This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

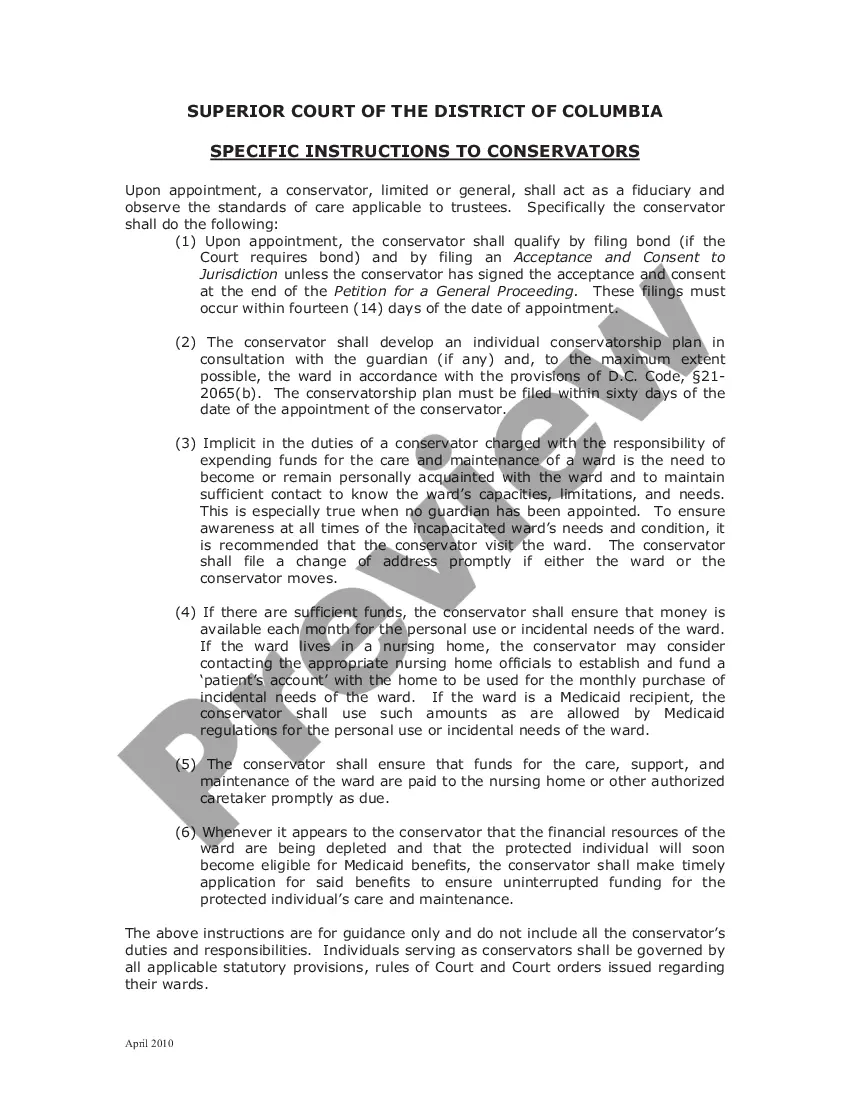

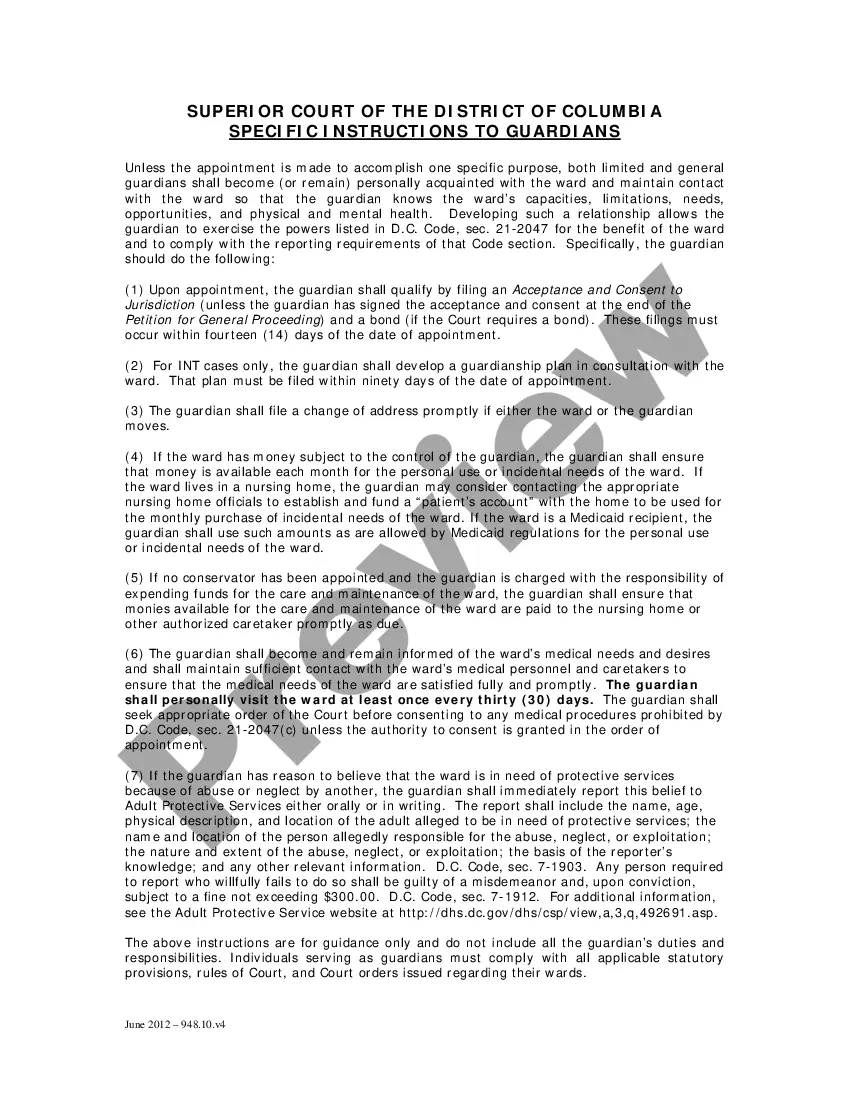

District of Columbia Specific Instructions to Conservators and Conservator Information Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Specific Instructions To Conservators And Conservator Information Sheet?

The greater the number of documents you generate - the more anxious you feel.

You can discover countless District of Columbia Specific Guidelines for Conservators and blanks for the Conservator Information Sheet online, but you may lack confidence in knowing which ones to trust.

Streamline the process and make acquiring examples easier with US Legal Forms.

Provide the requested details to set up your account and complete the payment for the order using PayPal or a credit card. Choose a document format that works best for you and obtain your template. Access every file you download in the My documents section. Simply head there to create a new copy of your District of Columbia Specific Guidelines for Conservators and the Conservator Information Sheet. Even when utilizing well-prepared forms, it remains crucial to consider consulting your local attorney to review the completed document to ensure that it is accurately filled out. Achieve more for less with US Legal Forms!

- If you have a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the page of the District of Columbia Specific Guidelines for Conservators and the Conservator Information Sheet.

- If you have not used our platform previously, complete the registration process with these steps.

- Confirm the validity of the District of Columbia Specific Guidelines for Conservators and the Conservator Information Sheet in your state.

- Verify your selection by reviewing the description or utilizing the Preview feature if it's available for your chosen document.

- Click on Buy Now to initiate the registration process and select a pricing plan that suits your requirements.

Form popularity

FAQ

Limited conservatorship allows for the management of specific aspects of a person’s life, such as their finances or health care, while still allowing the individual to retain some rights and responsibilities. In contrast, LPS conservatorship is designed for individuals with serious mental health conditions who may require more comprehensive oversight. Understanding these distinctions is essential, and referring to the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet can provide further guidance on these important topics.

