Pennsylvania Revocation of Living Trust

About this form

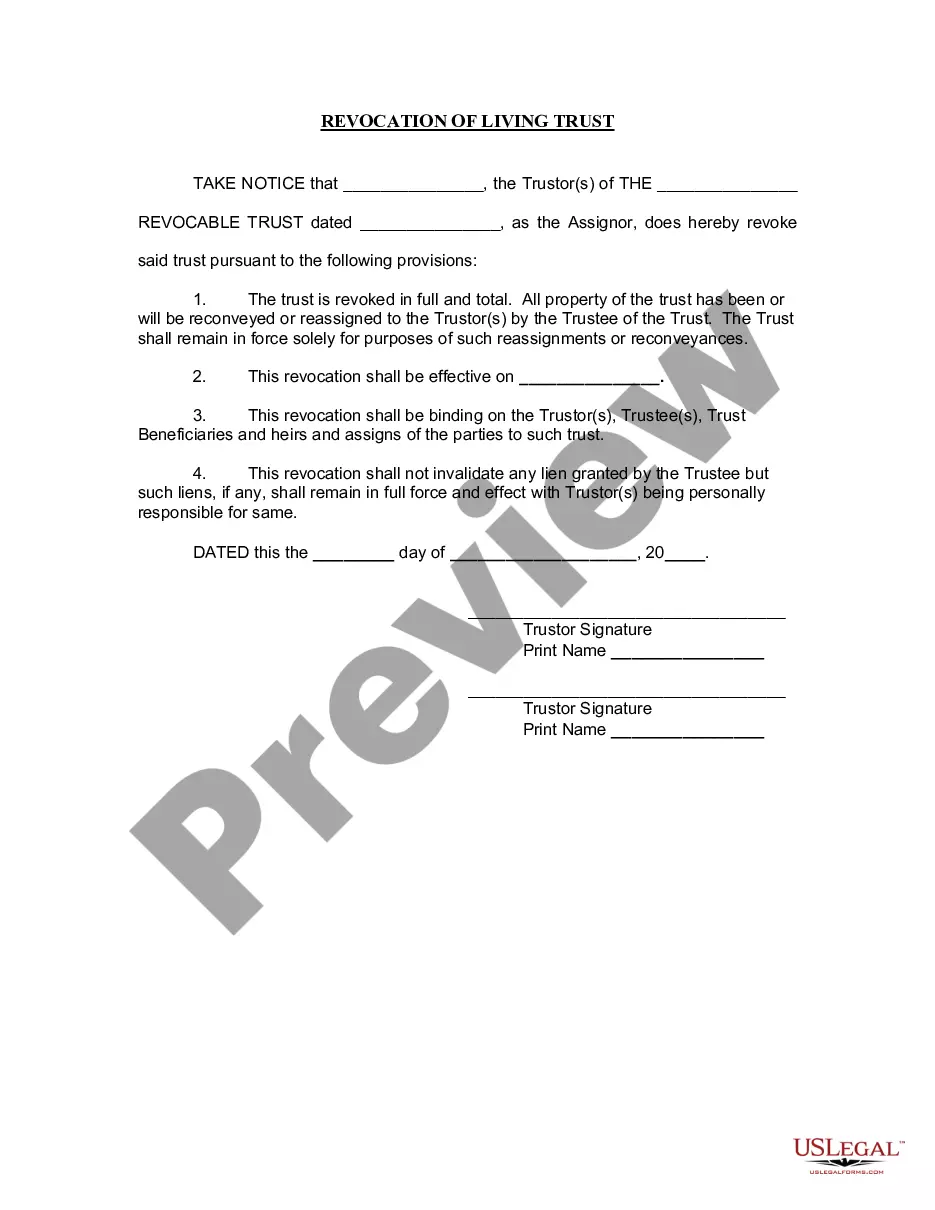

The Revocation of Living Trust form is a legal document used to officially revoke an existing living trust. Unlike other estate planning documents, this form specifically addresses the termination of a living trust, enabling the trustor to reclaim ownership of the trust assets. By completing this form, the trustor ensures that the trust is fully and completely revoked, making it an essential step in estate management.

