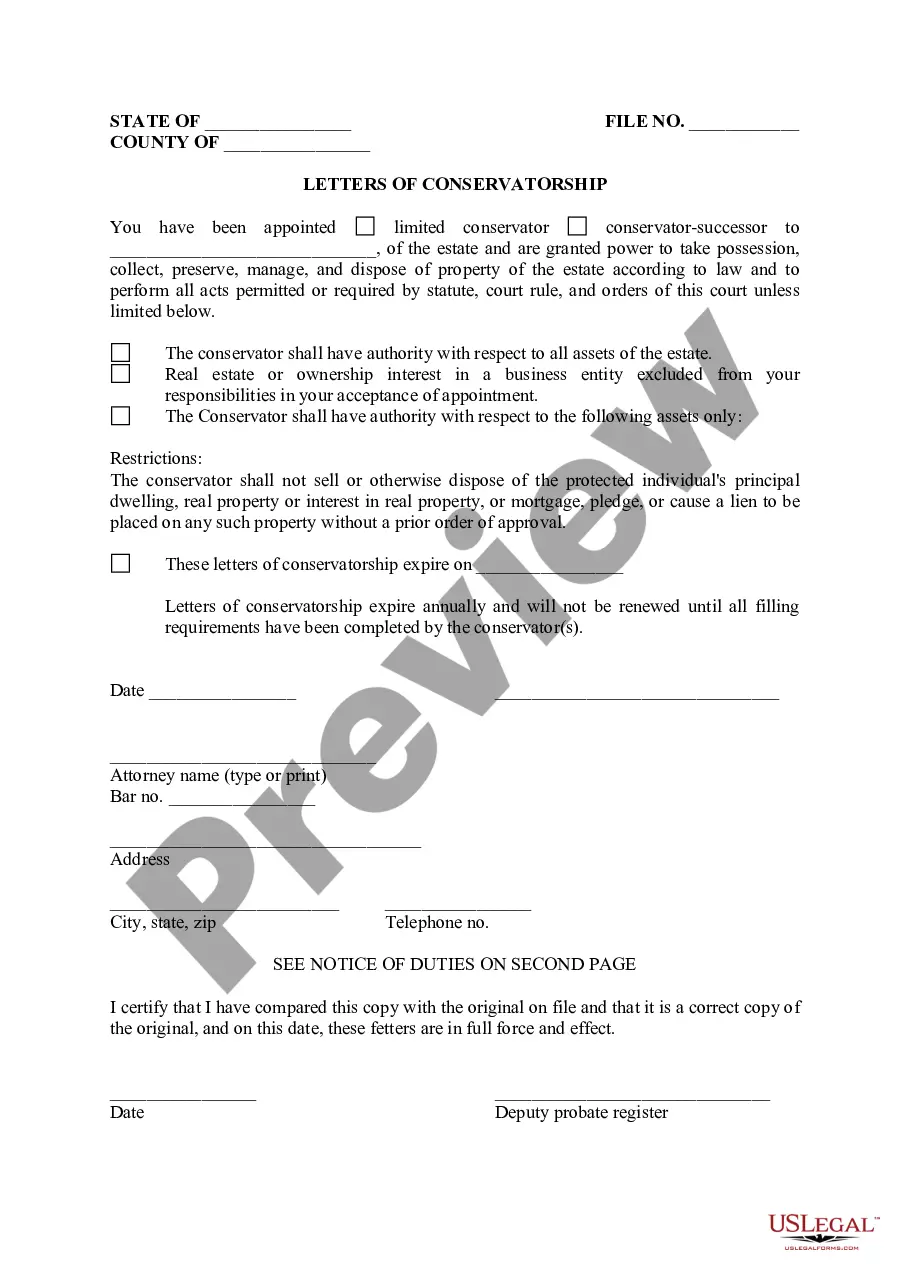

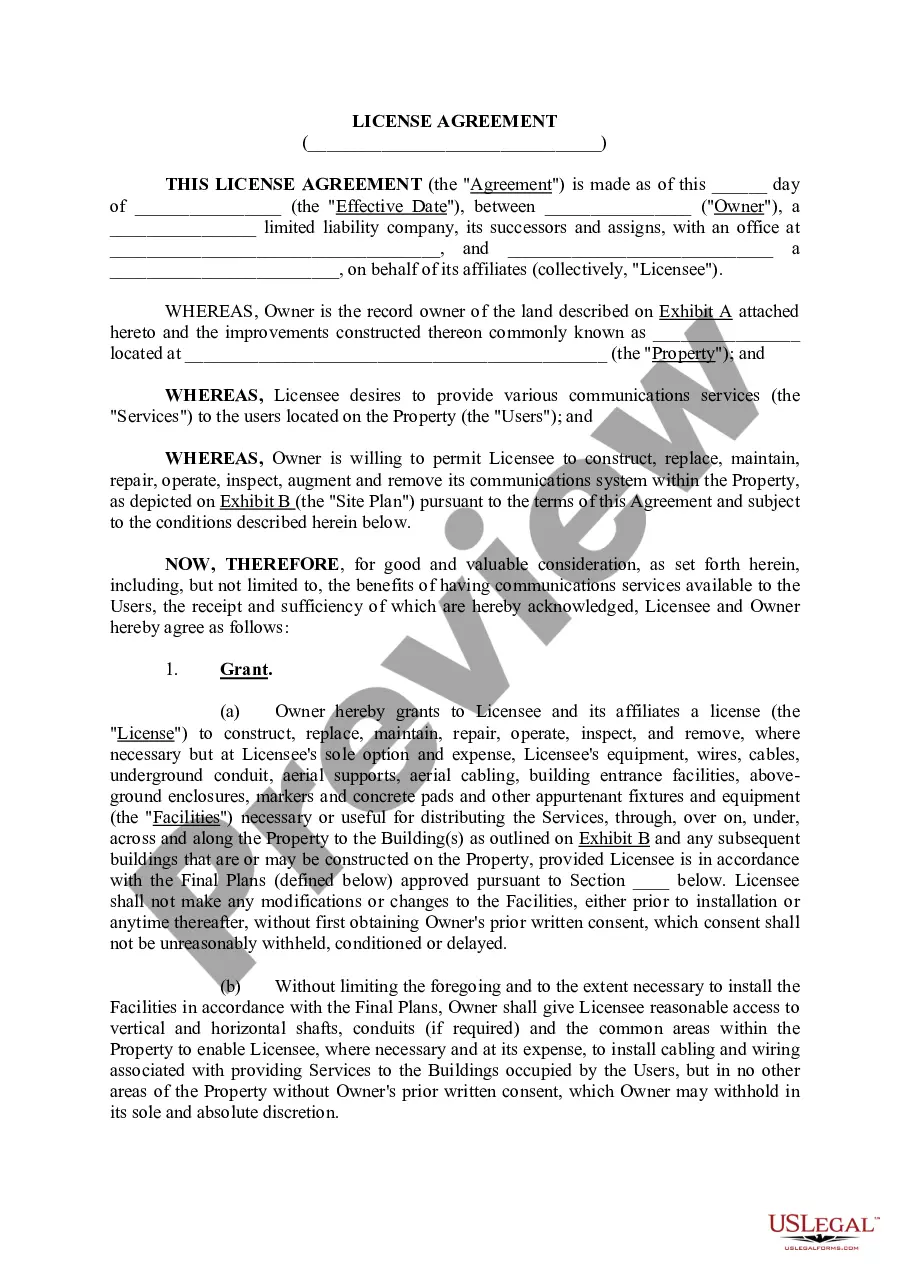

The "Determining Self-Employed Independent Contractor Status" form is a checklist designed to help businesses assess the classification of workers as independent contractors or employees. This form is based on IRS Form SS-8 and provides a systematic approach to evaluate various factors that determine a worker's employment status. Using this form can help prevent potential legal issues and ensure compliance with tax regulations by clarifying the relationship between the contractor and the business.

Main sections of this form

- Section to describe the business and the work performed.

- Fields for detailing written agreements or terms of service.

- Questions regarding training and supervision of the worker.

- Sections on payment methods and any potential expenses incurred by the worker.

- Questions related to competition, scheduling, and any need for licensing.

Situations where this form applies

This form should be used when a business is unsure of how to classify a worker. It is particularly useful for situations where the worker provides services on a freelance basis but may be misclassified as an independent contractor. Completing this form can help clarify the nature of the working relationship, ensuring that both the worker and the business understand their rights and obligations.

Who can use this document

- Employers seeking to determine the employment status of their workers.

- Freelancers and independent contractors who want clarification on their classification.

- Business owners wanting to ensure compliance with IRS guidelines.

How to prepare this document

- Begin by describing your business and the nature of the work done by the worker.

- Indicate whether there is a written agreement in place and attach a copy if applicable.

- Respond to each question regarding the degree of control, training, and supervision provided to the worker.

- Detail how the worker is compensated, including any expenses they may incur.