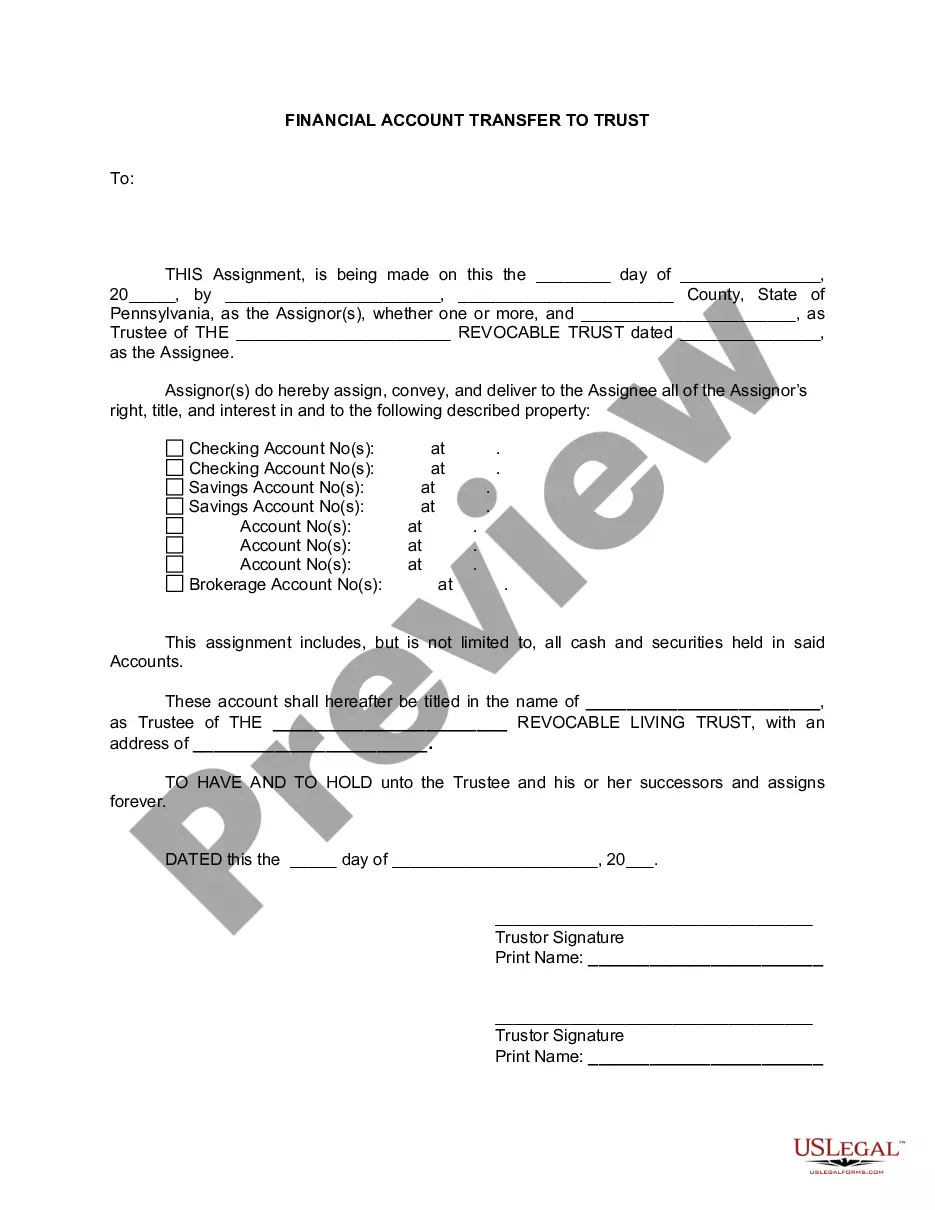

A guardian conservator account is a financial account specifically designed for managing the funds and assets of individuals under conservatorship. This account helps ensure that the financial interests of the protected person are properly handled according to the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet. By establishing such an account, guardians can ensure transparency and accountability in financial dealings, providing peace of mind for all parties involved.

A conservator does hold authority over financial and certain personal decisions that a Power of Attorney (POA) may have handled previously. While both roles aim to protect the interests of the individual, a conservatorship often comes into play when a court has determined the person cannot make decisions for themselves. For a more thorough understanding, review the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet.

Obtaining conservatorship can be a complex process, often requiring legal documentation and a court hearing. It involves demonstrating the need for a conservator for the person in question. For a smoother experience, explore the guidelines available in the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet, which detail the procedures and necessary paperwork.

In Washington D.C., guardianship typically involves caring for someone who cannot care for themselves physically, whereas conservatorship relates to managing the finances of someone deemed incapacitated. Each situation requires different legal considerations and responsibilities. To navigate these distinctions, refer to the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet for clarity on each role.

A conservatorship account usually does not have a beneficiary as the funds are for the benefit of the conservatee. Instead, the conservator manages the account directly until a decision is made regarding the conservatee's assets. For detailed guidance on managing these accounts, consult the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet.

Setting up a conservatorship account involves contacting your bank to discuss their requirements. Typically, you will need to present legal documentation that establishes the conservatorship. For comprehensive details, refer to the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet to ensure all steps are followed correctly.

Yes, a conservator can add themselves to a bank account associated with the conservatorship. This step is often necessary for managing the finances of the conservatee effectively. Always ensure that any actions taken comply with the guidelines in the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet.

When naming a conservatorship account, it should be clearly labeled to reflect the conservatorship status. You may title the account with the name of the conservatee followed by ‘Conservatorship’ and the name of the conservator. This helps in organizing the financial management of the conservatorship as outlined in the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet.

Conservatorships can have significant drawbacks, such as limited control for the person under conservatorship. The process can be expensive and may require ongoing court supervision. To learn more about the implications and responsibilities of conservatorships, examine the District of Columbia Specific Instructions to Conservators and Conservator Information Sheet for detailed guidance.