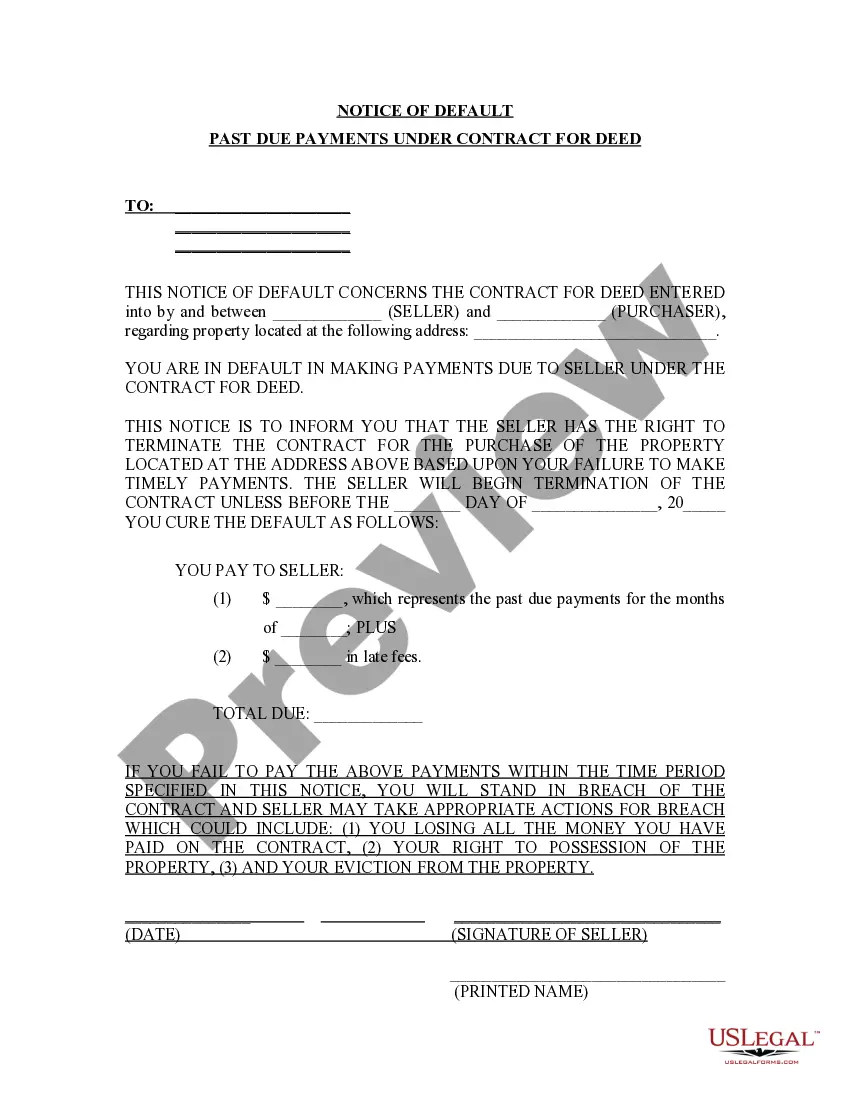

This form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Hawaii Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Hawaii Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to acquire a printable Hawaii Notice of Default for Delinquent Payments related to Contract for Deed. Our court-acceptable forms are created and consistently refreshed by proficient lawyers.

Ours is the most comprehensive Forms library available online and provides economical and precise templates for clients, legal experts, and small to medium-sized businesses.

The documents are organized into state-specific categories, and several of them may be previewed prior to downloading.

US Legal Forms provides a vast array of legal and tax documents and packages for business and personal requirements, including Hawaii Notice of Default for Delinquent Payments related to Contract for Deed. Over three million users have successfully utilized our platform. Choose your subscription plan and acquire high-quality forms in just a few clicks.

- Ensure you have the correct template according to the state required.

- Examine the document by reviewing the description and using the Preview function.

- Click Buy Now if it is the template you seek.

- Create your account and pay through PayPal or by debit|credit card.

- Retrieve the template to your device and feel free to use it multiple times.

- Use the Search engine if you wish to locate another document template.

Form popularity

FAQ

A Hawaii Notice of Default for Past Due Payments does not technically expire, but its implications can change over time. If the borrower does not resolve the default, the lender may take further actions, such as initiating foreclosure. Therefore, it's crucial to address the notice promptly to avoid escalation.

To find properties with a Hawaii Notice of Default for Past Due Payments, you can check local county recorder’s offices or utilize online databases that track foreclosure listings. Additionally, some real estate platforms provide alerts on properties in default. Keeping a close watch on these listings could present investment opportunities or help you understand the marketplace better.

Yes, a Hawaii Notice of Default for Past Due Payments in connection with Contract for Deed is considered a public record. This means anyone can access the information through public records databases. Knowing this can be important for potential buyers or investors interested in a property that is under default, so it is vital to take timely action to address a default.

When you receive a Hawaii Notice of Default for Past Due Payments in connection with Contract for Deed, your first step is to carefully review the notice. Understand the grounds for default and the timeline for response. It is advisable to communicate with your lender or servicer to discuss your situation and negotiate a possible resolution. You may also want to seek legal advice to ensure that your rights are protected.

The 120-day rule for foreclosure in Hawaii requires lenders to wait 120 days following a missed mortgage payment before starting foreclosure proceedings. This rule allows homeowners time to resolve any payment issues, thus reducing the number of forced sales. Understanding this rule is essential for anyone facing a Hawaii Notice of Default for Past Due Payments in connection with Contract for Deed. Utilizing platforms like USLegalForms can assist in navigating this process effectively.

Foreclosure actions typically involve five key stages: pre-foreclosure, notice of default, auction, redemption period, and post-foreclosure. Initially, the lender sends a notice of default to the borrower, marking the start of the foreclosure process. Following this, the property may be auctioned off, providing an opportunity for buyers. Awareness of these stages is vital when dealing with a Hawaii Notice of Default for Past Due Payments in connection with Contract for Deed.

The 120-day rule in Hawaii mandates that lenders must wait for 120 days after a borrower misses a payment before initiating foreclosure proceedings. This rule provides the borrower with time to address past due balances and potentially avoid losing their home. The waiting period is designed to facilitate communication and resolution between the lender and borrower. Knowing this can help individuals facing a Hawaii Notice of Default for Past Due Payments in connection with Contract for Deed.

In Hawaii, certain situations allow for exceptions to the 120-day rule related to foreclosure actions. For instance, if the borrower commits fraud, or if the property is abandoned, the lender may bypass this waiting period. Additionally, cases involving a reverse mortgage also do not adhere to the 120-day timeline. Understanding these exceptions is crucial for anyone dealing with a Hawaii Notice of Default for Past Due Payments in connection with Contract for Deed.

If you are three months behind on your mortgage, you will likely receive a notice of default from your lender. This situation can lead to serious consequences like foreclosure if not addressed quickly. Taking immediate action, such as seeking professional help, can help you understand your options and mitigate risks in your Contract for Deed.

A deed in lieu of foreclosure example involves a homeowner transferring the ownership of their home to the bank to avoid foreclosure. This process can sometimes help the borrower avoid the negative effects of foreclosure on their credit score. Always consult legal resources and guides, such as those from USLegalForms, for comprehensive documentation.