Key parts of this document

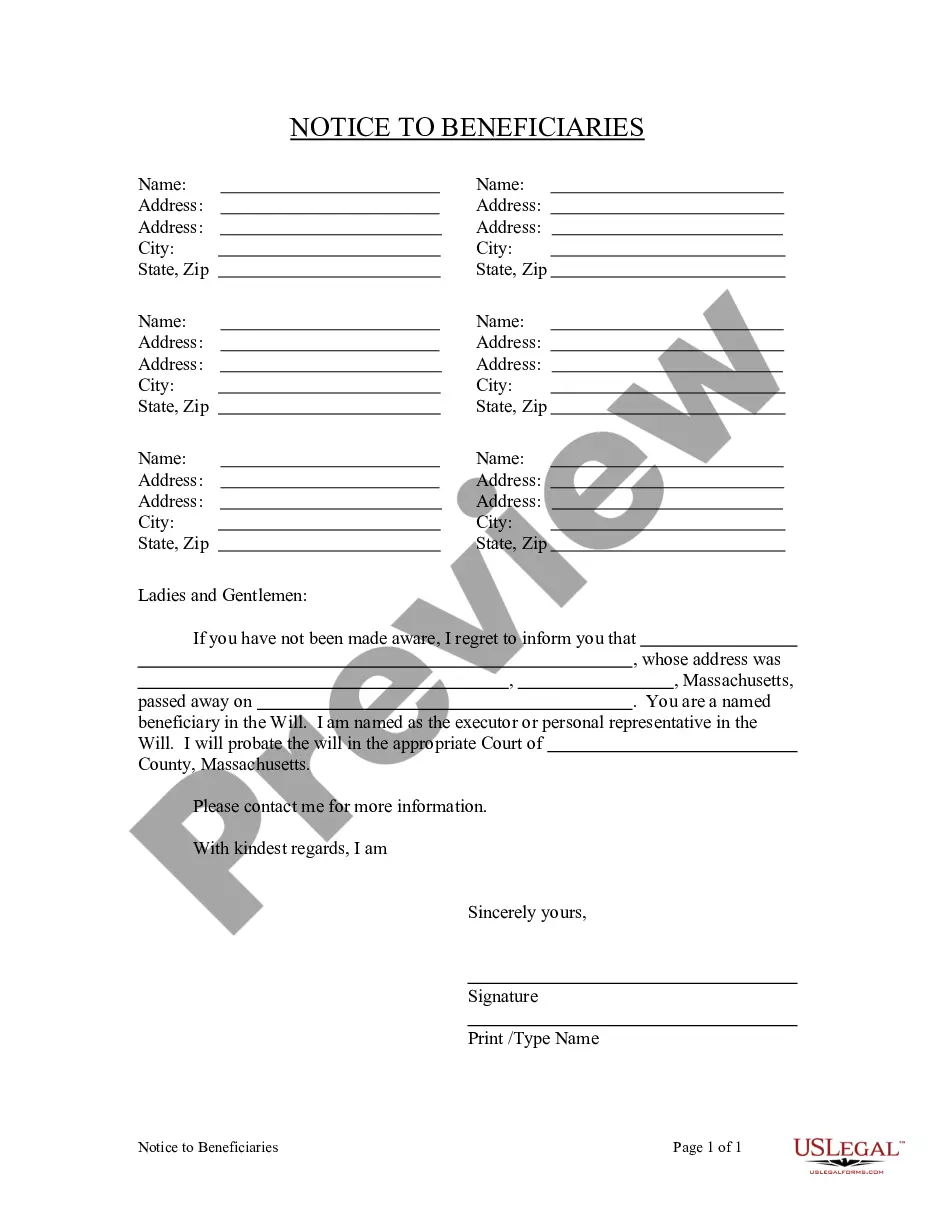

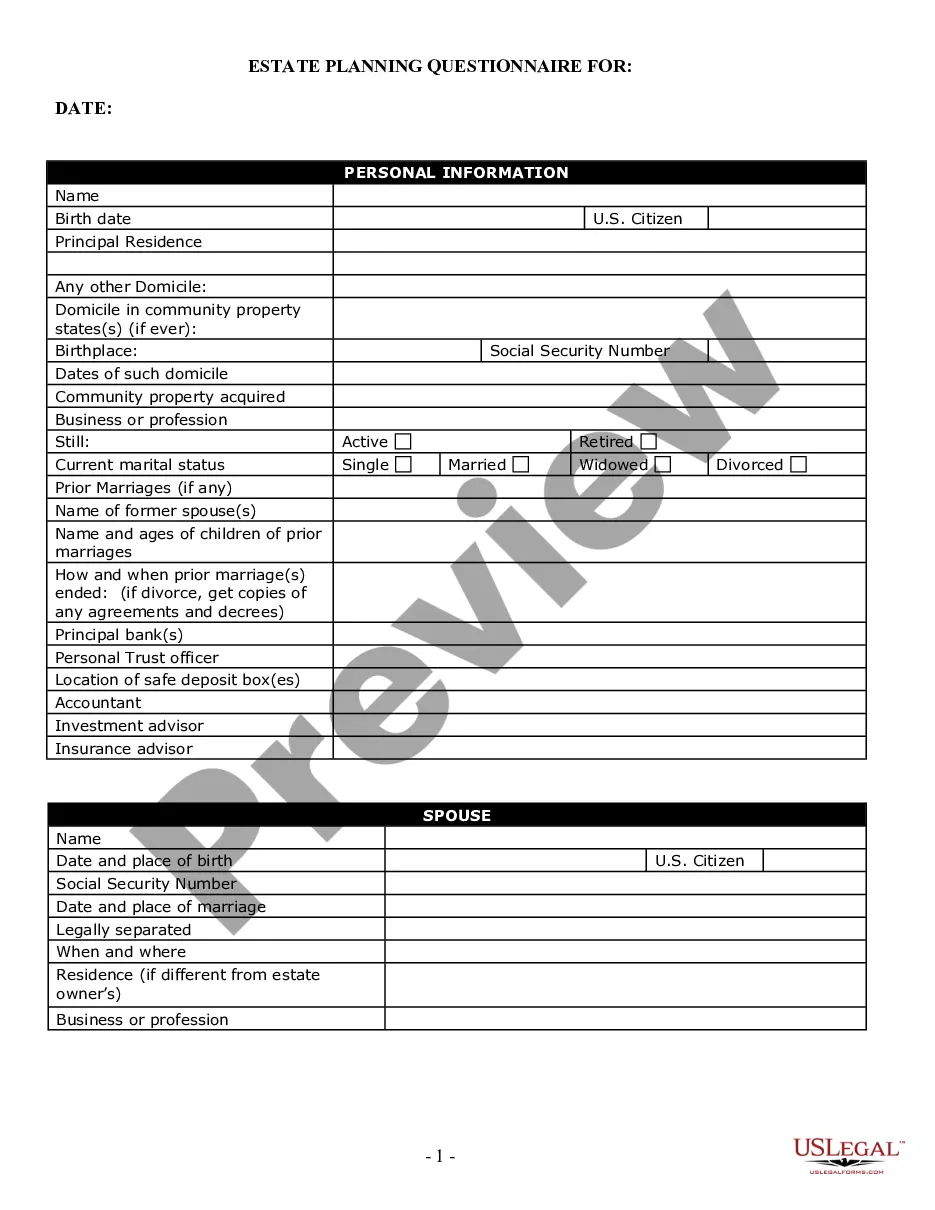

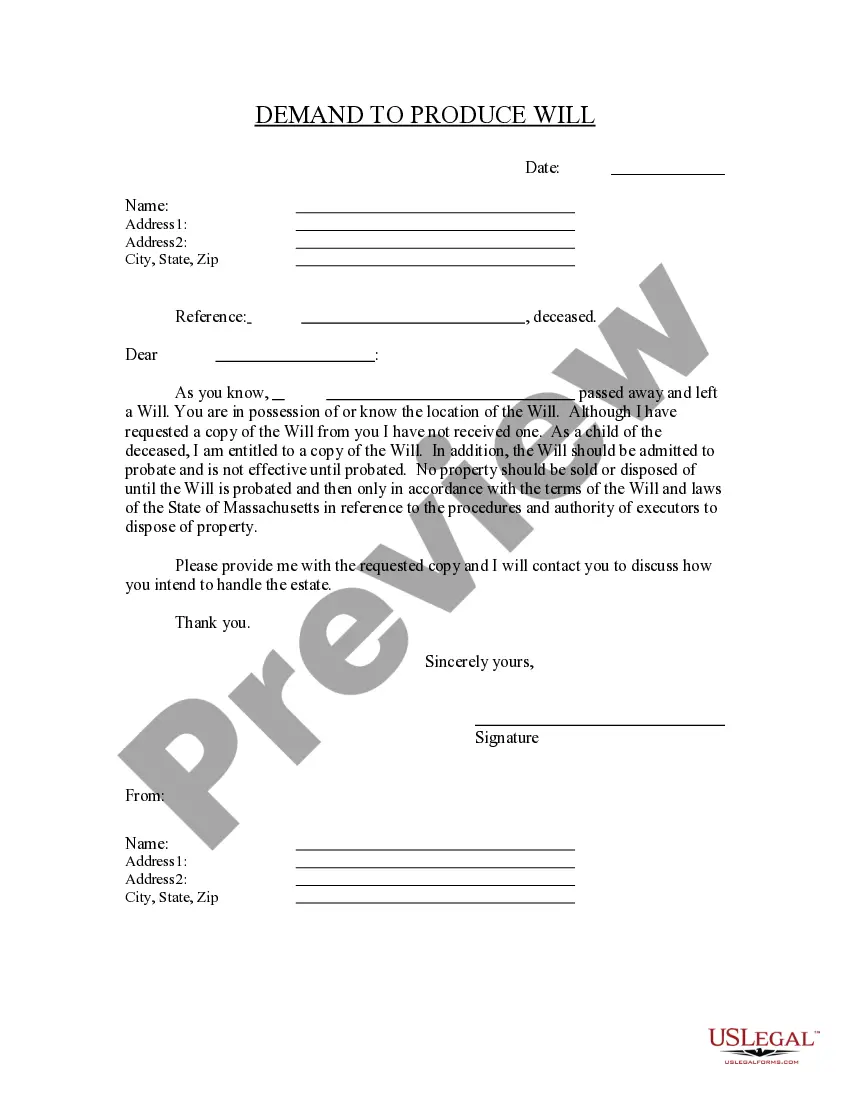

- Identification of the trustor(s) and the living trust being revoked.

- Declaration of full and total revocation of the trust.

- Statement regarding the reconveyance of trust property to the trustor(s).

- Effective date of the revocation.

- Signature lines for trustor(s) and notary acknowledgment.

When to use this form

This form should be used when the trustor wishes to terminate an existing living trust. Common situations include when a trustor wishes to change their estate plan, has experienced a significant life event (such as divorce or the death of a beneficiary), or simply prefers to manage their assets without a trust. Completing this form is crucial to ensure that all assets are returned to the trustor properly and legally.

Who should use this form

- Anyone who has established a living trust and wishes to revoke it.

- Individuals looking to change their estate planning strategy.

- Trustors who have experienced changes in personal or financial circumstances.

- Anyone needing to formally document the revocation for legal purposes.

Steps to complete this form

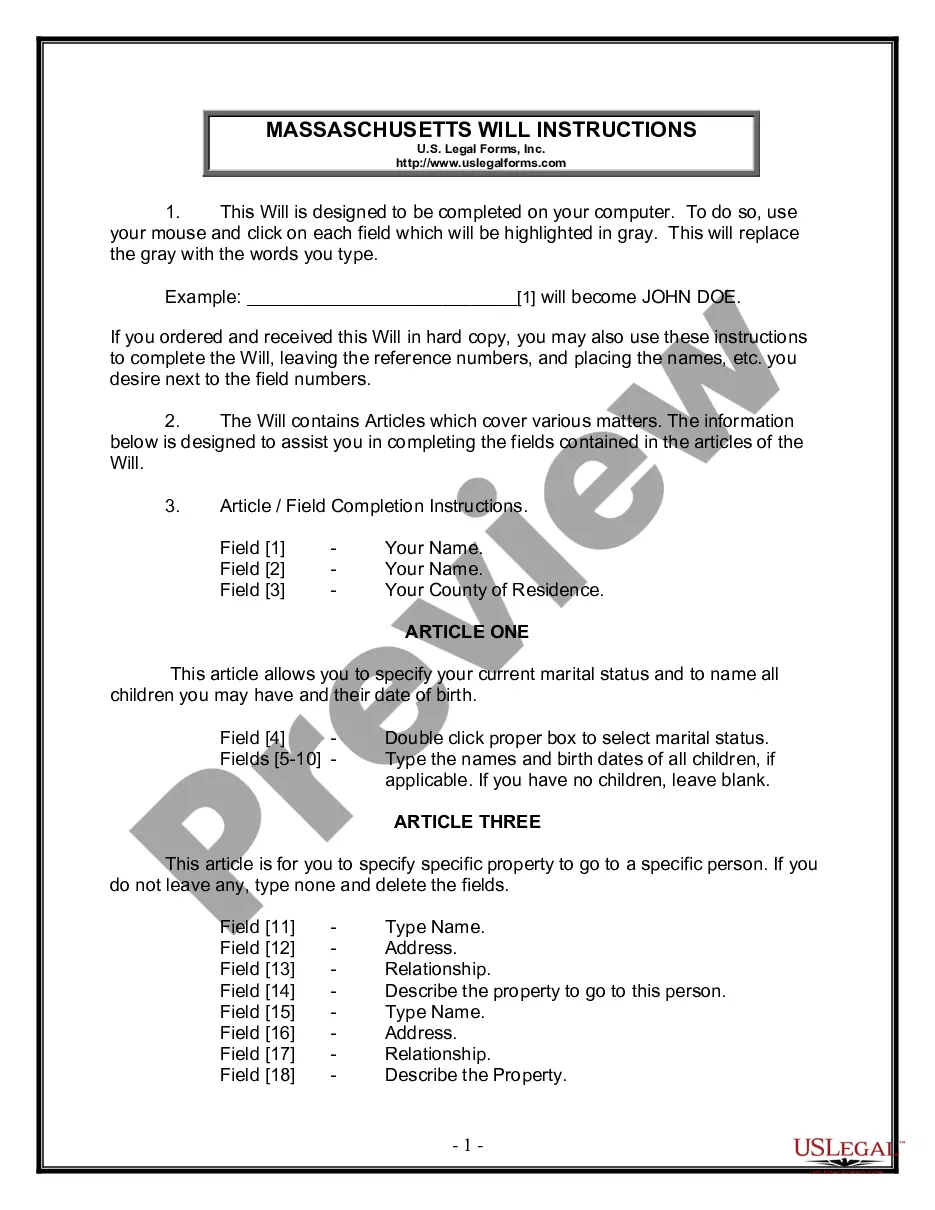

- Identify the trustor(s) and specify the name of the revocable trust being revoked.

- Declare the complete revocation of the trust.

- Record any details regarding the reconveyance of trust property.

- Enter the effective date of the revocation.

- Have the trustor(s) sign the form in the presence of a notary public.

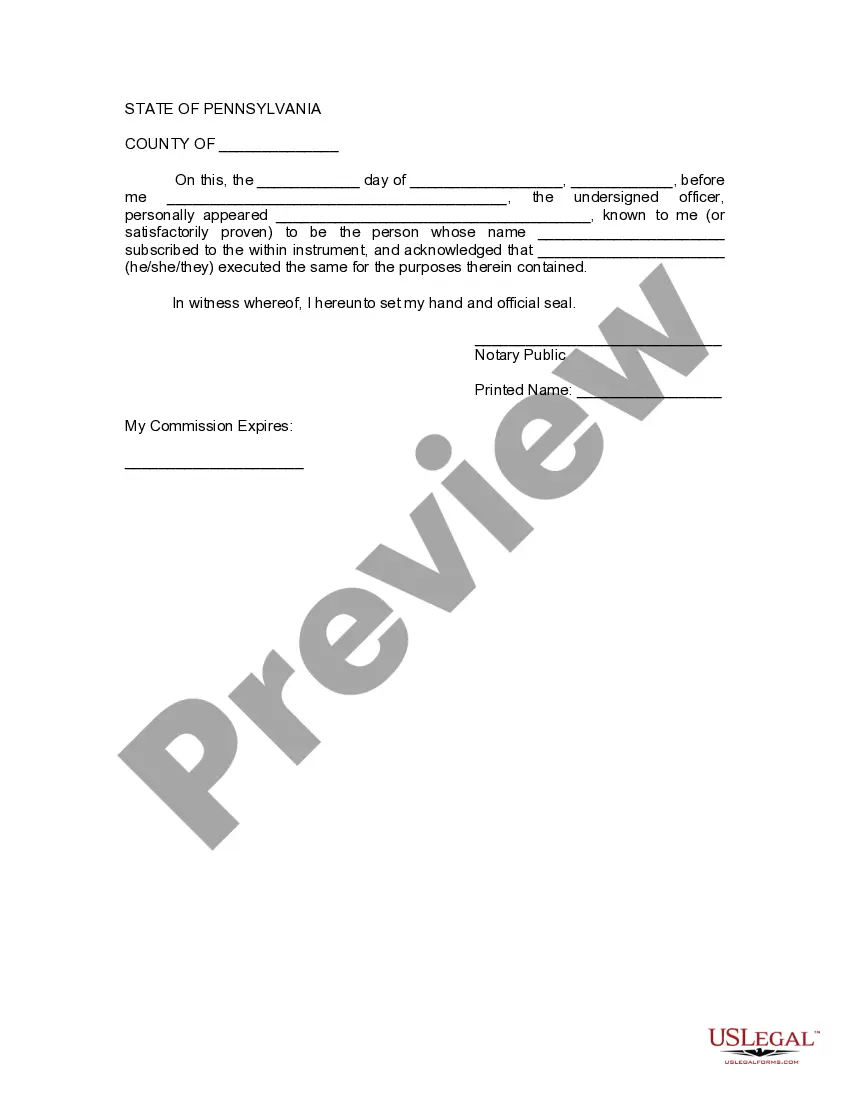

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Mistakes to watch out for

- Failing to properly identify the trust and the trustor(s).

- Not including an effective date for the revocation.

- Missing signatures or not having the document notarized.

- Assuming the revocation is valid without following state-specific formalities.

State-specific compliance details

For residents of Pennsylvania, this form is designed to comply with state laws regarding the revocation of living trusts. It includes signature requirements for trustors and a provision for notarization to ensure its legal validity.

What to keep in mind

- The Revocation of Living Trust form is essential for terminating a living trust legally.

- It requires proper notarization to ensure its validity.

- Understanding when and how to revoke your trust can prevent future legal complications.

Form popularity

FAQ

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

In some states, your trustee must submit a formal accounting of the trust's operation to all beneficiaries.Trustees can sometimes waive this requirement if all beneficiaries agree in writing. In either case, after the report is made, the trust's assets can be distributed and the trust can be dissolved.

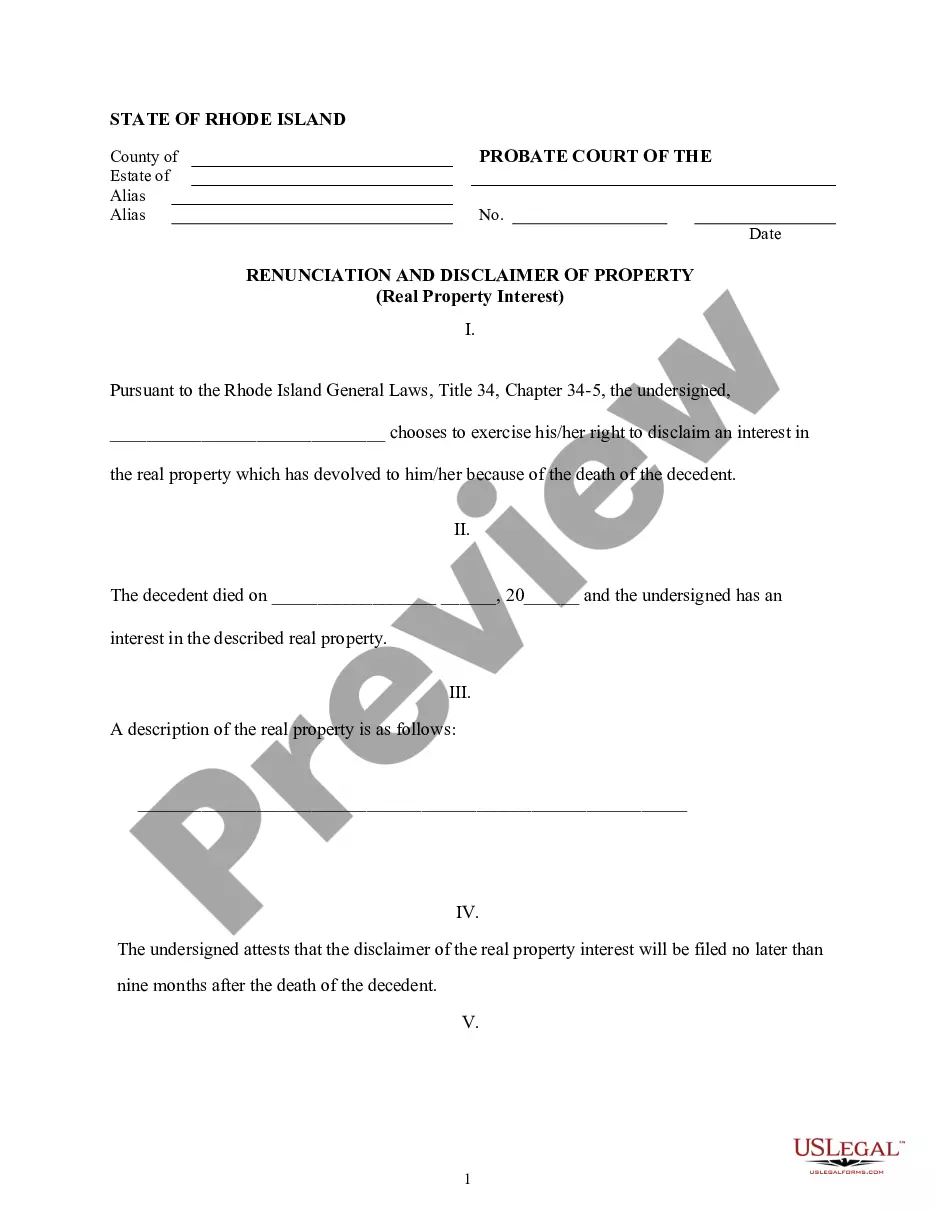

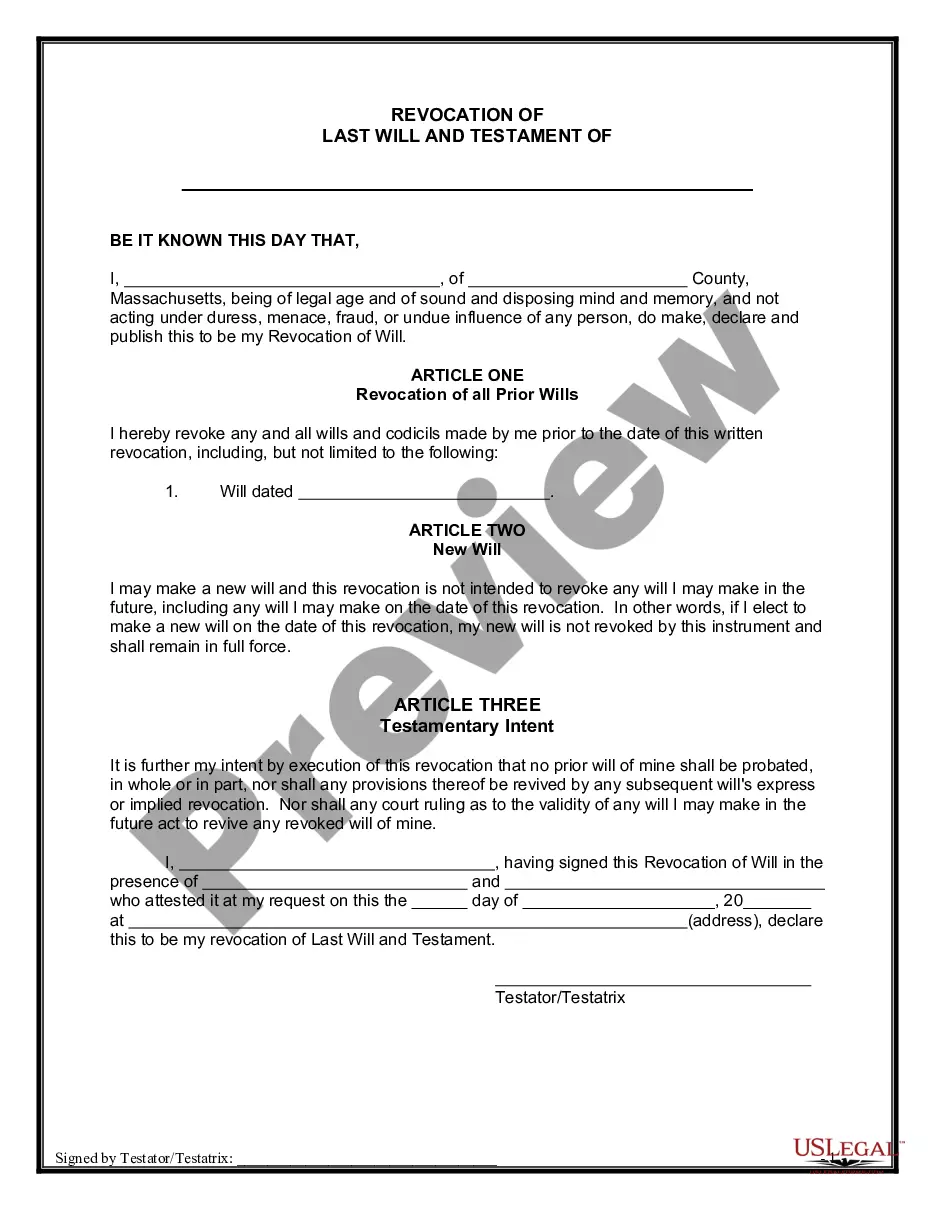

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

Dissolving irrevocable trusts if you're a beneficiary or trustee. State trust law may also permit a trust beneficiary or trustee to petition the court if they want to dissolve (or amend) the trust. The court may grant approval based on reasons cited above.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.