- Complete sections concerning any business licenses or local regulatory requirements affecting the worker's role.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide comprehensive descriptions of the work performed.

- Not attaching relevant written agreements that clarify the worker's role.

- Overlooking the importance of detailing control and supervision levels.

Why complete this form online

- Convenience of completing forms from any location without the need for physical copies.

- Editability allows users to revise answers as needed.

- Reliable source of guidance based on IRS regulations, reducing the risk of misclassification.

Looking for another form?

Form popularity

FAQ

Income-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement. Contracts and agreements. Invoices. Bank statements and Pay stubs.

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.

Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do. Choose a Self-Employed Business Structure and Get a Proper License. Open a Business Bank Account. Advertise Your Independent Contractor Services.

Wage and Tax Statement for Self Employed (1099). These forms prove your wages and taxes as a self employed individual. Profit and Loss Statement or Ledger Documentation. Bank Statements.

Many doctors, lawyers, dentists, and individuals who offer their services to the public are often independent contractors. As mentioned above, freelance writers work as independent contractors, writing articles and selling it to publications.

Workers who complete tasks or work on individual projects will fall under a 1099. An independent contractor is able to earn a living on his or her own rather than depending on an employer.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee.The payer must correctly classify each payee as either an independent contractor or employee. Another term for an independent contractor is freelancer.

What's the Difference Between an Independent Contractor and an Employee?For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors.